Orca Gold: something for nothing? Two points investors don’t know about Northern Sudan

Nov 29

Man! things were looking pretty good for gold and gold stocks through mid-October. Until Janet rearranged a few words in the fed minutes that is, then… no dice. Despite reports of record prices and physical demand abroad, gold in US dollar terms, the only term that seems to matter, was smacked down.

Nothing to do but play the hand we’re dealt, and it’s no exaggeration to say Penny Stock Experts made the best of a bad situation in 2015, when practically everything aside from FANG (Facebook, Amazon, Netflix & Google) and biotech didn’t perform so well. As regular readers and subscribers know, well-thought-out names like Claude Resources, St. Andrew Goldfields, and Richmont Mines (the majority of this years content) have outperformed dramatically.

–the donate button is top right

All that to say this– the art of stock picking isn’t dead.

Money can be made in gold stocks even during one of the worst bear markets on record.

I’ll admit, despite recent successes, finding the cajones to buy-buy-buy gold stocks right now isn’t easy. Regardless of how cheap, the group seems to get cheaper every week.

But i, like a small minority of others, believe we are close to the bottom of this down swoon in precious metals, and the eventual up swoon should more than compensate for interim pain. However, not all companies will take part in the recovery– and the recovery is a question of when for sure (not if), but the “when” part is tricky.

Therefore, my strategy-in-action is to wager slowly but surely on the way down. A company like Orca Gold Inc (CVE: ORG) (OTCMKTS: CANWF) has at least 24 months of cash on hand, it’s a name i’m betting will survive and eventually thrive.

Be choosey(er) than ever.

For me, paying a low price for “resources in the ground” or optionality isn’t enough. I’ve got to have low cost production, organic growth, less than 5-times operating cash flow and little to no debt [for a mining stock]; or a high-quality resource with massive upside potential that is valued at or close to zero [for exploration stocks].

–depending on perspective, that’s how bad or good this environment is

Additionally, in both categories i need to see a management team with a proven track record and skin in the game, ideally, they should be buying stock at record low prices. If insiders aren’t ballsy enough to put money down, why should we be?

Back to Orca Gold, it entered 2015 with $24.7M cash. Expenses for the full year are expected to be $5M, so it should start 2016 with approximately $19M.

–today’s market value is just under $17M

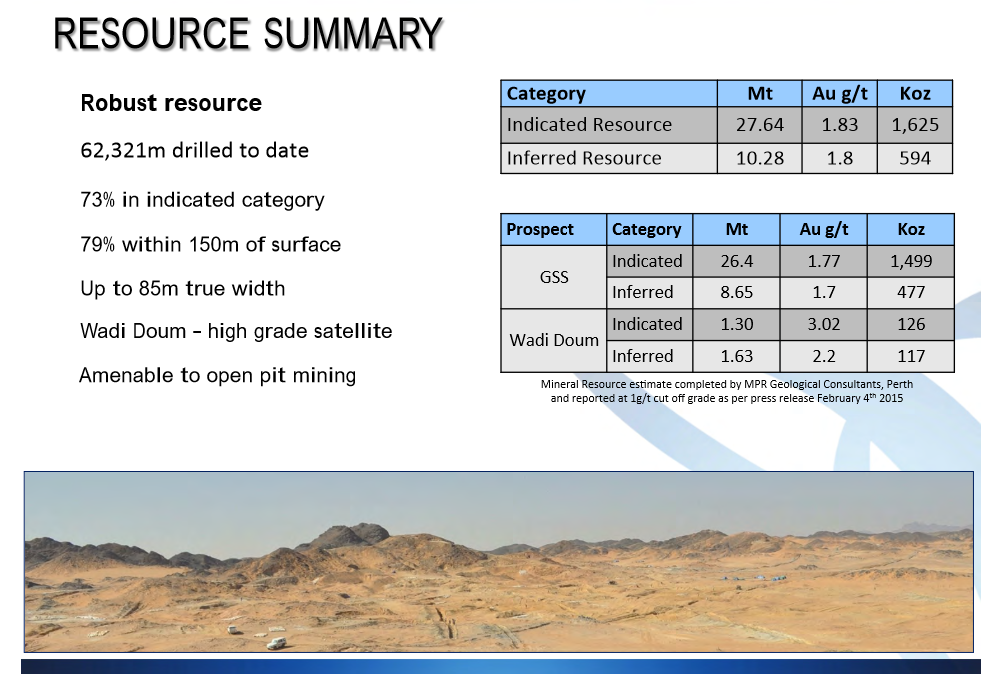

In other words, the share price is completely covered by cash. I’m getting the Galat Sufar South (GSS) project for free. Presently, it consists of 27Mt (million tonnes) @ 1.83 g/t Au “indicated” and 10Mt @ 1.8 g/t Au “inferred”, an estimated 2,219,000 ounces of gold resources in ground at a respectably high grade.

My thinking is… why buy “optionality” (a lower quality resource needing much higher metal prices to become a mine) for optionality sake, when i can get optionality on a higher quality project for free? Again, i’m no geologist, but i can tell you Orca Gold’s GSS project has thousands of artisanal miners working it now. With metal detectors as a guide, many of them are plucking nuggets right off the ground.

To reiterate the slide above, 80% of Orca Gold’s resource is within 150m of surface. In all likelihood it continues to much deeper depths, but it doesn’t need to prove that to begin with an open pit. Of late, its focus is finding higher grade satellite deposits, such as Wadi Doum and Liseiwi. Highlighted drill results from each include 24m @3.89g/t Au, 21m @ 19.35g/t Au, and 28m @ 16.52g/t Au.

Northern Sudan — is it riskier than Burkina Faso or Mali?

Despite its non-existent trade relations with the USA, one could make a strong argument that Northern Sudan is a more stable political jurisdiction than Burkina Faso, judging by recent coup attempts. In Mali’s capital city, there was recently an attack at the Radisson Blu hotel, two mining executives were lucky to escape with their lives.

So is Northern Sudan more risky than Burkina Faso and Mali, or anywhere else in Africa for that matter?

I can’t answer that question definitively from the outside looking in (judging by recent headlines i’d lean toward no), but i can say, from conversations with other investors, they don’t recognize a distinction between North and South Sudan (or even know there is one). Potentially, the market may reassess this situation, and investors holding assets in Burkina Faso and Mali could come to see North Sudan as less risky on par, given its neglected nature and potential.

Listen to Hugh Stuart’s presentation at the Precious Metals Summit in Zurich, in it he shares a few boots on the ground experience(s) from traveling in and out of the country.

In my view, the market is missing two important points regarding Northern Sudan…

1) The country is in the midst of an artisanal gold rush involving up to 1.5 million people. Amazingly, despite having no commercial mining operations, its estimated Northern Sudan will produce 60-80 tonnes of gold in 2015. Placing it among the top producing gold countries in all of Africa.

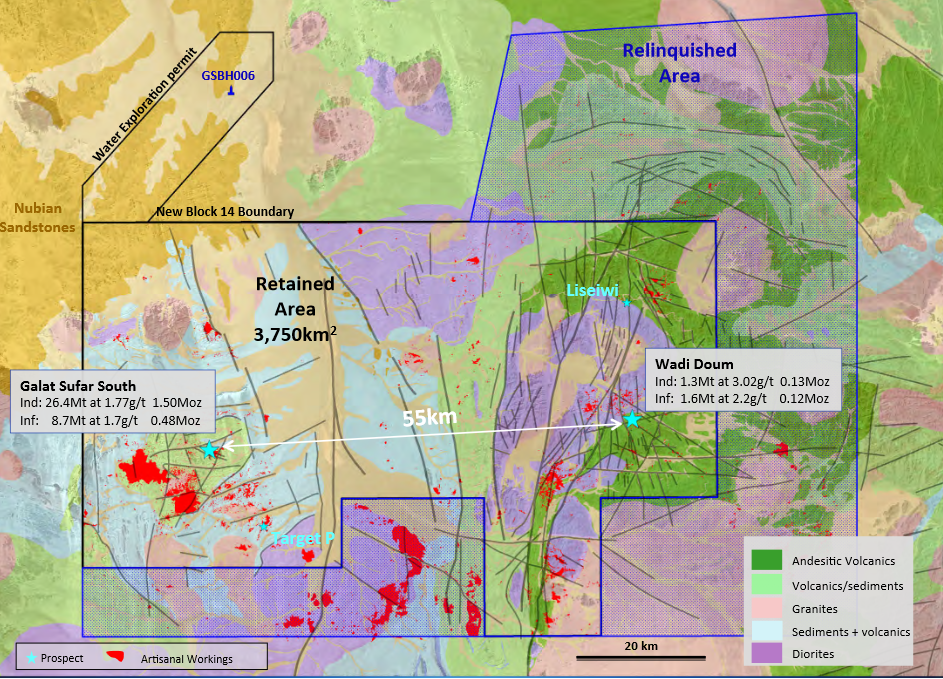

Notice the artisanal workings in red below:

2) Northern Sudan and Southern Sudan are not the same. The government of Northern Sudan has been in power for 26 years, and it’s “incredibly supportive of what we’re doing”, according to Orca Gold’s CEO Hugh Stuart. Most of Sudan’s oil is produced in the South. The North is dependent on and promoting mining as a revenue source, as it no longer generates significant funding from oil. Resource hungry nations like China and Russia are moving into Northern Sudan in a big way. Sinotec, a Chinese multinational, owns over 10% equity in Orca Gold and has seats on the board.

Additional notes worthy of mention…

a) Government owns 20% of Orca Gold’s Block 14 — a 3,750 sq. kilometer land package in far north east Sudan (Arabian Nubian Shield).

b) Galat Sufar South is four hours from the nearest town, and relatively flat desert terrain. There is no armed security personnel or fence on the property.

c) Orca Gold is expected to move forward on a preliminary economic assessment (PEA) study within weeks, it’s expected to be completed by the end of Q2 2016 — Probable budget/expenditures for 2016 is $5M

d) According to CEO Hugh Stuart: “we have effectively proved concept”… in regards to finding water in the Nubian sand stones, north of GSS. Access to water is a top concern for Orca Gold moving forward.

e) Despite extensive artisanal mining activity in the area, Block 14 (over 900k acres) had never seen a drill hole until Orca Gold — the exploration upside to Orca’s current 2 million ounce resource is considerable. Artisanal miners are mining host rock, not veins. Consistent grade is seen across 50-70m widths.

Final Thoughts: the team running Orca Gold have a recent success story in selling Red Back Mining to Kinross for $7.1 billion. Prior conversations with investors and geologists lead me to believe Northern Sudan’s gold rush is largely unknown. In my view, Orca Gold is completely off the radar, evidenced by its lack of analyst coverage. A relatively high grade resource of 1.8g/t Au for open pit standards (near surface) — i’m comfortable exchanging any country risk for the upside potential at current prices. Orca Gold’s current cash position should buy them 24-36 months, if they want it to.

Daniel T. Cook

P.S. If you want more information like this sent directly to your inbox>>> subscribe with your email >>> its on the top right of this page>>>

*Author has a long position in Orca Gold Inc.

DISCLAIMER: The information in this publication is not intended to be, nor shall constitute, an offer to sell or solicit any offer to buy any security. The information presented on this website is subject to change without notice, and neither Penny Stock Experts nor its affiliates assume any responsibility to update this information. Additionally, it is not intended to be a complete description of the securities, markets, or developments referred to in the material. Penny Stock Experts and its Author(s) cannot and do not assess, verify or guarantee the adequacy, accuracy or completeness of any information, the suitability or profitability of any particular investment, or the potential value of any investment or informational source. Additionally, Penny Stock Experts and its Author(s) in no way warrants the solvency, financial condition, or investment advisability of any of the securities mentioned. Furthermore, Penny Stock Experts and its Author(s) accept no liability whatsoever for any direct or consequential loss arising from any use of our product, website, or other content. The reader bears responsibility for his/her own investment research and decisions and should seek the advice of a qualified investment advisor and investigate and fully understand any and all risks before investing. Information and statistical data contained in this website were obtained or derived from sources believed to be reliable. However, Penny Stock Experts and its Author(s) do not represent that any such information, opinion or statistical data is accurate or complete and should not be relied upon as such. This publication may provide addresses of, or contain hyperlinks to, Internet websites, Penny Stock Experts takes no responsibility for the contents thereof. Each such address or hyperlink is provided solely for the convenience and information of this website’s users, and the content of linked third-party websites is not in any way incorporated into this website. Those who choose to access such third-party websites or follow such hyperlinks do so at their own risk. The publisher, owner, writer or their affiliates may own securities of companies mentioned in this publication.