“Palladium Central”

Apr 29

“Palladium Central”

That’s what Abraham Drost, geologist and CEO for Clean Air Metals (AIR, TSX-V), calls this part of the world – “Palladium Central”.

Following a brief delay, AIR expects to start trading next week and it’s got the potential to be a high flying stock right away! Eric Sprott was the lead order in Clean Air’s $15 million financing. He’ll own approximately 9.6%. In addition to Sprott, another 50+ people, a mixture or high-net worth and institutional investors (I presume), participated in the 20-cent financing.

I’m guessing AIR will start trading at least 20% above the offering price, call it 25 cents, kind of a big deal for Benton Resources (BEX, TSX-V) which is sitting on 24.6 million shares (or $6.1 million, starting out). Benton owns approximately 19.6% of the company and is Clean Air’s largest shareholder. Considering 500+ holes and $100+ million has been spent on the projects (Escape Lake and Thunder Bay North), AIR has room to triple before having an enterprise value commensurate with “exploration and development” expenditures made thus far.

At 75 cents per share Benton’s equity holdings in AIR would be worth $18.4 million, twice their current market cap.

Another beneficiary is going to be Transition Metals (XTM, TSX-V) which owns 100% of the Saturday Night Project and a 25% interest in Implats‘ Sunday Lake (drill results pending), on trend with Escape Lake and Thunder Bay North. Transition also has a lot of other irons in the fire, another reason we’re bullish on this play as well. It continues to creep higher.

Benton Resources (BEX, TSX-V)

The chart on BEX is looking quite nice, quite nice indeed, as market participants have really started to factor in the significance and certainty of this deal (one I’ve been talking about since Benton tied these projects up via contract).

Meanwhile Steve Stares may have another trick up his sleeve – possibly another arrangement with Rio Tinto? – so his network and connections are really proving to be valuable.

During Clean Air’s conference call yesterday, a prelude to listing next week, Drost disclosed he’s a shareholder of BEX. He said everybody else should probably be a shareholder of BEX, too. Obviously Drost likes AIR but recognizes BEX as a proxy for playing it, while simultaneously endorsing Stares’ talent and ability to keep generating new deals (strong testimonial for Benton).

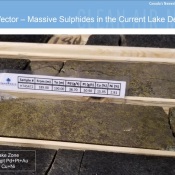

In a snapshot, this section of core is why Stares’ was so excited to get these projects under contract to begin with.

Stares’ excitement, which was infectious, ultimately attracted high-profile executives and investors because they couldn’t pass up the chance to find more. Just a stunning intercept there – 98 g/t Palladium Platinum and Gold plus 14.9% Nickel + Copper over 2.6 m – and they think they’re still looking for the “high-grade” feeder zone!

During the call Clean Air’s Executive Chairman Jim Gallagher, P.Eng., CEO of NA Palladium until it sold for $1 billion, said Lac des Llles doesn’t have the extreme high-grade like they have here ‘nor does it have the Nickel-Copper.

I found that point to be noteworthy, considering Gallagher knows Lac des Llles better than most.

He and Drost think they could have a “mini Norilsk” on their hands, the granddaddy of magma conduit systems.

High-grade drill results were practically promised to be released before the end of May.

Such a promise can be made and delivered upon in this case because Rio Tinto was sitting on assays that were kept private.

So Clean Air should be off and running sometime next week (BEX should tag along for the ride). Exploration starts next week, too! And the Company is funded for a planned 25,000 m of drilling this year. One of the initial goals is to double the size of the Escape Lake resource.

Tagging one of the feeder zones could create an even bigger score for holders of AIR and BEX.

Here’s a link to a replay of yesterday’s live presentation.

Finally, a few quick points on Palladium fundamentals. While automobile production is expected to slow considerably, approximately 30% is what some analysts are calling for, modern catalytic converters (in keeping with more stringent environmental regulations) require 30% more Palladium. Therefore a good portion of lower auto production could be offset by higher usage of metal. Recycling as a percentage of total supply is thought to have peaked, or recycled volumes of Palladium can’t go any higher, while new global supply is sourced from relatively unstable countries like South Africa and Russia. Given the differential in prices, still about $1,000 per ounce, people keep thinking auto manufacturers could substitute Platinum for Palladium (which has historically been done), but Gallagher basically said that ain’t happening. Platinum can no longer replace Palladium on a 1-for-1 basis in modern catalytic converters, according to Gallagher.