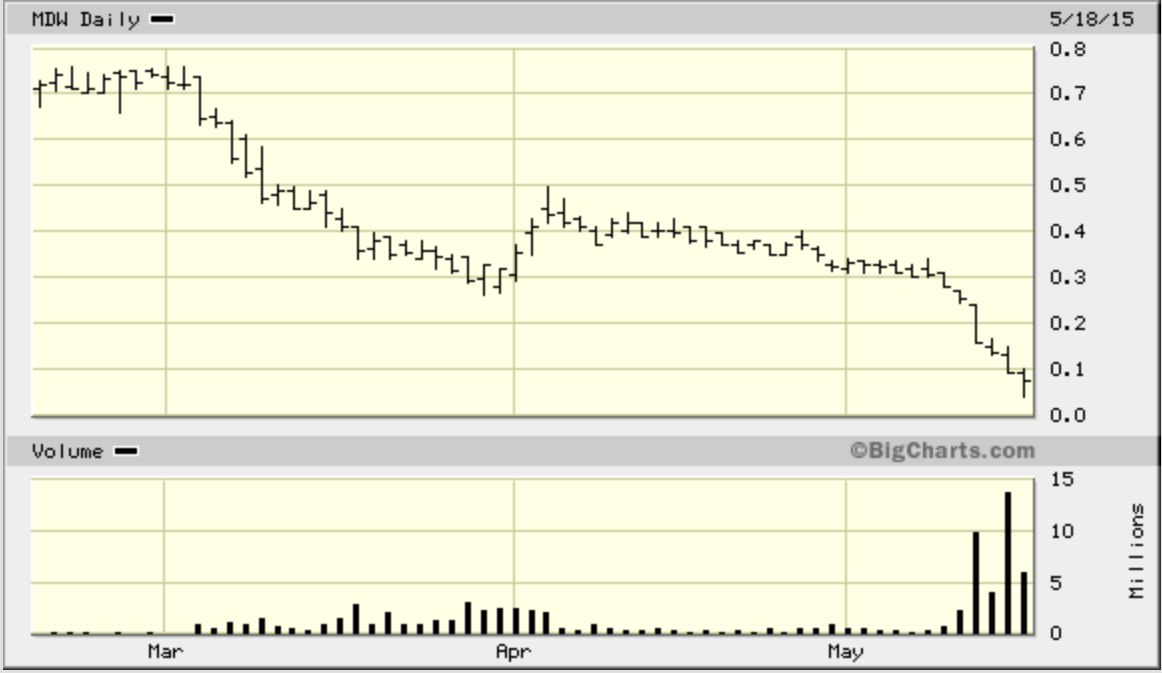

Midway Gold: Spectacular, Yet Simple 10 out of 10 Fail

May 18

Well that escalated quickly. Shares of Midway Gold (NYSEMKT: MDW) have collapsed 85% in less than three months. What was supposed to be the best of times [Nevada’s newest gold producer!] turned out to be the worst of times [teetering on default?].

Apparently the Pan Mine wasn’t so “simple” to operate after all.

Now I’m no Lukas Lundin or Rob McEwen, but I interpreted simple as being core to Midway Gold’s business model. For years, Midway Gold advertised simplicity, and this word still features prominently throughout its investor presentation.

Speaking at the Denver Gold Forum September 2014, former CEO Ken Brunk spoke confidently and simply, stating Pan would make a nice chunk of change>>> Listen Here

What could go wrong with Pan?

Ore starts at surface, less than 2:1 strip ratio, no need for crushing equipment, just scoop-dump-repeat. With a confident and qualified CEO, projected all-in-costs under $900 per-ounce, bank financing in place… Midway Gold appeared to check all the boxes a professional mining analyst would want to see. Hindsight being 20/20, the Pan mine was just too simple, something had to go wrong, and it did.

On the hook…

After announcing the highly-anticipated (albeit behind schedule) 1st gold pour, it only took a couple more press releases to leach the life out of Midway Gold’s stock price.

Sophisticated institutions like Vanguard, Oppenheimer, Van Eck, Franklin Resources and Hale Capital (just to name five) took the bait, all owned more than 3% according to Midway Gold’s investor presentation— for whatever that’s worth. In full disclosure, MDW also hooked me, right in the corner of the mouth.

Production delays and lower grades weren’t just a blip— bad assumption. It doesn’t feel any better to be in the company of Vanguard and Oppenheimer either, I thought they did better research. Anyhow, have to write this off as a learning lesson (avoid startup mines and run away at the first sign of trouble), but good ones don’t come cheap.

Pointing Fingers>>>

Natural resource consultants at Gustavson Associates were responsible for the in-the-ground gold projections. Those resource estimates were wrong, far worse than reported. I’ll let the mining gurus and financiers determine whether or not Gustavson Associates did the job it was hired to do or not. Midway Gold was successful in securing financing, but it could be the rope that hangs it.

Crushing it. Advertised as a run-of-mine heap leach operation, the powers that be within Midway Gold decided against buying rock crushing equipment— not a cost worth cutting. Likely a huge blow to their credibility, Midway Gold’s management was wrong, Pan needs crushing equipment.

At this point, I can’t help but wonder… how many attorneys are licking their chops or have already begun filing. Could be open and shut, simple case.

Bottom Line: Cannacord Genuity kicked Midway Gold while it was down last week, reducing its price target to 10 cents. Music is still playing for MDW, if you listen closely you can just barely hear it. But what a spectacular fail!

I don’t think many people saw this coming. If you did please contact me, I’d be interested in borrowing some brilliance, how’d you figure it out?

As terrible as the stock is trading, the odds could favor a bounce to 20-30 cents within six months, even if it’s just a dead cat. Midway Gold has a few levers left to pull:

1) 25% ownership in Spring Valley must be worth something to Barrick Gold

2) CEO and Wharton grad William Zisch just recently left Royal Gold, maybe it’s interested in a royalty?

DISCLAIMER: The information in this publication is not intended to be, nor shall constitute, an offer to sell or solicit any offer to buy any security. The information presented on this website is subject to change without notice, and neither Penny Stock Experts nor its affiliates assume any responsibility to update this information. Additionally, it is not intended to be a complete description of the securities, markets, or developments referred to in the material. Penny Stock Experts and its Author(s) cannot and do not assess, verify or guarantee the adequacy, accuracy or completeness of any information, the suitability or profitability of any particular investment, or the potential value of any investment or informational source. Additionally, Penny Stock Experts and its Author(s) in no way warrants the solvency, financial condition, or investment advisability of any of the securities mentioned. Furthermore, Penny Stock Experts and its Author(s) accept no liability whatsoever for any direct or consequential loss arising from any use of our product, website, or other content. The reader bears responsibility for his/her own investment research and decisions and should seek the advice of a qualified investment advisor and investigate and fully understand any and all risks before investing. Information and statistical data contained in this website were obtained or derived from sources believed to be reliable. However, Penny Stock Experts and its Author(s) do not represent that any such information, opinion or statistical data is accurate or complete and should not be relied upon as such. This publication may provide addresses of, or contain hyperlinks to, Internet websites, Penny Stock Experts takes no responsibility for the contents thereof. Each such address or hyperlink is provided solely for the convenience and information of this website’s users, and the content of linked third-party websites is not in any way incorporated into this website. Those who choose to access such third-party websites or follow such hyperlinks do so at their own risk. The publisher, owner, writer or their affiliates may own securities of companies mentioned in this publication.