Globex Mining: 40 Former Mines Under One Roof + Cashflow

Feb 07

Money In The Bank!

Plus 40 former mines under one roof!

At this rate, $170,109 per month, Globex Mining’s (GMX, TSX) Zinc royalty on Nyrstar’s Tennessee mine is going to bring in just over $2 million this year.

And that was based on $1.45 Zinc. Now it’s selling for more than $1.60. Given the supply/demand picture, many think Zinc is headed even higher.

So while we know Trader Jack Stoch (Globex Mining’s CEO) isn’t the type to wave his arms around and get Mr. Market’s attention, although he should, GMX remains a savvy speculator’s speculation. With a market cap of $24 million the company is priced at less than 12 x cash flow, based on the one royalty (and Trader Jack’s always working a new deal or angle to bring in cash).

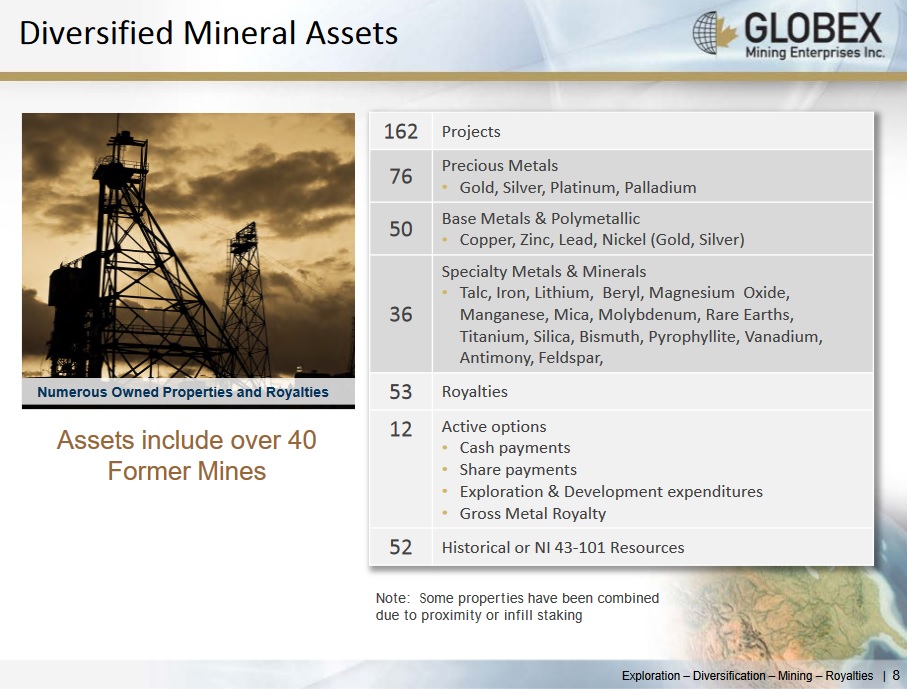

He’s assembled an incredible number of properties and assets under one roof via Globex Mining.

Call me crazy, but at its current $24 million valuation, given a royalty that could bring in $2 million annually and that suite of assets, Globex Mining is the type of stock one could buy for their grandmother (and/or grandfather for that matter). At this price and assuming a natural resource bull market, it’s that safe of a bet.

Want to Trade Like The Experts? Click below for more about our Subscriptions and receive the next up and coming opportunity!

*Daniel has a long position in Globex Mining

DISCLAIMER: The information in this publication is not intended to be, nor shall constitute, an offer to sell or solicit any offer to buy any security. The information presented on this website is subject to change without notice, and neither Penny Stock Experts nor its affiliates assume any responsibility to update this information. Additionally, it is not intended to be a complete description of the securities, markets, or developments referred to in the material. Penny Stock Experts and its Author(s) cannot and do not assess, verify or guarantee the adequacy, accuracy or completeness of any information, the suitability or profitability of any particular investment, or the potential value of any investment or informational source. Additionally, Penny Stock Experts and its Author(s) in no way warrants the solvency, financial condition, or investment advisability of any of the securities mentioned. Furthermore, Penny Stock Experts and its Author(s) accept no liability whatsoever for any direct or consequential loss arising from any use of our product, website, or other content. The reader bears responsibility for his/her own investment research and decisions and should seek the advice of a qualified investment advisor and investigate and fully understand any and all risks before investing. Information and statistical data contained in this website were obtained or derived from sources believed to be reliable. However, Penny Stock Experts and its Author(s) do not represent that any such information, opinion or statistical data is accurate or complete and should not be relied upon as such. This publication may provide addresses of, or contain hyperlinks to, Internet websites, Penny Stock Experts takes no responsibility for the contents thereof. Each such address or hyperlink is provided solely for the convenience and information of this website’s users, and the content of linked third-party websites is not in any way incorporated into this website. Those who choose to access such third-party websites or follow such hyperlinks do so at their own risk. The publisher, owner, writer or their affiliates may own securities of companies mentioned in this publication.