The Hot Cell Therapy Space Needs This Company’s Cold Solutions

Mar 23

What is “cell therapy”?…

According to the Medical Dictionary, cell therapy is the transplantation of human or animal cells (typically by infusing or injecting them into the patient) to replace or repair damaged tissue.

The purpose of cell therapy is to introduce cells into the body that will grow and replace damaged tissue. This process could lead to the commercialization of important treatments for cancer, diabetes, vision loss, stroke, and many other health problems.

*This article was first published March 9th at BullMarketRun.com

A unique challenge facing the development of cell therapies…

Obviously, there are a litany of challenges facing pharmaceutical and biotechnology companies throughout the drug development and approval process. Reaching the finish line often takes years or decades worth of time and the cost can reach into the hundreds of millions. All without any guarantee the outcome will be successful.

Compared to other biologics, cell therapies are more fragile and sensitive to physical and environmental stresses. This creates another unique challenge for drug developers.

By definition, cell therapies utilize living cells. Due to the fragile nature of these biologic materials (such as bone marrow, peripheral blood, or adipose tissue) and limited shelf life outside the body, cold chain technologies are being used more frequently with an aim toward reducing temperature. Maintaining a consistently cold temperature helps to slow or stop metabolic activity during transport (a similar concept to organ donation).

Extending the shelf life of source material should be the goal of every biotechnology and drug development company.

So what?…

Biopreservation and cold storage solutions will make or break the next generation of cell therapies and regenerative medicine.

Assuming there’s a large opportunity emerging, a little company based out of Bothell, Washington, called BioLife Solutions (BLFS, NASDAQ) looks like the best way to play it, as we see the landscape now.

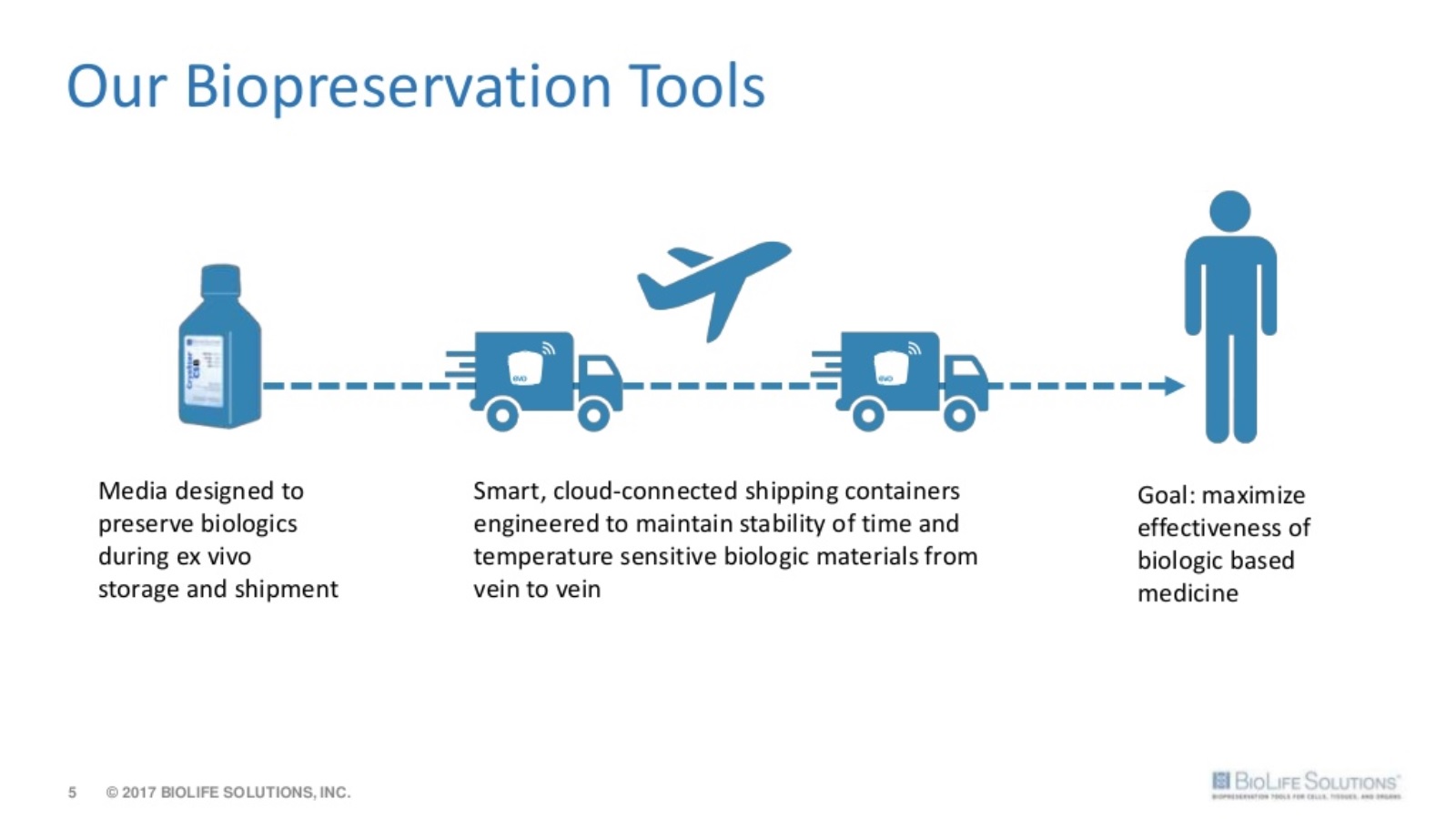

BioLife‘s mission is to become the leading provider of biopreservation tools for cells, tissues, and organs.

To date, “CryoStor” and “ThermoSol” – BioLife’s 2 flagship biopreservation (freeze media) products – are embedded into more than 250 clinical stage trials (of approximately 802 cell therapy clinical stage trials total ending 2016). Upon regulatory approval and scale up to commercial manufacturing, BioLife‘s revenues generated as it relates to that particular drug would increase dramatically relative to revenues generated during the trial period.

In other words, BLFS offers exposure and leverage to successful cell therapies developed by the biotechnology and pharmaceutical industry but limits the downside associated with any particular clinical trials failure.

The combination of CryoStor, ThermoSol, and BioLife’s high-performance insulated shipping containers greatly improves the chance for success during clinical trials. Therefore, for a tiny expense, relative to the overall cost of developing a drug, the odds of regulatory approval and large-scale commercial production are improved.

Excluding its distributor relationships (via the “evo” line of smart shippers), BioLife has 530 customers in 33 countries.

BioLife has executed 10 year-supply agreements with more than one of its marquee customers.

Sizing up the “shipping container” competition…

Amazingly, considering the precious cargo, the most commonly used insulated container in the healthcare industry is made from polystyrene (eg. beer coolers!). Packs of ice or dry ice are wedged inside the cooler in an attempt to stabilize the temperature, but there is no external or internal monitoring capability.

BioLife‘s smart shipping containers are a step forward in an area that was badly in need of innovation.

Combined with a cloud-based management system, the evo smart shipper is ideal for transporting time and temperature sensitive drugs, vaccines, biologics and other delicate life-saving materials.

Just in case you were wondering why BioLife could improve the chance for success during clinical trials (because that’s a big claim), the company provides the following slide as a visual example.

While we are no experts in cell therapy, common sense would lead one to believe healthy cells would perform better and more reliably than dead cells amidst a clinical trial setting (by the way, BioLife‘s management team agrees with that line of common sense thinking).

How large is the prize?…

The IMARC Group forecasts that the demand for cold chain packaging and instrumentation services will grow from $3.2 billion in 2013 to $5.1 billion in 2018. BioLife believes its addressable market for small payload shippers and related monitoring devices is several hundred million dollars. And the market potential for biopreservation media is better than $400 million last year.

Here’s how BioLife’s revenues have grown since 2012:

The opportunity in shipping containers and related monitoring devices has yet to get off the ground, but after restructuring this business segment there’s reason to be optimistic it can going forward.

BioLife is calling for positive quarterly EBITDAs by the end of 2017.

Looking at the 6-month chart on BLFS, it would appear other market participants are beginning to buy in. Notice the massive volume during the middle of February. The stocks continues to build on that recent momentum.

Following today’s close, BioLife reported 4th quarter and full year 2016 results – check out the news as part of your own due diligence. Below are highlights from the news release:

2017 catalysts…

- A number of cell therapy customers, including Kite Pharma, Kiadis Pharma and Kolon Life Sciences, are seeking regulatory approvals to commence marketing and commercial manufacturing in 2017, which, as a result, should drive increased demand for BioLife’s proprietary biopreservation media products

- Continued adoption of CryoStor and HypoThermosol in pre-IND validations and phase 1, 2 and 3 clinical trials of new cell and tissue based products and therapies

- Adoption of the evo Smart Shipper and use of the biologistex Cold Chain Management SaaS by leading cell therapy companies

2017 guidance…

Management reaffirms the full-year 2017 guidance provided in January as follows:

- Biopreservation media revenue is expected to grow between 20–25% over 2016, with revenue in excess of $10 million

- Gross margin is expected in a range of 55% to 60%

- Annual operating expenses are expected to range from $8 to $9 million

- Positive quarterly EBITDAS by the end of 2017

We’d be remiss not to mention the insider shareholdings – preferably the management team would have more skin in the game, but ultimately their salaries depend on the support of Thomas Girschweiler and Walter Villiger, 2 long-term investors who own about 48% (or more) of the 12.9 million shares outstanding.

DISCLAIMER: The information in this publication is not intended to be, nor shall constitute, an offer to sell or solicit any offer to buy any security. The information presented on this website is subject to change without notice, and neither Penny Stock Experts nor its affiliates assume any responsibility to update this information. Additionally, it is not intended to be a complete description of the securities, markets, or developments referred to in the material. Penny Stock Experts and its Author(s) cannot and do not assess, verify or guarantee the adequacy, accuracy or completeness of any information, the suitability or profitability of any particular investment, or the potential value of any investment or informational source. Additionally, Penny Stock Experts and its Author(s) in no way warrants the solvency, financial condition, or investment advisability of any of the securities mentioned. Furthermore, Penny Stock Experts and its Author(s) accept no liability whatsoever for any direct or consequential loss arising from any use of our product, website, or other content. The reader bears responsibility for his/her own investment research and decisions and should seek the advice of a qualified investment advisor and investigate and fully understand any and all risks before investing. Information and statistical data contained in this website were obtained or derived from sources believed to be reliable. However, Penny Stock Experts and its Author(s) do not represent that any such information, opinion or statistical data is accurate or complete and should not be relied upon as such. This publication may provide addresses of, or contain hyperlinks to, Internet websites, Penny Stock Experts takes no responsibility for the contents thereof. Each such address or hyperlink is provided solely for the convenience and information of this website’s users, and the content of linked third-party websites is not in any way incorporated into this website. Those who choose to access such third-party websites or follow such hyperlinks do so at their own risk. The publisher, owner, writer or their affiliates may own securities of companies mentioned in this publication.