Marrone Bio (MBII) Breaks Through! 3 Reasons It Should Keep Growing…

Jan 21

Marrone Bio Innovations (MBII, NASDAQ) Is Making Its Move!

Regarding “volume preceding price”, this MBII chart makes for another great example.

Look how the stock comes back to kiss that 90-cent support line following a gap higher on volume the month before. Just lovely, isn’t it? Now that MBII has shaken out the weak hands, a strong floor is in place and I suspect that floor will support much higher prices in 2018.

A close above $1.25 would represent a 6-month breakout for MBII.

After that there’s minor resistance at $1.50 and $2.

With the wind at its back, this is the type of stock that could fly toward $4 in a hurry.

3 Reasons Marrone Bio Should Keep Growing Higher!

- Debt was a real concern for Marrone Bio, bankruptcy wasn’t out of the realm of possibilities – but that was then. On December 18 the company concluded a comprehensive financing and debt restructuring transaction. Lenders converted $35 million worth of notes into stock at $1.75 per share. Marrone Bio’s financial position has taken a 180 degree turn over the past month.

- Marijuana! Government’s across the land are legalizing it, and given the deficits they’re running I don’t see that trend changing, only quickening. California is the most recent, and CEO Pam Marrone has helped numerous states, such as California, craft guidelines on what pesticides and fertilizers are safe for growers to be using.

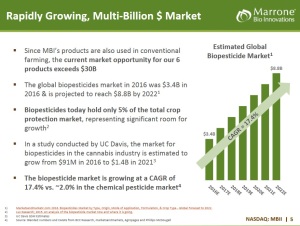

- Organic! It’s all about organic food (and organic marijuana). And you can’t label a food product “organic” unless it’s been grown without chemicals. Marrone Bio is an emerging supplier of non-chemical pesticides and fertilizers.

Here’s a powerful illustration showing why many people may prefer being in the “biopesticides” business as opposed to the agricultural chemicals business over the coming years.

Restructuring matters, converting debt into equity was a huge positive for Marrone Bio (and a huge vote of confidence by the lenders!).

MBII is heading a lot higher from here.

Want to Trade Like The Experts? Click below for more about our Subscriptions and receive the next up and coming opportunity!

*Daniel has a long position in MBII

DISCLAIMER: The information in this publication is not intended to be, nor shall constitute, an offer to sell or solicit any offer to buy any security. The information presented on this website is subject to change without notice, and neither Penny Stock Experts nor its affiliates assume any responsibility to update this information. Additionally, it is not intended to be a complete description of the securities, markets, or developments referred to in the material. Penny Stock Experts and its Author(s) cannot and do not assess, verify or guarantee the adequacy, accuracy or completeness of any information, the suitability or profitability of any particular investment, or the potential value of any investment or informational source. Additionally, Penny Stock Experts and its Author(s) in no way warrants the solvency, financial condition, or investment advisability of any of the securities mentioned. Furthermore, Penny Stock Experts and its Author(s) accept no liability whatsoever for any direct or consequential loss arising from any use of our product, website, or other content. The reader bears responsibility for his/her own investment research and decisions and should seek the advice of a qualified investment advisor and investigate and fully understand any and all risks before investing. Information and statistical data contained in this website were obtained or derived from sources believed to be reliable. However, Penny Stock Experts and its Author(s) do not represent that any such information, opinion or statistical data is accurate or complete and should not be relied upon as such. This publication may provide addresses of, or contain hyperlinks to, Internet websites, Penny Stock Experts takes no responsibility for the contents thereof. Each such address or hyperlink is provided solely for the convenience and information of this website’s users, and the content of linked third-party websites is not in any way incorporated into this website. Those who choose to access such third-party websites or follow such hyperlinks do so at their own risk. The publisher, owner, writer or their affiliates may own securities of companies mentioned in this publication.