On Tuesday August 2nd, Kopin (KOPN, NASDAQ) released its Q2 operating results and a business update. The stock dropped 15% on the news. Revenues were disappointing, to say the least – just $4.4 million vs. $10.9 million in the prior year.

I’m betting Q2 or Q3 (coming next) will prove to be Kopin’s worst quarters for the next decade.

Why so confident?…

Declining sales are almost always a bad thing, unless the company has a good excuse. For instance, one of my earlier investments in life was a company called Advanced Battery. I won’t go into all the details, but it traded down significantly because of a few bad sales numbers.

However, after digging into the story a bit, it became clear Advanced Battery’s sales weren’t down because no one wanted its batteries. Sales were down temporarily because it was relocating to a larger manufacturing facility, gearing up for an increase in demand. By reading the 10K filings I also determined Advanced Battery was on a hiring spree.

The speculation worked out well.

While the vast majority of analysts would never stick their neck out for a company like Kopin, I will. In my view KOPN is a steal in the low $2′s. It has roughly $1.55 per share worth of cash, and no long-term debt. Today Mr. Market thinks KOPN is a value stock, merely milking what’s left of its outdated technology products. When in fact, KOPN will become a growth story by year’s end with momentum building into 2017.

Bottom line, not unlike my

Advanced Battery example,

Kopin’s sales are declining for a good reason – it sold legacy business units to focus on “wearable technology”, arguably the next big thing. Thus, sales have declined.

Where will the growth come from?…

Kopin developed Solos in coordination with the U.S. Olympic cycling team. Within 24 hours Solos reached its funding goal on KickStarter. This validated the concept and Kopin got valuable consumer feedback. Kopin’s innovative and patented Pupil™ Optics have the unique performance feature of a sunlight readable, transparent image in a tiny and energy efficient form factor, which is perfect for Mobile Augmented Reality (AR) headsets.

Serious cyclists from across the world will buy Solos for $400-$500 MSRP this October. I estimate the “serious cyclist” market to be approximately 5 million people worldwide. Assuming 2% of them buy a pair of Solos, this would result in roughly $50 million sales for Kopin (almost no one is expecting that). Many people on KickStarter also asked if Solos could be useful for “runners” (the answer was yes). While its target niche is cyclists, serious runners would expand the market size for Solos dramatically.

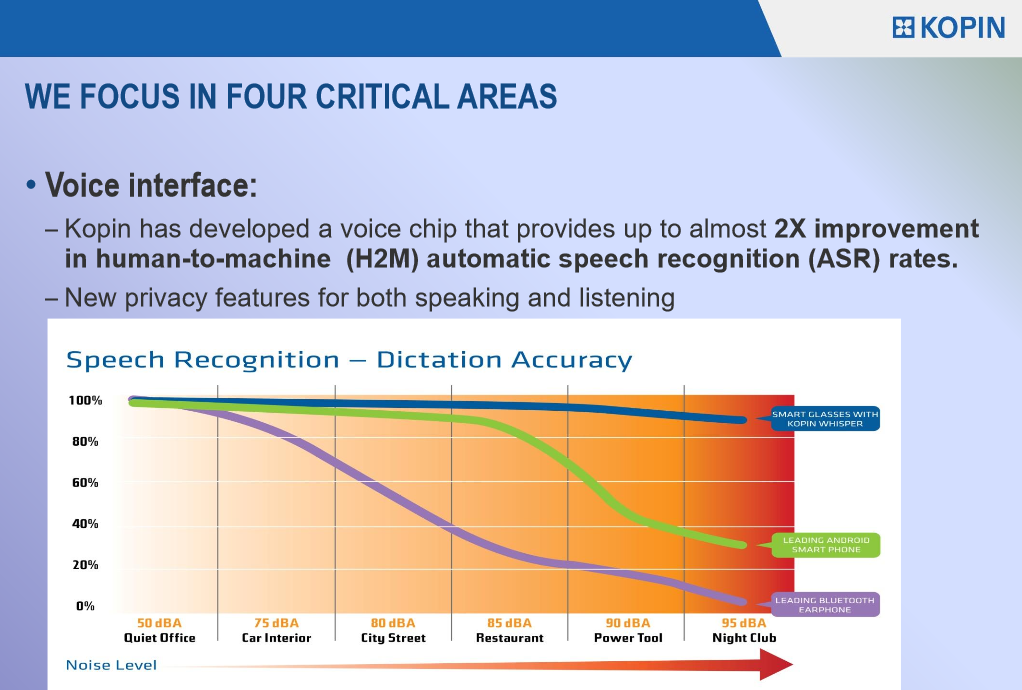

Kopin’s Whisper™ Technology is based on Artificial Intelligence. It identifies and differentiates voice and noise in the acoustic environment using neural network processing. It is not a traditional noise cancellation approach. For years, Kopin has stressed “voice will be the next touch” (and it will be upon achieving 99% accuracy).

The technology has been used in industrial and military headsets for several years, and now Kopin has incorporated the Whisper Technology into a Whisper Chip for commercialization in consumer applications.

The market size for Whisper Chip is immense, we’re talking tens of millions of units (think smartphones, watches, sunglasses). Depending on the volume purchased, Kopin could be generating $5 to $10 per chip.

Is Kopin’s growth potential not obvious?…

Kopin is a player in every aspect of wearable/hands-free technology – micro displays, micro batteries, and voice control. Over 300 patents have been issued to date, most of which are related to wearable technology.

Today an investor is paying just $30 million (after backing out the cash) for Kopin’s growth potential and deep intellectual property portfolio.

That’s a great price to pay, if you ask me.

*Daniel has a long position in KOPN

DISCLAIMER: The information in this publication is not intended to be, nor shall constitute, an offer to sell or solicit any offer to buy any security. The information presented on this website is subject to change without notice, and neither Penny Stock Experts nor its affiliates assume any responsibility to update this information. Additionally, it is not intended to be a complete description of the securities, markets, or developments referred to in the material. Penny Stock Experts and its Author(s) cannot and do not assess, verify or guarantee the adequacy, accuracy or completeness of any information, the suitability or profitability of any particular investment, or the potential value of any investment or informational source. Additionally, Penny Stock Experts and its Author(s) in no way warrants the solvency, financial condition, or investment advisability of any of the securities mentioned. Furthermore, Penny Stock Experts and its Author(s) accept no liability whatsoever for any direct or consequential loss arising from any use of our product, website, or other content. The reader bears responsibility for his/her own investment research and decisions and should seek the advice of a qualified investment advisor and investigate and fully understand any and all risks before investing. Information and statistical data contained in this website were obtained or derived from sources believed to be reliable. However, Penny Stock Experts and its Author(s) do not represent that any such information, opinion or statistical data is accurate or complete and should not be relied upon as such. This publication may provide addresses of, or contain hyperlinks to, Internet websites, Penny Stock Experts takes no responsibility for the contents thereof. Each such address or hyperlink is provided solely for the convenience and information of this website’s users, and the content of linked third-party websites is not in any way incorporated into this website. Those who choose to access such third-party websites or follow such hyperlinks do so at their own risk. The publisher, owner, writer or their affiliates may own securities of companies mentioned in this publication.