On A “Per-Ounce” Basis Is Orvana The Cheapest Gold Mining Stock Right Now?

Nov 12

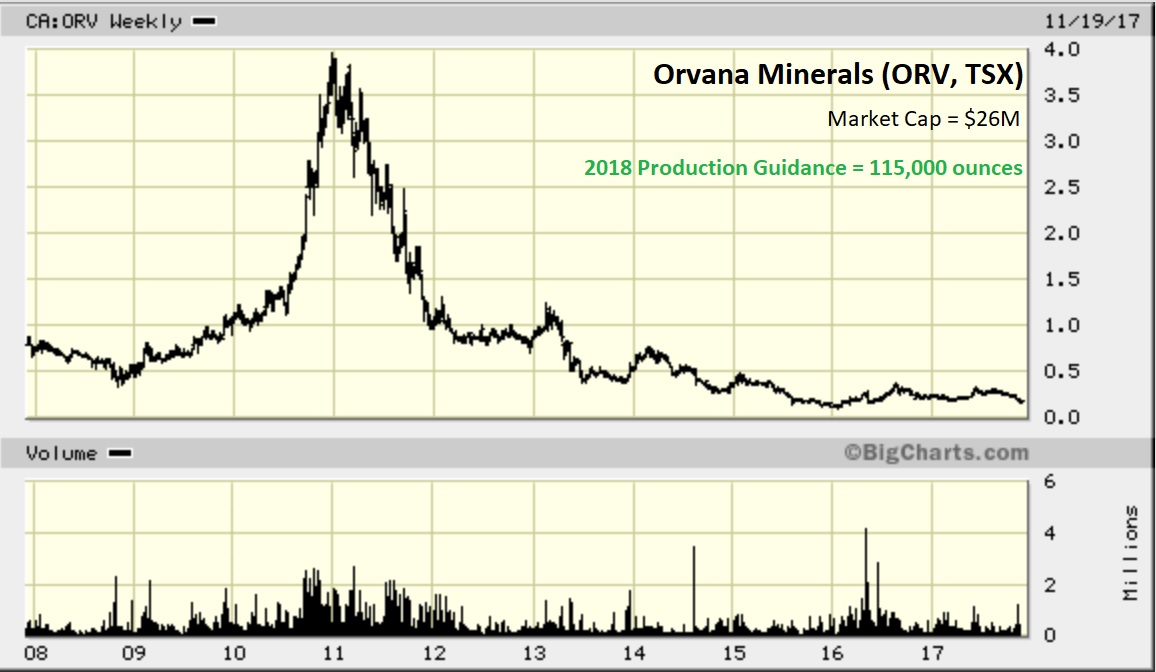

Now here’s one that’s been on my watch list for a long time, and the company has been around even longer. According to Google Finance this stock has been trading since the year 2000. Since then it has been as low as 6 cents and as high as $3.90 during the boom years for precious metals. Presently, shares are selling for 19 cents, so with approximately 137 million shares outstanding it’s valued at about $26 million.

Today we’re talking Orvana Minerals (ORV, TSX)!

First published at Bull Market Run November 27th

Just $288 Per-Ounce?

According to this press release (October 16), Orvana produced 90,292 ounces of Gold this year. By dividing its market cap of $26 million by total ounces produced we get $288. So that means at 19 cents per share, investors are paying the equivalent of $288 per ounce of Gold mined by Orvana.

The 5 stocks below were selected to provide some context, so you have a better idea of what other junior miners are selling for on a “price-per-ounce” basis. Each stock is held within Sprott’s Junior Gold Miner ETF:

- With a market cap of $563 million and production of 270,000 ounces (mid-range of guidance) Golden Star Resources (GSC, TSX) is valued at $2,085 per ounce. The mines are located in Ghana;

- With a market cap of $276 million and production of 215,000 ounces (mid-range of guidance) Teranga Gold (TGZ, TSX) is valued at $1,284 per ounce. The mines are located in Senegal;

- With a market cap of $245 million and production of 55,000 ounces (mid-range of guidance) Wesdome Gold Mines (WDO, TSX) is valued at $4,454 per ounce. The mines are located in Ontario;

- With a market cap of $445 million and production of 126,000 ounces (mid-range of guidance) Argonaut Gold (AR, TSX) is valued at $3,532 per ounce. The mines are located in Mexico;

- With a market cap of $584 million and production of 220,000 ounces (mid-range of guidance) Klondex Mines (KDX, TSX) is valued at $2,654 per ounce. The mines are located in North America.

Of course, every mine is unique, so there are no exact comparisons (or comparables). However, the list above does provide geographic diversity, spanning from Canada to Africa, and a range in terms of size, from 55,000 ounces to 270,000 ounces of annual production. On a price-per-ounce basis, on average, those 5 Gold mining stocks are valued at $2,802.

Therefore, at $288 per-ounce, Orvana is priced about 90% lower.

Obviously, 5 examples is far from being a comprehensive list (and I don’t have an updated price-per-ounce figure industry-wide), but I think it does serve our purpose and provide some validation to what Orvana’s CEO Jim Gilbert called an “extreme undervaluation”.

Duh, ORV Is Cheap For A Reason! Arguably Many Reasons!

Yep, there are quite a few reasons NOT to like ORV right now, such as:

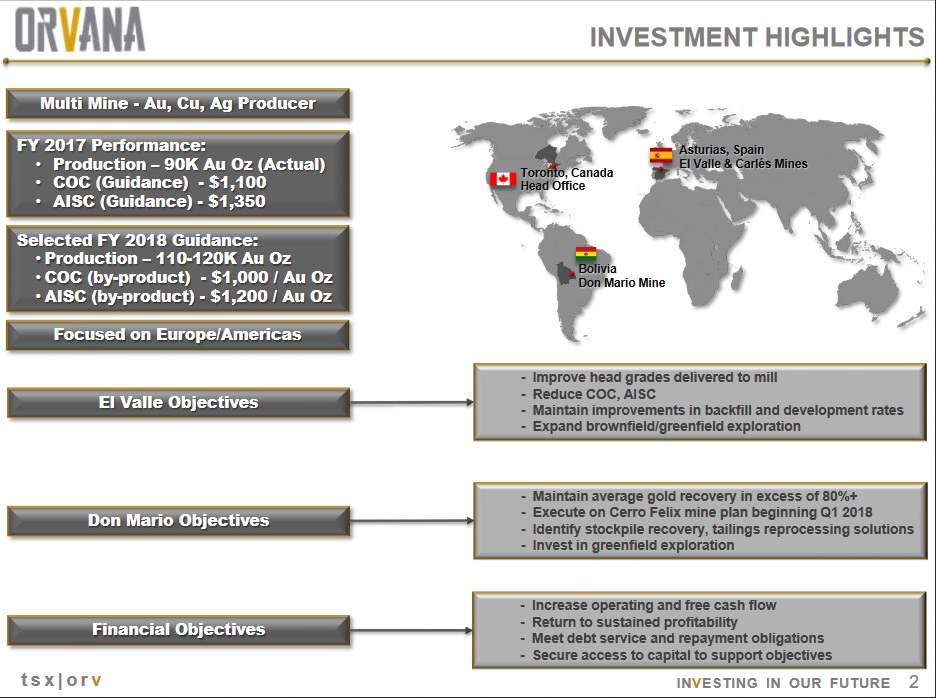

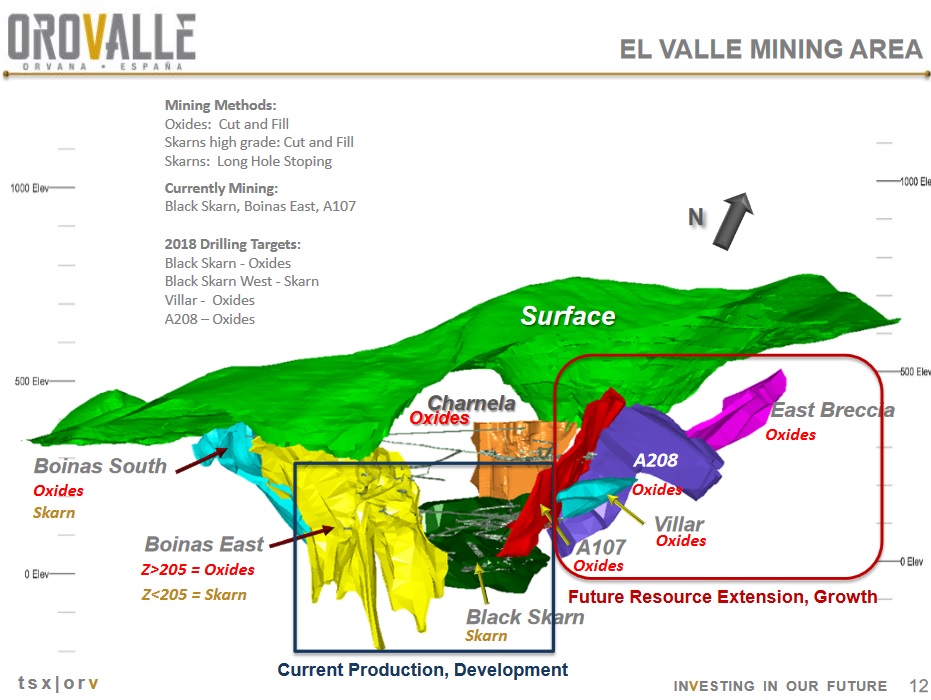

- The El Valle mine, located in northern Spain, has been operating at about 2.4 g/t Gold. That’s too low for making money mining underground at today’s prices;

- Due to unexpected shortfalls in grade, production costs at El Valle have looked ugly;

- Location – Orvana’s 2nd mine is in Bolivia, a place that has some perception issues (or worse?). The Don Mario mine, an open-pit, has had chronically low recovery rates and it is believed to be running out of material/resources;

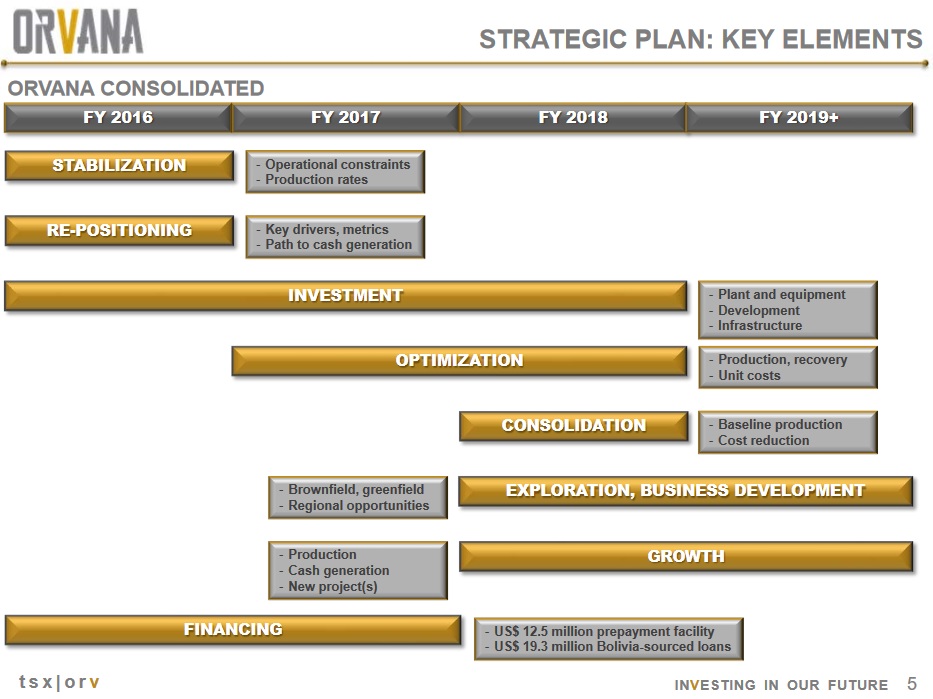

- There has been a chronic under-investment into exploration and mine infrastructure;

- A 52% shareholder, which may remove “takeover potential” from the equation.

There may be many more reasons for not liking ORV. In fact, I’ll bet there are. I’m only in the beginning stages of my due diligence.

Yet, as investors, of the sophisticated variety, we have to be looking ahead. What improvements, if any, has Orvana been making behind the scenes that the market hasn’t taken notice of yet?

That’s the question we must figure out!

And I’ll tell you what – after listening to Gilbert’s presentation again, from the Precious Metals Summit (watch it here), there are reasons to believe Orvana may be about to turn the corner next year.

For one, the company has addressed that “chronic under-investment” by upgrading its operations to the tune of $45 million (since August 2016). From the sounds of it, Orvana’s miners had become pretty demoralized, and how could you blame them given a deficit of quality tools needed to do the job. With a newer fleet of trucks and better equipment in hand the company should expect to see efficiency improvements. Orvana is looking to invest another $25 million into infrastructure and exploration in 2018.

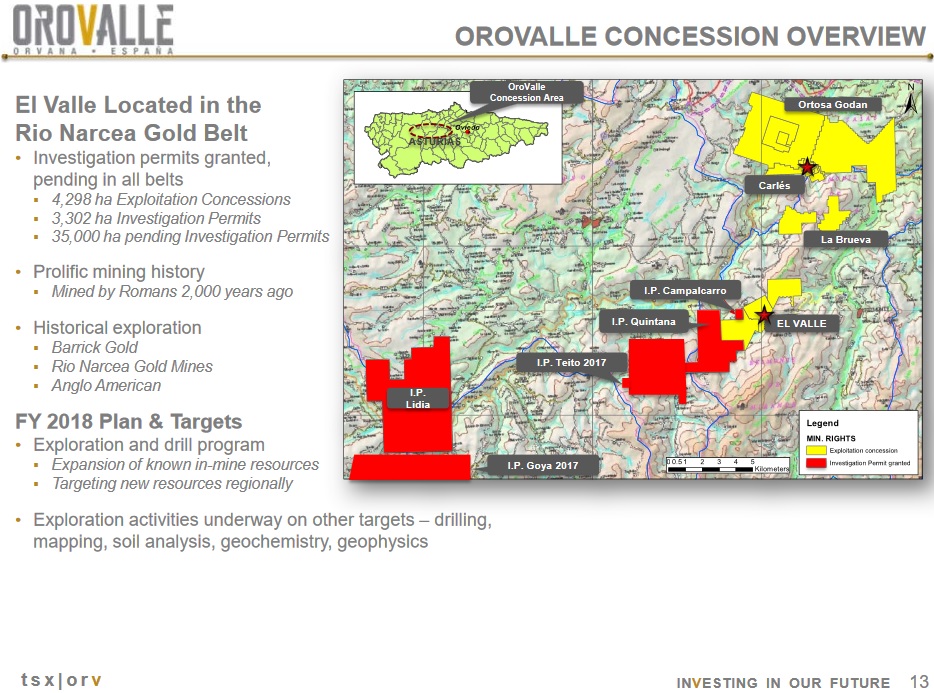

There’s no shortage of exploration potential at either El Valle or Don Gregorio.

One of the key reasons Orvana hasn’t had any exploration success over the past few years is that it hasn’t been exploring.

Also of interest, and I will bring this question up when I talk with Gilbert (which is near the top of my “to do list”), is the Samsung factor. I believe Samsung did a forward purchase agreement with Orvana. And Samsung did something similar with Avino Silver (ASM, TSX), because their aim is to source metals that aren’t contaminated with things like child labor and polluting the environment. If this is indeed the case, Samsung typically does a thorough vetting process on the mine. And that would be a plus for ORV in my book.

Here’s my thinking on it – sure, production costs are rather high, but at least Samsung has vetted the mine and we know it passed their standards concerning mining practices. And we’ve got some reason to believe, following a $45 million investment into infrastructure, that Orvana’s AISC (all-in-sustaining costs) should be declining in the years ahead.

Why Now?

Given the upward bent to Gold prices and what I suspect will be a “downward” bent in Orvana’s costs of production over the next 6 to 18 months, the stock represents a superb risk/reward scenario. On a price-per-ounce basis I believe ORV must be among the cheapest Gold mining stocks in the world. Therefore, if Orvana can improve its operations on the ground, the stock offers MEGA leverage!

64.2 g/t Gold Over 4.9 M!

By the way, today’s press release was a huge motivator in getting the Orvana story into your hands ASAP. As part of a 23,000-m drill program at El Valle aimed at de-isking the mine plan for 2018 and expanding the resource base, it hit 64.2 g/t Gold over 4.9 m (East Breccia Zone).

Also, they hit 8.3 g/t Gold and 1.9% Copper over 9.6 m.

“We are very pleased with the results of the infill drilling activities at the El Valle and Carlés Mines during the past fiscal year. One of our stated objectives in fiscal 2018 is to improve grade control of the ore coming from our Spanish operations by targeting the development of higher-grade oxide areas, which will, in turn, positively impact our overall unitary costs. The successful infill drilling campaign completed in fiscal 2017 means that we are now well-positioned to achieve this objective, and also to increase mineral reserves and resources within the new higher-grade Black Skarn Oxide areas identified by the program,” said CEO Jim Gilbert.

As a reminder, Orvana has been mining at grades between 2.5 and 4.5 g/t Gold at El Valle. And it just hit more than 2 ounces over nearly 5 m (from surface!) only a little northeast of the current mine development. Obviously, this could be quite a significant piece of new news. Or it might not prove to be that significant, but either way the market has yet to pass judgement.

For the world to see, ORV is in a major league downtrend. Buying stocks that are in a downtrend can be dangerous, and they don’t always provide the instant gratification of buying into a rising market. However, once in a while one may get lucky enough to buy at or near the all-time lows just prior to a huge reversal (and we may be nearing that exact moment with ORV).

I’m going to stop there for now so I can call Jim Gilbert. Expect to hear more about Orvana in the week(s) ahead.

*Daniel has a long position in ORV

DISCLAIMER: The information in this publication is not intended to be, nor shall constitute, an offer to sell or solicit any offer to buy any security. The information presented on this website is subject to change without notice, and neither Penny Stock Experts nor its affiliates assume any responsibility to update this information. Additionally, it is not intended to be a complete description of the securities, markets, or developments referred to in the material. Penny Stock Experts and its Author(s) cannot and do not assess, verify or guarantee the adequacy, accuracy or completeness of any information, the suitability or profitability of any particular investment, or the potential value of any investment or informational source. Additionally, Penny Stock Experts and its Author(s) in no way warrants the solvency, financial condition, or investment advisability of any of the securities mentioned. Furthermore, Penny Stock Experts and its Author(s) accept no liability whatsoever for any direct or consequential loss arising from any use of our product, website, or other content. The reader bears responsibility for his/her own investment research and decisions and should seek the advice of a qualified investment advisor and investigate and fully understand any and all risks before investing. Information and statistical data contained in this website were obtained or derived from sources believed to be reliable. However, Penny Stock Experts and its Author(s) do not represent that any such information, opinion or statistical data is accurate or complete and should not be relied upon as such. This publication may provide addresses of, or contain hyperlinks to, Internet websites, Penny Stock Experts takes no responsibility for the contents thereof. Each such address or hyperlink is provided solely for the convenience and information of this website’s users, and the content of linked third-party websites is not in any way incorporated into this website. Those who choose to access such third-party websites or follow such hyperlinks do so at their own risk. The publisher, owner, writer or their affiliates may own securities of companies mentioned in this publication.