HDSN: A Nearly-Monopoly on R-22 Freon

Apr 07

Hudson Technologies (HDSN, NASDAQ):

Refrigerants, Recycling, And Energy Efficiency

Refrigerants keep things cool – like houses, commercial buildings, semi-tractor-trailer trucks, and food sitting on shelves at supermarkets. Without refrigerants, air conditioning wouldn’t be a thing. We could live without air conditioning, but many people choose not to because summertime would be hotter indoors. We could live without refrigeration but it wouldn’t be convenient, and lots and lots of food would spoil.

So you’d agree, then, modern societies need chemical refrigerants.

R-22 (aka. freon) is one of the most widely known and consumed refrigerants.

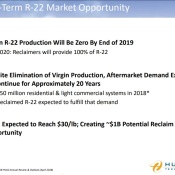

You probably knew that, but did you know 2020 is the first year no new R-22 is being produced (zero-zip-nothing-nada). Thanks to strict environmental regulations, R-22, which isn’t considered to be “eco-friendly”, has been banned. Following a multi-year phase out plan, 2020 is the first full year with no new supply. Virgin production has been completely eliminated.

Therein lies a problem for the tens of millions of homeowners and businesses who possess equipment that relies on R-22 for cooling.

With no new supply where will they get R-22?

Hudson most likely. They’ve captured about 35% market share of the refrigerant reclamation industry. The only “new supply” of R-22 going forward will come from recycling and as one of America’s largest, Hudson has a near-monopoly and $1 billion opportunity in front of them (pretty substantial for a company with a $37 million market cap, don’t you think!).

Yeah, so I’ve been nibbling on some HDSN lately and I think it’s a fantastic speculation while it lasts below $1 per share.

Coming into 2020 the price per pound of R-22 (freon) was $10. Assuming tried and true supply/demand fundamentals still hold, R-22 prices have nowhere to go but up. Demand remains similar, while declining at some rate until year 2030 or 2040, but there’s no new supply coming onto the market (other than reclaimed R-22). Not unlike any other commodity producer, Hudson’s fixed costs stay about the same and they make more money when commodity prices rise.

You know how Oil producers make more money at $100 per barrel than $30? Well, Hudson will make a heck of a lot more money when R-22 is $20 or $30 per pound instead of $10.

Long-term supply/demand factors point to rising R-22 prices that will have a directly positive impact on Hudson’s revenues and profitability.

Quick look and you see, holy cow, HDSN was a $10 stock in the midst of a multi-year bullish trend and than it all fell apart – what happened?

Long story short, what happened was (to use a phrase from my urban dictionary) Hudson made a big acquisition in late 2017. They took on $185 million worth of borrowings to get the deal done, which seemed to make sense at the time.

Here was CEO Kevin J. Zugibe’s rationale back then for making the acquisition: “We’re very pleased to have closed this transformative acquisition which represents a milestone in our company’s history. The addition of ARI significantly strengthens our leadership position in the refrigerant and reclamation industry by enhancing our product offerings, increasing our geographic reach and customer base and enhancing our sales and distribution capabilities. This strategic combination considerably increases the scale of our company which will allow us to better serve our customers during the ongoing phase out of HCFC refrigerants and as the industry continues its transition to next generation HFC refrigerants, which have also been identified for future phase down. We welcome ARI’s experienced management team and employees and look forward to working together to serve our existing and new customers with our expanded product and service capabilities.”

Mr. Market didn’t see all those benefits, though, and was obviously scared off by this new stress to the balance sheet. Aside from that, supply/demand factors haven’t really kicked in yet, which should almost surely cause R-22 prices to rise.

After monitoring Hudson’s progress over the years, and the chart, this feels like the right time to be a buyer. I’m not sweating the debt after hearing Zugibe say they’ve already paid down $68 million from operating cash flow, or nearly 40% of the debt originally taken on.

When R-22 prices start rising from $10 toward $20 per pound, Hudson will be able to pay down the remaining debt even faster.