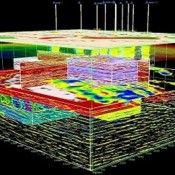

3D Seismic, a Safer Way to Bet on Oil?

Feb 09

With oil prices off 50% or so from the $80 to $100 per barrel range, investors are hunting for bargains across the energy sector. Production, pipeline, and service related stocks are obvious choices, but there are hundreds and hundreds to choose from. Separating winners from losers can be a tricky task. As a backdrop, the majority of “experts” now predict oil prices...

Read More