All Aboard Strategic Metals Ltd! This Train is About to Leave the Station!!

Feb 20

Ladies and Gentleman ! … this is your captain speaking. Just a friendly reminder, judging by the increasing level of buying and recent price appreciation, it looks like this Yukon-bound train [ Strategic Metals Ltd ] is about to leave the station.

Chug-a-chugga, chug-a-chugga, chooo!! choooooo!!!

Just in case you need to catch up to speed, Strategic Metals Ltd (CVE: SMD) (OTCMKTS: SMDZF), the preeminent prospect generator and dominant claim holder in the Yukon was highlighted by Penny Stock Experts here (featuring CEO Doug Eaton’s presentation at Precious Metals Summit), here, and then again here.

Now i’ve been told: “you’re not supposed to fall in love with any stock” — and i wouldn’t express my feelings for Strategic Metals Ltd as LOVE per say — but i am extremely attracted to the lovely price!

Call me cheap.

But don’t call yourself that!

If you’ve profited handsomely by piggybacking off ideas like Claude Resources (up 440% since October 2014 post), Richmont Mines (up 92% since November 2014 post), St Andrew Goldfields (up +90% since April 2015 post), and Mitek Systems (up 31% since January 31st), now is a great time to share the love via donation!!

If you missed those opportunities, perhaps SMD.V will be “The One”, so consider paying it forward, and i promise to keep working overtime to deliver results– for the both of us.

Getting back to the business of Strategic Metals Ltd…

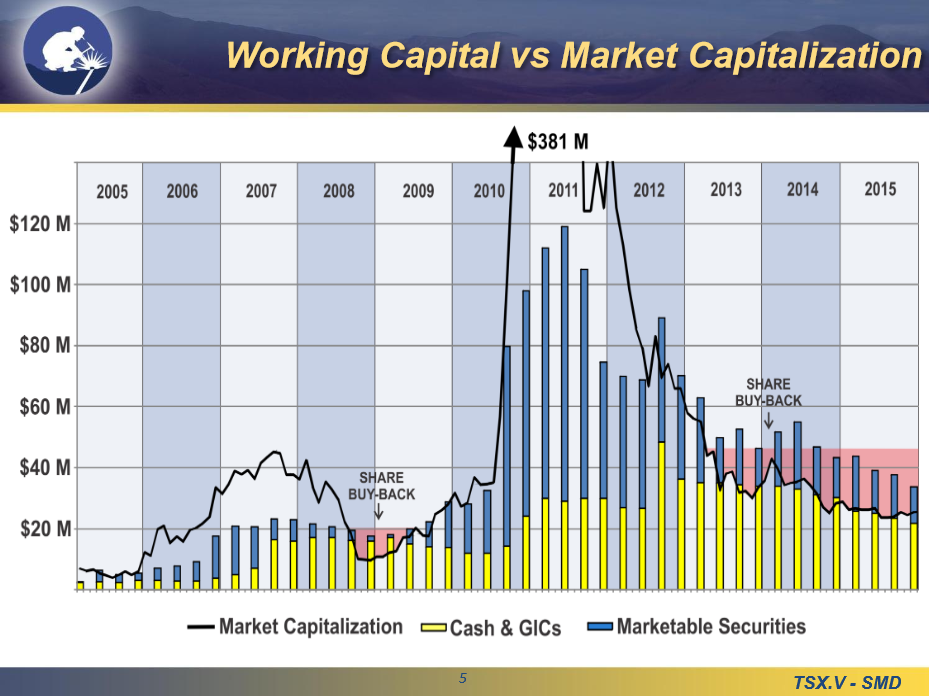

It’s hard to imagine this opportunity being priced so attractively, for so long, outside of a brutal bear market for exploration stocks / Toronto Venture Exchange. In my mind, SMD.V selling below cash was merely a sign of the times– at the bottom of any market even the best of breed is thrown out with the trash.

Despite appreciating smartly from the lows (almost 50%) in January, Strategic Metals Ltd continues to sell approximately 25% below its sum-of-parts worth.

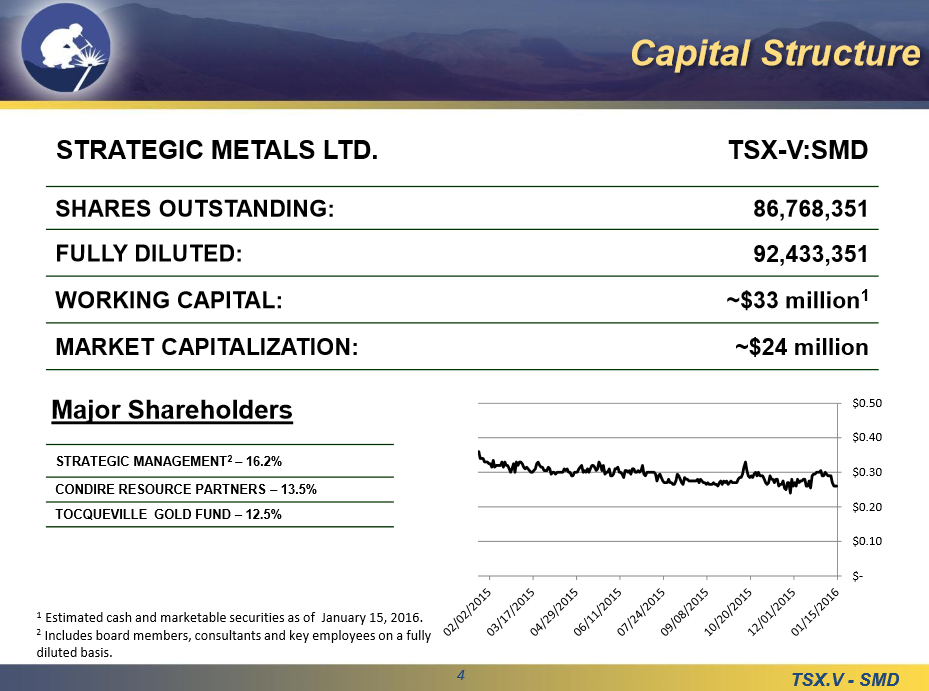

Please tell me if i’m wrong, or share your viewpoint(s), but i see the top risk for SMD.V relating to how it invests the $20 million ish’ cash position going forward. Assuming that risk, i’m comforted knowing the insiders/management have +15% equity ownership, a buy back is supporting the stock at or near cash (if someone wants to give it away), and this years exploration spend will be conservative again (around $2M for 2016).

As CEO Doug Eaton stated in Denver (video link above): “through three cycles we’ve demonstrated ability to capitalize on downturns and really exploit upticks.” Notice the steady increase in Strategic Metal’s cash and marketable securities in the chart below.

Going back to CEO Doug Eaton again: “i would rather be patient, wait two or three years to do the right deal, than do bad deals in a down market.”

While the statement has undertones of wisdom and experience, it means more when knowing Strategic Metals Ltd has +-$5 million worth of exploration credits (a few years worth) on the books with the mining-friendly Yukon Government (who’s investing $900k to promote mining and pushing for the “Northern Resources Gateway Project”, which would improve road access to the Dawson and Nahanni Ranges).

…so it costs virtually nothing to hold it massive land portfolio (140 projects / 17.7% of all claims in Yukon).

With so many properties, how does Strategic Metals Ltd. prioritize you ask?

Back to Doug: “the market tells me where our focus should be”. Historically, some of Strategic’s largest wins have come from minerals/commodities you wouldn’t necessarily think about– like tungsten! Doug isn’t in love with everything either, he only hangs onto the properties that look really good. Let’s just hope Doug and Team know em’ when they see em’.

The business model boils down to acquiring on weakness, dealing into strength, then repeating.

As a value investor at heart, i can appreciate that.

Winding down here, let’s not forget, a recent survey of mining executives voted “Yukon” as the #1 place in the world (geologically speaking) to make discoveries. And its one of the safest political jurisdictions to boot– a double whammy. Thankfully for Strategic Metals shareholders, its geologists are top notch, and its you scratch our back we’ll scratch yours relationship with Archer Cathro & Associates ensures access to the best maps /data banks.

If anyone is going to make discoveries in the Yukon, judging by history, you could bet Strategic Metals Ltd. and/or Archer Cathro will be nearby (or on the spot).

Additional notes worthy of mention?

a) more gold has been found in Yukon over past five years than in previous 110 after Klondike Gold Rush

b) mining is key to Yukon’s economy, approximately 20% of GDP. There are three deep water ports, located two days closer to Asia than any other western port (assuming Asia will need copper, nickel and zinc again, someday)

c) Yukon’s royalty and tax regime encourages mineral production; Strategic Metals Ltd controls the largest property portfolio in country

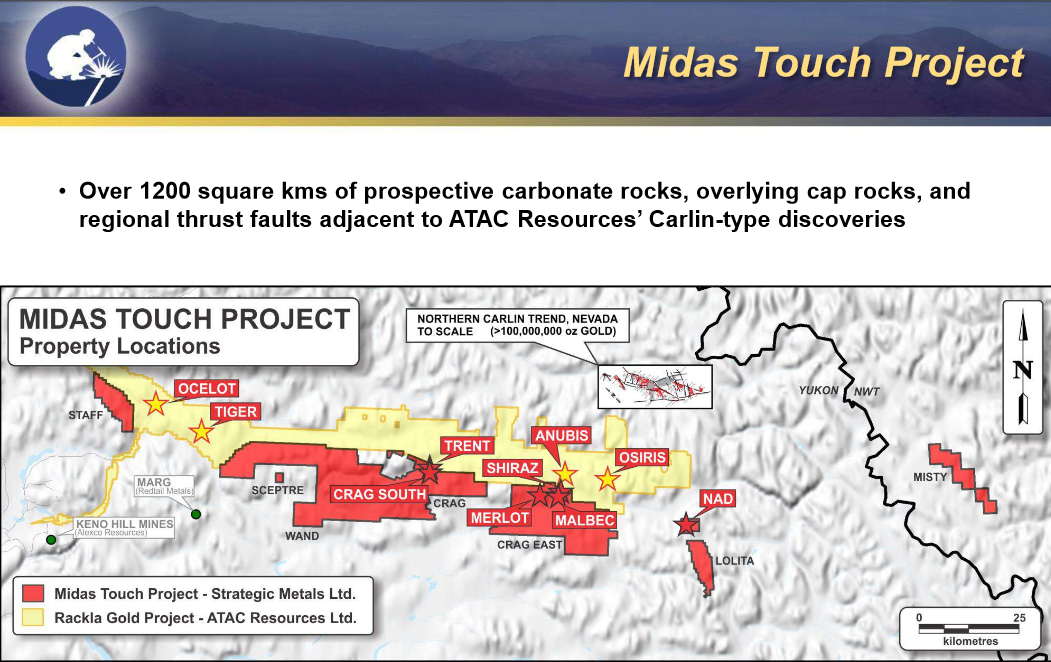

d) Strategic’s “Midas Touch Project” straddles ATAC’s Rackla Gold Project across its southern boundary.

Despite limited field programs by ATAC during the downturn, its still turning up lots of gold (mainly low hanging fruit). Any feeder structures and big faults controlling mineralization have yet to be found. While there’s still potential for a discovery at surface for Midas Touch, it’s theorized the gold is located deeper.

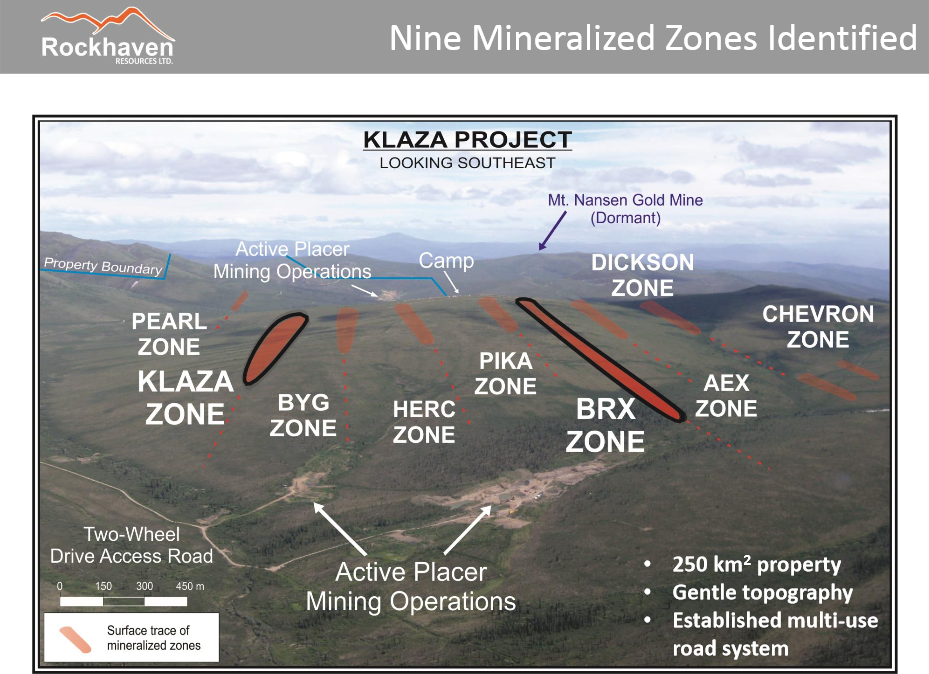

e) Despite reduced crowds at the Vancouver Roundup, lots of attendees had never heard of Rockhaven’s Klaza story. Hosting an inferred resource of 1,793,000 ounces at 5.92 g/t gold equivalent (Strategic owns about 46% equity in RK.V). Klaza’s resource potential remains wide open at depth, and there is potential for grades to increase with further infill drilling.

f) Strategic’s team has been and is meeting with lots of First Nations– moving toward community acceptance, environmental approval, and permitting for top tier projects (+-20). While not press release worthy, this is important work, as the goal is to remove any and all hindrances ahead of time. When JV partners come knocking Strategic will be prepared to move quickly.

g) Year 2015 closed with a cash position of +-$21M; and the exploration budget for 2016 is currently +-$2M.

Daniel T. Cook

P.S. If you want more information like this sent directly to your inbox>>> subscribe with your email >>> its on the top right of this page>>>

*Author has a long position in Strategic Metals Ltd.

DISCLAIMER: The information in this publication is not intended to be, nor shall constitute, an offer to sell or solicit any offer to buy any security. The information presented on this website is subject to change without notice, and neither Penny Stock Experts nor its affiliates assume any responsibility to update this information. Additionally, it is not intended to be a complete description of the securities, markets, or developments referred to in the material. Penny Stock Experts and its Author(s) cannot and do not assess, verify or guarantee the adequacy, accuracy or completeness of any information, the suitability or profitability of any particular investment, or the potential value of any investment or informational source. Additionally, Penny Stock Experts and its Author(s) in no way warrants the solvency, financial condition, or investment advisability of any of the securities mentioned. Furthermore, Penny Stock Experts and its Author(s) accept no liability whatsoever for any direct or consequential loss arising from any use of our product, website, or other content. The reader bears responsibility for his/her own investment research and decisions and should seek the advice of a qualified investment advisor and investigate and fully understand any and all risks before investing. Information and statistical data contained in this website were obtained or derived from sources believed to be reliable. However, Penny Stock Experts and its Author(s) do not represent that any such information, opinion or statistical data is accurate or complete and should not be relied upon as such. This publication may provide addresses of, or contain hyperlinks to, Internet websites, Penny Stock Experts takes no responsibility for the contents thereof. Each such address or hyperlink is provided solely for the convenience and information of this website’s users, and the content of linked third-party websites is not in any way incorporated into this website. Those who choose to access such third-party websites or follow such hyperlinks do so at their own risk. The publisher, owner, writer or their affiliates may own securities of companies mentioned in this publication.