“Predictive Modeling” Software Identifies Provincial-Scale Copper Gold Project For Montreal-based Explorer

Mar 16

Good things come to those who wait.

But those who soon buy Azimut (AZM, TSX-V) and Salazar (SRL, TSX-V) shouldn’t have to wait very long to receive good things because these companies have the wind at their backs right now. In my view, this is exactly the right time to establish a new position or add to existing positions. AZM and SRL are relatively low-risk plays – they’ve recently come off all-time lows (clearly having bottomed), and they offer HUGE upside.

AZM has run from the low 20’s to 40 cents since February and wants to keep running toward its 52-week high of 47 cents (then beyond). Volume has been picking up nicely of late, too, for this relatively thinly traded equity.

Worth keeping in mind, once upon a time (2007) this was a $9 stock (and great stocks eventually like to chase their old highs).

While honing his technological skills over the past 16 years, aimed at using big data and “predictive modeling” to identify mineral deposits, CEO Jean-Marc Lulin has maintained an enviable share structure.

Sophisticated speculators have a warm place in their hearts for operators like Lulin, because with only 53 million shares outstanding any economic discovery could send AZM to the moon (again!). He’s been able to get a lot of bang for Azimut’s bucks, too! For every $1 the company has spent exploring since 2003, partners have spent roughly $7, or $70 million worth of expenditures in total.

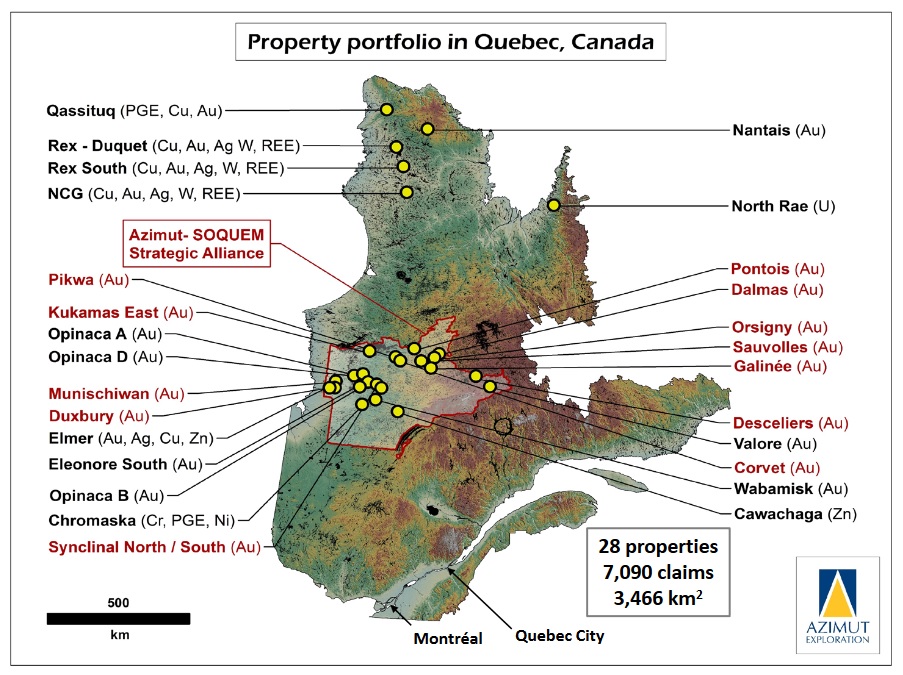

The AZM rally got going February 25 following a deal Azimut struck with SOQUEM, Quebec’s state sponsored exploration company. As per their strategic alliance agreement, SOQUEM has made a commitment to spend $24 million exploring Azimut’s projects in Nunavik ($4 million per year, minimum).

Now that we’re in a full fledged discovery-driven bull market (mining companies are clamoring for new product), you wouldn’t want to underestimate what’s unfolding here and the implications it could have for AZM. I mean, we hear about “district scale” opportunities all the time. Everyone’s touting their district scale land package – they’re a dime a dozen.

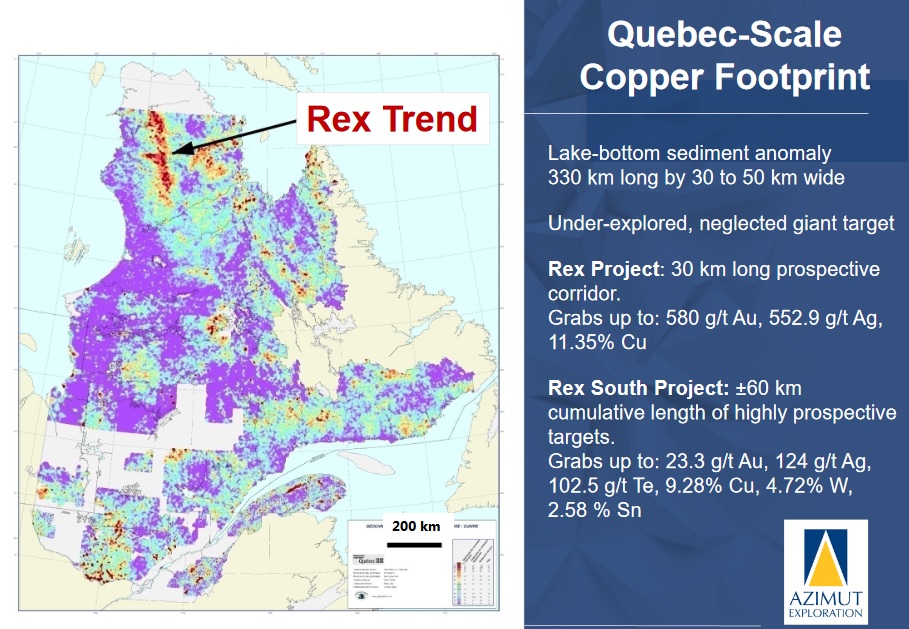

Azimut‘s +100 km Rex Trend is actually quite unique, though, and Nunavik has new mineral province potential!

Geologically speaking, the scale of the lake-bottom sediment anomaly hosted within Azimut’s Rex Trend is phenomenal.

Yes, it’s remote, but it’s Canada remote which is arguably preferable to most remote places across the world. And the government has a long-term plan in place (the Plan Nord) to help the region become more accessible. They really want exploration and economic activity to work its way north – Azimut couldn’t be more prepared for this outcome.

Way south of Nunavik, in the James Bay region, one of Canada’s youngest Gold camps, Azimut is also a big claim holder. Lulin’s predictive modeling software identified the James Bay region even before Eleonore was discovered (a $2 billion mine). I say that to say this…since Azimut was a first mover in James Bay their ground is likely some of the best available. Yet, Mr. Market still sees little to no value in Azimut being one of the largest claim holders in Canada’s youngest Gold camp.

I suspect that low to no valuation will change rather dramatically before long (again, mining companies are clamoring for new product and they’re signing JVs like crazy).

Azimut’s projects within James Bay, all 21 of them, are pinned within the red box below.

Presently, AZM seems to be getting some love from the work Midland (MD, TSX-V) is doing on its Mythril project (Azimut has a project adjoining it). An IP geophysical survey has outlined a well-defined chargeability anomaly forming a continuous zone measuring +2 km long by hundreds of metres wide. According to Midland‘s press release, the zone of chargeability/resistivity anomalies is remarkably coincident with known Cu-Au-Mo-Ag showings and locally sourced mineralized float fields found in 2018, as well as with strong Cu-Mo soil anomalies.

Midland’s going to start drilling its best IP anomalies in mid-March.

Success at Mythril could spark a land rush in James Bay, according to John Kaiser or Kaiser Research. He recently recommended AZM as the way to play it.