Orphaned by the institutions, this junior gold miner is CHEAP. Still 92% off the peak!

Oct 11

Claude Resources Inc. (TSE: CRJ) (OTCMKTS: CLGRF) is a fully integrated Canadian gold exploration and mining company that has the proven ability to “Discover, Develop & Deliver”. The Company has a strong operating base and significant upside potential. Having been in operation during times of low gold prices, Claude has proven that it has the ability to survive challenging business environments.

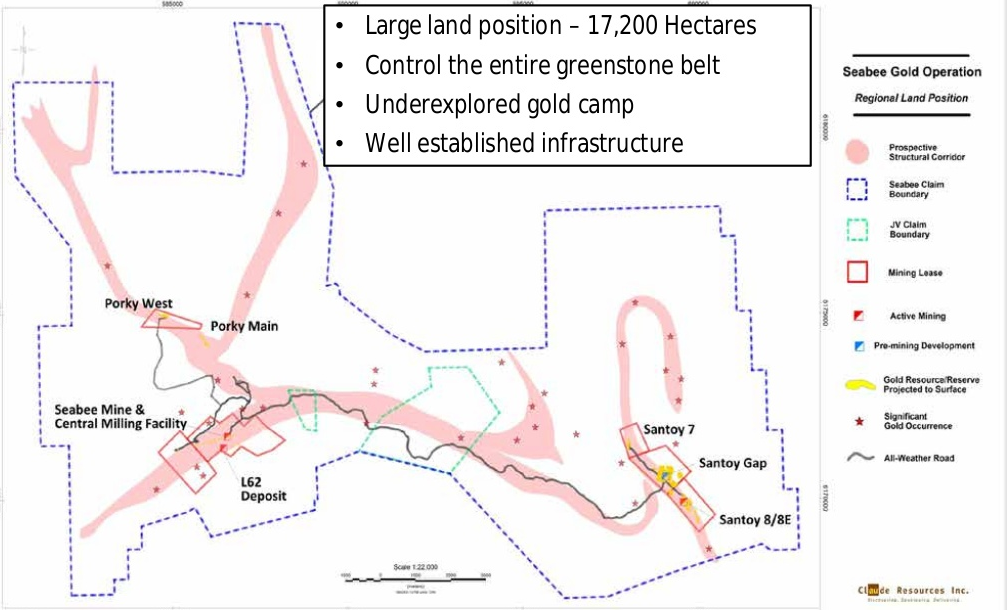

Claude’s asset base is located entirely in Canada. Since 1991 Claude has produced over 1,000,000 ounces of gold from its Seabee Gold Operation in northeastern Saskatchewan. The Seabee property spans across 42,500 acres, despite its history there is still plenty of blue sky potential on top of the 422,900 ounces proven and probable reserves existing today.

Production up 63% year to date — $3.3 million net profit in Q2

Claude Sets Another Quarterly Production Record by Producing 20,614 Gold Ounces in Q3 — according to the press release.

What’s with the turnaround? Perhaps just a coincidence, but Claude’s operational team has been knocking the ball out of the park since shaking up the management team back in March. Mike Sylvestre, a mining engineer with 35 years experience leading outfits such as Vale Inco stepped in as interim CEO, and hopefully he’ll stick around for awhile, because Claude has achieved record gold production back to back (18,742 ounces in Q2 and 20,614 ounces in Q3 — up 96% yoy) under his tenure so far.

Year to date, the Company has produced 50,700 ounces of gold from throughput of 219,046 tonnes at an average grade of 7.53 grams per tonne. Claude attributes part of the increase to switching to the Alimak mining process, this method allows Claude to mine a 100 metre high zone in 9 months versus 16 months, all while reducing waste material.

During 2014, Claude has built up $13.3 million worth of cash and bullion — reduced debt by $9.7 million

At this time last year the financial position looked more dire, so how did Claude turn things around? In addition to the operational improvements mentioned, Claude sold a 3% NSR to Orion Mine Finance for $12 million. Also, it sold the Madsen project to Pure Gold Mining (CVE: PGM), raising approximately $11.2 in cash and shares. This move was heartbreaking (although feelings and emotions should typically be left out of the investment process) to many of Claude’s long-term shareholders, as many of them invested because of Madsen. Being located next to Goldcorp (NYSE: GG) in the prolific Red Lake District of Ontario, it held great promise, but ultimately had to be sold (at a painful loss) to firm up Claude’s working capital position and ensure its survival.

CATALYST: Santoy Gap yielding higher grade gold and wider vein widths

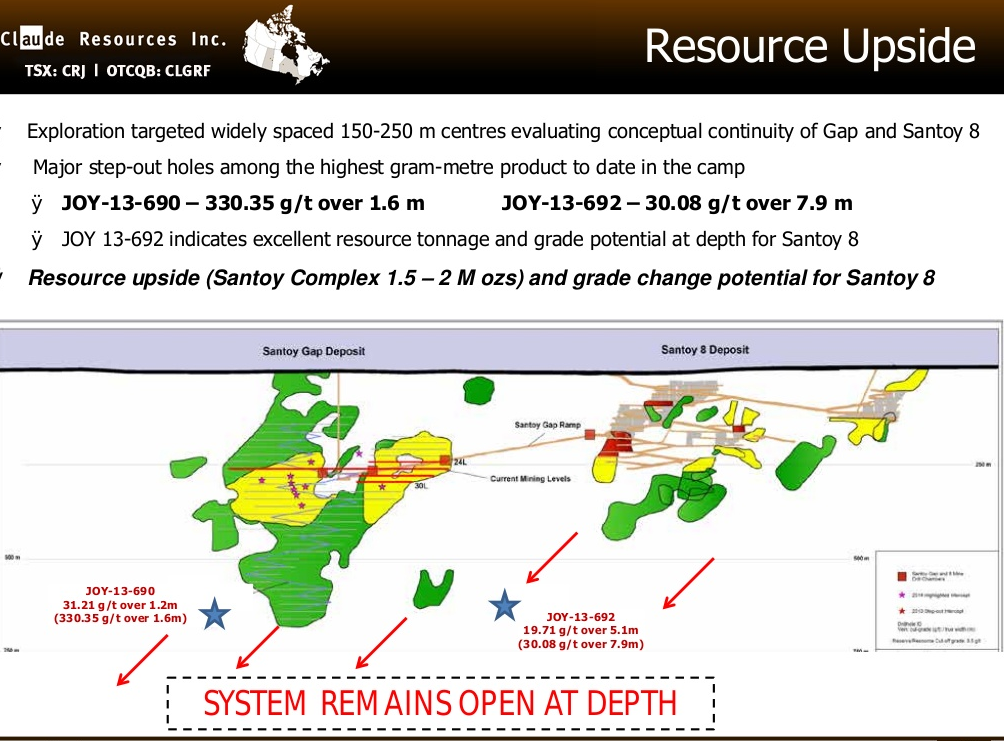

The market has yet to appreciate the game changing nature of Claude’s Santoy Gap deposit. Within proximity of the mill, the Santoy Gap is yielding 2,000 ounces gold per vertical metre, double that of Seabee’s historical endowment of 1,000 ounces per vertical metre. Quite efficiently, Claude advanced the Santoy Gap from discovery to production in less than three years.

By the end of the third quarter, production from the Santoy Gap deposit reached approximately 330 tonnes per day. To date, the Santoy Gap deposit has produced approximately 26,000 tonnes at 8.1 grams per tonne… significantly higher than the current Mineral Reserve grade of 6.40 grams per tonne. As you will see below, the resource upside at Santoy Gap is significant. Blue sky potential remains open to the north, south, and at depth. Recent intercepts suggest that Gap could link up with Santoy 8, located 300 metres to the south.

Q3 Earnings Announcement November 3, 2014

While gold prices have declined during the past three months, it’s likely that Claude will still be profitable in Q3. During Q2 it sold 17,690 ounces and received $1,397 per ounce Canadian, cash costs were $753 (U.S. $691). Resulting in $9.9 million cash flow and $3.3 million net profit. As per the production update, we know Claude produced 20,614 ounces, but only sold 17,578 of those. Minus the dip in gold prices during September, all other things (eg. costs) remaining equal, Claude’s average grade was 8.8 g/t during Q3, versus 7.7 g/t in Q2. The increase in grade should offset any decrease in price received per ounce, during the months of July and August prices fluctuated between $1,380 and $1,420 Canadian. All and all, this is likely to be Claude’s second profitable quarter in a row, the first time in many years.

Institutional money threw in the towel some time ago, Claude’s shareholder base is predominately retail. Meaning, there is no shortage of buyers available to come off the sidelines once they take notice of Claude’s new normal.

Arguably, Claude’s equity is inexpensive on numerous metrics.

Current market valuation is around $42M. It trades at a fraction of book value. Assuming it produces 60,000 ounces of gold this year (50,700 through 9 months) investors / acquirers can buy an ounce of today’s production for $700. If you take a look around the industry, you’ll find that many of the best pre-revenue stage projects cost more than $1,000 to generate one ounce of new production, not to mention the risks associated with building a new mine .

Through the first half of 2014, Claude is averaging $5.85M cash flow per quarter. If that holds for the year, you can buy Claude today for 1.8 times cash flow.

Geologists estimate that Claude has 422,000 ounces of Proven + Probable Reserves, so today’s valuation reflects a $100 per ounce “in the ground” cost. If you wanted to assign any value to its Indicated + Inferred Resources, of which Claude has more than 750,000 ounces, then the per ounce in the ground cost would come down further.

Also, we’re only talking about Claude’s Seabee operation. We haven’t even mentioned the Amisk Gold Silver Project, which is located directly west (nearly adjacent) of Hudbay Minerals’ (NYSE: HBM) 777 Mine and the Konuto Mine (closed). Claude’s Amisk property encompasses 99,800 acres, making it one of the largest land positions in the Flin-Flon mining district. Amisk, to which the market assigns no value whatsoever, would be a large bulk tonnage, open pit type operation (gold and silver mining speculators used to prefer these over underground mines… many of the majors still do). Mineralization at Amisk measures 1.2 kilometers strike length by 400 metres in width, it has been tested successfully to a depth of +600 metres. The most recent NI 43-101 report assigns Amisk with 58 million tonnes of 0.83 g/t Au equivalent in the Indicated + Inferred category.

Claude does have some debt to contend with, but most of it doesn’t mature until 2018. By then, with any help from gold prices, it should be in a stronger position to negotiate terms.

What do they say, something about buying low?

As you can see, shares of Claude Resources are 92% off the highs of 2010, back when speculators had a voracious appetite for gold miners. Today, the risk versus reward scenario favors the buy side. The 200 day moving average is around 62 cents, technically speaking, one might expect a bounce back to those levels. Looking at a smaller time frame, Claude appears to be consolidating smartly in the 15 to 30 cent range. Since December 2013 it has been building upward momentum with higher lows and higher highs.

*Full Disclosure… the analyst writing this report owns stock in Claude Resources. No payment was received for this publication.