The Bullish Outlook for Copper! Plus 4 Copper Stocks to Watch Closely in 2018!

Jan 03

Copper-Copper- and Copper Stocks – Prices Continue Zooming Higher!

Following a sharp drop to $2.94 per pound in early December, Copper prices have zoomed back to nearly $3.30, a new 3.5-year high. Looking at the Big Picture, all the stars seem to be in alignment for Copper prices (and Copper stocks) to continue higher over the coming months and years.

Supply is Trending Down

In all likelihood, production from Grasberg, one of the world’s largest Copper mines, will decline due to resource nationalism (plus under-investment). Elsewhere, the world’s largest Copper mines (20 make up about 40% of the world’s supply) are slowly but surely dying of old age.

Significant new discoveries have been few and far between. And those important deposits are frequently located in unstable political jurisdictions. The development costs are spectacular, too!

Compounding the supply problem, this morning some media outlets reported that Jiangxi Copper, China’s largest producer, is halting all output in the southeastern province following a government order to reduce pollution. Earlier in the month, Tonnegling Nonferrous Metals Group, the nation’s second-largest Copper producer, halted up to 30% of its smelting capacity in the eastern province of Anhui after a similar order.

Finally, China seems to be getting serious about curbing its pollution problems (which are severe and life threatening). It’s very likely that these efforts will only intensify across other provinces, which will lead to lower output until China makes the capital investments required to produce Copper in a less toxic way.

Demand is Trending Up

Chinese imports were stronger than expected in November. And Copper usage across the power and construction industries is up 30% year to date. In addition to infrastructure, almost every household item that plugs into a wall contains Copper. Do you think the emerging consumer classes throughout China, India, Africa and across the world won’t want to have computers, refrigerators, and HVAC?

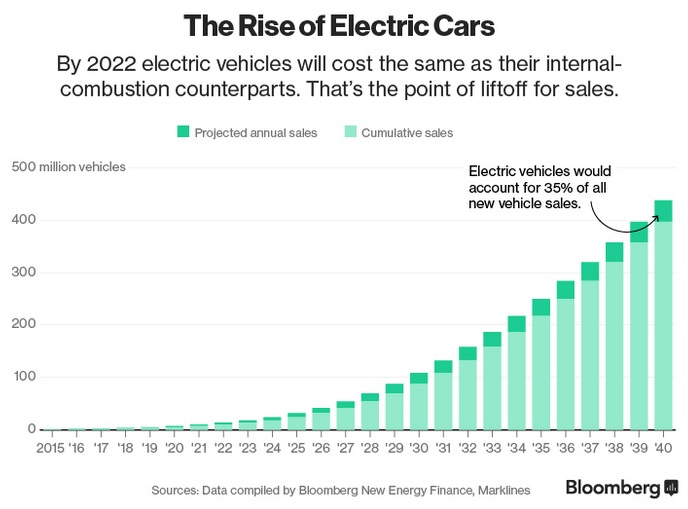

The rise of electric cars will also keep a charge in Copper demand and quality Copper stocks!

Additionally, we know the metals and materials used in batteries will benefit from this trend away from internal combustion engines – think Nickel, Cobalt, Lithium and Vanadium.

Given the anticipated supply and demand backdrop, many Copper stocks / assets should be increasing in value.

Below you’ll find 4 Copper stocks that are worthy of your attention:

Imperial Metals (III, TSX)

Following a myriad of problems, Imperial finds itself on the brink of bankruptcy. I suspect the conventional wisdom is that they will go bankrupt.

But if they don’t!

Oh boy, if Imperial survives there aren’t many other stocks out there that offer more leverage to higher Copper prices – that’s why III is such an interesting speculation right now. This thing could work it’s way back toward $8 per share, or more, if the company gets its financial and operational houses in order (or if there’s a takeover).

Yes, those are big “ifs”, but Imperial has substantial assets in the Red Chris and Mount Polley mines. Combined, these B.C.-based mines are pumping out nearly 20 million pounds of Copper per quarter. Also, regarding Imperial’s survival, which would likely require a mix of operational performance, Copper prices, and successful financial negotiations, Canadian billionaire N. Murray Edwards is the largest shareholder with a 38% stake (so maybe he can help).

Polymet Mining (POM, TSX)

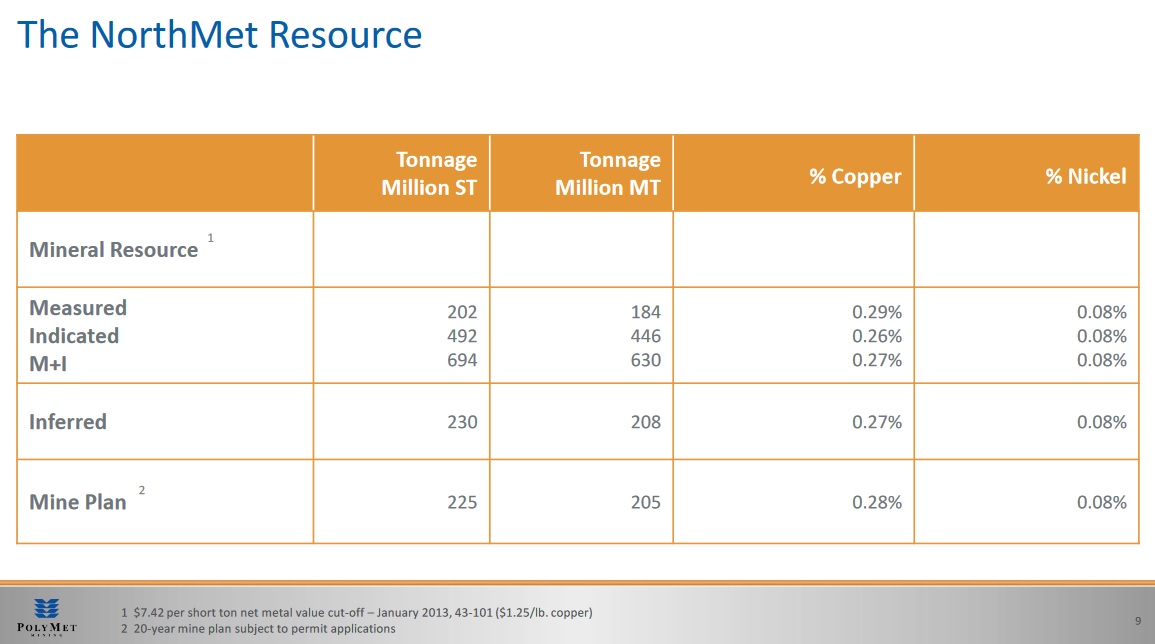

It’s sickening to think about, but Polymet has already spent $128 million on environmental reviews and permitting trying to move the NorthMet Project toward production. That gets me thinking – how much could NorthMet be worth if the company spent $128 million just to appease Minnesota’s regulators and environmentalists?

This deposit is relatively low grade, but it’s MASSIVE! Nearly a billion tonnes! And it’s got a little something in it for everybody – Copper, Nickel, and Cobalt.

If it ever reaches the finish line, Polymet is expected to produce 72 million pounds of Copper, 15.4 million pounds of Nickel, 720,000 pounds of Cobalt and 106,000 troy ounces of precious metals in concentrate annually.

Mining and trade giant Glencore likes it and owns approximately 29% of Polymet’s shares outstanding.

On December 13 the company said it anticipates receiving a “release of draft permit to mine in the near future.” That news, along with rising metal prices seems, to have put a floor underneath POM.

Two Porphyry Deposits That Get No Love!

With all the excitement surrounding Cobalt, Lithium and Nickel lately (plus anything with the word “blockchain” in it), there isn’t much left for Plain Jane Copper porphyry deposits.

However, that’s got to change as Copper prices continue their ascent. I believe the following two stocks are cheap and will eventually be embraced by Mr. Market (who shows little to no love toward them right now).

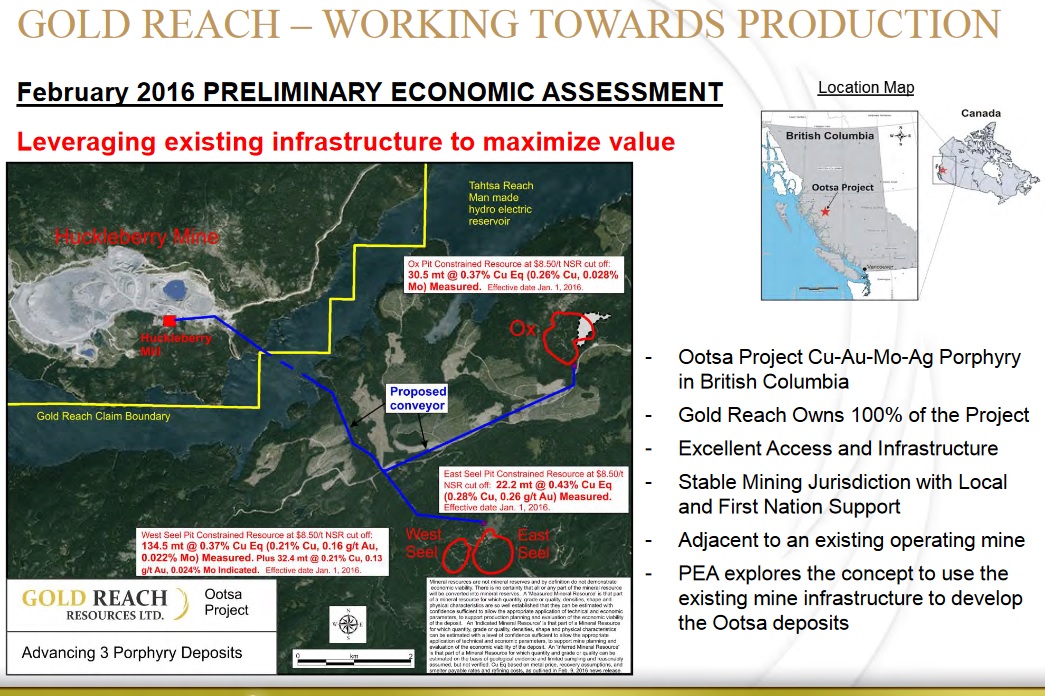

Gold Reach Resources (GRV, TSX-V)

After doubling on hefty volume in November, GRV has retraced roughly half of its move which makes for a nice entry point.

As far as I can tell, Gold Reach has everything going for it and has better than average odds of becoming one of British Columbia’s next Copper-Gold mines.

- To date, over 140,000 m have been drilled and $25 million has been spent on the Ootsa Property. Intercepts worth highlighting include 238 m of 0.73% CuEq (from 30 m depth) and 817 m of 0.45% CuEq (to a depth of 1,000+ m).

- Early stage economics (PEAs) don’t get much better. Assuming Gold Reach’s capital cost projections ($64 million) are correct, the after-tax IRR would be 81% under a contract mining and toll milling scenario.

- Location-Location-Location!

Sometimes I describe myself as a “Realtor” for commodities properties, because I’ve got a pretty good idea on what the going rate is.

Putting that hat on while considering the location and grades at Ootsa (average or slightly higher than existing mines in B.C.), GRV is undervalued in my book. The market cap is just over $8 million and the existing resource estimate stands at 1.1 billion pounds of Copper and 1 million ounces of Gold.

Some might think of that as being on the small side, but they probably don’t realize Gold Reach’s 67,000 hectare land package has a substantial amount of exploration upside (the known deposits are open and there are many untested targets).

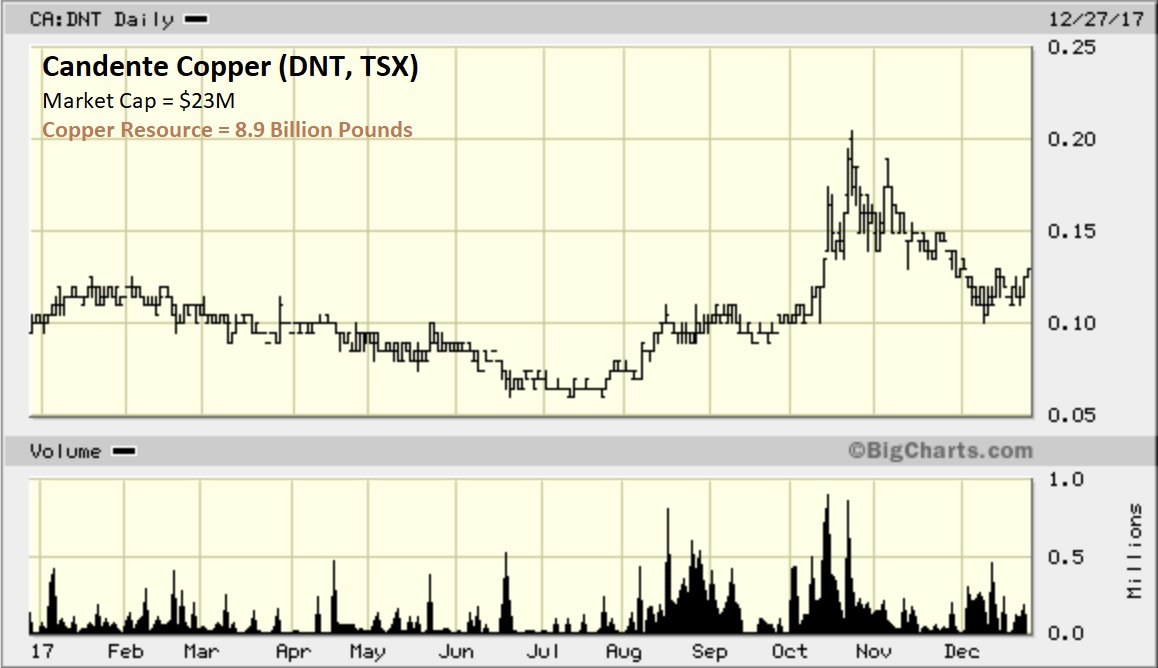

Candente Copper (DNT, TSX)

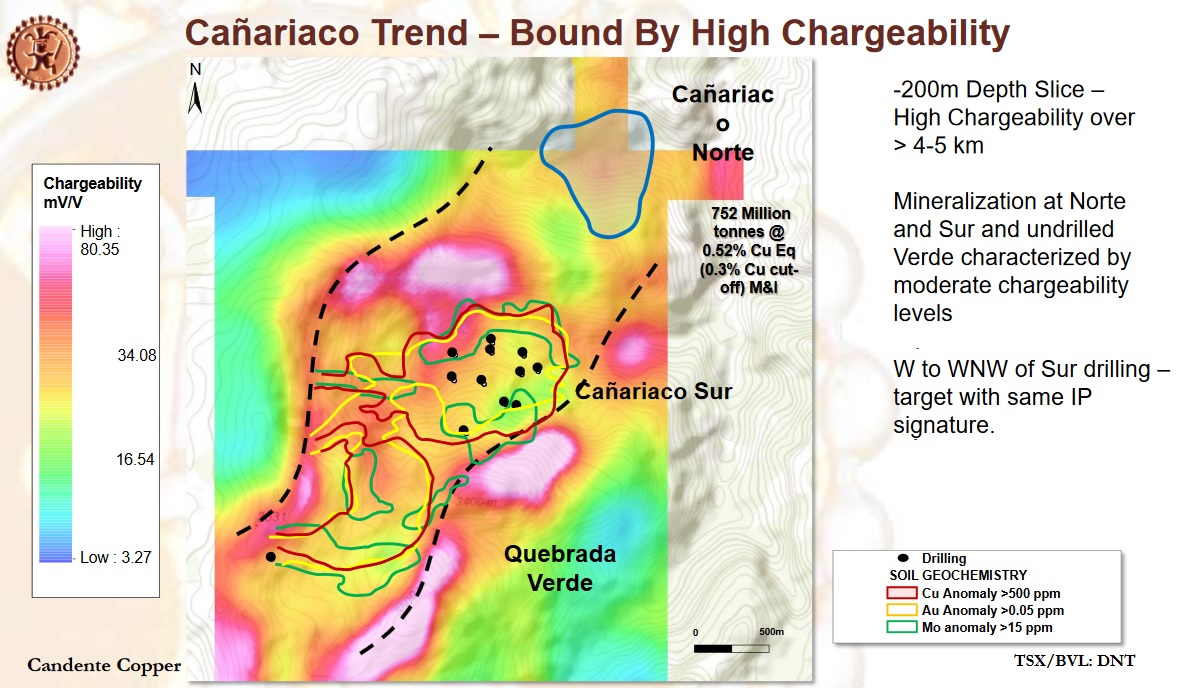

The Canariaco Norte Property isn’t as well located as Ootsa, but it’s already got the size and scale many investors are looking for (the grades are competitive, too).

To date Candente has drilled more than 240 holes (72,000 m) at Canariaco Norte and defined a Measured + Indicated resource of 7.5 billion pounds grading 0.45% CuEq (plus 1.4 billion pounds of Inferred). The property is located in northern Peru, approximately 42 km from a highway and 57 km from a power grid.

Here to, exploration upside is considered to be substantial.

The presence of at least 1 additional Copper-Gold porphyry (Canariaco Sur) has been confirmed. Mineralization at Canariaco Sur remains open in 3 directions and to depth. Drilling to date (13 widely-spaced holes between 200 m and 300 m) has intersected porphyry-style mineralization from surface down to 500 m.

There has been a misconception in the market that a mine at Canariaco Norte would be opposed by the local community (which could help explain the relatively low valuation). Despite the consensus view, many months ago when we first highlighted Candente Copper, CEO Joanne Freeze told me that wasn’t the case.

Then, just last month the local minister confirmed it (see the local paper here).

At today’s price Canariaco Norte has buyout candidate written all over it.

The chart’s starting to look really good, too!

We always like when the fundamentals and technicals are in alignment.

*First published December 27 at BullMarketRun

**Daniel has a long position in GRV

DISCLAIMER: The information in this publication is not intended to be, nor shall constitute, an offer to sell or solicit any offer to buy any security. The information presented on this website is subject to change without notice, and neither Penny Stock Experts nor its affiliates assume any responsibility to update this information. Additionally, it is not intended to be a complete description of the securities, markets, or developments referred to in the material. Penny Stock Experts and its Author(s) cannot and do not assess, verify or guarantee the adequacy, accuracy or completeness of any information, the suitability or profitability of any particular investment, or the potential value of any investment or informational source. Additionally, Penny Stock Experts and its Author(s) in no way warrants the solvency, financial condition, or investment advisability of any of the securities mentioned. Furthermore, Penny Stock Experts and its Author(s) accept no liability whatsoever for any direct or consequential loss arising from any use of our product, website, or other content. The reader bears responsibility for his/her own investment research and decisions and should seek the advice of a qualified investment advisor and investigate and fully understand any and all risks before investing. Information and statistical data contained in this website were obtained or derived from sources believed to be reliable. However, Penny Stock Experts and its Author(s) do not represent that any such information, opinion or statistical data is accurate or complete and should not be relied upon as such. This publication may provide addresses of, or contain hyperlinks to, Internet websites, Penny Stock Experts takes no responsibility for the contents thereof. Each such address or hyperlink is provided solely for the convenience and information of this website’s users, and the content of linked third-party websites is not in any way incorporated into this website. Those who choose to access such third-party websites or follow such hyperlinks do so at their own risk. The publisher, owner, writer or their affiliates may own securities of companies mentioned in this publication.