Thanks to A Lack Of Analyst Coverage This Obvious Growth Catalyst is Being Overlooked — St Andrew Goldfields

Apr 23

In all likelihood, a small cap value stock by the name of St Andrew Goldfields (TSE: SAS) (OTCMKTS: STADF) will never be noticed or discussed by mainstream financial media.

For this I am grateful!

Reflecting back: by my teenage years I had first-hand experience with stocks that proved markets were NOT efficient. All those college professors and television talking heads never had a chance at brainwashing me to believe otherwise.

On top of that, I figured my mentors Warren Buffett and Peter Lynch (the local library introduced me to them) were more worthy of modeling after.

Buffett and Lynch convincingly stated:

“I’d be a bum on the street with a tin cup if the market was always efficient.” [Buffett]

“Efficient markets? That’s a bunch of junk, crazy stuff.” [Lynch]

The way I figured it, if researching and picking individual stocks worked for them over the long haul, why couldn’t it work for me and everyone else?

As crazy as it might sound, I actually enjoy digging through thousands of stocks, listening to conference calls, and reading through the fine print. Now a days less and less people are doing it— brokerage firms have been lightening up on their analyst departments for decades now, the masses are instructed to buy ETFs, and the professionals are at the beach or golfing (letting algorithms do all the work).

With those trends firmly in place… there’s never been a better time to be a stock picker!

St Andrew Goldfields is overlooked and under-loved by analysts… for now.

When I highlighted Claude Resources over six months ago [here and here], before it increased in value by more than 100%, no “professional” analysts were officially covering the stock—now Scotia, Cormark, Dundee, Paradigm and National Bank all love the thing [CRJ]!

Ideally, to capture the deepest discounts, I want to begin accumulating shares before the analyst community and institutional money jumps in. Because their endorsement, publicity, and buying is what’s going to drive the price up quickly. Today, I’m highlighting St Andrew Goldfields because I see an obvious catalyst (very similar to what I saw with Claude Resources) that seems to be overlooked so far.

What’s the growth catalyst?

Looking into Q4 2015 and 2016 a new mine, Taylor (St. Andrew’s third), is expected to contribute additional ore to the Holt Mill. At the moment it is awaiting final permits, but when those are granted St Andrew Goldfields can grow production by 20-35%… it wouldn’t be unrealistic to see 135,000 ounces of gold on an annualized basis going forward.

At the European Gold Forum CEO Duncan Middlemiss said: “Taylor probably is going to give us 50% growth.” He didn’t qualify that with a timeframe, but looking out to 2017 and 2018, my 20-35% production growth forecast could prove to be conservative.

Watch the 20 minute presentation::: St Andrews at European Gold Forum

For the last three years St. Andrew Goldfields has consistently produced between 80k to 100k ounces annually from its Holt and Holloway mines. Taylor should be the asset that helps take them (and the stock price) to the next level; most of the Big Money players tend to shy away from any gold miners producing less than 100k ounces.

Give me the green light, but surprise me!

When the market begins to hear about Taylor’s permits being approved the stock should react positively. That will be the green light for the team on the ground to begin filling the mill, which is currently operating below its 3,000tpd capacity.

Additionally, early signs point to Taylor’s ore being far superior (not unlike Claude Resources’ Santoy Gap), grading about 100% higher than what is being processed currently. According to this press release, a 17,540 ton bulk sample averaged 9.01g/t Au, a pleasant surprise compared to the geologically forecasted head grade of 7.20 g/t.

What’s the rub? Ore from Taylor will be trucked 70km down Hwy 101 to the Holt mill. Management indicated they have trucked lower grade ore a similar distance and made money doing it in the past, so they seem to be enthused about the opportunity. This enthusiasm has been backed up with insider buying over the last 6 months in the 25 to 30 cent range.

8 Additional points you may want to know about…

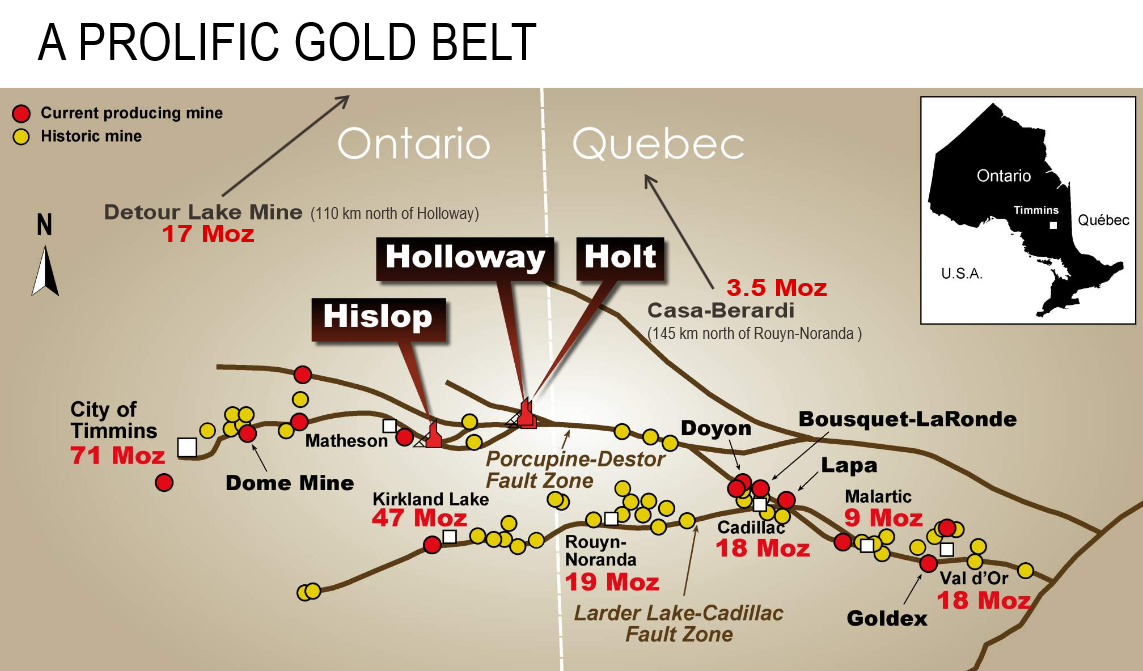

1) St Andrew Goldfields controls 120km of strike length straddling the Porcupine-Destor Fault (roughly 55,000 hectares), this land position is certainly coveted by many. Despite its prolific location plenty of blue sky and brownfield exploration potential remains, as much of the ground is hidden by glacial till. Any new discovery/project can be easily connected to the electric grid. Ore is easily trucked via paved Highway 101.

2) As of the most recent update, gold in the ground includes 833,000 ounces in the “reserve” category and 4,822,000 ounces in the “resources” category.

3) Despite significant royalty expenses of $110 per-ounce at Holt and Holloway, total cash costs were most recently $816oz. All-in costs for 2014 were $1,072 per ounce US. Roughly $15 million was invested during the year advancing Taylor; royalty costs will be lower there.

4) Exploration program at Holt Deep has been successful at intersecting mineralization 600-800m west of existing production. Intercepts include 37 g/t Au over 21.7 metres and 4.02 g/t Au over 37.3 metres.

5) Strong financial position: $22 million cash (and growing?) and $nil long-term debt

6) Quality mill infrastructure operating at 60-70% capacity, Newmont and Barrick were prior owners.

7) Previously expected to wind down by late 2015, Holloway production is expected to continue through late 2016, based on what’s known today, because of the Smoke Deep extension.2015 Production guidance is 85-95,000 ounces (65k Holt / 25k Holloway)… if all goes according to plan Taylor will contribute higher grade material from Q4 2015 onwards.

8) 2015 Production guidance is 85-95,000 ounces (65k Holt / 25k Holloway)… if all goes according to plan Taylor will contribute higher grade material from Q4 2015 onwards.

Bottom Line: St Andrew Goldfields has been on my radar for many years, but I never purchased the stock because I viewed it as a marginal low-grade operator. However, the recent higher-grade bulk sample(s) at Taylor and step-out drilling successes at Holt position St. Andrew Goldfields for organic growth while simultaneously bringing down costs… that recipe (and an obviously cheap valuation) worked for Claude and I expect it will work with SAS too. Now is a window of opportunity to accumulate before the analyst community catches on and broadcasts this information.

*Author has a long position in St. Andrew Goldfields

DISCLAIMER: The information in this publication is not intended to be, nor shall constitute, an offer to sell or solicit any offer to buy any security. The information presented on this website is subject to change without notice, and neither Penny Stock Experts nor its affiliates assume any responsibility to update this information. Additionally, it is not intended to be a complete description of the securities, markets, or developments referred to in the material. Penny Stock Experts and its Author(s) cannot and do not assess, verify or guarantee the adequacy, accuracy or completeness of any information, the suitability or profitability of any particular investment, or the potential value of any investment or informational source. Additionally, Penny Stock Experts and its Author(s) in no way warrants the solvency, financial condition, or investment advisability of any of the securities mentioned. Furthermore, Penny Stock Experts and its Author(s) accept no liability whatsoever for any direct or consequential loss arising from any use of our product, website, or other content. The reader bears responsibility for his/her own investment research and decisions and should seek the advice of a qualified investment advisor and investigate and fully understand any and all risks before investing. Information and statistical data contained in this website were obtained or derived from sources believed to be reliable. However, Penny Stock Experts and its Author(s) do not represent that any such information, opinion or statistical data is accurate or complete and should not be relied upon as such. This publication may provide addresses of, or contain hyperlinks to, Internet websites, Penny Stock Experts takes no responsibility for the contents thereof. Each such address or hyperlink is provided solely for the convenience and information of this website’s users, and the content of linked third-party websites is not in any way incorporated into this website. Those who choose to access such third-party websites or follow such hyperlinks do so at their own risk. The publisher, owner, writer or their affiliates may own securities of companies mentioned in this publication.