Mitek Systems: Minting Money On Millennials’ Love For Selfies

Nov 27

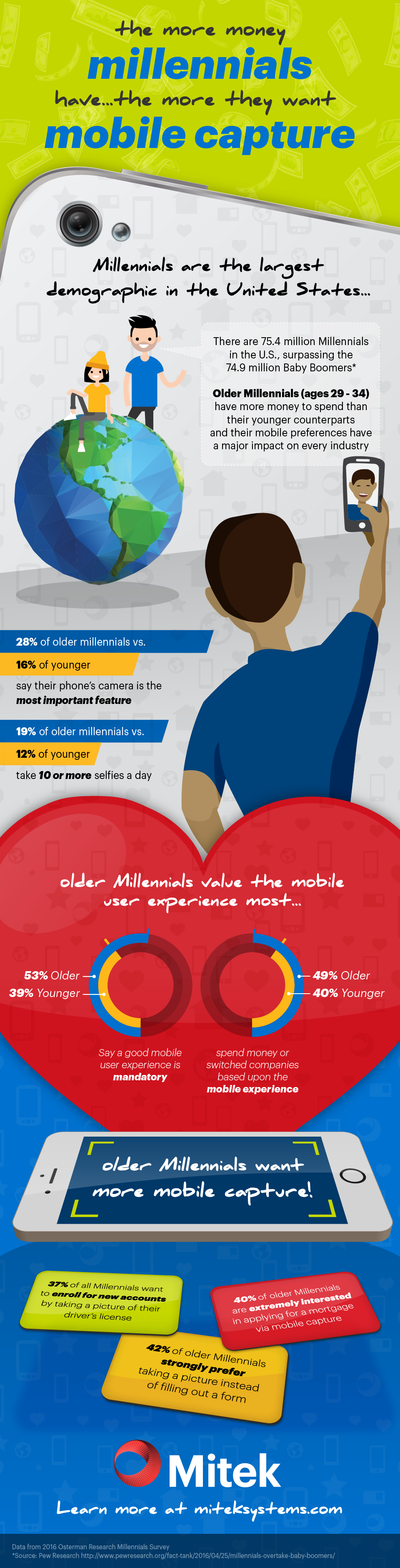

Mitek Systems (MITK, NASDAQ), a global leader in mobile capture and identity verification software solutions, recently released findings from a survey of more than 3,000 millennials in the U.S., Canada and the U.K. on their mobile preferences, purchase habits and financial goals.

“As the largest generation in the U.S., millennials get what they want,” said Kalle Marsal, CMO, Mitek. “For the first time, this survey shows how the most valuable millennial customers expect to use their mobile device camera for commerce and banking. Smart businesses should welcome this news since leveraging millennials’ selfie habit gives them an easy way to verify ID’s, authorize purchases, enroll new customers and achieve compliance in an increasingly regulated mobile world. Their most valuable customers have spoken and the answer is a win-win.”

Forward-looking businesses must have mobile capture, and Mitek’s the leader!

Key findings from the survey conducted by Osterman Research includes:

Millennials are addicted to their smartphone cameras: 85% take selfies and many are taking more than five a day.

- The number of older U.S. millennials taking 20 or more selfies a day is double that of younger millennials.

- More than a quarter of older millennials say the camera is the most important function on their mobile device, vs. 16% of younger millennials.

There is enormous potential demand to use selfies and the camera for commerce and identity verification…

- Only 4% of U.S. millennials currently use selfies to authorize purchases, but 46% would like to do so.

- Only 6% of millennials use selfies to verify their identity, but 39% would like to do so.

- 42% of the oldest millennials strongly prefer taking a picture of their driver’s license instead of filling out a form vs. 23% of the youngest.

Mobile experience matters to millennials, and should matter to businesses that want them as customers…

- 84% of U.S. millennials consider a good mobile user experience important or essential in order to do business with them.

- 84% of millennials are conducting transactions from their mobile device with 15% doing so multiple times a day.

- Nearly half of older millennials have made a decision on where to spend money or switched companies based upon the mobile experience.

- When asked which industries provide the best mobile user experience, banking ranked #1 by the majority (57%) of millennials – outranking car services such as Uber and Lyft.

Identity verification volumes are going up, way up!

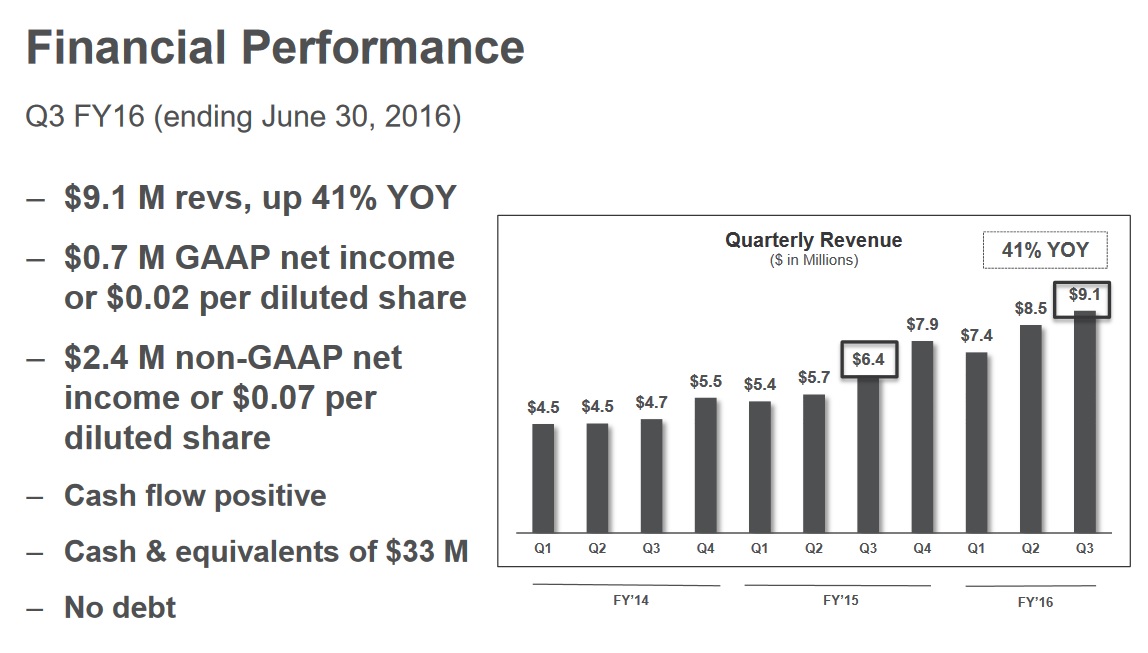

Millenials aren’t the only cohort driving Mitek’s 41% YOY revenue growth.

Big Brother, embodied as the Financial Action Task Force (FATF), an organization (190 jurisdictions worldwide) tasked with combating money laundering and terrorist financing techniques, is contributing big league.

For one, the FATF has embraced an electronic form of identity. Businesses love electronic ID’s because customers don’t have to show up. Therefore time-constrained customers love it just as much. For two, identity verification is now required for relatively small movements of currency. Here’s an example: identity verification is now required for just a $250 euro payment/remittance! Previously only currency movements of $2,500 or more required identity verification.

Mitek’s solutions are fighting fraud…

While perhaps counter intuitive, Mitek’s ID verification solution is reducing fraud. As it turns out, it can be easier to fool someone with a fake ID presented physically than machine learning algorithms trained to find fakes.

Fraud happens at “account opening”.

To the extent Mitek can prevent and reduce occurrences of identity fraud it’s a win for everyone. Given millenials and a growing percentage of Baby Boomers desire for self-service commerce, accounts of all types (from financial to healthcare) are being opened online. More than 400 million bank accounts are opened every year. By 2019 there is estimated to be 1.8 billion “mobile banking users” globally (25% of population). Of course, more than 5,400 banks (including the Top 10 Big Banks) use Mitek’s remote deposit solutions.

Mitek is only scratching the surface of these massive markets. But the growth potential doesn’t stop there. Another report by Ovum estimates there will be 1.6 billion people making P2P (peer to peer) payments by 2019. And P2P users expect security, convenience, and speed.

This just in!

Today Mitek was included in a collaborative alliance with Fujitsu.

The joint proposition enables financial institutions to collect, process and verify documents and the identity of new applicants in less than 5 minutes. It operates across multiple channels to give a seamless customer experience, ultimately increasing conversion and reducing the cost of acquisition of new customers. “Smart Origination” reduces identity fraud by up to 99% and decreases application abandonment by 40%, enabling financial institutions to reduce the financial expense associated with fraudulent customers and more easily attract new customers (according to the press release).

Going global…

On December 6 and 7, Mitek will be in London presenting to bank executives from across the world at the “Branch Transformation Summit”. During the Q4 conference call, Mitek disclosed it was in discussions with two of the largest European banks, so this upcoming conference will only serve to push its mobile capture and identity verification solutions further into international markets.

Finally, looking at the 4-year chart below, you can see MITK is in the early consolidation phase of a what I expect will take shares well into double-digits. The stock closed at $5.70 today, about 70 cents above the rising 500-day moving average (SMA). Bargain-hunters are getting a deal!

From high to low shares are off roughly 42% (on relatively light volume), providing an attractive entry point for new investors.

Undoubtedly, many existing investors (BlackRock, State Street and Vanguard being three of the largest) are using the recent downturn to acquire more MITK.

>>>> Leave your email address for research reports >>> top right side of page >>>>

*Author has a long position in MITK

DISCLAIMER: The information in this publication is not intended to be, nor shall constitute, an offer to sell or solicit any offer to buy any security. The information presented on this website is subject to change without notice, and neither Penny Stock Experts nor its affiliates assume any responsibility to update this information. Additionally, it is not intended to be a complete description of the securities, markets, or developments referred to in the material. Penny Stock Experts and its Author(s) cannot and do not assess, verify or guarantee the adequacy, accuracy or completeness of any information, the suitability or profitability of any particular investment, or the potential value of any investment or informational source. Additionally, Penny Stock Experts and its Author(s) in no way warrants the solvency, financial condition, or investment advisability of any of the securities mentioned. Furthermore, Penny Stock Experts and its Author(s) accept no liability whatsoever for any direct or consequential loss arising from any use of our product, website, or other content. The reader bears responsibility for his/her own investment research and decisions and should seek the advice of a qualified investment advisor and investigate and fully understand any and all risks before investing. Information and statistical data contained in this website were obtained or derived from sources believed to be reliable. However, Penny Stock Experts and its Author(s) do not represent that any such information, opinion or statistical data is accurate or complete and should not be relied upon as such. This publication may provide addresses of, or contain hyperlinks to, Internet websites, Penny Stock Experts takes no responsibility for the contents thereof. Each such address or hyperlink is provided solely for the convenience and information of this website’s users, and the content of linked third-party websites is not in any way incorporated into this website. Those who choose to access such third-party websites or follow such hyperlinks do so at their own risk. The publisher, owner, writer or their affiliates may own securities of companies mentioned in this publication.