Off 89%, TAG Oil is a Value Investors Dream Coming True.

Mar 16

Judging by TAG Oil’s stock performance one could easily assume it’s headed toward bankruptcy. Since 2012 shares have crashed from $10.99 to $1 and change.

He loves me… he loves me not.

Buyers of TAG Oil (TSE: TAO) (OTCMKTS: TAOIF) seem to be few and far between these days. The interim CEO/founder Alex Guidi and the company itself are the only two showing much interest, each has purchased shares religiously much of the way down. More recently, TAG Oil repurchased 1,977,200 shares at an average cost of $2.10 during 2014, and it has authorized buying up to 5,800,000 more through 2015.

Mr. Market has fallen in and out of love with TAG Oil numerous times over its five year relationship, while Alex Guidi and TAG’s board have stayed committed throughout— focusing their efforts on building New Zealand’s premier energy company.

Strong to quite strong

TAG Oil has matured to become an integrated company capable of discovering, transporting, and processing 100% of its own product. Aside from a few well-timed equity raises (e.g. $46M at $10.45 per share), TAG Oil has funded its growth via operating cash flows. To date, over $100 million has been invested into infrastructure. Assets include state of the art processing facilities and pipelines.

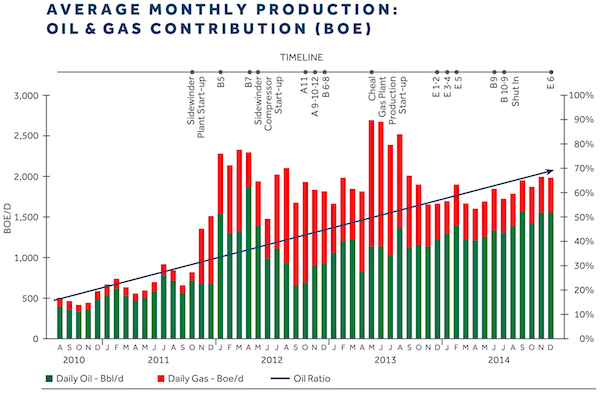

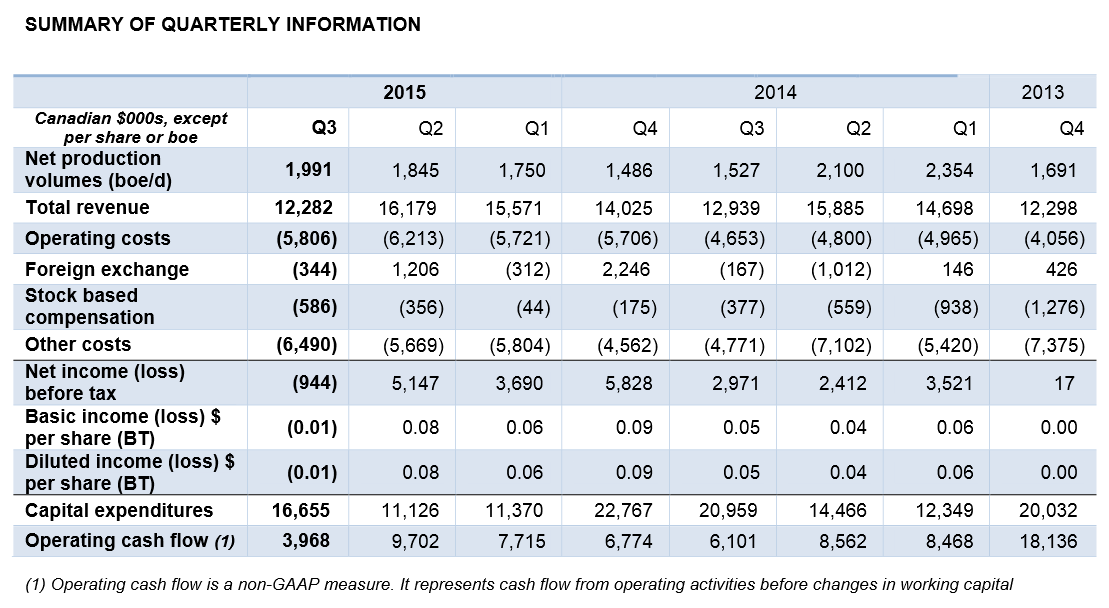

Production volumes have maintained a smooth upward trajectory since day one, up over 400% in total.

TAG Oil’s clean balance sheet of $0 debt and $31 million cash should ensure it survives or thrives during the current downturn.

Cause for concern?

Weak oil and gas pricing has certainly caused downward pressure on the stock (and the industry as a whole), but the simultaneous departure of TAG Oil’s long-time CEO and COO February 11th have also weighed on investor confidence. However, any worrying on that matter should prove to be unwarranted, it’s highly unlikely TAG Oil will have any trouble attracting experienced professionals to join its New Zealand based team.

Where would you rather work?

Additionally, outgoing CEO Garth Johnson worked with TAG Oil for over a decade, so a change in leadership should be good for both parties

Blue skies smiling at TAG Oil

Geologically speaking, for hundreds of years Kiwis and industry experts have known oil and gas literally bubbles up to the surface in parts of New Zealand, yet only a pinprick of exploration has taken place there to date. According to one of TAG Oil’s video presentations New Zealand hosts 18 sedimentary basins, but only one has been commercialized to a limited extent: Taranaki.

Watch Video: get a better feel for TAG Oil’s operations!

TAG Oil’s onshore lease holdings span 2.3 million net acres and three basins: Taranaki, East Coast, and Canterbury. Additionally, it controls shallow-water offshore permits. From the outside looking in, and taking the company at its word, there is no shortage of prospective locations for proven low-risk and higher-risk drilling opportunities looking forward.

Political stability, regulatory incentives, existing infrastructure and excellent weather makes for a climate that juniors and super-majors are keen to invest in [New Zealand].

Top Ten one and two-liners worthy of mention:

- TAG Oil is focused on lowest cost/lowest risk investments in Taranaki, maximizing production from current reserves, and postponing the majority of its capital program that planned on targeting non-core non-producing permits (seeking farm-in partners for non-core assets; East Coast Basin and deep Kapuni Formation Taranaki)

- Positioned to internally fund its adjusted 2015/2016 fiscal year operations program

- TAG Oil’s oldest wells have been on stream 5 years, average well just 3 years old, “we’re the first guys, our learning curve is solidifying”… Shallow Miocene pools (TAG’s bread and butter) have flat-lined around 150bopd

- Cheal B3: original estimates pegged reserves at 70,000 barrels, after five years it has produced more than 400,000 barrels

- Average daily production for quarter ended Dec 31, 2014 = 1,991 BOE/d (77% oil); majority of current production coming from “lightly explored” Cheal and Greater Cheal Fields (Cheal = cash flowing machine for TAG Oil)

- Discovery potential… 1) shallow water offshore Kaheru and 2) conventional frontier exploration in Canterbury Basin

- According to the published “Proven and Probable Reserves”, TAG Oil has 5.5 million barrels, approximately 9 years of reserves assuming a production rate of 1,500 bopd.

- Alex Guidi, interim CEO and founder owns 3,701,039 shares (buying recently in open market)… Fidelity held 9% or 5,787,793 as of most recent disclosure

- $0 debt and $31M cash… Liquid assets equivalent to 50 cents per share

- TAG Oil crude based off “Tapis”… often used as an oil marker for Asia and Australia, typically trades at a premium to WTI and Brent because of its low sulfur content and high API

Bottom Line: value investing requires an element of mental toughness; not everyone can “buy low” because a stock will often go lower after their purchase… and paper losses can feel uncomfortable. Therefore, in a society that prefers instant gratification, “buying high and selling higher” is the masses preferred strategy. As per the points referenced above, TAG Oil is a valuable and growing business that depreciates in worth on a monthly basis (until it doesn’t anymore), so I’m acquiring some now, but hoping it drops even lower.

*Author has a long position in TAG Oil

DISCLAIMER: The information in this publication is not intended to be, nor shall constitute, an offer to sell or solicit any offer to buy any security. The information presented on this website is subject to change without notice, and neither Penny Stock Experts nor its affiliates assume any responsibility to update this information. Additionally, it is not intended to be a complete description of the securities, markets, or developments referred to in the material. Penny Stock Experts and its Author(s) cannot and do not assess, verify or guarantee the adequacy, accuracy or completeness of any information, the suitability or profitability of any particular investment, or the potential value of any investment or informational source. Additionally, Penny Stock Experts and its Author(s) in no way warrants the solvency, financial condition, or investment advisability of any of the securities mentioned. Furthermore, Penny Stock Experts and its Author(s) accept no liability whatsoever for any direct or consequential loss arising from any use of our product, website, or other content. The reader bears responsibility for his/her own investment research and decisions and should seek the advice of a qualified investment advisor and investigate and fully understand any and all risks before investing. Information and statistical data contained in this website were obtained or derived from sources believed to be reliable. However, Penny Stock Experts and its Author(s) do not represent that any such information, opinion or statistical data is accurate or complete and should not be relied upon as such. This publication may provide addresses of, or contain hyperlinks to, Internet websites, Penny Stock Experts takes no responsibility for the contents thereof. Each such address or hyperlink is provided solely for the convenience and information of this website’s users, and the content of linked third-party websites is not in any way incorporated into this website. Those who choose to access such third-party websites or follow such hyperlinks do so at their own risk. The publisher, owner, writer or their affiliates may own securities of companies mentioned in this publication.