Mining stocks historically follow a life cycle pattern, why isn’t Midway Gold cooperating?

Nov 13

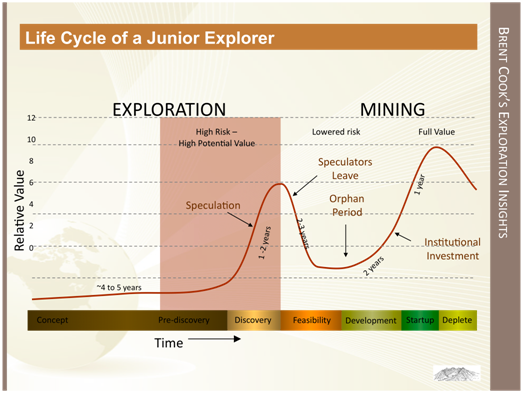

According to the illustration below, courtesy of Brent Cook’s Exploration Insights, stocks typically follow a life cycle pattern.

As you can see, upon discovery, exploration stocks tend to appreciate considerably. When the speculators are finished buying share prices will move lower, consolidating for a few years or more. During the development / construction phases stocks typically move higher because investors anticipate revenues and cash flows are just around the corner.

So why isn’t Midway Gold (NYSEMKT: MDW) cooperating with historical norms?

Simply put, that would be too easy. Today’s vicious bear market for precious metal stocks refuses to comply with life cycle patterns and conventional wisdom.

Life cycle ketchup

While anyone who has purchased MDW since 2011 is seeing red, mining stocks are famous for their volatility. With a bit of luck, years-worth of losses could be replaced with gains in a matter of months.

As of Midway’s most recent update, 500 thousand tonnes have been placed on the leach pad (as of September mining has begun!). Ledcor, the mining contractor is operating three crews around the clock. Located on Nevada’s Eureka trend, the first gold pour at Pan is scheduled for January 2015.

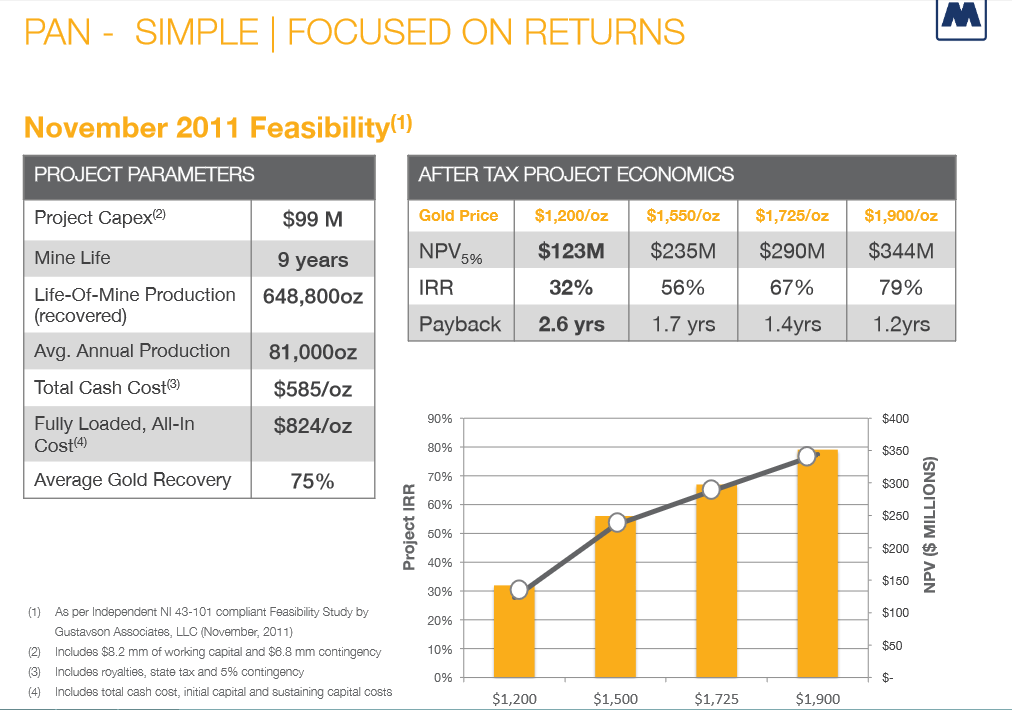

According to Midway’s feasibility study, at commercial production Pan will average 81,000 ounces gold per year at fully loaded all-in costs of $824 per ounce.

If Midway delivers on the projected numbers it will be generating strong cash flows, especially at today’s gold price. So don’t be surprised if the market revalues MDW higher in a hurry once the company starts releasing more news related to production, cash flow, and exploration.

MDW has been ice cold; shareholders should take comfort in the warm blanket of institutional money.

Those who already own Midway Gold should double-back, why did you purchase MDW in the first place? If nothing material has changed [which doesn’t appear to be the case] consider buying more, reducing cost basis and taking advantage of a down market in the process.

Prospective investors and current holders alike may find reassurance in the fact that “key stakeholders” in MDW include respected names such as BlackRock, Franklin Templeton, and Vanguard (so they’re losing money on MDW lately too). Additionally, after conducting their own due diligence, the Commonwealth Bank of Australia lent Midway more than $50M at attractive interest rates to ensure the Pan project becomes a mine.

—do you think they want their money back?

Of course, but that’s not enough for this Australian bank. It doesn’t want to miss out on any upside potential, so it has previously subscribed to a large percentage of Midway’s equity offerings.

Highlights from Midway’s investor presentation:

3 Projects – Near term production: “Pan”… first gold pour January 2015, “Gold Rock”… in permitting, “Spring Valley”… Barrick pursuing pre-feasibility (all located in Nevada)

Pan is oxide only, life of mine strip ratio less than 2:1

Pan’s current resource stands at more than 1 million ounces, but exploration upside remains open to the north, south, and at depth.

Measured + Indicated resource at Gold Rock = 20,215,000 tonnes @ 0.79 g/t Au (Pan-style deposit); wide open for growth

Barrick has invested $38M to earn 70% at Spring Valley; if Barrick funds everything to production Midway will retain a 25% interest.