Orca Gold has plenty of Au, now it needs to discover H2O!

May 29

When evaluating gold exploration stocks there are three boxes that MUST be checked before making a “yes” investment/speculation decision:

1) The Right People

2) The Right Rocks

3) The Right Share Structure

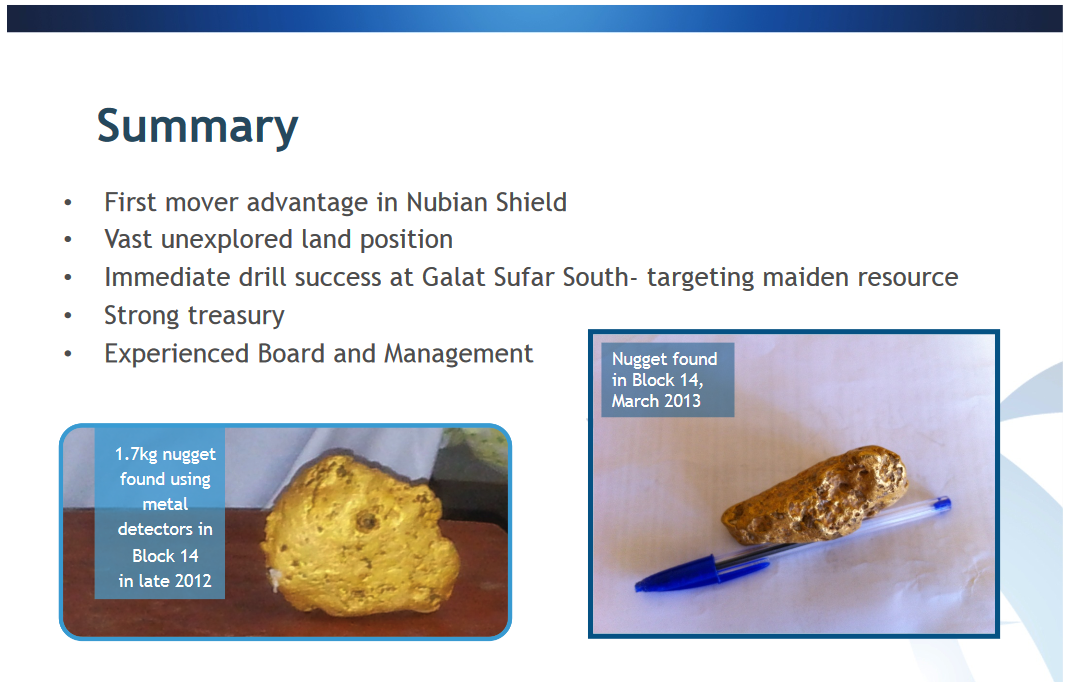

As far as I can tell, Orca Gold (CVE: ORG) (OTCMKTS: CANWF) meets or exceeds the above criteria. Its team has a proven track record, including a BIG success story— selling Red Back Mining for $7.1B in 2010. While somewhat complex, I understand the geology (Arabian Nubian Shield) hosts plenty of gold, evidenced by thousands of artisanal miners working Orca Gold’s Block 14, of which it owns 70%.

CEO Hugh Stuart suspects Orca Gold is just scratching the surface on its 926,645 acre land mass, looking at the map of “targets” below, the prospect for adding additional ounces is good (to quite good).

Thirdly, for share structure, approximately 40% of Orca Gold’s 107 million shares are held by Zebra Holdings [Lundin Trust], Sinotec [Beijing based multinational] and its management/BOD.

Gold-gold-everywhere, but not a drop to drink.

Orca Gold needs to discover water!

In 2014, a Nubian sandstone aquifer was intersected 55km north of a potential mine site at depths of 35m to 80m. More recently, according to page 14 of the corporate presentation, a 24 hour pump test achieved 3.75 litres per second with good re-charge.

Is that good? – I don’t know for sure.

From what I hear, more than one sophisticated speculator doesn’t think Orca Gold will solve its “water problem” (so these initial results are an encouraging sign, but not good enough?). After asking around and listening carefully, I suspect pessimism surrounding H2O has dampened Orca Gold’s stock price thus far.

But, and that’s a BIG BUT… if Orca Gold discovers water in large enough amounts to support a low-cost starter heap leach operation, it would be a positive catalyst for the stock (and we could get confirmation any week now). Worst case scenario, Orca Gold, or a hypothetical acquirer/partner would need a 195km pipeline to the Nile River, additional costs associated would likely shift its focus toward drilling (as opposed to production).

Galat Sufar South: one of the Top 3 heap leach projects worldwide?

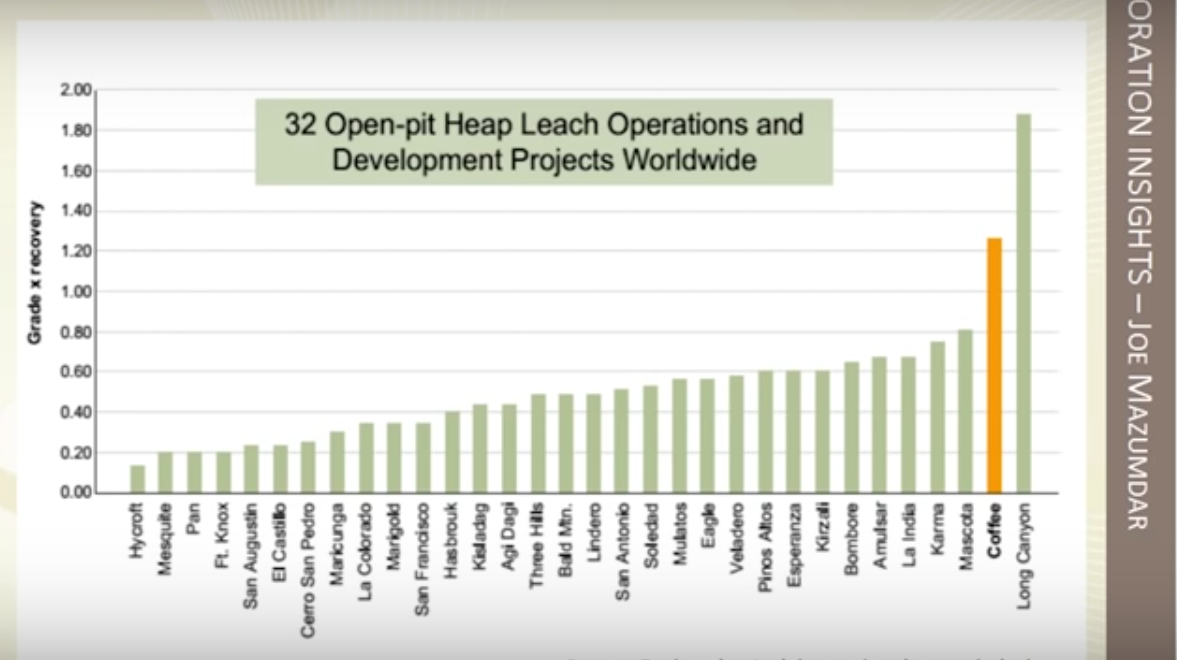

While more metallurgy work remains to be done, initial testing of “fine grind and leach” showed 81% recovery [pg 12]. Orca Gold’s PEA will consider three development options, one being a “low cost starter heap leach” at Galat Sufar South (aka. GSS).

a) According to its numbers>> 13.6 million tonnes of oxides @ 1.23 g/t Au [539k ounces]

b) According to my numbers>> 1.23 g/t Au multiplied by 81% recovery = 1 g/t Au “recovered grade”

Now then, water and country concerns aside (i touched on country risk here), according to the chart below, courtesy of Exploration Insights, GSS would rank among the Top 3 heap leach projects in the world— and #2 is being acquired by Goldcorp for $520M.

Bottom Line: I don’t think Orca Gold has a PR machine, but if it does, it hasn’t been running lately… things have been VERY quiet. However, “smart money” tends to accumulate during quiet periods. With a scheduled PEA announcement (by July?) and further water testing, Orca Gold should have many important things to communicate to the market in the near future. With a market value of $26M and $16M cash to invest into advancing GSS toward production or drilling (historically, it hasn’t struggled to find more ounces), I continue to like the risk/reward.

*Author has a long position in Orca Gold Inc.

DISCLAIMER: The information in this publication is not intended to be, nor shall constitute, an offer to sell or solicit any offer to buy any security. The information presented on this website is subject to change without notice, and neither Penny Stock Experts nor its affiliates assume any responsibility to update this information. Additionally, it is not intended to be a complete description of the securities, markets, or developments referred to in the material. Penny Stock Experts and its Author(s) cannot and do not assess, verify or guarantee the adequacy, accuracy or completeness of any information, the suitability or profitability of any particular investment, or the potential value of any investment or informational source. Additionally, Penny Stock Experts and its Author(s) in no way warrants the solvency, financial condition, or investment advisability of any of the securities mentioned. Furthermore, Penny Stock Experts and its Author(s) accept no liability whatsoever for any direct or consequential loss arising from any use of our product, website, or other content. The reader bears responsibility for his/her own investment research and decisions and should seek the advice of a qualified investment advisor and investigate and fully understand any and all risks before investing. Information and statistical data contained in this website were obtained or derived from sources believed to be reliable. However, Penny Stock Experts and its Author(s) do not represent that any such information, opinion or statistical data is accurate or complete and should not be relied upon as such. This publication may provide addresses of, or contain hyperlinks to, Internet websites, Penny Stock Experts takes no responsibility for the contents thereof. Each such address or hyperlink is provided solely for the convenience and information of this website’s users, and the content of linked third-party websites is not in any way incorporated into this website. Those who choose to access such third-party websites or follow such hyperlinks do so at their own risk. The publisher, owner, writer or their affiliates may own securities of companies mentioned in this publication.