enCore Energy: the ultimate optionality play on uranium?

Aug 06

William M. Sheriff and team captured 100% ownership of +100,000 acres within the Grants Uranium District with no holding costs. Located in New Mexico, Grants Uranium District is 1 of the top 5 largest historic producers globally. It accounts for nearly 40% of all Uranium mined in the United States. An estimated 400 million pounds of U3O8 mineralization remains in the ground.

Considering the U.S. is the world’s largest producer of nuclear power, yet imports 90% of its Uranium, Grants Uranium District is obviously a strategic location – enCore Energy (EU, TSX-V) says it controls over 30 million pounds of Uranium mineralization there.

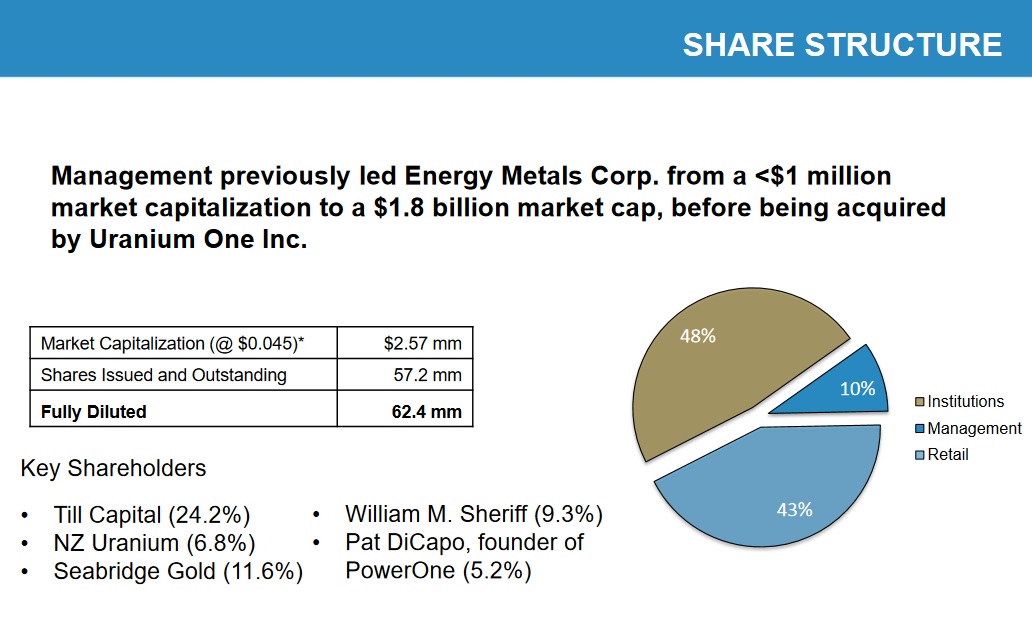

enCore’s management team has skin in the game, and they’re committed to delivering shareholder value. Their last Uranium deal went from <$1 million market cap to $1.8 billion.

Holy moly! Wouldn’t it be net worth changing if EU did an encore to that performance!

Then again, can anyone expect to do such a thing more than once in a lifetime?

Ok. I’m really going back and forth on this, Sheriff is also Chairman at Golden Predator Mining (GPY, TSX-V), another stock that’s been killing it lately (up 900% ytd). Friends! Sheriff is another guy we must talk to (the list keeps getting longer) – if anyone can pull something like Energy Metals off again he may be the guy.

Dear Mr. Sheriff,

Today enCore has a market cap just under $4 million. I think I speak on behalf of everyone at BMR when I say – we would be thrilled if you can grow enCore to $120 million over the next, let’s call it 2 to 4 years (with minimal dilution of course). Do you feel such a goal is attainable, and in a best case scenario how much do you think EU can be worth?

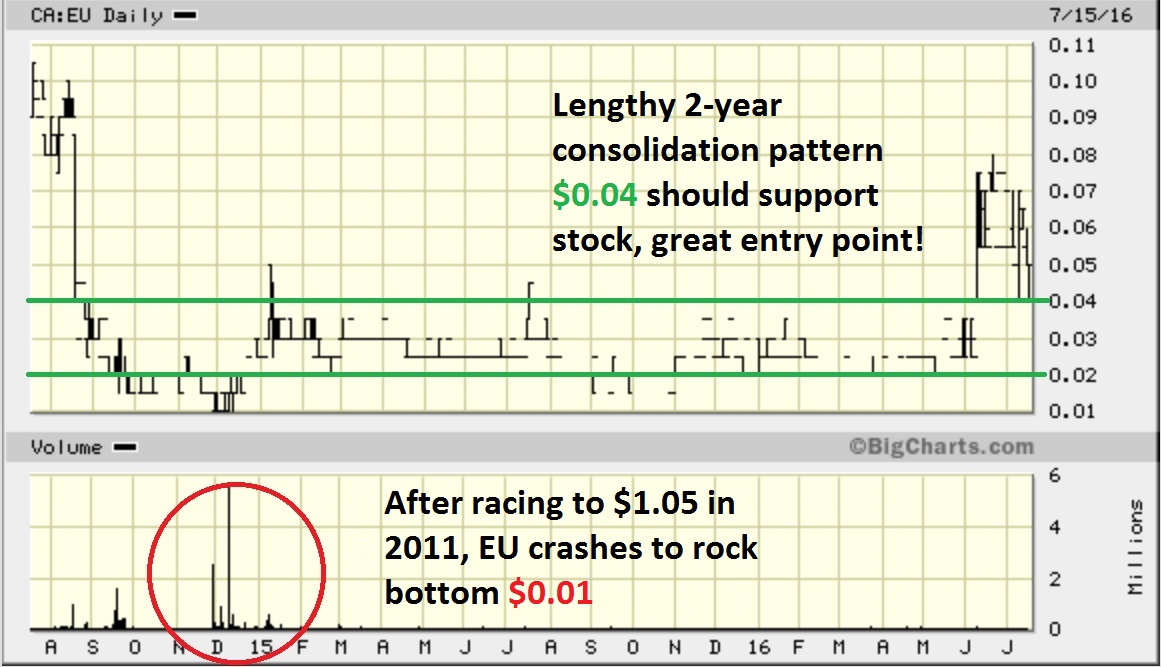

Looking at the chart below, clearly EU has been leaning toward a worst case scenario since 2011 when it hit $1.05 per share.

As a value investor at heart, and an aspiring technical analyst – I’m intrigued.

On the surface, enCore seems a textbook example of “optionality”. We’ve been talking about optionality quite a bit lately because we know it can be a successful strategy coming out of bear markets (here’s 4 more Major League Optionality Plays).

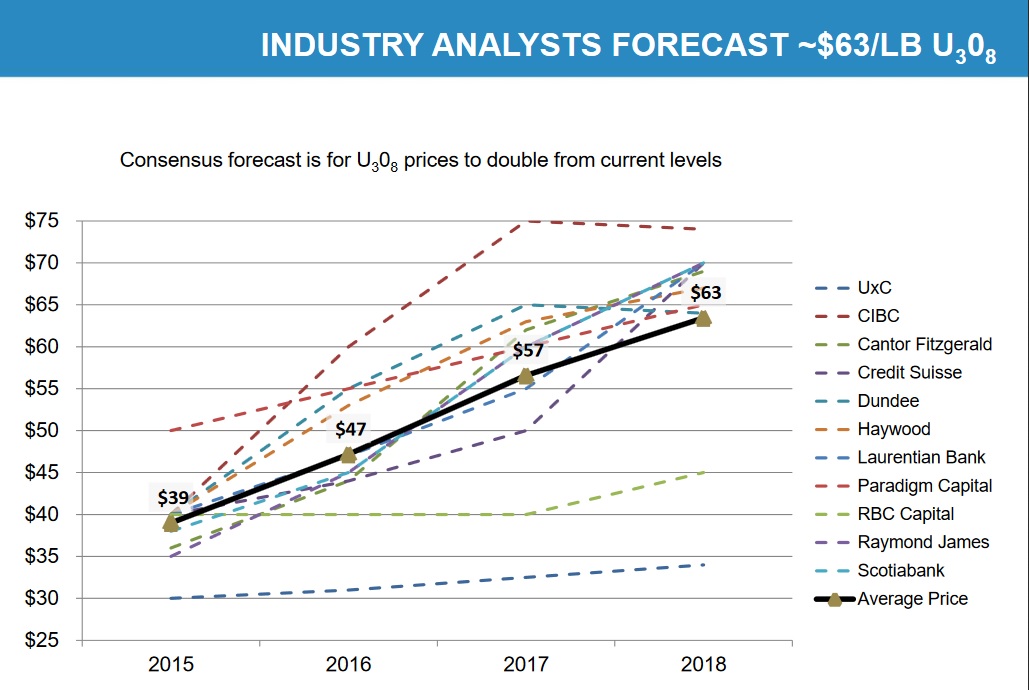

Uranium is in a bear market despite strong demand, trading near a 10-year low. Although nearly every brokerage house on the street is predicting higher prices.

How much longer can everyone be wrong?

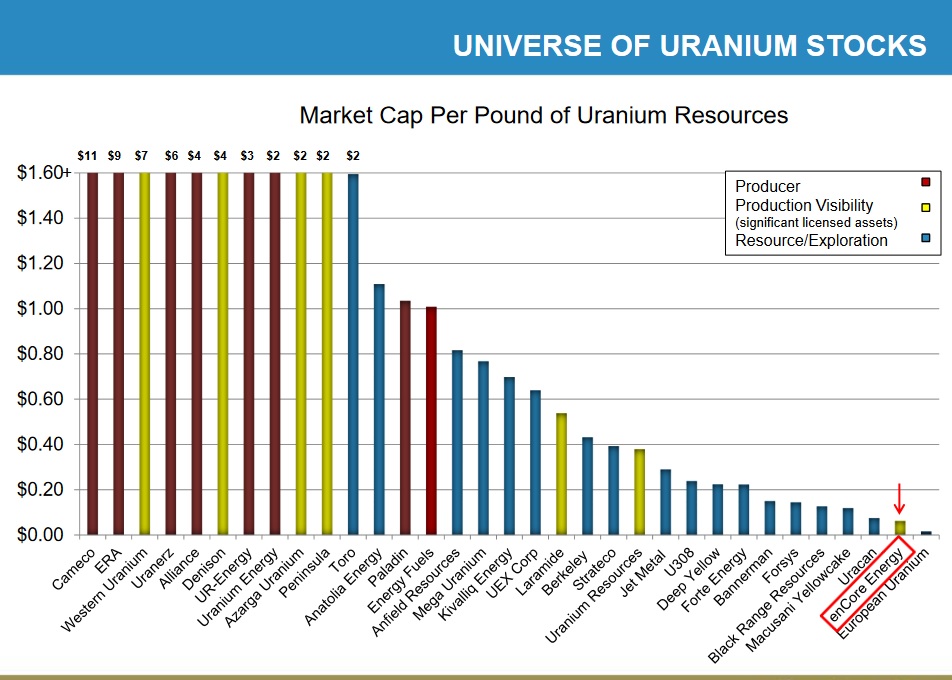

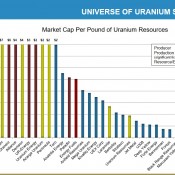

When U3O8 prices turn, and according to the laws of supply and demand they must, EU could be a grand slam. Presently, enCore’s in-ground resource base stands near 30 million pounds of Uranium (give or take a few thousand pounds). Speculators in EU are paying just over 10-cents per pound.

Cheap, relative to its peers.

7 more things you must know about enCore and Uranium…

1. enCore has a toll milling agreement in place with Energy Fuels (UUUU, NYSE). By securing the right to mill ore at the White Mesa Mill, the company has eliminated the need for capital expenditure financing and the onerous cost in dollars and time required to permit a new facility for conventional ore processing in the United States.

2. Energy Fuels owns 19.9% equity in EU;

3. Asia and Africa represent 70% of global Uranium supply. After nearly 30 years with no new reactors under construction the U.S. is expanding its nuclear energy capacity to meet growing energy demand;

4. Small Modular Reactors (SMR) are designed to be about a third of the size of a traditional reactor and will significantly reduce capital costs while enabling nuclear power to be more widespread;

5. enCore’s Crownpoint and Hosta Butte assets are both ISR-amenable deposits. Of the 6 active ISR plants in the U.S., the average Uranium equivalent grade is 0.118%, about the same as Crownpoint and Hosta Butte;

6. EU has been very quiet lately, only 5 news releases since January 2015 (3 related to hiring personnel);

7. Oh yeah! We prefer our optionality plays to spend little to no money until the commodity turns higher. enCore slashed its professional fees and staff costs (mainly the CEO) in Q1 to $34,002 from $78,000. It has roughly $270,000 cash (as of March 31) and $0 long-term liabilities.

EU shares outstanding = 71,492,750.

Market cap = $4 million.

Insiders and strategic investor ownership = +50%

*Daniel has a long position in enCore Energy

DISCLAIMER: The information in this publication is not intended to be, nor shall constitute, an offer to sell or solicit any offer to buy any security. The information presented on this website is subject to change without notice, and neither Penny Stock Experts nor its affiliates assume any responsibility to update this information. Additionally, it is not intended to be a complete description of the securities, markets, or developments referred to in the material. Penny Stock Experts and its Author(s) cannot and do not assess, verify or guarantee the adequacy, accuracy or completeness of any information, the suitability or profitability of any particular investment, or the potential value of any investment or informational source. Additionally, Penny Stock Experts and its Author(s) in no way warrants the solvency, financial condition, or investment advisability of any of the securities mentioned. Furthermore, Penny Stock Experts and its Author(s) accept no liability whatsoever for any direct or consequential loss arising from any use of our product, website, or other content. The reader bears responsibility for his/her own investment research and decisions and should seek the advice of a qualified investment advisor and investigate and fully understand any and all risks before investing. Information and statistical data contained in this website were obtained or derived from sources believed to be reliable. However, Penny Stock Experts and its Author(s) do not represent that any such information, opinion or statistical data is accurate or complete and should not be relied upon as such. This publication may provide addresses of, or contain hyperlinks to, Internet websites, Penny Stock Experts takes no responsibility for the contents thereof. Each such address or hyperlink is provided solely for the convenience and information of this website’s users, and the content of linked third-party websites is not in any way incorporated into this website. Those who choose to access such third-party websites or follow such hyperlinks do so at their own risk. The publisher, owner, writer or their affiliates may own securities of companies mentioned in this publication.