The Price is Right for Kopin, but How About the Timing?

Mar 06

As a business, i would describe Kopin Corporation (NASDAQ: KOPN) as intriguing, with a pinch of exciting. As a stock, i would describe it as serially disappointing.

When looking at the potential– many would say WOW! Kopin’s addressable market is yuuuuge!!

Cowen & Co. estimates global sales for wearables will hit $170 billion by 2020.

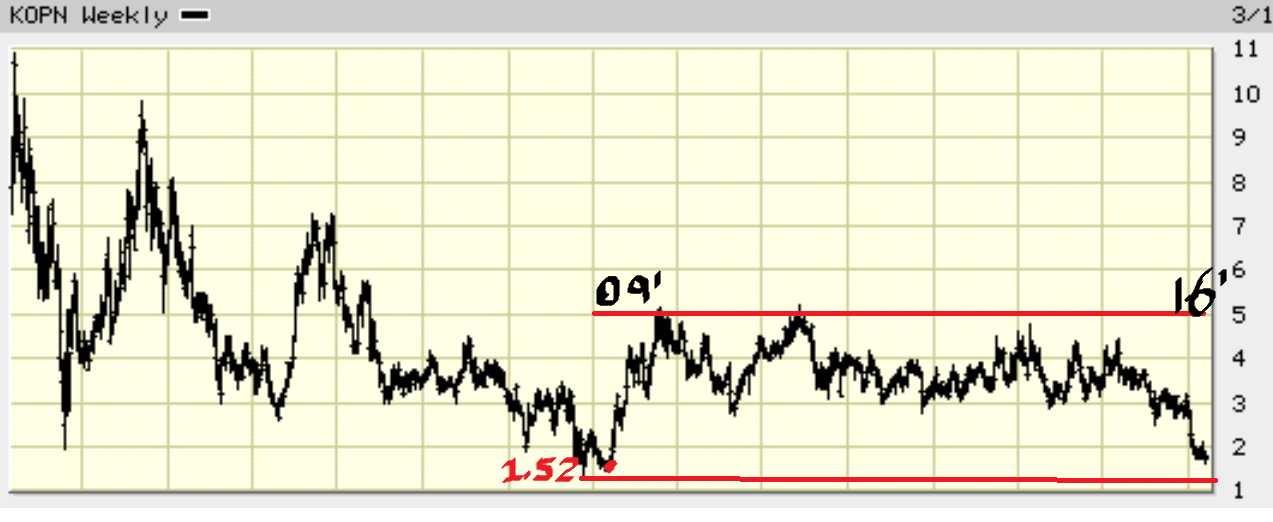

When looking at the stocks performance– many would say WOW! But for all the wrong reasons… KOPN has been an absolute dud for more than a decade!!

Any reason to believe this serially disappointing stock will bear fruit soon?

Arguably, Kopin is downright cheap. In fact, cheap enough that hard core value investors may begin to take notice (that alone could be worth 10-20% appreciation from here).

As of the close Friday March 4, 2016 Kopin is valued at $108 million– with approximately $95M cash and no debt.

Hmm… I guess one doesn’t have to “pay up” for somewhat sexy technology stocks that are pure plays on burgeoning trends after all. KOPN looks to be a bargain based off the balance sheet, and Mr.Market assigns little to no value to its +300 patents and patent pending portfolio (95% of which are geared toward wearable technologies). Plus, after backing out the cash, it sells for less than 1-times sales, 22% are from a customer called Google (up from 11% in 2014) by the way.

…so how about near-term catalysts?

Well, Kopin is fresh off a “very successful” Consumer Electric Show (CES) in January, having 15 companies displaying products with its components (last year was less than five). A Tier One company (unnamed, but “makes lots of watches” Eg. Garmin?) launched a health and fitness product utilizing Kopin components at the event. Additionally, Kopin expects to begin selling its “Solos” smart-glasses in the summer, perhaps a must have item for the cycling enthusiast, expected retail price between $400 – $500.

Solos were a featured item at an IBM analytics conference recently– discussing data collection via wearables.

I’m told Kopin isn’t going to spend much on marketing the Solos. Kopin will be happy if the product sells, but its design is geared toward showing what’s possible when combining Kopin’s battery, display and Whisper chip technology.

Three additional catalysts that may snap KOPN out of its hibernation…

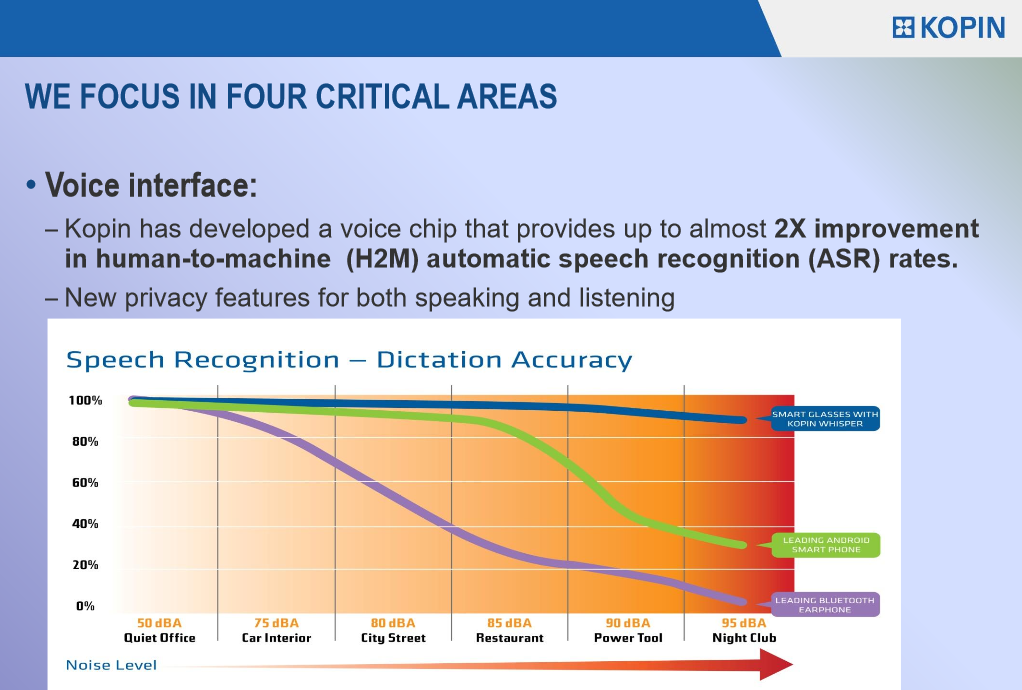

1) The Whisper Chip — a dramatic leap forward in voice control (hands free) technology

Ted Steko, the new product development manager at Verizon says: “our customers tell us it’s the only solution that is truly hands free”. Kopin’s Whisper Chip (aka. “Voice Extraction Filter Technology”) allows users to speak in a low or normal voice in loud environments. Reportedly, Whisper Chip delivers speech recognition accuracy above 97% in environments up to 85dB of ambient noise and over 92% in ambient noise over 100dB.

In other words, whether your out on a busy street, in the subway, or at a nightclub, the Whisper Chip should allow Siri or any other to recognize speech accurately. Technically, the chip (which does NOT require “design-in”) sits between a microphone and speech recognition engine for almost any device.

2) Vista VR — a new generation of micro display for the immersive Virtual Reality markets

Kopin could be onto something with its: “The World is Looking Up” marketing campaign (if you can call it such). Humans are turning into a herd of palm-people whom are staring down at phones, virtually all the time.

…somewhat sad, really.

In regards to getting the world looking upwards again, its critical the device is light-weight, portable, thin, and consumer friendly. Between Kopin and its partners (Olympus for miniature optics and Hitachi Maxell for better batteries) it addresses the needs of an entire wearable computing system.

Two examples of wearable technology products incorporating Vista VR thus far…

a) DloDlo V1, incredibly thin and lightweight (78g)

b) Fat Shark’s Dominator HD, a first person viewer for competitive drone racing

3) Military and Weapons Systems – historically Kopin’s bread and butter

Let’s not forget that Kopin has reliably provided key components of “wearables” to the U.S. military for 20 years. Kopin believes it has 90% market share in the military avionics market; from the new F-35 Lightning to helicopters, almost all pilots view important data via its displays. Kopin’s display units are also used in various thermal weapons systems, and its currently qualifying to take part in the next generation of “Family of Weapon Sights” (an order that could be booked in the 2nd half if successful).

Kopin’s core technology stems back to MIT engineers, scientists, and a $50M dollar grant from DARPA. For FY 2015, 50% of Kopin’s $32M revenue was from Raytheon and the U.S. military.

The F35 is a 10-year program that could be worth $100M over the whole term (sales are loaded heavily toward back years).

Institutional Ownership = heavy | Analyst Coverage = light

According to Whale Wisdom’s 13D filings (as of early 2016), the largest holders of Kopin’s stock are below:

AWM Investment Co. = 6,400,000

T. Rowe Price = 3,400,000

First Eagle = 5,900,000

Black Rock = 6,400,000

CEO/Founder John C.C. Fan Ph.D. = 3,500,000

*despite a smattering of institutional support, only “2” analysts officially cover KOPN stock. In other words, the story of Kopin being a pure play and IP leader in the category of “wearable technology” is not being widely distributed… yet.

Bottom Line(s): KOPN represents a solid risk/reward opportunity. Arguably, the downside risk is limited to the cash balance (approx. $95M), or 20%. The upside risk for anyone betting against KOPN is much higher, the average price between 2009 and 2015 is about $3-$4 per share (if it wanted to drift back toward a median). Additionally, Kopin’s CEO/Founder John C.C. Fan would fit the definition of “visionary”, and his vision looks to begin playing out in a much bigger way over the next 36 months.

Dr. Fan is an early advocate for wearables– his first patent for computing headset was issued in 1998! Additionally, he was selected by AsiaWeek as a Top 100 Asian American Entrepreneur.

Despite the stocks serial disappointment, its a compelling option for new money, and while taking longer than some expected, i’d bet the wearables trend will gain momentum 2016-2020.

*Author has a long position in Kopin

DISCLAIMER: The information in this publication is not intended to be, nor shall constitute, an offer to sell or solicit any offer to buy any security. The information presented on this website is subject to change without notice, and neither Penny Stock Experts nor its affiliates assume any responsibility to update this information. Additionally, it is not intended to be a complete description of the securities, markets, or developments referred to in the material. Penny Stock Experts and its Author(s) cannot and do not assess, verify or guarantee the adequacy, accuracy or completeness of any information, the suitability or profitability of any particular investment, or the potential value of any investment or informational source. Additionally, Penny Stock Experts and its Author(s) in no way warrants the solvency, financial condition, or investment advisability of any of the securities mentioned. Furthermore, Penny Stock Experts and its Author(s) accept no liability whatsoever for any direct or consequential loss arising from any use of our product, website, or other content. The reader bears responsibility for his/her own investment research and decisions and should seek the advice of a qualified investment advisor and investigate and fully understand any and all risks before investing. Information and statistical data contained in this website were obtained or derived from sources believed to be reliable. However, Penny Stock Experts and its Author(s) do not represent that any such information, opinion or statistical data is accurate or complete and should not be relied upon as such. This publication may provide addresses of, or contain hyperlinks to, Internet websites, Penny Stock Experts takes no responsibility for the contents thereof. Each such address or hyperlink is provided solely for the convenience and information of this website’s users, and the content of linked third-party websites is not in any way incorporated into this website. Those who choose to access such third-party websites or follow such hyperlinks do so at their own risk. The publisher, owner, writer or their affiliates may own securities of companies mentioned in this publication.