SeaChange (SEAC, NASDAQ): The Turnaround Story That’s Made For TV!

Apr 15

SeaChange International (SEAC, NASDAQ) is an originator of content management, delivery and advertising management software solutions that have shaped the premium video and advertising market for nearly 25 years.

If Rogers (RCI, TSX) is your cable television provider, as it is for more than 2 million Canadians, you’re using SeaChange’s software without even knowing it!

Simply put, SeaChange is the engine that powers the delivery of video from Rogers to your television. SeaChange does the same thing, and more, for Liberty Global (LBTYA, NASDAQ), the world’s largest cable provider serving 46 million television sets across 12 countries. Household names and internationally dominant companies like Comcast (CMCSA, NASDAQ) and Verizon (VZ, NYSE) also rely on SeaChange’s software solutions.

With such an impressive list of clients, SeaChange has more than 200 in total, one has got to wonder…why has the stock been performing so poorly?

That was an understatement – SEAC has performed terribly! Looking at the long-term chart ($15 to $2) you’d think we’re talking about an exploration company working moose pasture, not a software company the world’s largest cable providers depend on to deliver television to +50 million subscribers.

While the long-term looks terrible, SEAC looks to be bottoming out more recently.

Shareholders have lost more than 85% of their money from the highs, so what happened? Where did this seemingly respectable software company go wrong?

Act #1: Rightsizing A Bloated Business

SeaChange was not always the lean and mean company that CEO Ed Terino has in place today.

Terino, the turnaround and software veteran, officially took the helm on April 7, 2016.

The brief back story: In or around 2012 SeaChange began shifting from hardware and software solutions to 100% software. Prior to this transition, which didn’t go smoothly, SeaChange’s business model was largely dependent on upfront licensing revenues and large-scale hardware deployments (i.e., set top boxes). That made for a lumpy and unpredictable revenue stream.

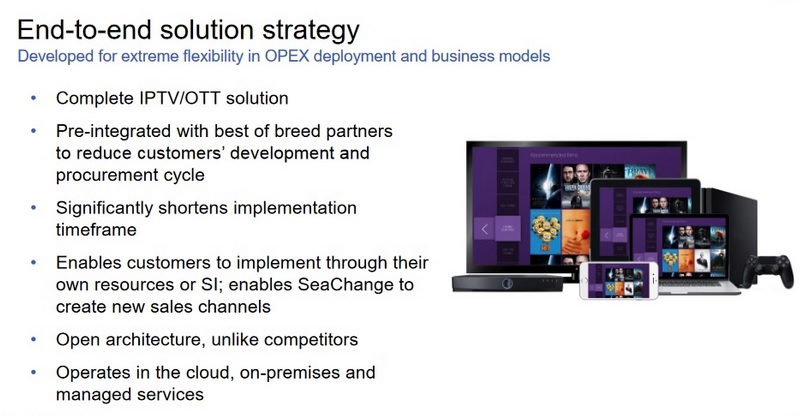

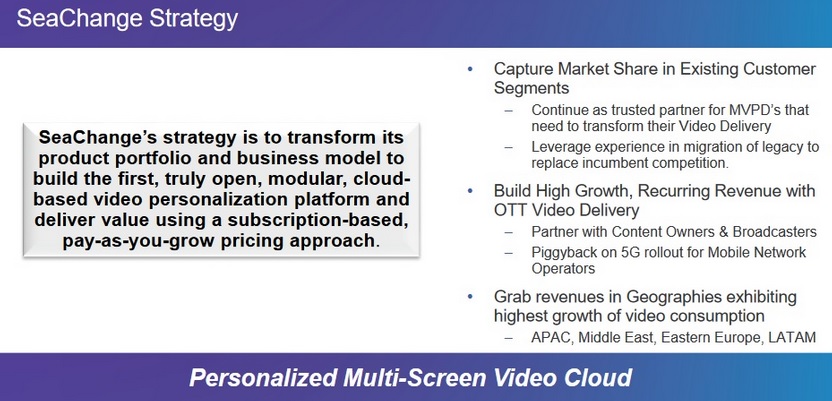

Now, having transitioned to a 100% software and cloud-based business, SeaChange’s revenue stream is more predictable (less lumpy). It offers a subscription based pay-as-you-go model which allows clients to start using the software faster, with less upfront costs.

Since Terino’s arrival, expenses were reduced by $38 million. SeaChange is now operating more efficiently with 300 employees than they were with 700 employees. Six offices were closed. Terino acquired a 70-person software engineering company based in Warsaw, Poland. That team proved to be more productive and capable than SeaChange’s California-based team, at a savings of $8 million annually.

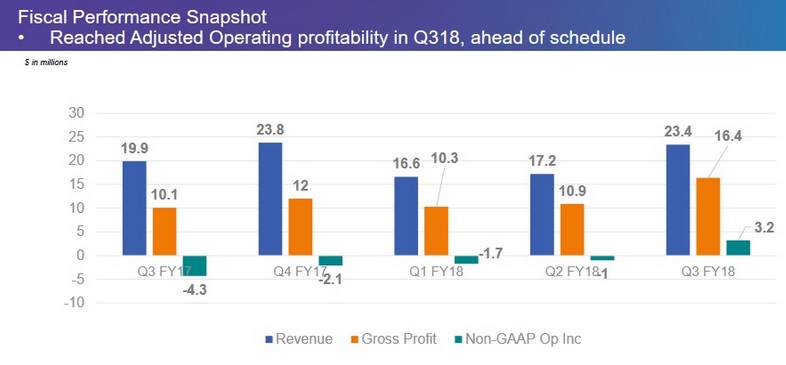

Bottom line, Terino’s turnaround is now complete and SeaChange is cash-flow positive!

SeaChange achieved Non-GAAP operating income of $3.2 million last quarter, for the first time in years. Going forward the company is breaking even with revenues of $80 million, according to CFO Peter Faubert. Gross margins are expected to be 60% or slightly better.

Next Monday, SeaChange will present Q4 results. These numbers should demonstrate a third consecutive quarter of positive cash flow. Plus, it will add confidence and further proof Terino’s turnaround is complete.

With announcements like this: Liberty Global Selects SeaChange for Next-Generation Cloud-Based Video Offering, I’m convinced the financials will continue improving. Combine that with what looks to be signs of stability (a bottom?) on the chart and I think we’ve got a terrific value investment on our hands right now.

I’m seeing tremendous value in SEAC – roughly $1.25 per share cash on a $2.61 share price (no debt), selling for less than 1 x sales. And I’d be surprised if it drops below $2.50, so the risk/reward is favorable.

Act #2: Change The Channel To Growth

Mr. Market currently sees SeaChange as a plain old legacy business (and he’s valuing it that way).

But actually, SeaChange is a spicy growth story!

SeaChange has mastered video management on a massive scale for delivery and monetization.

The television landscape has been fundamentally altered. With nearly ubiquitous internet viewers expect to be able to watch on any device (computer, tablet, phone, t.v., etc.) at any time.

Plus, viewers want tons of content choices! And preferably those choices would be tailored to their viewing history (just like with Amazon, your cable providers know what types of shows/movies you like and don’t like).

Network operators want a worry-free video delivery solution that’s future proof. Content owners and broadcasters want to reach a global audience. And they want to get paid when people watch their content. Advertisers want bang for their buck, that means “targeted ads”.

Therein lies the challenge! Delivering video at a massive scale while managing the interests of viewers, content owners, broadcasters, and network operators isn’t easy! SeaChange is one of very few companies in the world that’s capable of providing an end-to-end solution for cable, telecom, and satellite providers of all sizes.

Rogers Communications learned just how challenging this is the hard way. Back in 2016 Rogers decided to strip out SeaChange’s software and replace it with Ericsson, a much larger competitor. Thing is, Ericsson’s video management, delivery and monetization software didn’t work flawlessly. Rogers was forced to delay its Internet TV (aka. IPTV) roll out and take a $500 million write down!

SeaChange is one of Liberty Global’s five “critical vendors”. The world’s largest cable provider would be in a world of hurt without SeaChange’s software, it’s heavily embedded into their systems. Some experts have described SeaChange as being in Liberty Global’s bloodstream.

That speaks to the inherit value and “stickiness” of their software solution(s). According to Terino, Liberty Global was an unhappy customer several years ago. Terino believes that Liberty Global would have walked away from this decade long relationship if they could have.

However, their bonds are strengthening again, as you can hear: “Our selection of SeaChange as a key part of our video platform reflects their continued development of leading video delivery technologies and their relentless commitment to operational excellence,” said Olivier Philippe, Liberty Global’s Vice President of Entertainment.

Liberty Global will go from having 17 “back offices” throughout Europe to 1 virtual back office. Thanks to SeaChange video content, management for 24 million customers will now be handled from one central location! And save lots of money for the cable provider in the process.

Terino said this new deal with Liberty Global will result in sales of at least $30 million over the next two years (a key growth driver for the Company). Sales opportunities in SeaChange’s pipeline are 300% to 400% greater than at this time last year.

Act #3: “Cutting The Cord” And The Future Of Video Distribution

Many millions of people that aren’t subscribers of Comcast, Liberty Global, Rogers et al. are “cutting the cord”. You’re probably familiar with this term, which refers to cancelling your television provider.

Of course, the vast majority of these cord cutters aren’t doing away with television! They’re just switching to other streaming video services like Netflix, Amazon Prime, and other “over-the-top” media distribution outlets.

Lots of companies (increasingly telecom/broadband providers like Verizon and AT&T) are interested in providing video (generating cable subscription revenues) but don’t have the financial wherewithal and technical capabilities to make it happen.

Aspiring video/television providers worldwide are calling SeaChange for its solutions and advice.

Consumption of video/television is on the rise worldwide. Therefore, as one of few companies in the world capable of delivering to +50 million people on any device at any time, SeaChange’s future looks bright. Over their nearly 25-year history, hundreds of millions have been invested into developing and perfecting these software solutions.

In Summary: Terino’s turnaround is complete. More than $38 million in waste has been removed from the company. SeaChange is cash flow positive for the first time in years, now the transition is toward growth! Their software is “in the bloodstream” of some of the world’s largest cable and telecom providers (I interpret that as recurring predictable revenue, and takeover tycoons love recurring predictable revenue). SeaChange is interpreted as being a plain old legacy business, but it’s actually a spicy made-for-TV growth story in the making.

With approximately $1.25 per share worth of cash (less than 1 x sales), SEAC is undervalued and looks to have strong support at $2.50, excellent risk/reward! I’m expecting it to trade higher into or on the back of strong earnings and a conference call next Monday.

This article was first published at BullMarketRun.

Want to Trade Like The Experts? Click below for more about our Subscriptions and receive the next up and coming opportunity!

*Author has a long position in SeaChange

DISCLAIMER: The information in this publication is not intended to be, nor shall constitute, an offer to sell or solicit any offer to buy any security. The information presented on this website is subject to change without notice, and neither Penny Stock Experts nor its affiliates assume any responsibility to update this information. Additionally, it is not intended to be a complete description of the securities, markets, or developments referred to in the material. Penny Stock Experts and its Author(s) cannot and do not assess, verify or guarantee the adequacy, accuracy or completeness of any information, the suitability or profitability of any particular investment, or the potential value of any investment or informational source. Additionally, Penny Stock Experts and its Author(s) in no way warrants the solvency, financial condition, or investment advisability of any of the securities mentioned. Furthermore, Penny Stock Experts and its Author(s) accept no liability whatsoever for any direct or consequential loss arising from any use of our product, website, or other content. The reader bears responsibility for his/her own investment research and decisions and should seek the advice of a qualified investment advisor and investigate and fully understand any and all risks before investing. Information and statistical data contained in this website were obtained or derived from sources believed to be reliable. However, Penny Stock Experts and its Author(s) do not represent that any such information, opinion or statistical data is accurate or complete and should not be relied upon as such. This publication may provide addresses of, or contain hyperlinks to, Internet websites, Penny Stock Experts takes no responsibility for the contents thereof. Each such address or hyperlink is provided solely for the convenience and information of this website’s users, and the content of linked third-party websites is not in any way incorporated into this website. Those who choose to access such third-party websites or follow such hyperlinks do so at their own risk. The publisher, owner, writer or their affiliates may own securities of companies mentioned in this publication.