Stake a claim on Salazar Resources; Ecuador is mining’s next golden frontier.

Dec 20

Geologically speaking, Ecuador is positioned perfectly along South America’s western border between Colombia and Peru— two destinations with lots of gold in the ground!

Both geologists and artisanal miners have known Ecuador to be gold-rich, but its mining laws made doing business there prohibitively expensive. As a result, Ecuador’s mining industry has stagnated for many years.

However, this trend is reversing thanks to the mining-friendly laws enacted during 2013. As per the new law there is an 8% ceiling on royalties. Any windfall taxes aren’t applicable until the initial investment has been recouped. Additionally, a streamlined regulatory process exists for “medium-sized” mines (2,000 tpd or less) and the royalty is fixed at 4%.

Mining magnates staking their claims on Ecuador

Enticed by the proven geology and new laws, at least two mining magnates have already begun staking their claims on lightly-explored Ecuador.

- Ross Beaty, founder and chairman of Pan American Silver (NASDAQ: PAAS) is betting on Ecuador via Odin Mining and Exploration (CVE: ODN). Taking part in Odin’s most recent financing, he is now the largest shareholder with a stake valued at nearly $10M.

- Lukas Lundin, a Swiss-Canadian mine financier is taking Fruta del Norte, thought to contain 10 million ounces of gold, off the hands of Kinross. Via Lundin Gold (TSE: LUG), formerly Fortress Minerals, he acquired Fruta del Norte at an 85% discount ($240M) to what Kinross paid and invested into the property.

With help from their seals of approval, Ecuador is becoming a hot destination for mining and exploration activity, despite the frigid climate facing the overall industry.

Salazar’s Curipamba project has the richest combined metal grades of all VMS camps in the Andes.

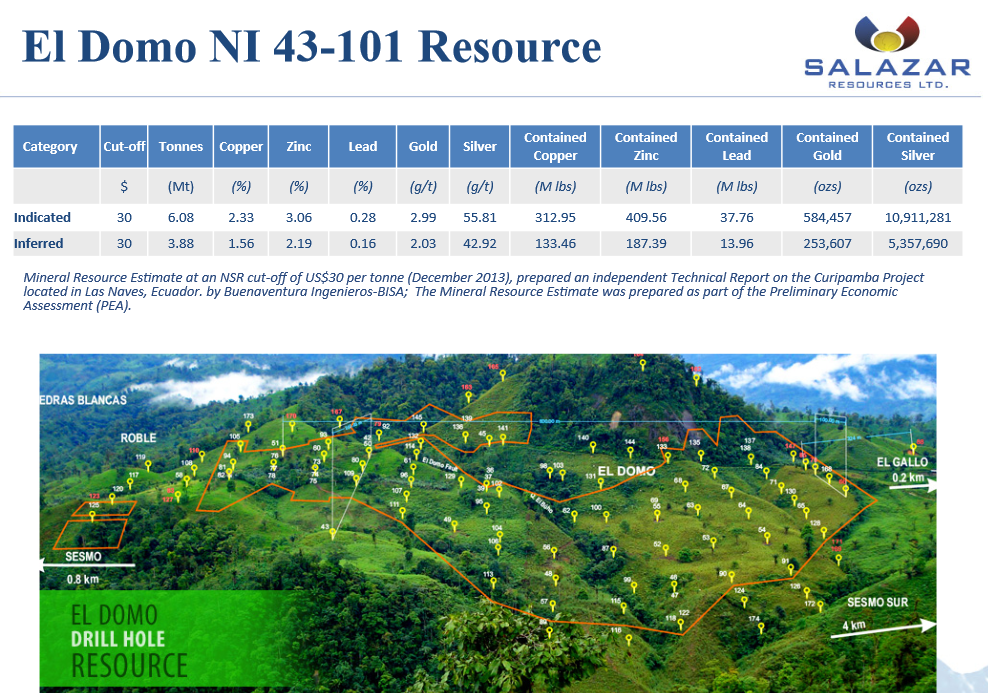

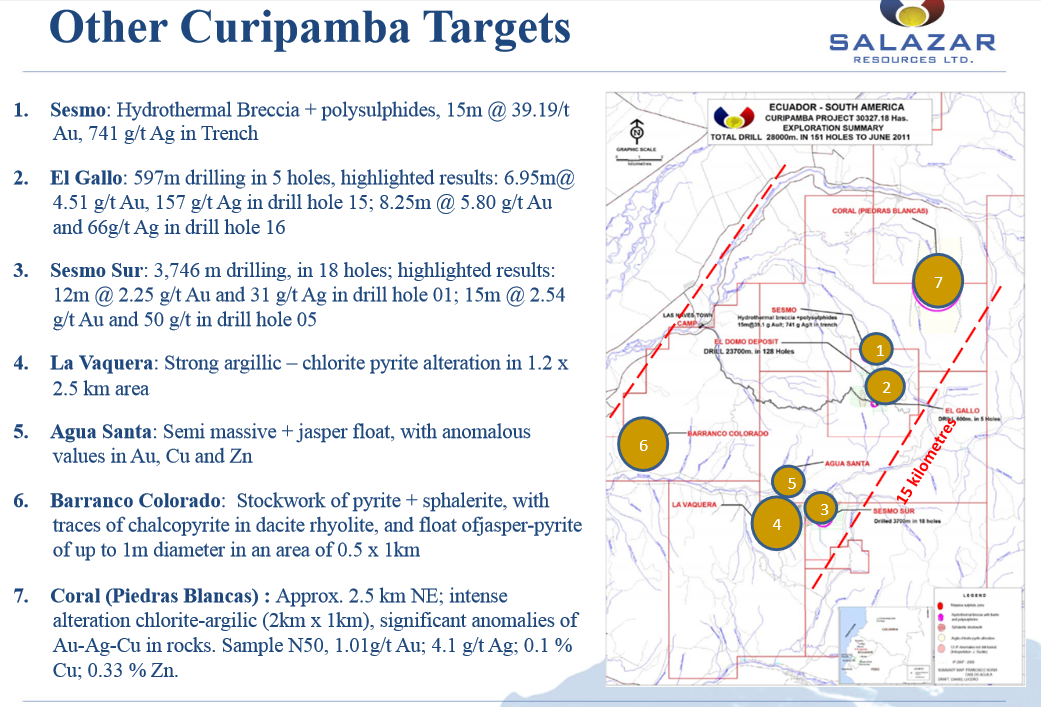

A unique feature of volcanogenic massive sulphide (VMS) deposits is that it occurs in clusters, so once one is identified, the odds are very good that another, or as many as five others could be close by. To date, “El Domo” is the largest and most extensively worked section of the Curipamba project. El Domo is a flat lying mineral body that begins just 50 meters below surface. Compared to other VMS deposits, its metal content is amongst the richest in the world.

The resource estimate above was generated from drilling 168 holes / 31,770 meters of core, and 7,736 soil samples assayed at 50m spacing.

Of the 30,327 hectare land package called Curipamba, El Domo as we know it today encompasses only 250 hectares, and it remains open to the north, south, west, and at depth.

Eight high priority geophysical anomalies surrounding El Domo still need to be drill tested.

Buy Salazar Resources for peanuts now, because the circus is coming to Ecuador.

The opportunity for speculators is that Curipamba has been all but forgotten. I believe this is evidenced by the miniscule (sometimes non-existent) trading activity and deeply depressed market value ($9M).

With Salazar one is not betting on a pure exploration story and hoping for a discovery, because its team of geologists have already made a HUGE one at El Domo. Not even considering the strong lead, silver, and zinc credits— El Domo’s stellar gold and copper metal content could merit building a mine on their own! As per the PEA [Sedar.com April 3, 2014], Salazar would be processing 2,000 tpd of 2.06% CU and 2.9 g/t AU from an open pit.

But that’s not all! El Domo is open in almost all directions and at depth.

Did I mention that eight other geophysical anomalies have yet to be drill tested at Curipamba?

If today’s price tag to own the Curipamba project wasn’t cheap enough, Salazar owns 100% of three more prospective properties— I’d like to think we’re getting something of value there for free. One of which, the 2,910 hectare Ruminahui, hosts two large structural trends and deserves to be drilled, following up on a channel sample that glistened with 2.76 g/t gold over 55 meters.

A tale of two hands?

On the one hand—no analysts or brokers cover Salazar, so it’s overlooked and under-loved. Promotional efforts have been non-existent for three years, the lion’s share of money is invested into exploration, advancing El Domo, and betterment of community.

On the other— Salazar has been endorsed by, and has strong-handed shareholders such as Lundin Mining (owns 10%), Trafigura (owns 10%), Silvercorp (owns 7%) and management controlling 30%.

If Salazar only had a larger cash position… that’s the biggest negative I can see. Salazar needs to close a deal with a larger outfit who will pay for building the mine, it looks like the Chinese deal fell through (I can’t say it’s all that surprising), raising money will be especially dilutive at recent prices but they’ll have to do it.

Notes worthy of mention…

- I’m told there are no natural reserves, protected forests or native populations in the vicinity of Curipamba.

- Preliminary metallurgical test work confirmed El Domo’s feed is amenable to conventional flotation technology.

- Excellent access to area along paved roads, 2 ½ hours to international airport (Guayaquil), and national power grid within 15km.

- Modern exploration in the Curipamba region began in 1991 with Rio Tinto conducting regional stream sediment surveys.

- Salazar has done little to no PR/marketing over the past three years, I’m told they should be turning the PR engine back on during 2015.

- The PEA estimated pre-operational Capex to be $110M, but with some adjustment the team would like to believe costs could be reduced to between $70-80M.

- Salazar’s team of geologists, led by its namesake Fredy Salazar, are Ecuadorian. They maintain a local office and are active in the community. In fact, Fredy carried out a geological survey for the ministry of Ecuador. His biography says he was instrumental in Aurelian Resource’s acquisition of the Fruta del Norte property.

- Geologist Dr. Warren Pratt describes El Domo as a “Kuroko-type VMS”. In the technical report he mentions observing hydrothermal brecciation at El Domo… “such settings are associated with many of the most productive VMS districts.” He goes on to say: “excellent potential for more discoveries”.

- Professional geologist John Buckle of Geological Solutions said, upon his appointment as technical advisor (but no longer with Salazar): “I am pleased to be involved with what I feel could be one of the most exciting VMS projects in the Americas.”

*Disclosure: author is long shares of Salazar Resources