Here’s How You Control Oil For Just 39-Cents Per Barrel

Dec 05

Thank you, Mr. Market…

For offering us one more opportunity to buy Africa Oil (AOI, TSX) at or near long-term support levels. We are thankful for this gift (filling the gap at $1.80), and will not let it go to waste.

Admittedly, I haven’t been to the optometrist lately, but AOI appears to be stair-stepping higher. This consolidation pattern is laying the groundwork for a powerful move to the upside – the only question is when.

Putting the prior 12 months of trading into perspective, by backing out to a long-term chart (all data), we can see a clear picture of where AOI stands (or sits?). The stock appears to have an upward bias.

When it runs, AOI likes to stretch its legs by 700% or more. I don’t see why another move of this magnitude is out of the question.

What’s the downside? The last stair-step up was during the month of August. That move, beginning with a gap, lifted AOI by roughly 33% (from $1.75).

Yesterday, AOI traded about 6 x its daily volume. Scotiabank, Dundee, and TD Securities have price targets for Africa Oil between $3 and $3.50.

Risk/reward is very attractive for a trade because we have relatively well-defined support zones. While possible, it’s hard to imagine AOI dropping back below $1.75 – implying a downside of 8.3% from yesterday’s $1.91 close.

Optionality struck twice! Will it strike again?…

I’m not sure about you, but after seeing Ivanhoe Mines (IVN, TSX) and Alderon Iron Ore (ADV, TSX) double and triple in price this year, I’m convinced “optionality” is a profitable strategy. Pending strategic selection(s).

Africa Oil offers exceptional leverage to Oil prices and exposure to one of the world’s best onshore discoveries (approximately the size of the North Sea!), which is nice. But the great thing is that the price is right and AOI has two near-term catalysts. Allow me to explain…

- The pipeline joint development agreement is expected to be signed before year-end.

- Africa Oil, along with partners Maersk and Tullow, are drilling 4 exploratory wells now. There’s potential to drill 4 in addition to those.

39 cents per barrel?…

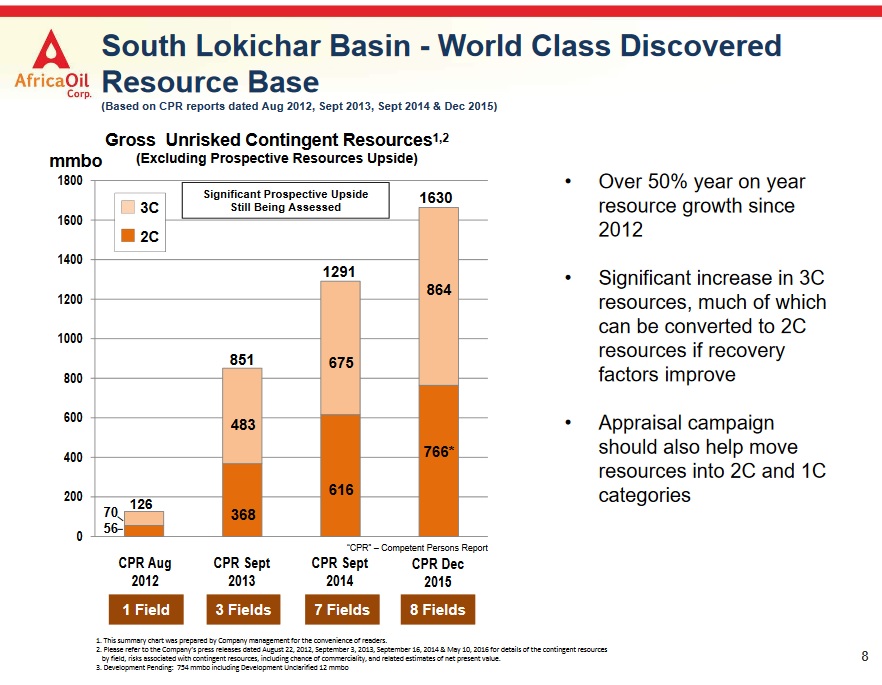

Looking at slide 8 from Africa Oil’s presentation, we see 3C Oil resources have increased dramatically over the past 4 years and are estimated to be 1.63 billion barrels gross.

Africa Oil has a 25% stake in the South Lokichar Basin, therefore 407 million barrels are net to it.

After subtracting Africa Oil’s cash position, $490 million (U.S.) from its market cap $650 million (U.S.), sophisticated speculators are paying $160 million for 407 million barrels of 3C resources or 39 cents per barrel.

Is 39 cents per barrel a fair price?

Considering the Oil industry’s “discovery costs” are between $2 and $4 per barrel, I would argue 39 cents is a steal for an investor.

Lastly, you should know Africa Oil and partners have approved an EOPS (early Oil pilot scheme) that will initially send 2,000 bpd via road by mid-2017. The company foresees reaching commercial Oil production without needing to dilute the stock. And depending on the timing of production and resource growth, Maersk may be required to pay up to $480 million in development costs on Africa Oil’s behalf.

*Author has a long position in Africa Oil

DISCLAIMER: The information in this publication is not intended to be, nor shall constitute, an offer to sell or solicit any offer to buy any security. The information presented on this website is subject to change without notice, and neither Penny Stock Experts nor its affiliates assume any responsibility to update this information. Additionally, it is not intended to be a complete description of the securities, markets, or developments referred to in the material. Penny Stock Experts and its Author(s) cannot and do not assess, verify or guarantee the adequacy, accuracy or completeness of any information, the suitability or profitability of any particular investment, or the potential value of any investment or informational source. Additionally, Penny Stock Experts and its Author(s) in no way warrants the solvency, financial condition, or investment advisability of any of the securities mentioned. Furthermore, Penny Stock Experts and its Author(s) accept no liability whatsoever for any direct or consequential loss arising from any use of our product, website, or other content. The reader bears responsibility for his/her own investment research and decisions and should seek the advice of a qualified investment advisor and investigate and fully understand any and all risks before investing. Information and statistical data contained in this website were obtained or derived from sources believed to be reliable. However, Penny Stock Experts and its Author(s) do not represent that any such information, opinion or statistical data is accurate or complete and should not be relied upon as such. This publication may provide addresses of, or contain hyperlinks to, Internet websites, Penny Stock Experts takes no responsibility for the contents thereof. Each such address or hyperlink is provided solely for the convenience and information of this website’s users, and the content of linked third-party websites is not in any way incorporated into this website. Those who choose to access such third-party websites or follow such hyperlinks do so at their own risk. The publisher, owner, writer or their affiliates may own securities of companies mentioned in this publication.