Meloy Property Sports Ball Crushing 7 x 3 km Copper Soil Anomaly! Strategic Metals (SMD, TSX-V)

Mar 17

We all know the world is hungry for Copper, and it’s got an appetite that’s unlikely to be satisfied. Explorers and geologists are chasing this stuff like crazy, they’re looking in very nook and cranny from New Mexico to No Man’s Land.

More of those energies and monies will eventually wind up in the Yukon, where good ol’ Strategic Metals (SMD, TSX-V) is sitting on two very prospective (and massive) porphyry targets.

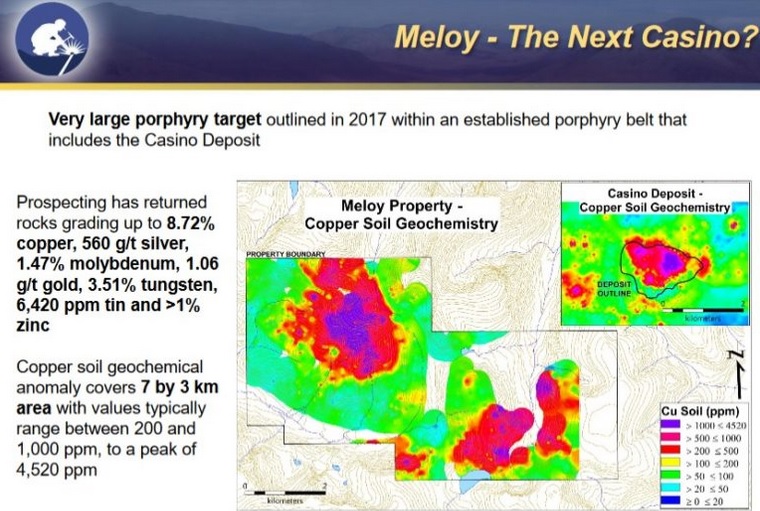

1) Meloy!

Pretty impressive isn’t it! Western Copper’s Casino deposit is big, like really big, weighing in at 4.5 billion pounds Copper and 8.9 million ounces Gold (and that’s in the “reserve” category).

…and the geochemistry footprint/anomalies on Strategic Metals’ Meloy Property is at least 300% larger.

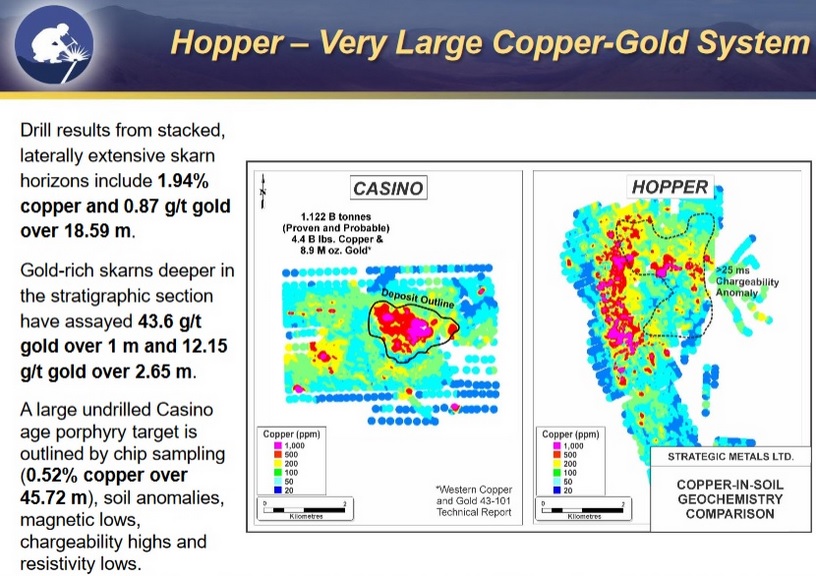

2) How Much Copper Could Be In The Hopper?

The boys at Strategic Metals seem to like picking on “Casino”, don’t they!

I’m no geologist, but from what I’ve read and heard “geochemistry” and “soil anomalies” are good early-stage indicators (especially in the Yukon). Yes, it’s very early in the discovery process, but here Strategic Metals is sitting on two properties with exceptional exploration potential (Casino-like potential?) and they’re basically worthless.

…Strategic Metals’ market cap is $37 million and they have about that much worth of cash and securities.

With any luck, Strategic Metals’ 40% stake in Rockhaven (RK, TSX-V) could be worth more than its current market cap alone. Its Klaza deposit is currently the highest-grade Gold deposit in the Yukon. With an estimated 1.3 million ounces in the ground, Strategic Metals’ share would equate to roughly 520,000 ounces.

Here’s some opposing ideas on how a prospective investor/shareholder might think about SMD:

- Screw these guys, I’ll never buy SMD because they have little or no respect for “marketing” and “promoting” their stock. They have a “build it and they will come” mentality. There’s too many moving parts. Therefore, it will remain undervalued and stuck in the “value bin” collecting dust. CEO Doug Eaton and Co. will never test their theories to the extent they could have, assuming the stock traded above its liquidation value from time to time (I’m sure it will at some point in this cycle, but wanted to be somewhat dramatic).

- This is one of the cheapest damn stocks in the entire resource market! Prospect generation is arguably the most reliable and relatively safest ways to participate in a mineral discovery (without losing all your money a couple times first). We’re in the first or second inning of a “discover/exploration driven bull market”, and as the largest claim holder in Yukon (supported by smart people and the best geological database) Strategic will eventually perform.

Here’s a link to Strategic Metals’ most recent presentation if you want to explore it further. I’m a shareholder. I’ve been sitting on SMD for nearly 2 years now. Following my next BIG WIN, it’s definitely a place I’d consider parking more money. In my view the downside from 40-cents is minute.

Want to Trade Like The Experts? Click below for more about our Subscriptions and receive the next up and coming opportunity!

*Author has a long position in Strategic Metals

DISCLAIMER: The information in this publication is not intended to be, nor shall constitute, an offer to sell or solicit any offer to buy any security. The information presented on this website is subject to change without notice, and neither Penny Stock Experts nor its affiliates assume any responsibility to update this information. Additionally, it is not intended to be a complete description of the securities, markets, or developments referred to in the material. Penny Stock Experts and its Author(s) cannot and do not assess, verify or guarantee the adequacy, accuracy or completeness of any information, the suitability or profitability of any particular investment, or the potential value of any investment or informational source. Additionally, Penny Stock Experts and its Author(s) in no way warrants the solvency, financial condition, or investment advisability of any of the securities mentioned. Furthermore, Penny Stock Experts and its Author(s) accept no liability whatsoever for any direct or consequential loss arising from any use of our product, website, or other content. The reader bears responsibility for his/her own investment research and decisions and should seek the advice of a qualified investment advisor and investigate and fully understand any and all risks before investing. Information and statistical data contained in this website were obtained or derived from sources believed to be reliable. However, Penny Stock Experts and its Author(s) do not represent that any such information, opinion or statistical data is accurate or complete and should not be relied upon as such. This publication may provide addresses of, or contain hyperlinks to, Internet websites, Penny Stock Experts takes no responsibility for the contents thereof. Each such address or hyperlink is provided solely for the convenience and information of this website’s users, and the content of linked third-party websites is not in any way incorporated into this website. Those who choose to access such third-party websites or follow such hyperlinks do so at their own risk. The publisher, owner, writer or their affiliates may own