Strategic Metals Ltd is Gold, Cash, and Land-Rich, but Valued Cheaper Than Dirt.

May 04

As a rule of thumb, most “penny stocks” are worth avoiding.

But like most rules of thumb, they aren’t accurate 100% of the time. So don’t be fooled into believing low priced stocks always equal low quality.

Warren Buffett says: “We don’t care about size… large cap, giant cap, middle cap, small cap, microcap— it doesn’t make any difference. The only question to us is can we understand the business. Does it sell for a price that’s attractive; and do we like the people running it.”

Now I’m no Warren Buffett, but I’m pretty darn sure a microcap called Strategic Metals Ltd (CVE: SMD) (OTCMKTS: SMDZF) is attractively priced. As of the close May 1st, 2015 its cash and equity portfolio is worth right around $41.7 million, but the market cap is just $27 million!

Cash and Equity Holdings breakdown:

Rockhaven Resources Ltd (CVE: RK) = 48.9 million shares

ATAC Resources Ltd (CVE: ATC) = 10.1 million shares

Silver Range Resources (CVE: SNG) = 9.5 million shares

Precipitate Gold Corp (CVE: PRG) = 5 million shares

Misc. Holdings = worth approximately $876,000

Cash Holdings = approximately $25,000,000

What else do you need to know?

Maybe you’re details oriented like I am; you command and demand to know more!

In that case, I’ll try to shed some light on the finer points. If all goes well, after reading this you’ll have some appreciation for Strategic Metals Ltd, a brain trust of geologists (yet humble and non-promotional) that aren’t afraid of getting their boots dirty trekking across the gold-rich Yukon Territory.

Strategic Metals Ltd controls more than 800 thousand acres of prospective terrain— approximately 4% of all the Yukon’s known mineral occurrences have been staked by them! Its database is so detailed and vast the government has requested a sneak peek on more than one occasion. That kind of information has got to be worth something, no?

Yet at today’s valuation savvy speculators get it for free.

Trading at a 35% discount to net asset value, this incubator (or prospect generator if you prefer) of future gold and copper mines is getting little to no respect from whoever’s left of the natural resource focused investment community. In fact, there’s only one professional analyst, Michael Gray from Macquarie, “officially” covering the stock.

Little to no analyst coverage can provide independent investors with an edge— because it means no one is telling Strategic’s story, and plenty of buying interest is on the sidelines.

Brilliant!

If any exploration group has a nose for making BIG discoveries in the Yukon its Archer, Cathro & Associates. This geological consulting company has been working in and around the Yukon Territory since 1965.

The top page of their presentation proudly states: “Looking for the right things in the wrong places: the Archer Cathro story”.

I don’t know about you, but I love that kind of style/approach! And it’s obviously been paying off. Archer Cathro has played a role in many of the discoveries made in the Yukon over the past five decades, including Casino, Wolverine, and Rackla.

Thanks to a close relationship with Archer Cathro, Strategic Metals Ltd has advisory support (and much more) from a team of brilliant scientists whom also have skin in the game, owning 17% of Strategic’s equity (and lots of Rockhaven too). Again, I don’t know about you, but I love people who eat their own cooking and aren’t throwing up.

Strategic Metals Ltd owns almost $10M worth of Rockhaven Resources, so its performance will impact that of SMD. If you’re interested, I’d suggest checking out Rockhaven’s CEO Matt Turner discussing the Klaza project.

Why bet on the Yukon?

Fraser Institute’s 2014 study ranked the Yukon #1 in mineral potential worldwide.

Ideally, what we want to see with any resource company is mineral potential, mining-friendly political jurisdiction, and a history of respecting land rights… I think the Yukon represents all three.

With help from Archer Cathro, Strategic Metals Ltd has grown to become the largest claimholder in the Yukon. Its land-rich portfolio consists of 16,500 claims (851,525 acres) and roughly 130 unique properties, each ranging in size from 4 claims to over 1,000 claims. All or almost all of its properties host gold showings or strong geochemical anomalies.

One important intangible asset is Strategic’s $6.25M worth of assessment credits.

While it waits for the market to heat back up, in the form of farm-out agreements, outright sales, and/or joint venture partners, Strategic Metals Ltd has the luxury of not unnecessarily burning through cash. Essentially, it has $6.25M worth of fees in the bank, ultimately reducing the cost of holding onto 16,500 claims.

Estimated overhead and exploration expenses for 2015 are $1.5M-$2.5M, including filing fees.

Grading B+ for “Market Awareness”

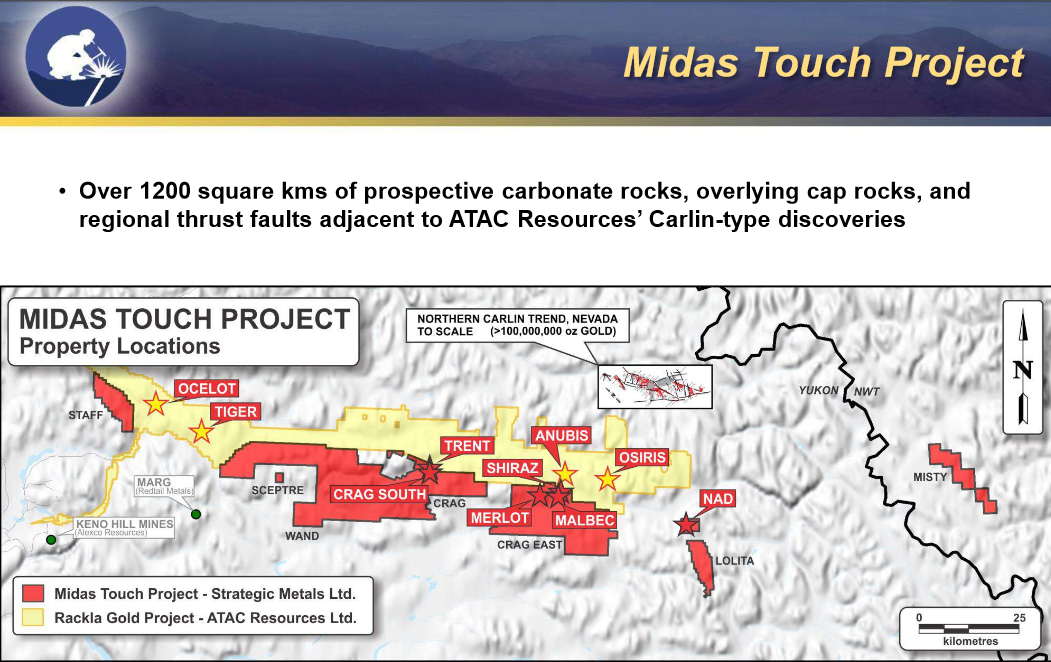

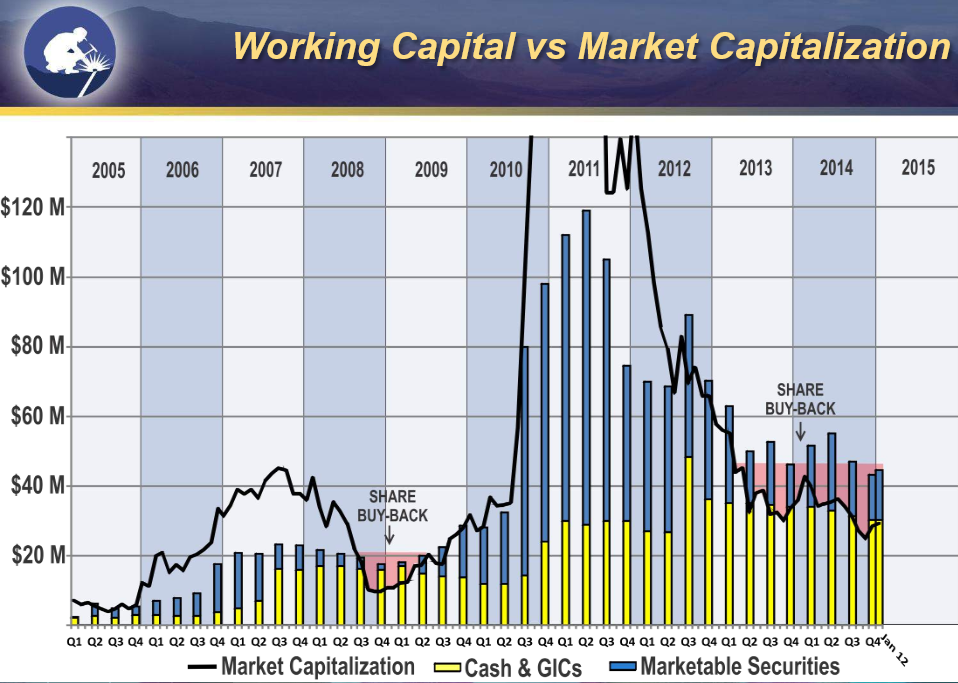

Between 2010-2011 shares of Strategic Metals Ltd climbed from below 50 cents to more than $4, largely based on excitement surrounding ATAC Resources’ Rackla Gold discovery, Canada’s only Carlin-type gold district. Although less richly-priced, Rackla is still just as exciting now, if not more so. In addition to Strategic’s large equity stake in ATAC, its Midas Touch property adjoins Rackla’s southern border, arguably another asset that gets zero value.

I’d encourage you to listen to ATACs recent presentation given by CEO Robert C. Carne, M.Sc, P.Geo. at the European Gold Forum.

As a result of timely equity raises, strategic buybacks and royalty sales, Strategic has been able to maintain a tight share structure (87.4 million outstanding).

Led by CEO Douglas Eaton, his team of respected geologists and scientists have shown a keen sense of market awareness. During the good times Strategic Metals Ltd tapped into demand for its shares at $1.45 ($15M raised Oct. 2010) and $3.25 ($16M raised Mar. 2011). Wisely, it also dumped three royalties back in 2012, collecting $30M in the process— those wouldn’t be worth nearly that much today.

Overall Strategic’s management team and board of directors receive a B+ for market awareness over the past five years. With the benefit of hindsight, selling more of its ATAC position (after spiking 10-fold) would have grabbed them an A+, but I can appreciate the difficult nature of market timing.

Additionally, as a core holding underneath the Strategic Exploration Group umbrella, parting ways with 100% of ATAC/Rackla amidst such enthusiasm would have been tough to do. As long as we’re on the topic of second guessing (I did refer to them as being brilliant, that should buy me some room to be critical), Silver Range Resources might be another handsome investment that gets away.

But no one’s perfect, not even Mr. Market’s favorite grandfatherly figure.

Bottom Line: When analyzing stocks of all shapes, sizes, and flavors I prefer looking at the downside before considering upside potential. Warren Buffett always said his #1 Rule was not to lose money. Of course, Rule #2 was not to forget Rule #1… I don’t think anyone enjoys losing hard earned money.

By purchasing Strategic Metals Ltd for well below NAV my downside is limited, because it can’t be valued below its cash balance forever (at least, I hope not). The biggest risk is that its management team makes poor decisions with the money, but based on their track record and accounting for the fact they own 17% (with a buyback plan in place) I’m confident everyone’s interests are aligned.

Insider and Institutional Shareholders include:

Management and Directors = 17%

Tocqueville Gold Fund = 12%

Condire Resource Partners = 13%

*Author has a long position in Strategic Metals Ltd

DISCLAIMER: The information in this publication is not intended to be, nor shall constitute, an offer to sell or solicit any offer to buy any security. The information presented on this website is subject to change without notice, and neither Penny Stock Experts nor its affiliates assume any responsibility to update this information. Additionally, it is not intended to be a complete description of the securities, markets, or developments referred to in the material. Penny Stock Experts and its Author(s) cannot and do not assess, verify or guarantee the adequacy, accuracy or completeness of any information, the suitability or profitability of any particular investment, or the potential value of any investment or informational source. Additionally, Penny Stock Experts and its Author(s) in no way warrants the solvency, financial condition, or investment advisability of any of the securities mentioned. Furthermore, Penny Stock Experts and its Author(s) accept no liability whatsoever for any direct or consequential loss arising from any use of our product, website, or other content. The reader bears responsibility for his/her own investment research and decisions and should seek the advice of a qualified investment advisor and investigate and fully understand any and all risks before investing. Information and statistical data contained in this website were obtained or derived from sources believed to be reliable. However, Penny Stock Experts and its Author(s) do not represent that any such information, opinion or statistical data is accurate or complete and should not be relied upon as such. This publication may provide addresses of, or contain hyperlinks to, Internet websites, Penny Stock Experts takes no responsibility for the contents thereof. Each such address or hyperlink is provided solely for the convenience and information of this website’s users, and the content of linked third-party websites is not in any way incorporated into this website. Those who choose to access such third-party websites or follow such hyperlinks do so at their own risk. The publisher, owner, writer or their affiliates may own securities of companies mentioned in this publication.