Mitek Systems — Fintech Sleeping Giant with 60 Million Customers, Still a Microcap?

Jan 31

Trying to restrain my enthusiasm with Mitek Systems (NASDAQ: MITK)!

Why so uppity on MITK? Because i’m not late to the party. Shares are still smack in the middle of a 3-year consolidation, a beautiful tight band has developed between $2 and $6.

Quickly>> i discovered this gem while researching a lesser quality penny stock called Cachet Financial Solutions (OTCBB: CAFN). While reading its 10K it became clear Cachet is licensing software/technology to provide its “solutions” from someone else.

…and that someone is the market leader, Mitek Systems.

It handles more mobile transactions than anyone in the world.

Roughly 1 of 5 Americans, and virtually all millennials are using Mitek’s “MiSnap” technology without knowing it.

The buzzword is Remote Deposit Capture– The Federal Reserve and others have called it: “the most important development the U.S. banking industry has seen in years.” With a user base of 60 million, estimated to be 80 million by 2017, you or someone you know is likely using RDC, the super-simple process of taking a picture of a check with your smartphone and depositing into your account… no need to go to the bank… voila!

As you can imagine, banks love this technology, and they’re spending Big Money marketing it.

Bank of America, one of Mitek’s 4,800 financial institution customers (4,400 are live), said it has closed 900 banks because increased use of mobile banking. Banks lower their transaction costs and customers save time, so its a classic win-win!

Mitek’s revenue from mobile deposit is driven by two factors:

1) size of customer base

-Top 10 largest retail banks using it now; Mitek gets a licensing fee upfront

2) adoption and transactions

-Mitek sells “blocks” of transactions (per million); collect a few cents (or more?) per click/photo snap

Arguably, the #1 risk for Mitek would be a structural decline in check usage, according to The Fed it has been declining at 9% annually. On the flip side, as of 2013, there were still approximately 18.3 billion checks written, so don’t expect the check to disappear as a payment method within this decade. Bank of America’s data for 2014 showed Americans (retail customers) were depositing 170,000 checks per day, and mobile deposits grew by 30%.

Encouragingly for Mitek’s transaction/usage rates going forward, its just now tapping into “commercial” multi-check deposit capture for businesses. Reportedly, a leading food distributor handling over 7 million invoices each year reduced its processing costs by 29% after converting to Mitek. Further validating how Mitek’s suite of offerings will expand outside its core banking market, during the last quarter first time customers include retailers, online gaming, crypto currency and a credit card issuer.

“Mobile Verify” and “Mobile Fill” Complement Mitek’s Remote Deposit Application

In today’s busy world very few consumers have an extra 10-minutes to fill out a form to get a free car insurance quote (or any other form). Mitek solves the problem! A company like Geico or Allstate uses Mobile Fill to give quotes in just a snap– simply take a photo of the drivers license and insurance card and you’re done. Two years ago less than 5% of Banks and Insurers were signing up customers on mobile, now its 30%!

When it comes to lead generation digital marketers are concerned with “abandonment”, so mobile capture/fill solves a problem and delivers a measurable ROI.

Corporations of all types spend billions to get people to their websites, problem is… the lead/customer is lost when the form isn’t filled out completely, a large percentage go abandoned. Not so with Mitek’s Mobile Fill though! Corporate customers are seeing a huge increase in completion rates when the only barrier between getting a hot lead or not is taking a picture. Booyah! Just recently i saw a TurboTax commercial promoting that all you have to do is take a picture of your W2, then your practically done with our taxes (can’t verify TurboTax is using Mitek, but i’m confident you see the blue sky potential).

Also, Mitek’s Mobile Verify addresses two pain points in the banking industry:

1) Anti-Money Laundering requirements

2) Know Your Customer rules

Thanks to Mitek banks of all sizes can streamline their compliance process (cutting costs), verifying identities in minutes instead of days. As of now, 3 of 10 largest insurance companies are using Mitek’s identity products.

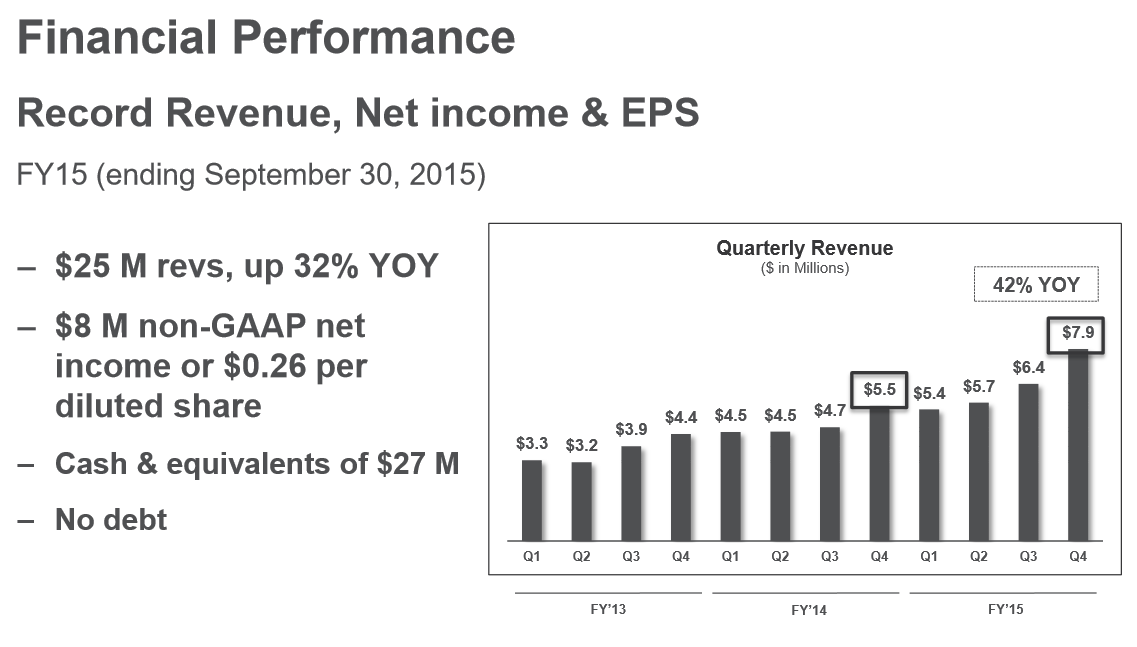

Fiscal year 2016 guidance:

Revenues = $31 – $33 million (judging by past performance, below, Mitek’s estimates are conservative)

Non-GAAP Earnings growth +20%

Cash = $27.6M

Sign up 10 Fortune 500 companies with Mobile Fill ID = 4 signed in Q1 (*a 5th signed Feb 2nd)

Analyst Coverage and Institutional Ownership still minimal:

According to Whale Wisdom’s last update Vanguard and BlackRock are the largest shareholders, but neither owns more than 3%. At this juncture there are only three analysts from Benchmark, William Blair, and Northland Securities covering MITK.

Other points worthy of mention…

a) consumer habits changing… millennials demand a mobile, self-service experience

b) trend points toward mobile, mobile, mobile and transacting on the go– using the camera as a keyboard is music to Mitek’s ears.

c) market size over $3 billion for Mobile Capture and ID Verification

d) opportunity in shared economy… think Uber, AirBNB, etc.

e) “all litigation except for patent trolls is behind them”

f) large pharmacy using ID verification for prescription mobile app

g) Harland Clarke, the world’s largest check printer, has begun embedding features/icons (“Photo Safe”) into checks that are only recognizable by Mitek. Ultimately reducing risk to banking institutions, so they will feel comfortable raising deposit limits.

h) Core science includes advanced algorithms, computer vision, and machine learning. Mitek would argue with its first mover advantage, patents, and difficulties reproducing, that barriers do exist.

i) Being pulled into other markets (healthcare, telecom, and retail) because of reputation in banking industry

j) Mitek says additional security features such as facial recognition, fingerprint, and iris are biometrics that can be done via camera in the future.

Daniel T. Cook

P.S. If you want more information like this sent directly to your inbox>>> subscribe with your email >>> its on the top right of this page>>>

*Author has a long position in Mitek Systems Inc.

DISCLAIMER: The information in this publication is not intended to be, nor shall constitute, an offer to sell or solicit any offer to buy any security. The information presented on this website is subject to change without notice, and neither Penny Stock Experts nor its affiliates assume any responsibility to update this information. Additionally, it is not intended to be a complete description of the securities, markets, or developments referred to in the material. Penny Stock Experts and its Author(s) cannot and do not assess, verify or guarantee the adequacy, accuracy or completeness of any information, the suitability or profitability of any particular investment, or the potential value of any investment or informational source. Additionally, Penny Stock Experts and its Author(s) in no way warrants the solvency, financial condition, or investment advisability of any of the securities mentioned. Furthermore, Penny Stock Experts and its Author(s) accept no liability whatsoever for any direct or consequential loss arising from any use of our product, website, or other content. The reader bears responsibility for his/her own investment research and decisions and should seek the advice of a qualified investment advisor and investigate and fully understand any and all risks before investing. Information and statistical data contained in this website were obtained or derived from sources believed to be reliable. However, Penny Stock Experts and its Author(s) do not represent that any such information, opinion or statistical data is accurate or complete and should not be relied upon as such. This publication may provide addresses of, or contain hyperlinks to, Internet websites, Penny Stock Experts takes no responsibility for the contents thereof. Each such address or hyperlink is provided solely for the convenience and information of this website’s users, and the content of linked third-party websites is not in any way incorporated into this website. Those who choose to access such third-party websites or follow such hyperlinks do so at their own risk. The publisher, owner, writer or their affiliates may own securities of companies mentioned in this publication.