4 Things Orvana Minerals (ORV, TSX) Must Do To Get Its Stock Up!

Dec 17

Assuming it does and executes on the following…

But first, in case you missed it, our piece titled “Is Orvana The Cheapest Gold Mining Stock Right Now?” will provide a good foundation for what I’m about to say.

1. Generate Awareness!

Hit the road, get on the phone, hire a professional – do something!

Well, after years of not doing much in this department, it sounds like they’re trying to ramp up awareness now. I talked to Orvana Minerals’ CEO Jim Gilbert this morning (finally). It only took 3 weeks and 6 voicemails for him to get back to me! But he has been traveling (I figured that would be the story). Gilbert said he was in London and a number of other big cities trying to get the word out. The company has a “turnaround story” to tell, so it’s important that they’re doing it.

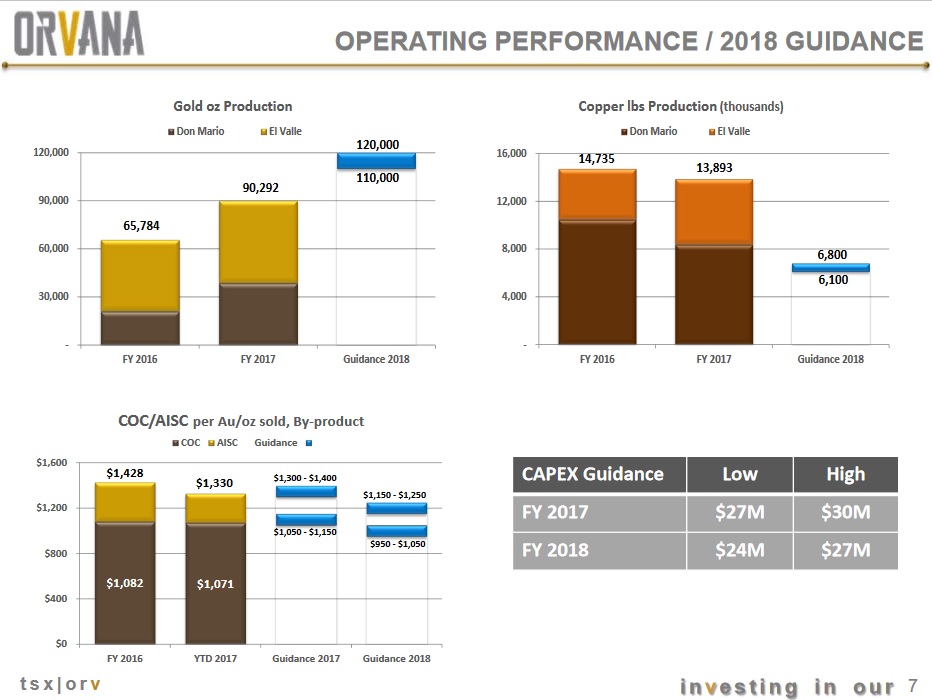

However, not many people seem to be listening. Over the past two months Orvana Minerals raised its production guidance for 2018 by about 30% and intersected 64 g/t Gold over 4.9 m northeast of the mine (milled grades are currently below 5 g/t).

…sounded like “good news” to me, but the stock is down roughly 20% since those announcements (although it appears to have found its footing lately).

There’s little to no chatter on the message boards, which is strange given the number of recent accomplishments worth talking about.

Also, there’s not 1 analyst on this thing. I know there are less and less people with the “analyst” title around every year (given the brokerage industry mass consolidation) but it’s still surprising nobody is covering ORV because it’s a legitimate “junior miner” with plans to produce 115,000 ounces next year. While we don’t necessarily need outside analysts to endorse our opinion, it’s nice when they do and getting one of the bigger brokerage houses on board would be a positive for the share price.

2. Execute The Plan!

Orvana is guiding for production growth and lower costs, a perfect combination.

Clearly, Orvana Minerals’ costs have been too high. You can’t make money producing Gold at $1,428 and $1,330 when an ounce is selling for $1,250. Said differently, if Orvana Minerals doesn’t get its costs under control the business will eventually be out of business.

Why should we expect costs to come down?

That’s the key question! Gilibert and Orvana Minerals would lead us to believe costs are coming down, in large part, because they have addressed what was “chronic under-investment” into the mines. Since August of 2016 more than $45 million has been spent, so lots of new equipment. This new equipment has reportedly lead to efficiency improvements and a better morale among the miners (who had become pretty demoralized after years of under-investment, and likely an under-appreciation of their efforts).

I’m told Mr. Juan Gavidia, Orvana Minerals’ new VP of Operations (since early 2016), has played an instrumental role running things on the ground. While it may sound cliche (or cheesy?), Gilbert says Gavidia has really empowered the miners via helping them take greater ownership and responsibility – I don’t think that’s a cheesy thing to say!

3. Bring Back the Buyout Potential!

Perhaps you can help me dig into this situation – who is Fabulosa Mines? And more important, who is the person or people behind it?

Fabulosa, beautiful name by the way, but the kind of ugly reality is that this group owns 52% of Orvana Minerals. And that’s a real downer because it would seem to put the kibosh on any buyout potential. I could be mistaken, but having a “majority owner” looming overhead and in the background is a real turnoff for many investors (or would-be acquirers). In my view, it’s just another thing keeping a lid on ORV.

Also, there’s some sort of relationship between Fabulosa and Orvana Minerals. I mean, in addition to having Fabulosa as a controlling shareholder, Gilbert (and perhaps the CFO?, don’t quote me on that) have worked for Fabulosa previously. Therefore, a lingering concern, so long as they own 52%, is that an entrenched management team (one that owns almost no stock by the way, we will address that next) “sells out” ORV shareholders by letting Fabulosa take it private in some sweetheart deal.

I hate to think that would happen, but it is within the realm of possibilities.

Bottom line, Orvana needs to work some sort of deal out by which Fabulosa’s stake is reduced to 49% or lower.

4. For Heaven’s Sake, Buy Some Stock!

One of my friends, a “deep value” investor, took a look at Orvana. We made money together on Claude Resources.

Claude’s Santoy Gap discovery was a real game changer and it reminds me of what Orvana Minerals may be onto at the East Breccia zone, with that 64 g/t Gold hit over 4.9 m!

Anyhow, the deep value guy said ORV definitely fits the bill because it’s trading way below book value. Thing is, he also likes to buy his deep value stocks when insiders are also buying. If their stock was really and truly undervalued it seems like they would be buying (doesn’t it?) – and Orvana Minerals insiders aren’t buying!

More troubling is that Gilbert told me he’s heard that same message lot from shareholders and prospective investors. Yet, the vibe I was getting is that, how should I say this… “Jim is sick and tired of hearing it”.

Jim, WTF, Man – Buy Some Friggin’ Stock!

Address the problem, it’s a simple fix.

According to Note 5 in Orvana Minerals financials – “Salaries, directors’ fees, and office administration” expenses are running at about $1 million per quarter. The senior management team consists of 3 people, says the website. Which leaves me thinking, Jim, Jeff (he’s the CFO), wtf guys, why aren’t you buying some friggin stock!

I’m buying, and you make more money than me.

Bottom line, I reminded Jim (even though he’s heard it before), that he doesn’t have to buy a million dollars worth of stock, or even a hundred thousand worth. Even putting $10k here and there into ORV would send a better message to the market.

It’s about the optics, Jim! It’s about the optics, and they’re not looking very good right now.

There you have it – the 4 things Orvana must do if it wants to turn the stock price around.

*This piece was first published December 11 at BullMarketRun.com

**Daniel has a long position in ORV

DISCLAIMER: The information in this publication is not intended to be, nor shall constitute, an offer to sell or solicit any offer to buy any security. The information presented on this website is subject to change without notice, and neither Penny Stock Experts nor its affiliates assume any responsibility to update this information. Additionally, it is not intended to be a complete description of the securities, markets, or developments referred to in the material. Penny Stock Experts and its Author(s) cannot and do not assess, verify or guarantee the adequacy, accuracy or completeness of any information, the suitability or profitability of any particular investment, or the potential value of any investment or informational source. Additionally, Penny Stock Experts and its Author(s) in no way warrants the solvency, financial condition, or investment advisability of any of the securities mentioned. Furthermore, Penny Stock Experts and its Author(s) accept no liability whatsoever for any direct or consequential loss arising from any use of our product, website, or other content. The reader bears responsibility for his/her own investment research and decisions and should seek the advice of a qualified investment advisor and investigate and fully understand any and all risks before investing. Information and statistical data contained in this website were obtained or derived from sources believed to be reliable. However, Penny Stock Experts and its Author(s) do not represent that any such information, opinion or statistical data is accurate or complete and should not be relied upon as such. This publication may provide addresses of, or contain hyperlinks to, Internet websites, Penny Stock Experts takes no responsibility for the contents thereof. Each such address or hyperlink is provided solely for the convenience and information of this website’s users, and the content of linked third-party websites is not in any way incorporated into this website. Those who choose to access such third-party websites or follow such hyperlinks do so at their own risk. The publisher, owner, writer or their affiliates may own securities of companies mentioned in this publication.