Mason Resources: Could It Be The Best Copper Deal On Earth Right Now?

Jul 08

Spinoff creates compelling opportunity…

Why would a company do a “spinoff”?

A management team decides to spinoff an asset or subsidiary because they believe it would be more valuable as a standalone entity. Value creation is at the heart of their reasoning in almost every circumstance.

First published June 19th at BullMarketRun.com

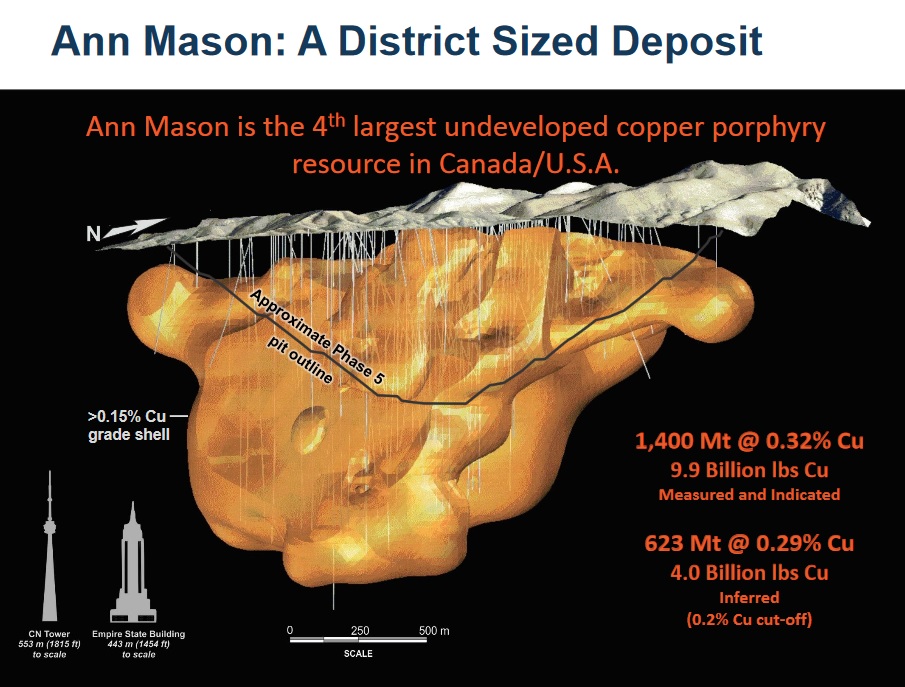

After years of being a hidden asset within Entree Resources (ETG, TSX), formerly Entree Gold, shareholders/directors voted to spinoff Ann Mason, the 4th largest Copper deposit in all of the United States and Canada, into a new entity called Mason Resources (MNR, TSX).

The arrangement concluded just over a month ago, May 9.

Unfortunately spinoffs are somewhat few and far between, because as a whole the category crushes the market averages. Why do spinoffs tend to beat the market? Circling back to what I stated up top, the asset/subsidiary would be more valuable standing alone, and it has the significance to do so. Plus, the standalone entity often gets a new management team’s full attention along with fresh capital to pursue growth (it’s own pair of wings for flying).

Spinoffs trade in a predictable pattern…

As surely as night follows day, the new stock “declines” in price for a month or so following the spinoff. Following a wave of indiscriminate selling, from people who don’t know what they’ve got or simply want to cash out, the spinoff can rise freely from its artificially depressed valuation.

I believe that’s about where things stand with MNR right now. Post-spinoff it’s down more than 50% and the valuation is almost identical to Mason‘s cash in the bank (one would think that may provide some support to the stock price).

At 17 cents per share the market cap is approximately U.S. $10 million.

With roughly $8.75 million cash and a market cap of $10 million, MNR fits my definition of “compelling value” (which loosely translates into “getting something for nothing”).

Freeport McMoRan shares a fence line with Mason…

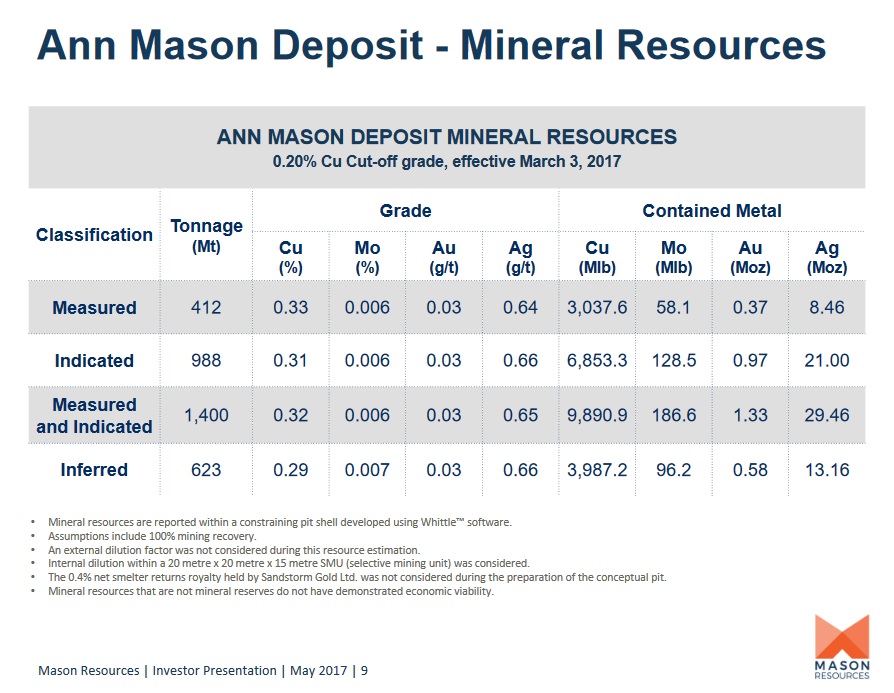

Mason Resources owns 100% of a very large Copper resource (an estimated 14 billion pounds), and major miners need large resources. If the large resource happens to be in a “mining friendly” jurisdiction that’s easily accessible and infrastructure-rich you’ve got a serious acquisition candidate on your hands.

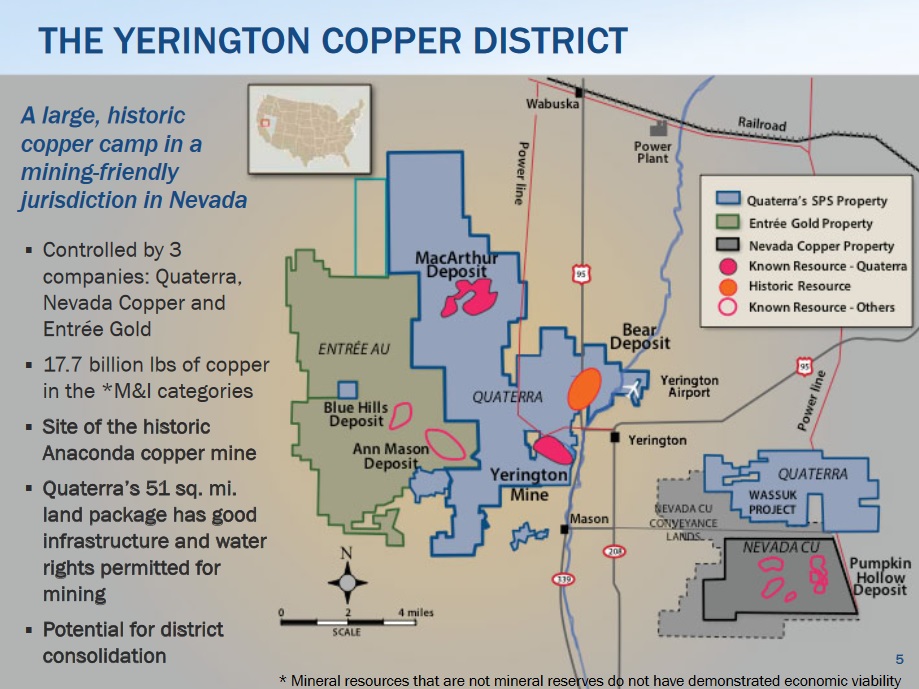

Being located in Nevada, within a historic mining camp, I believe that’s exactly what we’ve got with MNR.

Freeport McMoRan, one of the world’s largest Copper miners, has a joint venture in place next door (the properties share a fence line for over 7 miles). Initiated in 2014, Freeport has the right to earn a 75% interest in Quaterra Resources’ (QTA, TSX-V) Yerington Copper District (70 miles southeast of Reno), by spending upwards of $140 million. If Freeport carries the deal through feasibility, it would require an investment of more than $300 million.

Potentially a big commitment.

So what do we know now?…

We know that majors are interested in this proven Copper district, and Nevada is one of the few places in the world multi-billion dollar mines can be built with some level of long-term assurance.

Mason’s project couldn’t be closer (featured in “green” above) – it shares a fence line for over 7 miles with Quaterra/Freeport (which is featured in “blue”).

Nearly 2 billion pounds of Copper have been mined from this area historically. Mason and Freeport/Quaterra are both sitting on large resources, and Nevada Copper (NCU, TSX) also has one to the southeast (featured in “dark gray” above).

We know this district contains at least 25 billion pounds of reserves and resources right now within a relatively small area (roughly a 20 mile by 20 mile square). Plus, exploration upside is tremendous.

Additionally, it looks like there’s a really good opportunity for Mason Resources to make new discoveries and or expand outside its existing resource footprint.

What’s a 14 billion pound Copper resource worth?…

At $2.60 per pound, one could argue that Mason’s Ann Mason deposit is worthless, and that’s essentially what it’s valued at now. The Copper in the ground is valued at way less than 1/10th of 1 penny. Basically zero.

However, in a scenario where Copper is selling above $3 per pound I’d argue the Ann Mason deposit could command upwards of $0.01 or $0.02 per pound in the ground.

To be clear, as it stands now, Mason‘s project needs at least $3.25 to $3.50 per pound to even begin thinking about moving toward production. That said, we’ve seen other “optionality” plays like Alderon Iron Ore make spectacular moves by publishing economics on a smaller higher-grade starter pit. I’m recommending Mason Resources should do the same thing.

Digging deeper into valuation based on “peer comparisons”…

Here’s a slide that CopperBank (CBK, CNSX) uses in its investor presentation, take notice of the “Value $/lb assigned” category:

CopperBank cherry picked those deposits/assets to help justify its own valuation, which is quite rich in my view (relative to Mason Resources).

At that particular moment in time (when Paradigm Capital ran the numbers) every project on the list was valued between $0.02 and $0.05 per pound.

From what I see today, those valuations are on the high side, but there are at least 25 comparable deposits/assets to Ann Mason around the world. On average, each is selling for between $0.005 (half a penny) and $0.02 per pound.

Of course, the grades differ, but nearly all are within the 0.2% to 0.5% Cu range.

Freeport/Quaterra’s Yerington deposit and Mason’s Ann Mason deposit are roughly the same grade, 0.3% Cu equivalent (although Mason Resources is currently about 10 x larger).

When it comes to location almost none of the peer group is better located.

Essentially and practically “free”…

To my calculation, after backing out Mason Resources‘ $8.75 million cash position the asset is valued at about $0.00009 per pound (more than 50 x lower than the lower end of the average; $0.005 per pound).

Here’s how I arrived there – $1,250,000 ($10 million market cap minus $8.75 million cash) divided by 14,000,000,000 pounds of Copper.

Again, a compelling value considering the factors I’ve stated thus far. By purchasing MNR below 20 cents per share I believe investors are getting something of value for nothing (or next to nothing).

Why bet on Copper?…

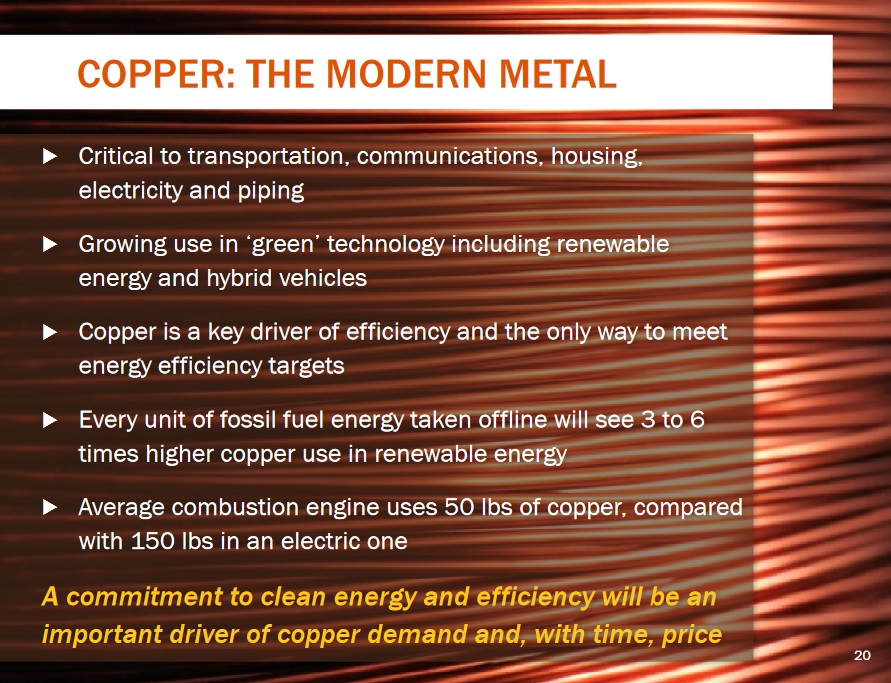

Looking forward a few years, many analysts predict there could be a supply crunch with Copper, not unlike with Zinc. It is the “green metal” of the future. And since the ascent of man began we have always consumed more and more electricity. As billions upon billions of people around the globe (think China, India, and Africa) rise out of poverty they will demand many of the same conveniences we take for granted.

If it plugs into the wall (think refrigerators, air conditioning systems, etc.) chances are, it has Copper in it.

Do you think the billions of people in India, China, and Africa will want any of those modern luxuries that we take for granted?

Final Thoughts: in my view, MNR represents a textbook opportunity. There’s 2 things working in our favor right now, the “spinoff” factor and “optionality” (a double whammy!). The biggest risk I see concerning Mason Resources is how management deploys its $8.75 million cash. Some fans of optionality, like Rick Rule, would suggest they do nothing (aside from waiting patiently for higher Copper prices) . Alternatively, if they decide to do something I’ve recommended it should be geared toward aggressively advertising MNR, securing a major partner, and/or demonstrating improved economics with a smaller higher-grade starter pit.

P.S.

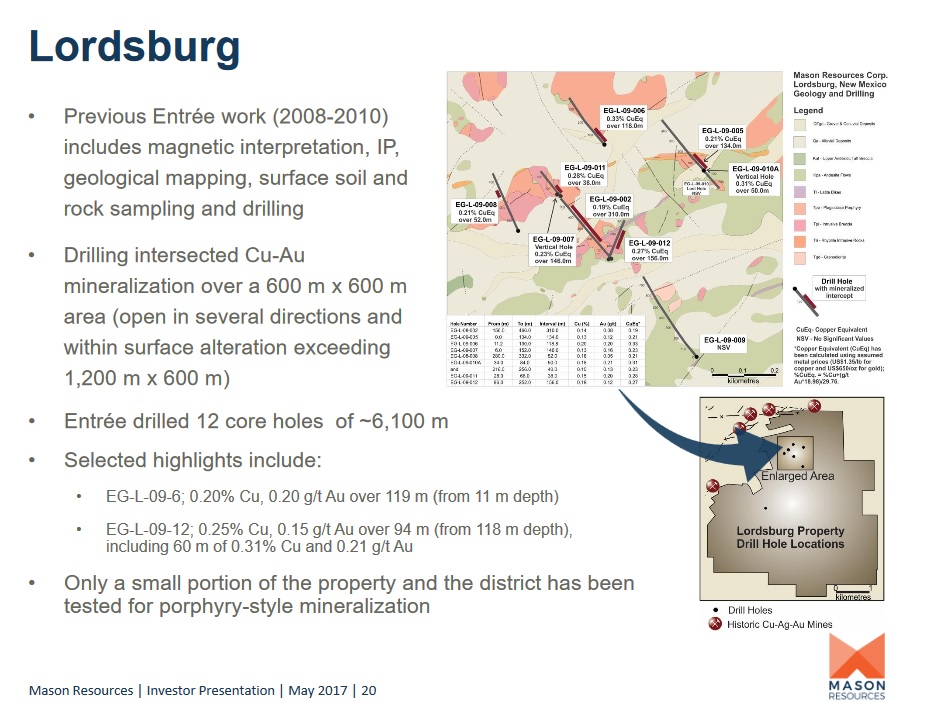

If Mason Resources didn’t already seem compelling enough it also owns 100% of an earlier stage Copper/Gold porphyry discovery in New Mexico.

Seemingly, the company gets little or no value for this project either.

*Daniel has a long position in MNR

DISCLAIMER: The information in this publication is not intended to be, nor shall constitute, an offer to sell or solicit any offer to buy any security. The information presented on this website is subject to change without notice, and neither Penny Stock Experts nor its affiliates assume any responsibility to update this information. Additionally, it is not intended to be a complete description of the securities, markets, or developments referred to in the material. Penny Stock Experts and its Author(s) cannot and do not assess, verify or guarantee the adequacy, accuracy or completeness of any information, the suitability or profitability of any particular investment, or the potential value of any investment or informational source. Additionally, Penny Stock Experts and its Author(s) in no way warrants the solvency, financial condition, or investment advisability of any of the securities mentioned. Furthermore, Penny Stock Experts and its Author(s) accept no liability whatsoever for any direct or consequential loss arising from any use of our product, website, or other content. The reader bears responsibility for his/her own investment research and decisions and should seek the advice of a qualified investment advisor and investigate and fully understand any and all risks before investing. Information and statistical data contained in this website were obtained or derived from sources believed to be reliable. However, Penny Stock Experts and its Author(s) do not represent that any such information, opinion or statistical data is accurate or complete and should not be relied upon as such. This publication may provide addresses of, or contain hyperlinks to, Internet websites, Penny Stock Experts takes no responsibility for the contents thereof. Each such address or hyperlink is provided solely for the convenience and information of this website’s users, and the content of linked third-party websites is not in any way incorporated into this website. Those who choose to access such third-party websites or follow such hyperlinks do so at their own risk. The publisher, owner, writer or their affiliates may own securities of companies mentioned in this publication.