These 2 Lines from Midway Gold’s Pan Mine Update Scared Investors

Mar 08

Since publishing a construction update on March 2nd shares of Midway Gold are off 22%. On the surface things sounded great! 3.1 million tons of ore have been placed on the heap leach pad, the water pumps are ramping up to 5,000 gallons per minute, and first gold production is expected within weeks. However, buried within a three page operational outline, these two lines most likely scared investors:

- Early sampling of ore grades have generally been below modeled grades

- Based on delayed production (originally expected by Dec 2014), this will likely result in a working capital shortfall of about $5 million

Those two lines stripped $28 million worth of market value away from Midway Gold.

I’m using this temporary weakness to buy shares of MDW rather aggressively. Please allow me 700 more words and a handful of numbers to try and explain why.

The Why

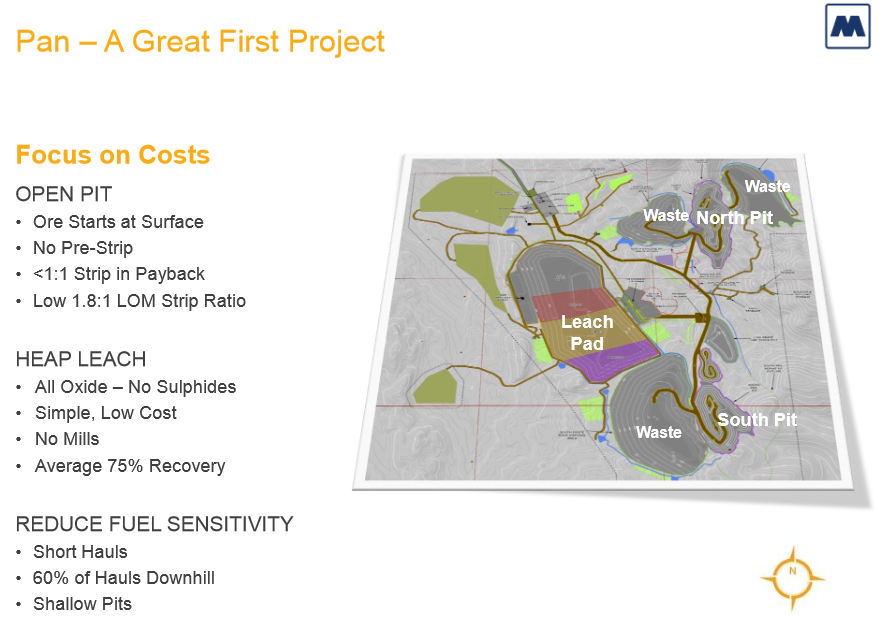

Midway Gold has a pipeline of projects that are “Simple – Manageable – Financeable” to use its words. What does simple, manageable, and financeable look like?

- Heap leachable open pit gold mines

- Ore starts at surface, strip ratio below 2:1, no crushing needed at outset

- Located in Nevada: infrastructure and people are close by

- Capital costs below $100 million

It’s too early to worry about grades being below expectations, the sample size is still relatively small, and Midway hasn’t given details (at least not publicly) about how “below” grades really are. Likewise, if the statement said ore grades are “above” estimates, it would be too early to justify excitement.

Midway Gold’s feasibility study calls for all-in production costs of $824 per ounce at Pan, so even at today’s gold price it has some room to err.

Thinking conservatively: let’s assume Midway’s all-in costs are 20% higher than what’s been forecasted [$824 per ounce] — $989 per ounce. After all, new mines have been known to stumble out of the gates. With that said, Midway Gold has an experienced management team in place, so I’d like to think it could still make a nice chunk of change at $1,170 gold, even considering this scenario.

Hindsight is 20/20

Previously, I touched on how mining stocks typically follow a life cycle pattern.

Apparently shares of MDW are oblivious to this pattern, one that states mining stocks should appreciate upon moving into production. I think MDW’s refusal to follow conventional norms is a sign of the times— gold and mining stocks are arguably the most hated sector on Earth.

Do you think it will stay that way forever?

If not, you have the luxury of buying Midway Gold, a company that has transformed from an exploration story to a production story over the past six years at or near its all-time lows. I’m expecting MDW will break out of its four year down trend by the end of 2015. Why’s that? Because the good news and downright cheapness of Midway Gold will be more obvious by then.

Today Midway Gold is just a wannabe, unproven, near-term miner that has missed deadlines and overshot (however slightly) on construction costs. Additionally, it has an overhang of dilutive financing and concern surrounding production costs that may or may not be warranted. Tomorrow, or twelve months from now, Midway Gold will be seen as a near 100,000 ounce producer with over a decade’s worth of resources in the ground and two quality mines on deck.

Buy 1 get 2 Free

I guess it’s debatable, but I would make the case that by paying less than $120 million for Midway Gold [Pan] one is getting Gold Rock and Spring Valley for little to no cost. Nor is the market fully appreciating the long-life low-cost nature of Pan.

As Ken Brunk, former CEO, said at the last Denver Gold Show: “we think we’ll expand Pan by at least a factor of two upon drilling further”. That statement is evidenced by Midway Gold budgeting $8M in 2015 to expand the heap leach pad by more than 100%, bringing its total capacity to 20 million tons.

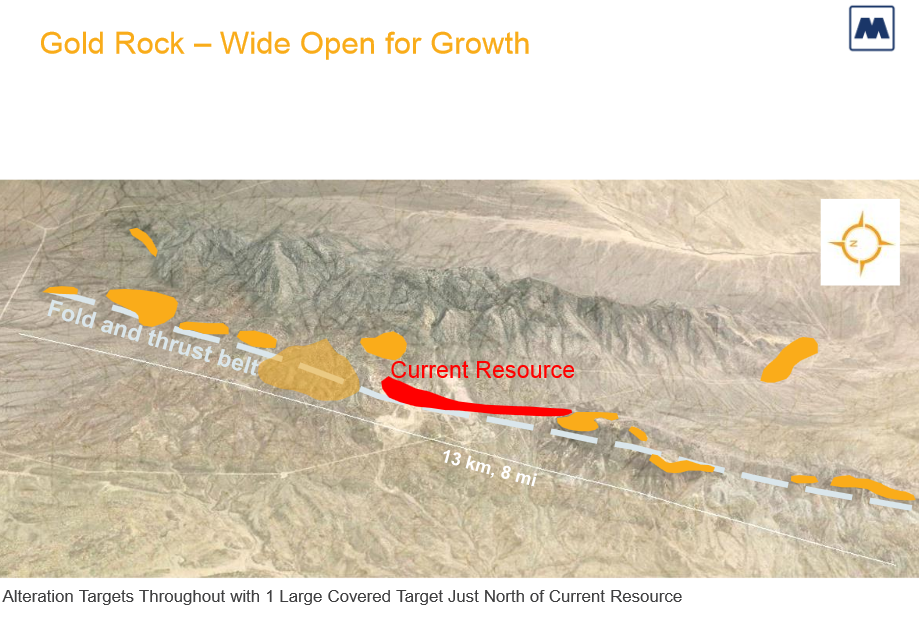

Five miles southeast of Pan is Gold Rock, a development stage project described as a “Pan look alike”, despite having potential for increased size, grade, and economics. Midway Gold controls 125 square kilometers or 80,000 acres, including much of the land between the two deposits. Referencing the image below, over one million ounces of resources have been outlined in the red area, do you think more gold will be found to the north and south?

If all goes according to plan Gold Rock could be in construction by the end of 2016.

Spring Valley is jointly owned between Barrick Gold and Midway Gold. As operator, Barrick has outlined a resource of more than 4 million ounces, it must fund all expenses through production to earn a 75% interest. Barrick’s CEO has stated publicly that Nevada will probably be an increasingly important part of its gold output going forward; it has invested over $38 million into Spring Valley thus far, so signs point toward it being a large standalone mine approximately four years from now.

Bottom Line: Midway Gold is trading at or near its all-time lows despite the incredible progress it has made advancing its portfolio of mines toward production over the past six years. Fundamentally speaking, if the projections from its feasibility study hold up [80,000 ounces annually at costs of $824 all-in], MDW is inexpensive on a forward looking operating cash-flow basis.

*Author has a long position in MDW

DISCLAIMER: The information in this publication is not intended to be, nor shall constitute, an offer to sell or solicit any offer to buy any security. The information presented on this website is subject to change without notice, and neither Penny Stock Experts nor its affiliates assume any responsibility to update this information. Additionally, it is not intended to be a complete description of the securities, markets, or developments referred to in the material. Penny Stock Experts and its Author(s) cannot and do not assess, verify or guarantee the adequacy, accuracy or completeness of any information, the suitability or profitability of any particular investment, or the potential value of any investment or informational source. Additionally, Penny Stock Experts and its Author(s) in no way warrants the solvency, financial condition, or investment advisability of any of the securities mentioned. Furthermore, Penny Stock Experts and its Author(s) accept no liability whatsoever for any direct or consequential loss arising from any use of our product, website, or other content. The reader bears responsibility for his/her own investment research and decisions and should seek the advice of a qualified investment advisor and investigate and fully understand any and all risks before investing. Information and statistical data contained in this website were obtained or derived from sources believed to be reliable. However, Penny Stock Experts and its Author(s) do not represent that any such information, opinion or statistical data is accurate or complete and should not be relied upon as such. This publication may provide addresses of, or contain hyperlinks to, Internet websites, Penny Stock Experts takes no responsibility for the contents thereof. Each such address or hyperlink is provided solely for the convenience and information of this website’s users, and the content of linked third-party websites is not in any way incorporated into this website. Those who choose to access such third-party websites or follow such hyperlinks do so at their own risk. The publisher, owner, writer or their affiliates may own securities of companies mentioned in this publication.