3D Seismic, a Safer Way to Bet on Oil?

Feb 09

With oil prices off 50% or so from the $80 to $100 per barrel range, investors are hunting for bargains across the energy sector. Production, pipeline, and service related stocks are obvious choices, but there are hundreds and hundreds to choose from. Separating winners from losers can be a tricky task. As a backdrop, the majority of “experts” now predict oil prices aren’t done going down. Some say oil may never see $100 per barrel again! In that case, do you want to be stuck holding shale plays in your long-term portfolio?

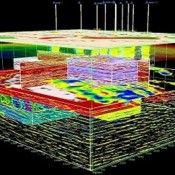

Diversification conscious investors desiring exposure to the energy sector (i.e. oil prices) may find a safer bet in 3D Seismic.

America’s Leader in 2D and 3D Seismic

Dawson Geophysical (NASDAQ: DWSN) is a technology-focused company that caters to the oil and gas industry. Founded in 1952, Dawson specializes in proprietary seismic solutions. Readers won’t be surprised to hear that finding oil isn’t easy and drilling for it ain’t cheap. Completing a fancy horizontal well to tap into Bakken and Eagle Ford shales can cost $10 million or more. Obviously, before risking that amount of money, anyone in their right mind would prefer to see a high resolution image of what’s underground before drilling— so they call Dawson Geophysical.

Why would oil and gas companies buy from Dawson? To reduce drilling risks, decrease finding costs, increase reservoir location and completion management. Dawson is capable of providing turnkey solutions— that includes designing, permitting, surveying, and data processing.

Best of Breed Becoming Best’er?

On October 9th 2014 Dawson Geophysical and TGC Industries (NASDAQ: TGE) announced plans to strategically combine. Stephen Jumper, Chairman, President and Chief Executive Officer of Dawson, said, “This is an exciting time for our companies as we work together to combine our complementary resources and create a best-of-breed company. The combination of Dawson and TGC results in a stronger company that will better serve our valued clients, shareholders and employees…. the combination of Dawson and TGC improves our ability to meet that demand with an expanded equipment base, logistics advantages, and improved services and expertise. Collectively, our resources are further positioned to increase utilization rates, reduce costs and provide multiple avenues of growth for the combined company.”

This is the second attempt at merging, it has already passed the important Hart-Scott-Rodino hurdle, and the transaction is expected to be completed during Q1 2015. The combined entity will trade under the symbol “DWSN”.

According to the conference, post merger, the corporation was anticipating a balance sheet with approximately $80M cash and $30M debt.

Bottom Line: Dawson Geophysical will be negatively impacted as drilling slows, but it has survived many down cycles since its’ founding in 1952, so I don’t think this one will kill them either. The science and technology behind seismic has lots of room to improve going forward, thus creating future opportunities for Dawson and its clients. Being that DWSN is off 65% in the past seven months, much of the pessimism is priced in. Additionally, at $11 shares are far from the peak of $85, so investors are more likely to be buying low than high.

DISCLAIMER: The information in this publication is not intended to be, nor shall constitute, an offer to sell or solicit any offer to buy any security. The information presented on this website is subject to change without notice, and neither Penny Stock Experts nor its affiliates assume any responsibility to update this information. Additionally, it is not intended to be a complete description of the securities, markets, or developments referred to in the material. Penny Stock Experts and its Author(s) cannot and do not assess, verify or guarantee the adequacy, accuracy or completeness of any information, the suitability or profitability of any particular investment, or the potential value of any investment or informational source. Additionally, Penny Stock Experts and its Author(s) in no way warrants the solvency, financial condition, or investment advisability of any of the securities mentioned. Furthermore, Penny Stock Experts and its Author(s) accept no liability whatsoever for any direct or consequential loss arising from any use of our product, website, or other content. The reader bears responsibility for his/her own investment research and decisions and should seek the advice of a qualified investment advisor and investigate and fully understand any and all risks before investing. Information and statistical data contained in this website were obtained or derived from sources believed to be reliable. However, Penny Stock Experts and its Author(s) do not represent that any such information, opinion or statistical data is accurate or complete and should not be relied upon as such. This publication may provide addresses of, or contain hyperlinks to, Internet websites, Penny Stock Experts takes no responsibility for the contents thereof. Each such address or hyperlink is provided solely for the convenience and information of this website’s users, and the content of linked third-party websites is not in any way incorporated into this website. Those who choose to access such third-party websites or follow such hyperlinks do so at their own risk. The publisher, owner, writer or their affiliates may own securities of companies mentioned in this publication.