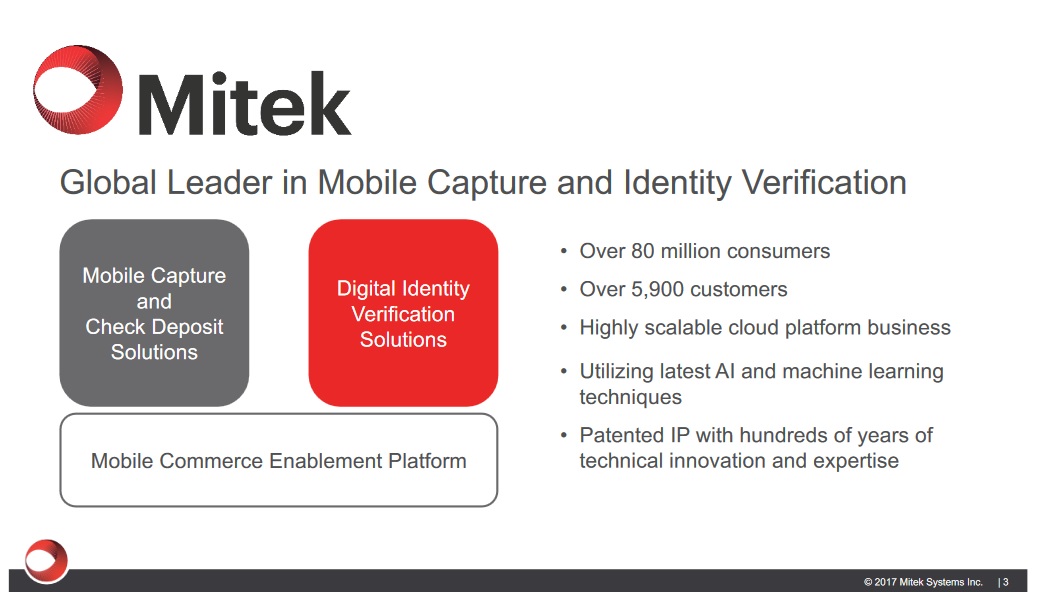

Mitek (MITK, NASDAQ): The Key Enabling Platform For Establishing Trust In A Digital World

Feb 04

The Key Enabling Platform For “Trusted” Commerce In A Digital World!

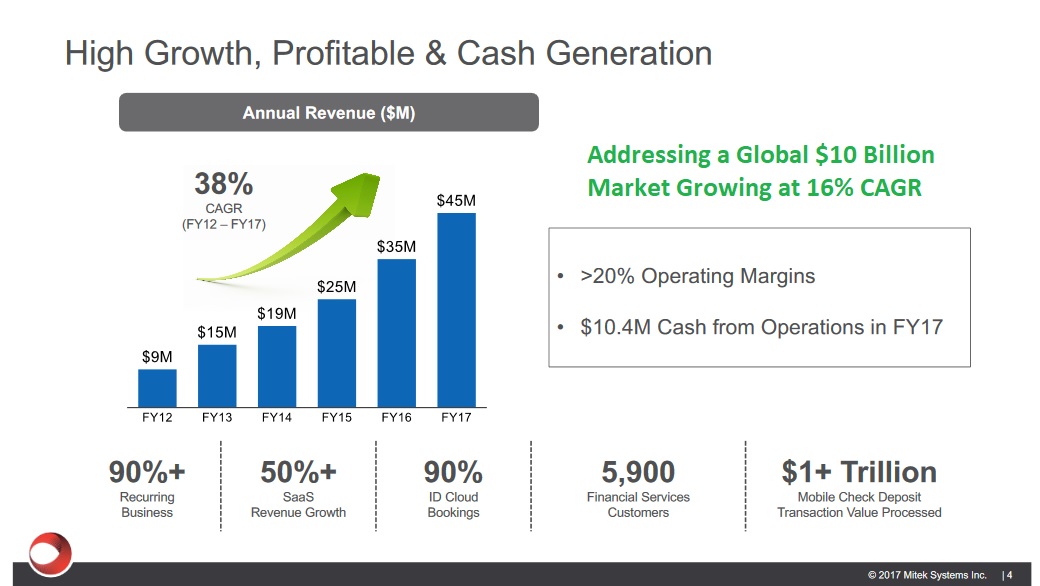

Mitek Systems (MITK, NASDAQ), a global leader in mobile identity verification and mobile deposit solutions, reported Q1 2018 revenues of $12.1 million last Thursday (up 31% yoy, and a new record).

Before we take a look at the highlights from the quarter, I’ll comment on MITK’s price action and the “Big Picture”.

Between late 2015 and mid-2017 the stock surged from below $3 per share to nearly $11. So while it’s somewhat frustrating to see it pull back to $7.65 (support?), when it looked poised to break above $10 a week ago, “it just is what it is”. And we may be looking at the final shakeout.

As investors I think we’re comforted by having a reason our stocks move UP and DOWN. Fact is, there isn’t always a rhyme or reason for the movements (often it’s purely emotions, impatience, or personal financial reasons – nothing to do with the underlying business).

One thing’s for sure – what used to be done in person is now being done online. Going forward, more and more transactions and services will be done online, not less. Mitek owns the key enabling platform (patent protected) for “trusted” commerce in this digital world. Therefore, Mitek has massive growth ahead of it (and its customers “NEED” the product).

Investors and speculators often lose sight of the big picture and grow impatient. They sell something to buy something else, jumping around too much. They might be concerned because Mitek’s revenues were $0.4 million off their estimates (or Q2 will be “flat” due to tough comps), but years from now that will have been long forgotten. They might think the chart is weakening and step to the sidelines, only to join the game later.

…that type of thinking and those leaders are not the ones you want to be following.

Bottom line – Mitek the stock isn’t looking so good at the moment, but the business and its prospects for growth are looking as great as ever. With $48 million cash and no debt, the balance sheet is rock solid. With 2018 revenue guidance of $58 million, Mitek is valued at 4 x sales (ex cash). That’s not a high price to pay for a growth stock in the sweet spot of “e-commerce”. This is a business model that’s close to minting money, roughly 90% gross margins.

Watch the stock – I bet it bottomed today at the rising 500-day moving average (SMA), just like it did earlier this year.

Highlights from the quarter and conference call:

“Our results for the fiscal first quarter reflect continued solid growth from both our digital identity software solutions and our industry leading Mobile Deposit. Our growing and profitable recurring business in mobile deposit continues to be a solid springboard from which to capture the growth in the global digital identity verification market. During the quarter SaaS ID transactions increased 117% year-over-year, and we ended the quarter with 29% more ID customers than a year ago. With our continued momentum in both markets, we are well positioned for growth in fiscal 2018 and beyond.”

Noteworthy and new “identity” customers gained:

- One of the world’s largest investment management companies is using Mitek’s mobile identity verification solution for streamlining new account opening

- One of the world’s largest airlines

- One of the world’s largest car rental companies

- A top 5 bank renewed its contract with Mitek

Nocks, one of Europe’s leading blockchain providers, reduced its new customer onboarding time by 98% (from 12 hours to 5 minutes!) thanks to Mitek’s “Mobile Verify” solution. That’s a big deal! People don’t like to wait around online, and Nocks’ enrollment jumped over 200%.

Final Thoughts – Mitek believes it possesses the world’s largest repository of “fake ID’s”. Its machine learning systems and AI learn from those fakes, so the company is getting quite good at catching the bad guys. Mitek will leverage its balance sheet to grow via acquisition – it acquired Icar Vision this year to maintain its dominant market position and competitive edge. In the technology space MITK is one of our top 5 picks.

Want to Trade Like The Experts? Click below for more about our Subscriptions and receive the next up and coming opportunity!

*Daniel has a long position in MITK

Ariticle first published at BullMarketRun

DISCLAIMER: The information in this publication is not intended to be, nor shall constitute, an offer to sell or solicit any offer to buy any security. The information presented on this website is subject to change without notice, and neither Penny Stock Experts nor its affiliates assume any responsibility to update this information. Additionally, it is not intended to be a complete description of the securities, markets, or developments referred to in the material. Penny Stock Experts and its Author(s) cannot and do not assess, verify or guarantee the adequacy, accuracy or completeness of any information, the suitability or profitability of any particular investment, or the potential value of any investment or informational source. Additionally, Penny Stock Experts and its Author(s) in no way warrants the solvency, financial condition, or investment advisability of any of the securities mentioned. Furthermore, Penny Stock Experts and its Author(s) accept no liability whatsoever for any direct or consequential loss arising from any use of our product, website, or other content. The reader bears responsibility for his/her own investment research and decisions and should seek the advice of a qualified investment advisor and investigate and fully understand any and all risks before investing. Information and statistical data contained in this website were obtained or derived from sources believed to be reliable. However, Penny Stock Experts and its Author(s) do not represent that any such information, opinion or statistical data is accurate or complete and should not be relied upon as such. This publication may provide addresses of, or contain hyperlinks to, Internet websites, Penny Stock Experts takes no responsibility for the contents thereof. Each such address or hyperlink is provided solely for the convenience and information of this website’s users, and the content of linked third-party websites is not in any way incorporated into this website. Those who choose to access such third-party websites or follow such hyperlinks do so at their own risk. The publisher, owner, writer or their affiliates may own securities of companies mentioned in this publication.