Presentation Time! 5 Standout Stocks From The Precious Metals Summit in Beaver Creek, CO

Sep 25

It’s that time of year again. Explorers, developers, and smallish producers were in Beaver Creek delivering presentations to investors and analysts at the Precious Metals Summit last week. Now, some of the same people and companies, along with many new names, have gathered in Denver for The Gold Forum.

This is the busy season in Colorado when it comes to story telling, networking, fundraising, and deal making in the mining industry.

I always like to listen to the presentations and webcasts, sometimes twice, because there’s so much new information and important reminders to chew on.

Here’s what you need to know right now about several of my favorite stocks!

Alexco Resource (AXU, TSX)

Alexco is in the final throes of a transition from explorer-developer to developer-producer.

A production decision is likely coming mid-2020.

Assuming Silver prices are $18 or better, you can bet Alexco’s board will decide to start mining.

Alexco’s Beta is a multiple to its peer group, a scarce group of primary Silver producers (+50% Silver), so when times are good they’re really good for AXU (and vice versa). A high Beta means increased volatility, and volatility makes AXU a “trader”. Nimble traders can definitely express their opinion on Silver, both short and longer-term, via AXU.

I should note: As it evolves into a “mining” company, Alexco may or may not lose some of its Beta mid-2020 because operational execution will become a question mark for at least the first few quarters of production (uncertainties other than the Silver price will be introduced for AXU).

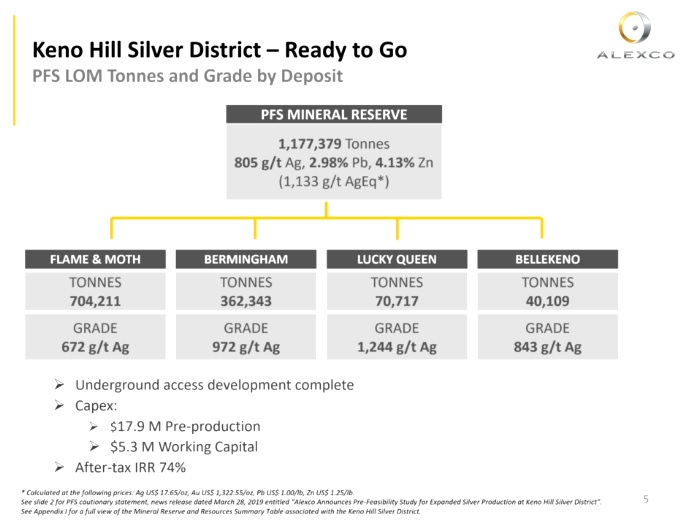

Past production in the Keno Hill Silver district (Yukon) was approximately 200 million ounces at 44 ounces per ton; Alexco’s PFS mine plan assumes grades of 25 ounces per ton. By the way, there’s also a growing Gold component to this high-grade district, as you’ll see below with Strategic Metals’ (SMD, TSX-V) Mount Hinton Project, which borders Alexco.

“The message is that this district has an ocean of 600 to 700 g/t Ag material that isn’t included in the current mine plan, so as we go forward we see the scalability of this district,” stated Chairman and CEO Clynton Nauman.

Nauman definitely wants his audience to know Alexco is capable of feeding a mill that’s bigger than 400 tpd, but that’s the right-sized plan for getting started.

…their environmental remediation business is nothing to sneeze at, either! Alexco currently has a contractual backlog of $200 million, with an estimated run rate of $30 million sales for 2019 (gross margins are around 30%).

Asanko (AKG, TSX)

With the vast majority of capital and development costs behind them, Asanko’s production is about to start turning into profits. In fact, CEO Greg McCunn is so comfortable with Asanko’s balance sheet and future growth, looking forward 12 to 18 months, he’s prepping shareholders for the idea of “dividends”.

Big picture – generalist investors want their mining companies to prove themselves, and paying a dividend (distributing excess profits to shareholders) goes a long way toward proving you’re a sustainable business.

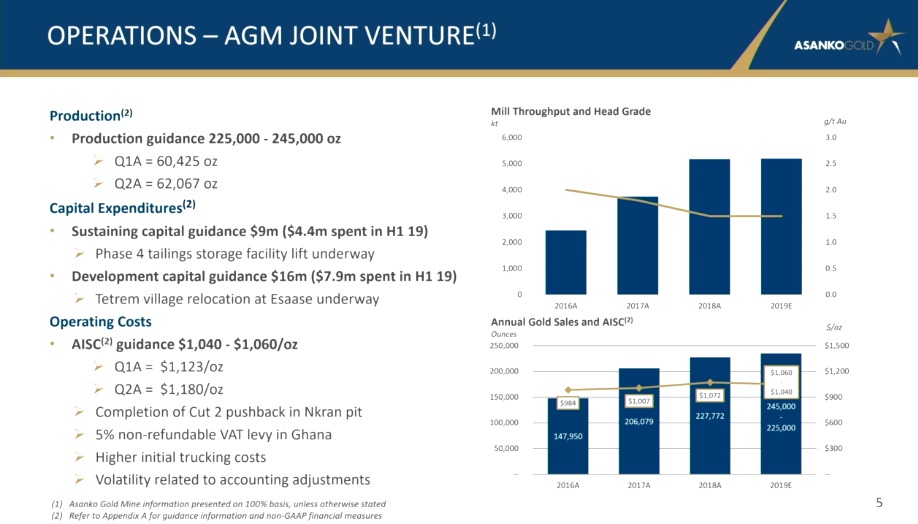

I see AKG outperforming its junior mining peer group because it offers production growth and the prospects of a dividend, while capital expenditures remain relatively low. Asanko is guiding for all-in costs to decline during H2 and into 2020.

Notice how mill throughput has basically doubled since 2016 while head grade stayed fairly flat (1.5 g/t Au is better than average for open-pit mines worldwide). That’s a great indicator Asanko is running a well-oiled machine! If these numbers just stay close to where they are now, in a flat or rising Gold market, AKG should do just fine.

Asanko owns 50% of its namesake Asanko mine in partnership with Gold Fields (GFI, TSX). The JV structure offers financial flexibility, GFI has a market cap of $3.8 billion, and it’s well capitalized with roughly $60 million working capital (no debt).

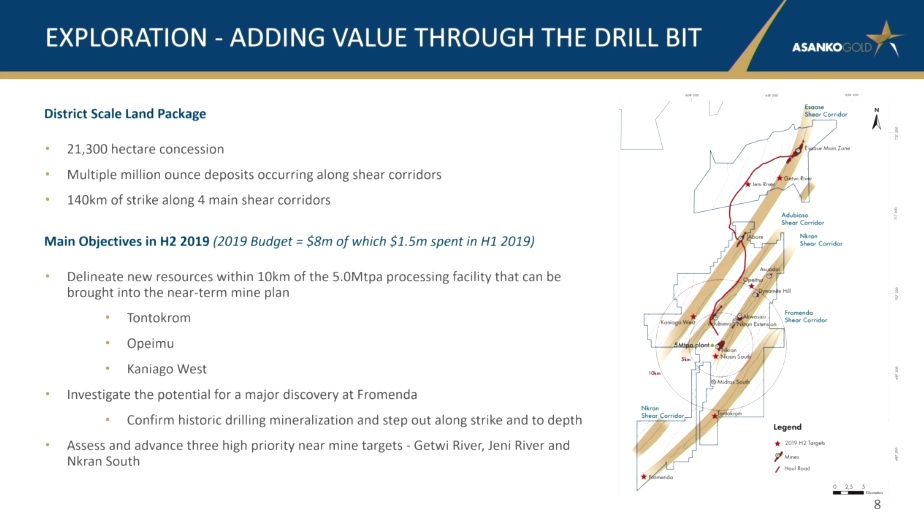

From an exploration perspective the JV holds a highly prospective district scale land package.

Asanko’s approach to exploration hinges on 3 factors: near-mine production exploration, reserve and resource expansion exploration, and advancing targets through the exploration pipeline.

They’re looking within the Fromenda shear structure for that next substantial discovery. Highlights from the Tontokrom target include 74 m at 1.93 g/t Au and 57 m at 2.96 g/t Au. Historical drilling at the Fromenda target, located 10 km further southwest of the Tontokrom target, has yielded 13.8 g/t Au over 9 m and 25.3 g/t Au over 5 m (from surface). A 5,000 m drill program for this particular area will commence during H2 and carry into 2020.

GoGold (GGD, TSX)

Having quadrupled off its all-time low, 20 to 80 cents, GGD has telegraphed its leadership role in this Gold-Silver bull market: I’m quite certain this relative strength will continue way into the future.

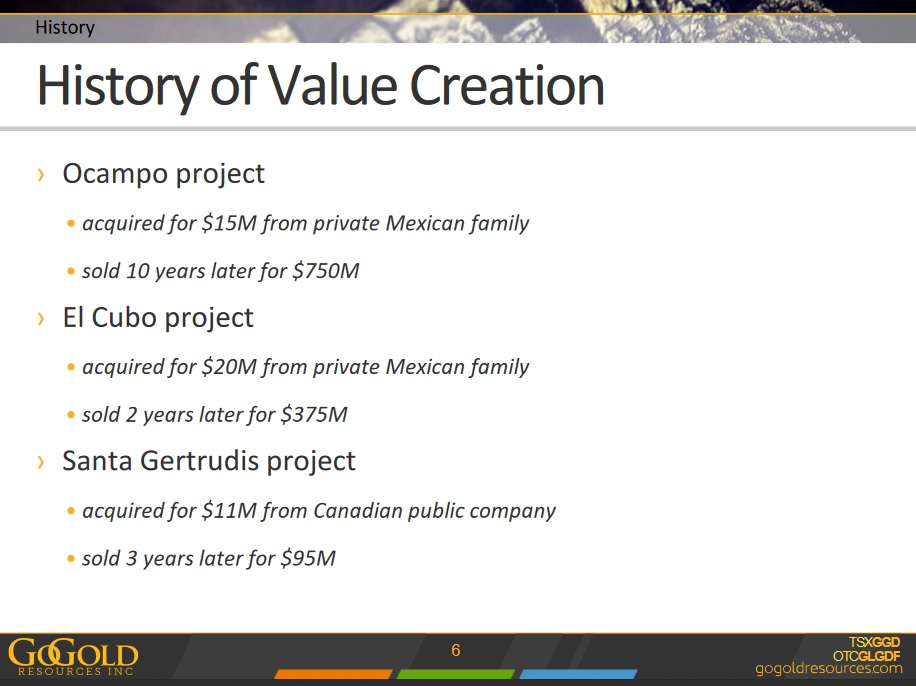

Over a multi-decade period CEO Brad Langille has made himself and shareholders very wealthy by focusing on 1 specific niche, acquiring “private” projects. Essentially, Langille and Co. uses its connections in Mexico to find Gold and Silver properties that aren’t on the market. Brand new product(s), in other words, that nobody really knows about it. Getting these private deals done takes more effort and time, but it’s worth it!

Los Ricos, for instance, is Langille’s most recent acquisition ($7.1 million paid in cash and shares). He thinks Los Ricos could be his “best ever”, too, which is really saying something given his track record.

Langille disclosed some important information about Los Ricos during his presentation – read the following 2 paragraphs very carefully:

“We’re fortunate that the manager of our exploration team, Dave Duncan, is a real historian. Before we started drilling at Los Ricos he found an archive in Missoula, Montana, and in that archive was all the records of this mine for 22 years. Every monthly report. Crosscuts, raises, all 8,000 underground samples, everything, from 22 years of mining. This has put us ahead probably 3 years and saved us millions of dollars. And it’s guiding our program right now.”

Mill records indicate recovery rates of +90% for Silver and Gold. What’s important here is what they took and what they left. That black ribbon below is the old stopes. Outside of that is the great drill results GoGold has been putting out (like 24 g/t AuEq over 21 m and 6.4 g/t AuEq over 17 m). You’re looking at a 25-m quartz vein. “They mined from 2 to 6 metres wide and left the rest for us,” Langille said casually. It goes down 850 m.

Langille’s drilled thousands of holes over the years, and 24 g/t AuEq over 21 m (from a depth of 30 m) is definitely one of the best holes ever. At Los Ricos, GoGold’s got 3.2 km of quartz veining with widths of approximately 25 m. Just tremendous. Ounces are going to add up really quickly, for bulk tonnage and underground mining.

With no debt, $9 million cash and 30% inside ownership, investors can’t sit around waiting for a PP (warrants and discounted shares). They’ll have to bid for GGD in the open market. Cash flow from GoGold’s Parral Tailings Project, which produces roughly 2 million ounces Silver annually, will be used to fund exploration and development work at Los Ricos. And Los Ricos will prove itself to be one of the best Gold-Silver deposits around, worldwide. Very exciting story here.

Salazar Resources (SRL, TSX-V)

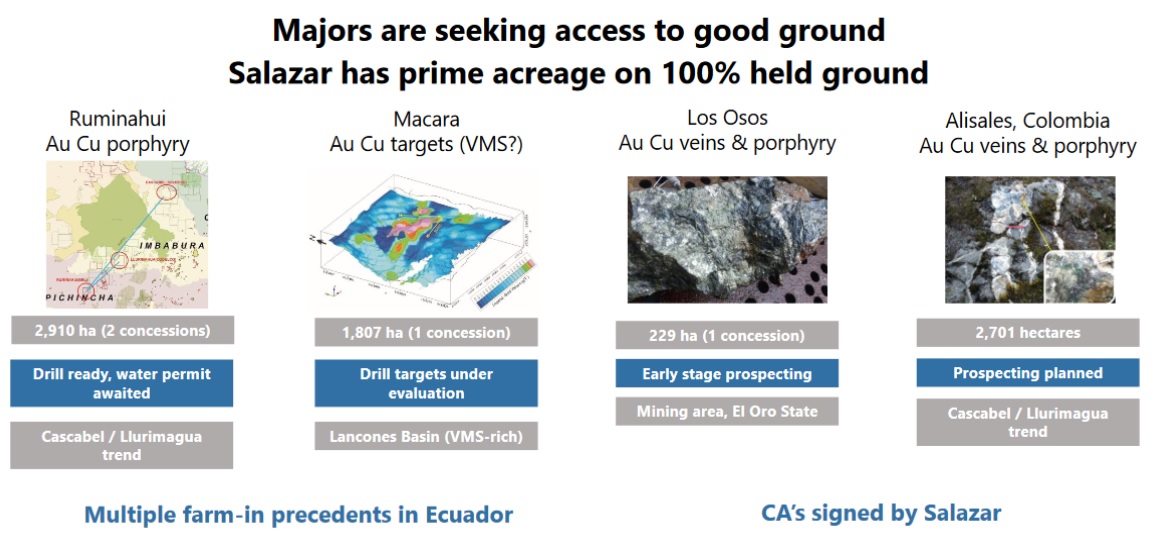

Led by Fredy Salazar, Salazar’s 40-person team of geologists and prospectors have been exploring Ecuador for decades. They know the region intimately and they’ve been involved with almost every major discovery in Ecuador to date, including Fruta del Norte.

“Mining”, once a dirty word in parts of Ecuador, is now being shouted enthusiastically by thousands of fans rooting for their favorite hometown soccer team…Los Mineros. Fredy’s youth futbol academy, along with other community support initiatives, has earned a considerable amount of goodwill for Salazar (and therefore Salazar’s projects). It’s a very powerful thing that can be rolled out across the country.

Salazar has a 25% carried interest, to production, on Curipamba. Based on this 25% carried interest, and that alone, SRL can support a share price of at least 36 cents (twice what it’s trading for lately).

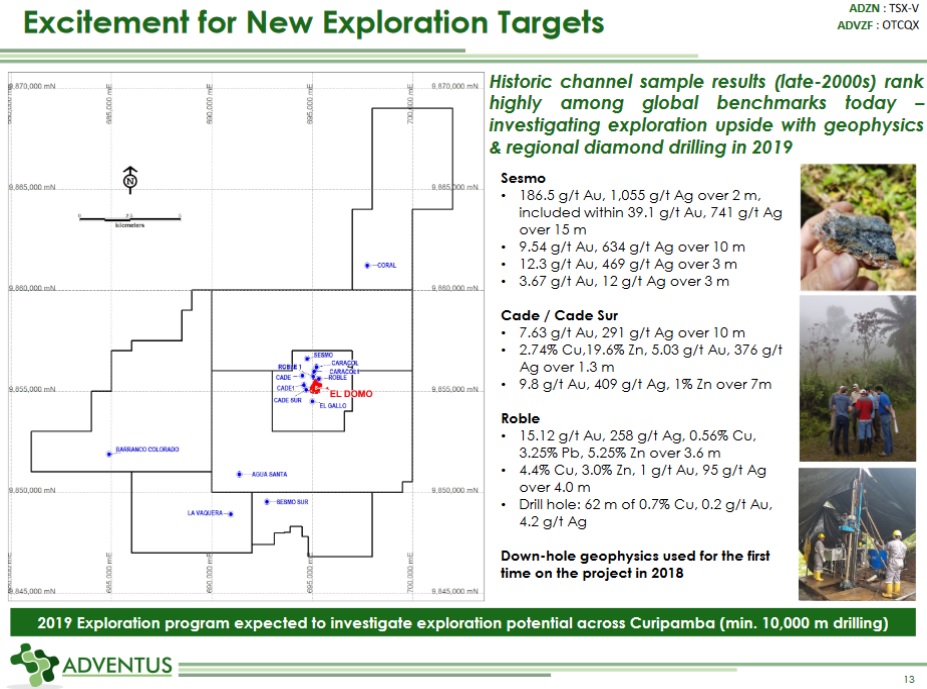

With 10 Mt grading 5% CuEq, El Domo, shown above in red, is one of the world’s highest grade VMS deposits. VMS deposits are known to occur in clusters and camps like Curipamba typically host at least 30 Mt to 50 Mt, so plenty of exploration upside is still to come.

Salazar earns roughly $1 million per year from advance royalty payments, management fees, and drilling services (they own 3 rigs). This income helps minimize share dilution while also funding exploration activities on the Company’s portfolio of 100%-owned projects.

Right now they’re sitting on roughly $5 million cash, and anxiously awaiting a final water permit so they can use some of that money to drill giant porphyry targets at Ruminahui.

Macara is another project Salazar is very excited about drilling (it’s also awaiting a water use permit). The Lancones basin is known for hosting giant VMS deposits.

Once Ecuador’s mining cadastre reopens (the computer claim staking system) Salazar may have up to 15 wholly owned projects.

Majors and junior miners are keen to find good ground in Ecuador and Salazar has a first mover advantage plus all the experience, so Fredy almost always gets a phone call.

Between their 25% carried interest in Curipamba, the exploration alliance with Adventus Mining (ADZN, TSX-V), and their wholly-owned portfolio of projects to self-fund and JV, Salazar should generate plenty of news flow in H2 and 2020. I suspect the best days for SRL are yet to come.

Strategic Metals (SMD, TSX-V)

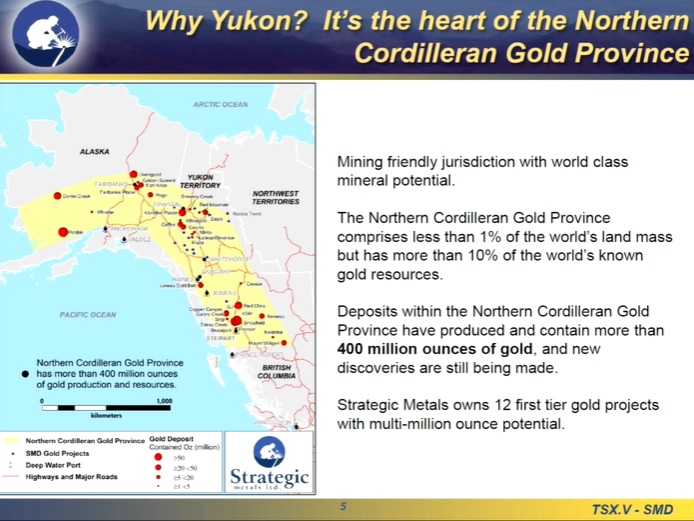

“We have a very property rich portfolio, but believe me it’s just the tip of the iceberg. This company has more facets to it than most diamond rings do,” said CEO Doug Eaton, to set the table for his presentation.

Database, personal experience spanning nearly 50 years in Yukon, and great relations with the First Nations are some of the things Strategic prides itself on.

“Why the Yukon?” is a question Eaton commonly gets asked.

As a cherry on top of the superb exploration potential found through the Northern Cordillera, Strategic’s cost to maintain its project portfolio (130 properties) is close to zero because of the $8 million assessment credits accumulated over the years. More than 10 of Strategic’s projects already have land use permits in place authorizing major drill programs. Eaton also likes the Yukon because it missed about 2 decades of exploration, from the 1980’s to 2000’s.

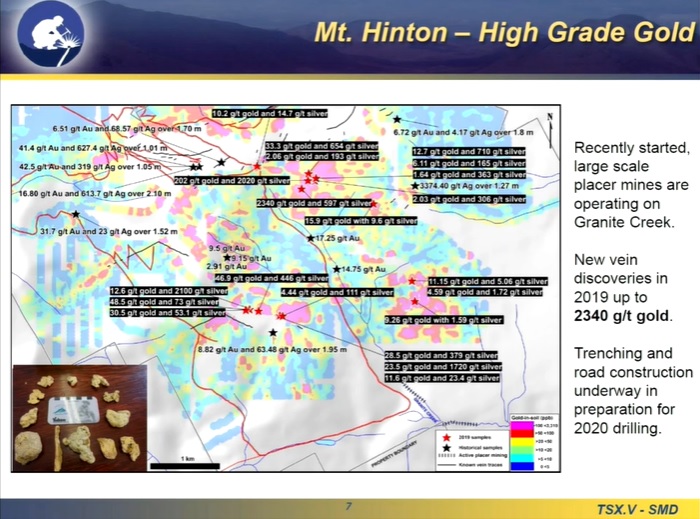

Within Strategic’s entire portfolio there’s probably only 1 property that is NOT for sale or JV, and that’s Mount Hinton.

“It’s the best grassroots discovery I’ve seen in a long-long time,” said Eaton. “Mount Hinton his located on the southern edge of the Keno Hill Silver camp (4 to 15 km by road from Alexco‘s mill). It’s hosted in exactly the same rocks as Keno Hill is, but we’re a little closer to the core. We have quartz veins with arsenopyrite, some very high Silver galena, and native Gold now, which we didn’t realize until this year,” Eaton added.

Strategic’s work has been predicated by recent discoveries made by placer miners. Eaton added it’s undoubtedly the best placer discovery made in Yukon over the last 50 years.

Strategic sent a few prospectors up to Mount Hinton earlier this summer and they found rocks with native Gold all over the place, along with quartzite boulders the size of small cars. One of the samples was 2,340 g/t Au! These widespread and relatively high-grade soil anomalies sit right within the heart of the most prospective stratigraphy of the Keno Hill district.

Speculators have been accumulating SMD on increasing levels of volume in anticipation of what could be a major high-grade discovery at Mount Hinton. The stock’s currently sitting at a 2-year high of 50 cents.

Additionally, Strategic drilled 3 holes at Meloy and 5 holes at Hartless Joe. The drilling rig is now at their Sixty Mile project, where 3 holes are underway within Yukon’s 2nd most productive placer district. Assays from all these holes are pending.

So driver #1 for SMD is Strategic‘s portfolio of 130 properties, upwards of 80 are Gold-Silver. Therefore, lots of inventory for doing JV deals as this cycle keeps heating up.

Driver #2 is their stock holdings. Strategic made a lot of money investing during the last downswing and selling on the way up.

They’re even more levered this go around. Rockhaven (RK, TSX-V) is currently their biggest shareholding, 65 million shares!

Driver #3 is a lot of fun, Eaton chuckled. He’s referring to Strategic’s 83% owned subsidiary called Terra CO2 Technologies. It’s the most exciting thing they’ve got going that’s got nothing to do with exploration. The patent pending process and technology relates to mine remediation and how tailings could be handled better. We thought the link could be CO2 sequestration, said Eaton, but as we progressed we realized not only did we have a good process for dry stack tailings, we have a process that could replace Portland Cement within the construction industry.

What’s the big deal, Eaton quipped…Portland Cement is bigger than the entire mining industry! It’s a huge-huge market and it creates 5% to 10% of the world’s C02.

Could Terra C02 disrupt the entire concrete market?

Unlikely, but there’s a slim chance. And it’s worth throwing a few dollars at Terra C02 because the reward is so large.

Strategic has a market cap of $48 million. The balance sheet is strong with no debt and approximately $29 million worth of working capital.