Nailed It! Claude Resources a 5-Bagger in Two Years for Penny Stock Experts

Mar 20

As many of you know, on March 7th Silver Standard Resources (NASDAQ: SSRI) announced its intention to acquire Claude Resources (OTCMKTS: CLGRF) (TSE: CRJ). At the time of announcement, the valuation implied a Canadian price of $1.27 or C$337 million.

Not a bad deal for anyone that’s bought Claude Resources over the past few years!

Those who follow Penny Stock Experts .com, and those i communicate with verbally, know how much i liked Claude Resources back in 2014.

In fact, it was the very first article i posted at PennyStockExperts.com

Here it is, in case you missed it… Orphaned by the Institutions, this Junior Gold Miner is CHEAP. Still 92% off the Peak!

Back then, not too many other people were talking positively about Claude Resources (zero analysts covered the stock), but here’s a few excerpts from what i was saying.

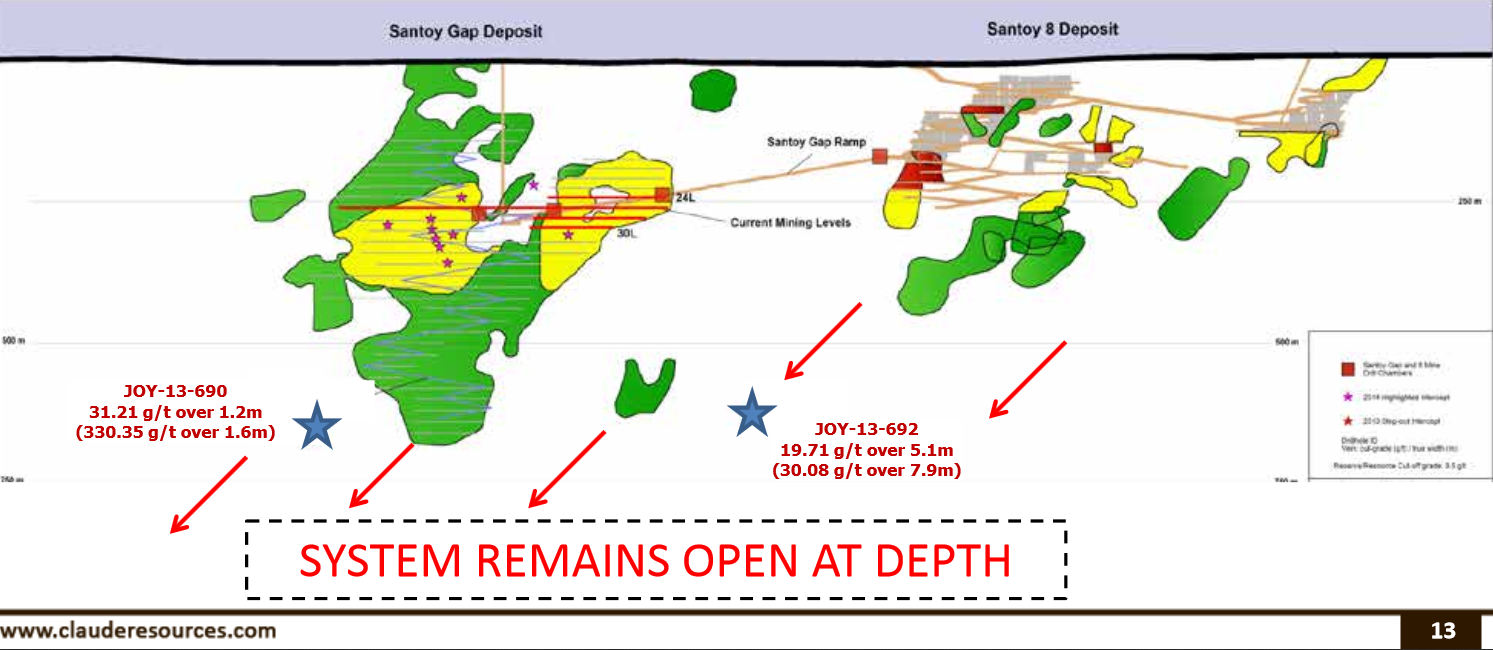

[October 11, 2014] To date, the Santoy Gap deposit has produced approximately 26,000 tonnes at 8.1 grams per tonne… significantly higher than the current Mineral Reserve grade of 6.40 grams per tonne. As you will see below, the resource upside at Santoy Gap is significant.

The market has yet to appreciate the game changing nature of Claude’s Santoy Gap deposit. Within proximity of the mill, the Santoy Gap is yielding 2,000 ounces gold per vertical metre, double that of Seabee’s historical endowment of 1,000 ounces per vertical metre. Quite efficiently, Claude advanced the Santoy Gap from discovery to production in less than three years.

With Silver Standard paying upwards of $4,000 per ounce of gold production (higher than recent deals such as St. Andrew Goldfields which Penny Stock Experts also nailed and Lake Shore Gold), it must be confident the under-explored 42,500 acre Seabee Gold Camp has more quality discoveries ahead of it.

Early in 2015 shares of Claude Resources began to trade upwards on consistently higher volume. As you’ll see below, there is a clear pattern of higher-lows and higher-highs forming.

On November 3, 2014 Claude Resources released its Q3 numbers, and they were better than expected across all key indicators.

It set a quarterly gold production record of 20,614 ounces (up 96% YOY), all-in sustaining costs were down 32%, head grades of 8.88 g/t (up 68%), and net profit was $6.9M (compared to a loss of $33M).

Long story short>>> Claude Resources was clearly turning its operations around, 2014 was a breakout year for the company, and anyone paying attention could see it.

CLGRF broke out to a new 16-month high on heavy volume during January 2015.

Prompting myself, via Penny Stock Experts, to post another… This Little Secret’s Almost Out, Claude Resources Ready to Spread Wings and Fly.

And fly it did… CLGRF increased more than 400% over the following 15-months!

Here’s what i was saying [Jan 13, 2015]: Upside breakout imminent?

You can only stretch a rubber band so far before it breaks or takes flight. Claude’s stock chart reminds me of a rubber band, i don’t think its going to break down, leaving only one option, it’s going to take flight.

With any help from gold Claude could be a $1 stock once again,

Let’s try to be conservative here, by assuming the lower-end of Claude’s projections hold [60,000 ounces production @ AISC $1,275 Cdn], it would be making a $200 per ounce margin at today’s Canadian gold price of $1,477 — or roughly $12 million. If investor psychology shifts from thinking gold is trending down to gold is trending up, it wouldn’t be outlandish for the market to assign a 10-multiple to operating cash flow (gold miners got premiums to that just a handful of years ago). That would move Claude closer to a market cap of $120M or 60 cents per share.

So what?

Claude Resources is a legitimate 5-Bagger since it was first highlighted by Penny Stock Experts .com (documented).

While there have been a few strikeouts along the way, i’d argue anyone who takes the time to review the track record (now dating back to 2014) will see a strong batting average– including more than a few home runs (more than compensating for a few misses).

No doubt, the evidence and track record is accumulating, and its beginning to show that following my research is worthwhile. In other words, a worthy use of your time. Therefore, be sure to tell others about Penny Stock Experts .com and provide your generous donation here.

Alternatively, call me direct at (407) 772-1135 for a complimentary review of your investment portfolio.

Now what– sell Claude Resources or wait to inherit Silver Standard?

Speaking only for myself, this announcement provides a natural opportunity to lighten up for those who haven’t along the way. However, Silver Standard Resources is a respectable company, arguably a higher-quality (compared to its peers) mid-tier mining stock, and it provides serious leverage to silver prices.

…of late, the silver/gold ratio (number of silver ounces needed to buy an ounce of gold) is at the high end of its historical range, above 80, so SSRI should outperform as this ratio decreases toward normal (approx. 40/1).

Check back in the future for additional thoughts on Silver Standard or read one of my previous postings on the topic here… Win Consistently with Commodity Stocks by Being Contrary. Plus! Using the “E” Word with SSRI.

Until the next time! Stay thirsty my friends.

Cheers to our next 5-Bagger,

Daniel T. Cook

(407) 772-1135

pennystockexperts@aol.com

P.S. If you or anyone you know is enthusiastic about discovering 5, 10, and 20-Bagger stocks (and who wouldn’t be) please refer them to our “Expert Network”. Members of the Expert Network will circulate knowledge and borrow brilliance from like minded professionals.

*Author has a long position in Claude Resources and Silver Standard

DISCLAIMER: The information in this publication is not intended to be, nor shall constitute, an offer to sell or solicit any offer to buy any security. The information presented on this website is subject to change without notice, and neither Penny Stock Experts nor its affiliates assume any responsibility to update this information. Additionally, it is not intended to be a complete description of the securities, markets, or developments referred to in the material. Penny Stock Experts and its Author(s) cannot and do not assess, verify or guarantee the adequacy, accuracy or completeness of any information, the suitability or profitability of any particular investment, or the potential value of any investment or informational source. Additionally, Penny Stock Experts and its Author(s) in no way warrants the solvency, financial condition, or investment advisability of any of the securities mentioned. Furthermore, Penny Stock Experts and its Author(s) accept no liability whatsoever for any direct or consequential loss arising from any use of our product, website, or other content. The reader bears responsibility for his/her own investment research and decisions and should seek the advice of a qualified investment advisor and investigate and fully understand any and all risks before investing. Information and statistical data contained in this website were obtained or derived from sources believed to be reliable. However, Penny Stock Experts and its Author(s) do not represent that any such information, opinion or statistical data is accurate or complete and should not be relied upon as such. This publication may provide addresses of, or contain hyperlinks to, Internet websites, Penny Stock Experts takes no responsibility for the contents thereof. Each such address or hyperlink is provided solely for the convenience and information of this website’s users, and the content of linked third-party websites is not in any way incorporated into this website. Those who choose to access such third-party websites or follow such hyperlinks do so at their own risk. The publisher, owner, writer or their affiliates may own securities of companies mentioned in this publication.