Value Hunting: 4 Stocks Trading At or Below Cash-on-Hand

Jan 04

Many bargain hunters are beginning to pull the trigger on metals, mining and exploration stocks.

Arguably, as a whole, this sector has never been cheaper. At the quality end of the spectrum, stocks like Goldcorp (NYSE: GG) and Pan American Silver (NASDAQ: PAAS) are selling at decade lows. Each of those are currently paying investors 3-5% annually to hold, while simultaneously offering leverage to metal prices.

When the best of breed is getting slaughtered you know things are really bad.

All know the way but few actually walk it.

-Bodhidharma

We’ve all heard about “buying low and selling high”— so easy to say; kind of rolls off the tongue. But how many amongst us have the mental toughness and intestinal fortitude to follow through on that strategy?

Bargain hunters and yield-starved investors alike will be well served buying stocks like Goldcorp and Pan American Silver at decade low prices. In addition to the respectable yield, each could double or better in the coming year(s).

Having great aim is important, but so is knowing when to pull the trigger.

For those adventurers brave enough to go further down the quality-curve, in their hunt for deeply depressed stocks, gains of five, ten, and even 20-fold can be bagged.

You’re reading this now, so you’re no dummy, and you instinctively know that +500% returns don’t come without risk. Also, I’ll go out on a limb here by assuming you know one +500% return can make up for more than a few losses. Therefore, if we’re willing to accept some risk in exchange for trophy rewards, is it possible to hedge our downside in the process?

The answer is yes!

Something for Nothing?

One way to take some “risk” out of risky-penny-stocks is by shooting at companies that are selling below their current cash on hand.

To clarify further, amongst the tens of thousands of stocks in existence, occasionally you will find one’s trading below their liquid asset value. Essentially, for that price you’re getting the underlying business / assets / resources for FREE.

Eureka! When I first started at this I assumed buying something below cash value was a sure thing

…but I was wrong.

You see, during the go-go, everything is awesome times, people throw money at bad projects. Some of these companies happen to have smart managers who just nurse that cash position so they can pay themselves nice salaries— just existing on the shareholders dime. I guess the good news is that you can still get lucky with this type, pending you buy right.

What’s really scarce is identifying potentially economic, cream of the crop type, deposits that can be scooped up for free. You’ll almost never see these, but once in a blue moon they’ll surface (however briefly) amidst the depression-like times the resource industry has faced lately. So you’ve got to constantly keep your eyes and ears open.

Keep in mind

Exploration stocks will be cash-flow negative until they become a mine or get acquired. If the people and project aren’t strong enough they won’t survive until better times; eventually the once cash-rich stock will aimlessly drift toward zero.

With that said, by hunting in the right area at the right time it definitely improves your win to loss ratio.

Ready… aim… investigate further!

The following names are trading below cash value or damn near close to it; sniper-like speculators will take aim and dig further into the technical reports (query management and geologists too) before shooting.

1) East Africa Metals (CVE: EAM) (OTCMKTS: EFRMF)

Weighing in at 102 million shares outstanding, East Africa Metals is valued at $7.16 million. As of October 2014 it had $14.6M cash and cash equivalents. Today’s value is somewhere closer to $12-$13M because East Africa Metals has been drilling its most advanced Terakimti project, located on the 50,903 acre Harvest Property (70% owned). Exploration expenditures are budgeted for $6M over the next twelve months so its cash balance will drop but news flow (a positive catalyst?) will increase.

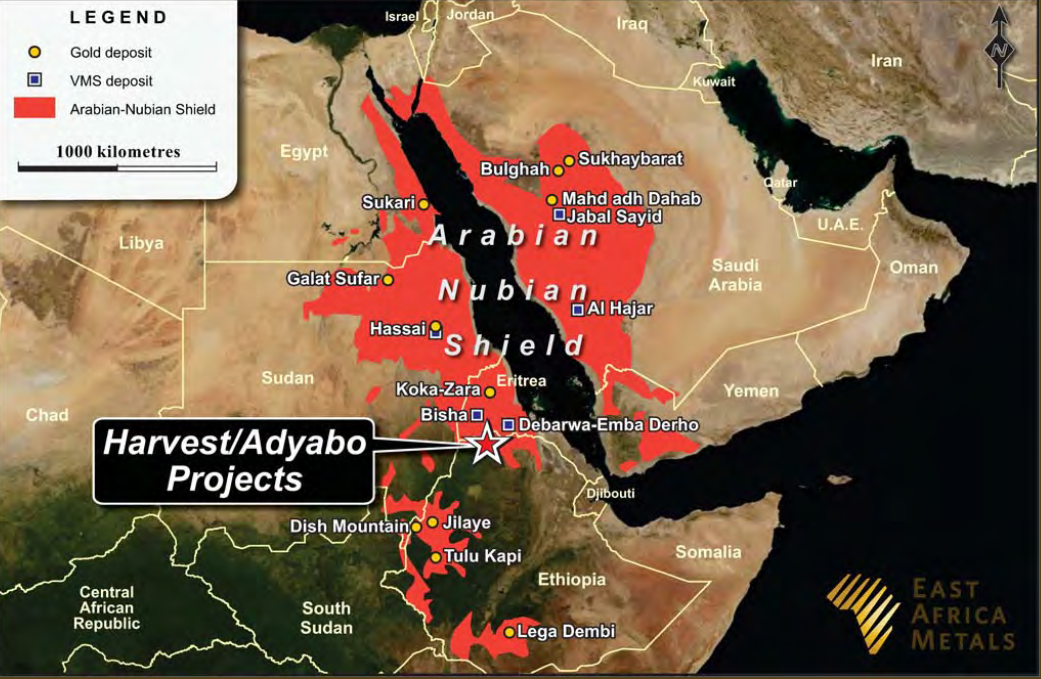

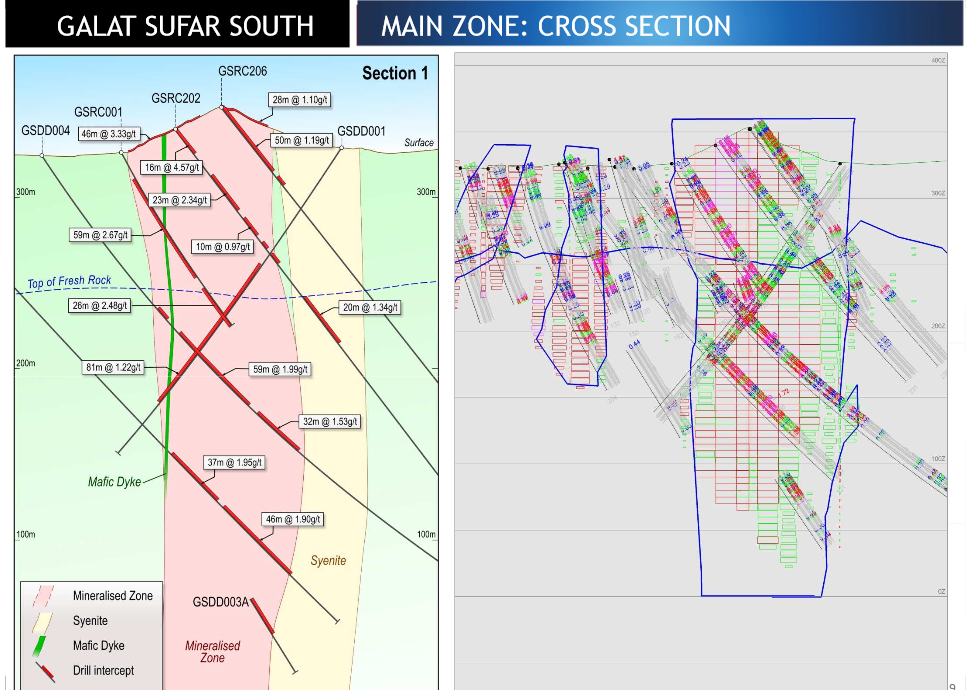

Located in far north Ethiopia, practically Eritrea, the Harvest Property sits on the southern end of the Nubian Shield— known for hosting VMS camps.

The most recent NI 43-101 at Terakimti is of modest size (incorporating 79 holes / 16,495m drilled) but relatively high-grade. Expect East Africa Metals to add tonnage and discover new deposits in the coming year(s) because VMS deposits typically occur in herds.

A minimum of 5,000 metres will be included in the next resource update. It would be nice to see an increase in the “near surface oxide component” (85,000 ounces gold Indicated + Inf.) at Terakimti. That could pave the way to a low cost heap leach operation to get started— highways, water and electricity lines are relatively close by.

2) Levon Resources (TSE: LVN) (OTCMKTS: LVNVF)

With a market cap around $55 million, Levon Resources has approximately $40M in cash and a 9.9% stake in Pershing Gold (OTCMKTS: PGLC) worth close to $10M at today’s prices.

Since discovering the Cordero deposit in 2009 Levon has drilled over 274 holes / 126,916 metres. With an indicated + inferred resource weighing in at 536 million ounces of silver and 9 billion pounds of zinc, Cordero is one of the largest silver-polymetallic deposits in Mexico. Exploration potential remains open at depth and along strike.

What’s the catch? Levon needs silver prices above $20, the IRR is too low for a mine to be built until then. Levon’s development strategy is to align with a major mining outfit. Insiders and management own more than 10% equity.

3) Orca Gold (CVE: ORG)

As of September 2014, the most recent corporate presentation, Orca Gold had $34M cash and its recent market value is $33M. Orca’s management team was instrumental in building Red Back and famously selling it off to Kinross near the peak of the market for $9.2 billion.

Orca controls a 15,674 square kilometer land package in northern Sudan (Nubian Shield). Initially, its focus is on Block 14, a 70% owned property sporting an acquisition cost of $9.5M. Pending political support over the coming three to five years, Orca looks to have scored for that purchase price! With 45,500 metres drilled through Sept 2014, the initial indicated and inferred resource is quite substantial— 28.8 million tonnes @ 1.85 g/t AU. Roughly 90% of the 1.7 million contained gold ounces lie within 100m of surface.

4) Entrée Gold (NYSEMKT: EGI)

Since 2011 shares of Entrée Gold have been punished, once trading for $3 ½ , EGI can be scooped up now for 18 cents. The market value is $28M and the cash position is something south of $38.7M, as of the Sept 30th presentation.

Entrée Gold offers exposure to two multi-billion pound copper resources, one in Mongolia and another in Nevada’s Yerington District. Each project has its share of problems, Ann Mason would cost more than $1 billion to build, and management has acknowledged mining wouldn’t take place there until at least 2019. Over in Mongolia, Oyu Tolgoi has faced numerous setbacks related to regulations and government, despite the fact that Rio Tinto has already sunk +$6 billion into it. Significant shareholders of Entrée Gold include Sandstorm (12%) and Rio Tinto (11%).