St Andrew Goldfields is cleared for takeoff, could it be the next CRJ.TO?

Oct 26

St. Andrew Goldfields (TSE: SAS) (OTCMKTS: STADF) reminds me of Claude Resources (TSE: CRJ) (OTCMKTS: CLGRF) before its stock price cruised higher by 300%.

If you have a few minutes, allow me to explain why. Below i will highlight four catalysts set to unfold (or have already begun unfolding) for St. Andrew Goldfields over the next 6-12 months. As stated, this sequence of events reminds me of what happened with Claude Resources. In fact, on January 13th i posted This little secret’s almost out, Claude Resources ready to spread wings and fly. Since that post CRJ.TO has increased from 33 cents to a recent high of 80 cents. I’m not saying that to brag (because PennyStockExperts nailed it here at 21 cents), merely to emphasize the powerful price appreciation that can result when these catalysts start playing out.

4 Catalysts for St. Andrew Goldfields

Last reminder… each of these catalysts played out for Claude Resources, contributing to CRJ.TO becoming one of the top performing gold miners for 2014 and 2015, two of the worst years on record for gold stocks.

1) Better Grades

Anyone watching Claude Resources during 2014 (likely a small cadre) was well aware it would be bringing on a new mine called Santoy Gap. Sparing you the disappointing backstory, Claude Resources was struggling operationally and financially. Its only ray of hope was Santoy Gap, a nearby (to Seabee mine) deposit that promised twice as many ounces per vertical metre. Seemingly out of nowhere, Claude’s operation started looking more sustainable as mined grades increased from 4-7 g/t to 8-12 grams per tonne.

“Santoy Gap” is to Claude Resources as “Taylor” is to St. Andrew Goldfields

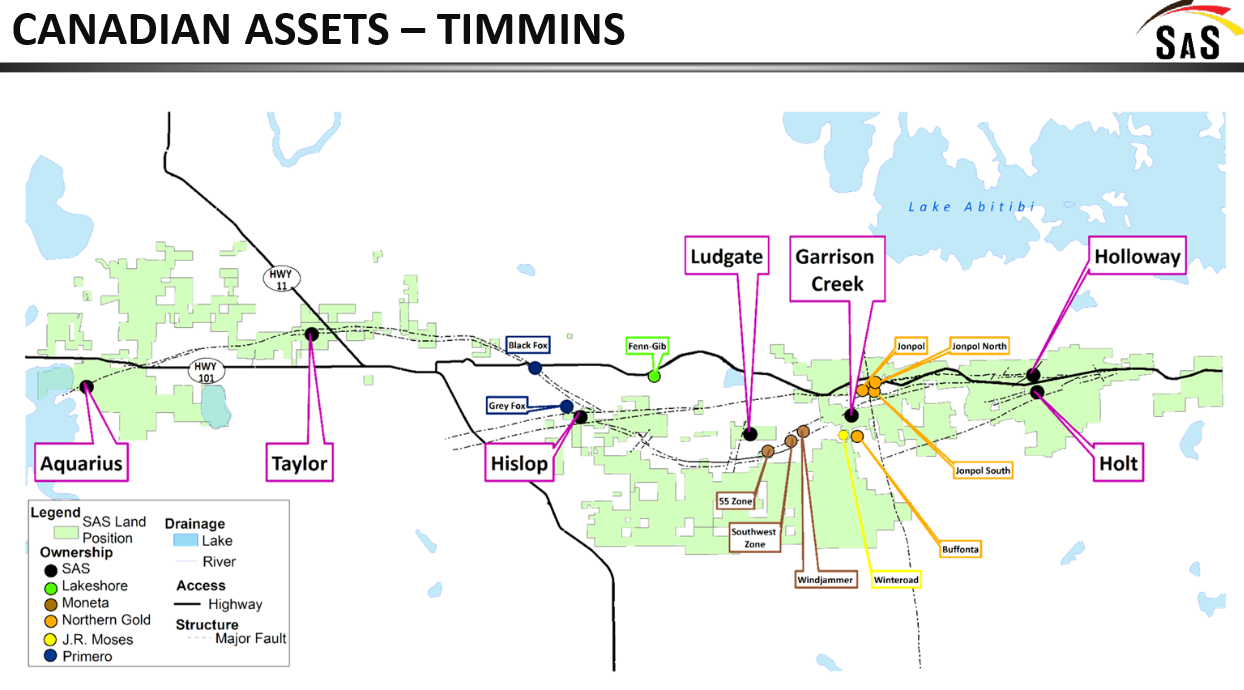

St. Andrew Goldfields is advancing Taylor toward production>> at the Precious Metals Summit CEO Duncan Middlemiss said mid-October or early-November, so those paying attention are expecting the announcement(s) any day now. Earlier in the year, an 18,000 tonne bulk sample from Taylor’s 1004 lens yielded 9 g/t, above the geological model forecast of 7.2 g/t. Either way, these grades will blend nicely with the 5 g/t St. Andrew is mining from Holt and Holloway.

2) Organic Production Growth

Thanks to increased tonnage coming from Santoy Gap, Claude Resources’ Seabee Camp is now expected to generate more than 70,000 ounces of gold per year! Nothing to write home about for some miners, but nearly double the 43,850 ounces it produced during 2013.

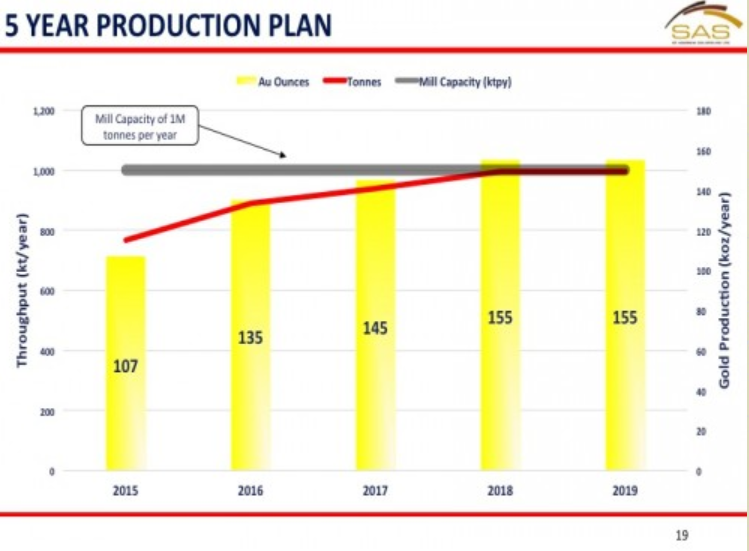

Take a look at St. Andrew Goldfields 5 year production plan below…

If all goes according to plan, Taylor (like Santoy Gap) will contribute to a near doubling (assuming current 85k ounce guidance for 2015) of St. Andrew’s production in the foreseeable future. Whether they want to or not, the analyst community will have to take notice.

3) Analysts Begin Boarding

At the end of 2014 Claude Resources had zero analysts covering the stock, now it has eight! Scotia slapped a $1 price target on CRJ.TO back when the stock was around 40 cents. This announcement put a strong bid into CRJ.TO immediately, all the other analysts jumped on the bandwagon soon after. Aside from PennyStockExperts and a few Seeking Alpha mentions, Claude wasn’t getting any love from the investment community before that.

Presently, St. Andrew Goldfields has little to no analyst coverage besides Mackie, who recently put a $0.70 price target on shares of SAS.TO , only question is… who will be the next firm to up the ante… do i hear $1 ?

4) Operational Improvements

Last but not least, improvements on the ground have driven down production costs for both Claude Resources and St. Andrew. Without getting into the technical details, which i’m not qualified to do, from the outside looking in personnel changes (new leadership) have increased worker moral– ultimately leading to more efficient mining and methods.

Brian Skanderbeg P. Geo was promoted to CEO for Claude Resources in late 2014, since he stepped in to run the company everything has been smelling like roses. Prior to becoming CEO Brian Skanderbeg was Chief Operating Officer for Claude. I think having a guy who leads from the front and commands the confidence of miners on the ground (and under it) has made a positive impact, which cannot be understated. Here we find yet another similarity between the two companies, Duncan Middlemiss P. Eng (now CEO of St. Andrew) also led the operations team before being promoted to CEO in late 2013.

Final Thoughts: St. Andrew Goldfields and Claude Resources are eerily similar, one of the biggest differences being that SAS.TO has yet to spread its wings and fly (like CRJ.TO has). My gut tells me it has some catching up to do over the next 6-12 months.

St. Andrew Goldfields has everything i look for in a solid junior mining stock:

a) strong balance sheet>> $27M cash and $0 debt

b) organic production growth potential with improving grades>> 85k to 135k annual ounces *According to presentation at Precious Metals Summit

c) leadership team with skin in game and operational experience>> buying back stock slowly buy surely lately

d) prospective land package; historically proven yet under-explored>> 120km strike length straddling Porcupine-Destor Fault

e) little to no analyst coverage>> let’s face it, this means very few people are telling the story = strong buying interest(s) sidelined

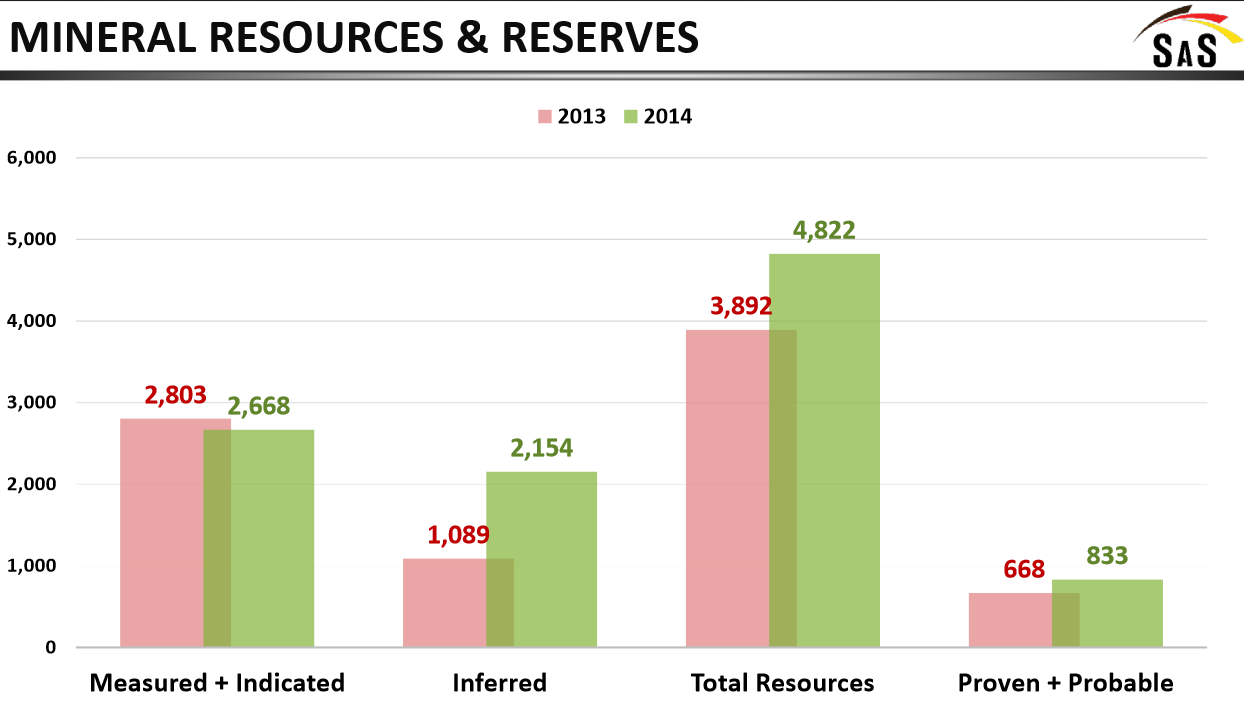

f) existing reserve and resource base>>

g) reasonably priced on a operating cash flow and resources in ground basis>> $18.7M cash from operations through 9 months; in-ground resources valued below $20 per ounce.

What am i missing here?

Daniel T. Cook

P.S. If you want more information like this sent directly to your inbox>>> subscribe with your email >>> its on the top right of this page>>>

*Author has a long position in Strategic Metals Ltd.

DISCLAIMER: The information in this publication is not intended to be, nor shall constitute, an offer to sell or solicit any offer to buy any security. The information presented on this website is subject to change without notice, and neither Penny Stock Experts nor its affiliates assume any responsibility to update this information. Additionally, it is not intended to be a complete description of the securities, markets, or developments referred to in the material. Penny Stock Experts and its Author(s) cannot and do not assess, verify or guarantee the adequacy, accuracy or completeness of any information, the suitability or profitability of any particular investment, or the potential value of any investment or informational source. Additionally, Penny Stock Experts and its Author(s) in no way warrants the solvency, financial condition, or investment advisability of any of the securities mentioned. Furthermore, Penny Stock Experts and its Author(s) accept no liability whatsoever for any direct or consequential loss arising from any use of our product, website, or other content. The reader bears responsibility for his/her own investment research and decisions and should seek the advice of a qualified investment advisor and investigate and fully understand any and all risks before investing. Information and statistical data contained in this website were obtained or derived from sources believed to be reliable. However, Penny Stock Experts and its Author(s) do not represent that any such information, opinion or statistical data is accurate or complete and should not be relied upon as such. This publication may provide addresses of, or contain hyperlinks to, Internet websites, Penny Stock Experts takes no responsibility for the contents thereof. Each such address or hyperlink is provided solely for the convenience and information of this website’s users, and the content of linked third-party websites is not in any way incorporated into this website. Those who choose to access such third-party websites or follow such hyperlinks do so at their own risk. The publisher, owner, writer or their affiliates may own securities of companies mentioned in this publication.