Did TAG Oil’s New Engineering Team and Henrik Lundin Crack Kapuni’s Code Already?

Jan 05

What?…

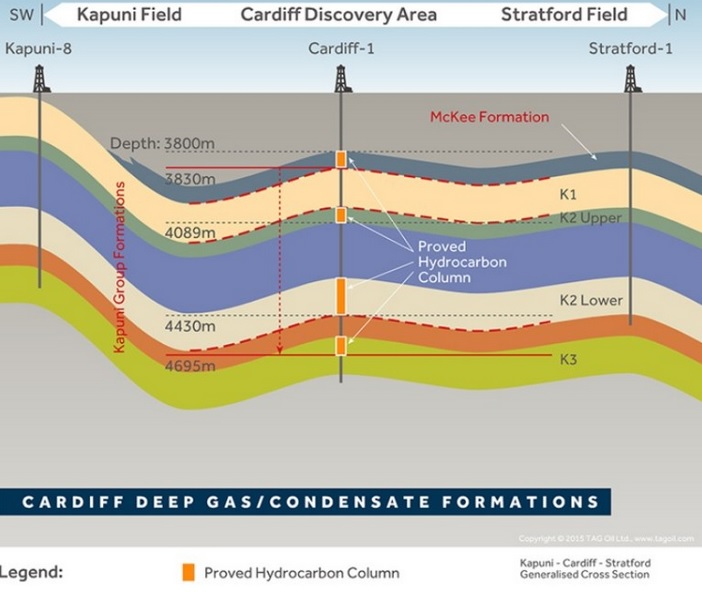

Back in 2014, a more prosperous time for petroleum companies, TAG Oil (TAO, TSX) invested more than $10 million drilling 3 deep wells targeting the Eocene-aged Kapuni formation which lies below its producing Cheal field in New Zealand. One of those wells, Cardiff-3, reached a total depth of 4,863 meters, intersecting all 3 zones (the upper McKee, the K1A, then the deepest and thickest K3E Sand) as planned.

Condensate-rich gas shows were recorded in all 3 target zones within the Kapuni formation, encountering an impressive 230 m of potential net pay in total. As a result, TAG cased the well to total depth and pursued a completion and testing program.

The deepest of 3 zones identified for further completion, the K3E zone, was perforated and hydraulically fractured. The following parameters were independently interpreted from that fracture stimulation:

- The reservoir pressure is 10,400 psi;

- The reservoir contains hydrocarbon gas with low (7%) CO2;

- The reservoir pressure and induced perforation pressure was suitable to give a 3,000 psi drawdown;

- The K3E zone produced gas, Oil and condensate with no formation water, but not at the commercial rates expected, given the above parameters.

Ultimately, independent experts and further analysis determined either the fracture stimulation was affected by a poor cement bond over the interval, or skin damage must exist in the near wellbore area, which restricted flow.

So what?…

Mechanical problems delayed a potentially huge success story.

TAG’s Kapuni formation isn’t far from the Kapuni field, New Zealand’s first major gas discovery. A consortium led by Shell and BP have produced an astounding 1.4 Tcf of gas and 65 mmb of condensate from the Kapuni field since 1969 and it’s still producing today!

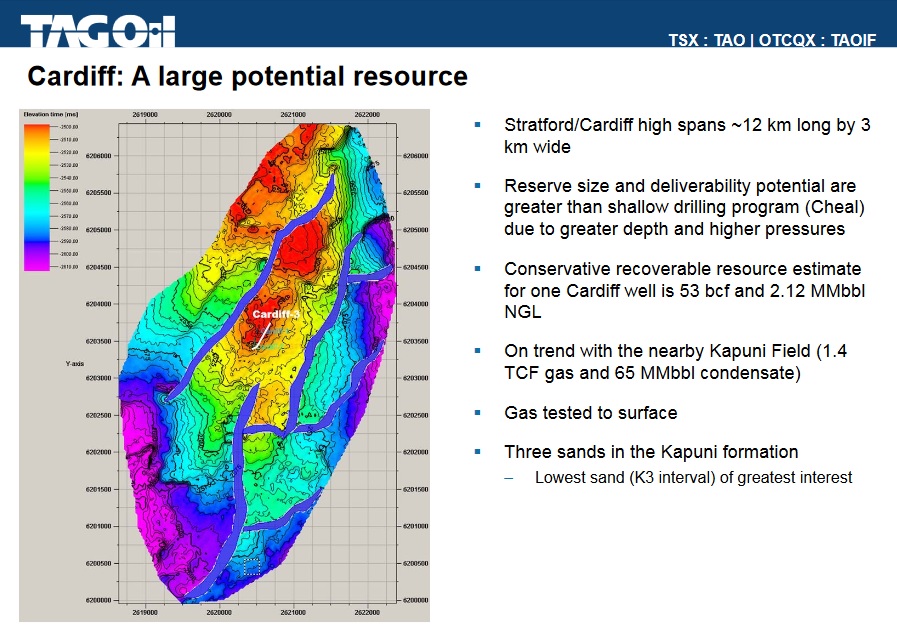

Given TAG’s near-production experience with Caridff-3 and the Kapuni formation’s proximity to Shell’s Kapuni field (as per the image above), we know there’s significant upside potential. In fact, we have numbers to support this potential. Sproule International Limited prepared an independent assessment on July 31, 2013, that estimates the undiscovered resource potential on TAG’s Cardiff prospect is 160 billion cubic feet gas and 5.59 million barrels of natural gas liquids on a P50 basis (P50 means 50% certainty of being produced).

A more conservative, yet still meaningful estimate for a company TAG’s size is provided below:

Now what?…

Over the past year TAG has reigned in spending and shifted its focus toward maximizing production from its existing assets. Additionally, TAG’s Founder and Chairman Alex Guidi (a significant shareholder) brought in new talent, including CEO Toby Pierce and COO Henrik Lundin. These new sets of eyes, an important pair being Lundin’s, a smart young petroleum engineer who must have gained invaluable experience in his previous positions working for Lundin Petroleum AB, may have cracked the code at Cardiff-3 (potentially unlocking 160 billion cubic feet gas and 5.59 million barrels of natural gas liquids; P50).

On December 6, just over two weeks ago, to little fanfare, TAG announced a successful interim flow test with gas and condensate produced to surface after years of struggle at Cardiff-3.

CEO Pierce commented, “I am very pleased to announce TAG’s successful initial well test results at the Cardiff-3 well. Demonstrating the possibility for economic production at Cardiff is the first step in unlocking the significant resources present in this deeper formation on our 100% Cheal owned acreage. The resources identified at Cardiff have the potential to become the major source of production for TAG Oil following development. Further, the positive results of the Supplejack-1 flow test and analysis represent a new producing location for TAG, with additional drilling opportunities identified. The TAG Oil team is continuing to build off our recent momentum at Cardiff and Supplejack and we will update the market with further information on these two assets in due course.”

You can watch a short video here.

Based on the preliminary test results, further testing is being undertaken in order to support commercialization of Cardiff production via tie back to the TAG’s nearby Cheal A facility. Mr. Market should catch wind of just how “commercial” Cardiff-3 is or isn’t within weeks or months.

An important one-liner that deserves to be re-emphasized within Pierce’s quote above is: “The resources identified at Cardiff have the potential to become the major source of production for TAG Oil following development.” Given the 3 “unsuccessful” wells drilled and TAG’s infrastructure in place, the development costs of bringing on new production will be very low (and any new low cost production helps). Buyers of TAO around 80 cents could hit the jackpot upon TAG achieving commercial success at Cardiff-3, but if they don’t expectations are so low I don’t envision any room for disappointment – which seems a good risk/reward situation to me.

In conclusion, relative metrics for TAG Oil…

Market Cap = $48.1M

Working Capital = $19M/Cash on Hand = $13.6M as of Sept 2016 (no debt)

Proven + Probable Reserves = 5.2 million barrels (implying a valuation of $9.25 per barrel, or $6.63 after deducting cash)

Average Production = 1,176 boe/d (implying a cost per flowing barrel of $40,901, or $29,337 after deducting cash)

At today’s valuation, TAG Oil is priced in line or superior to M&A deals that have concluded over the past month. TransGlobe Energy (TGL, TSX) paid $25,806 per flowing barrel and $3.76 per barrel of reserves to acquire assets in Alberta. And Steelhead Petroleum paid $58,823 per flowing barrel and $8.50 per barrel of reserves to acquire Toro Oil & Gas’ (TOO, TSX-V) assets straddling the Alberta-Saskatchewan border.

*Author has a long position in TAG Oil

DISCLAIMER: The information in this publication is not intended to be, nor shall constitute, an offer to sell or solicit any offer to buy any security. The information presented on this website is subject to change without notice, and neither Penny Stock Experts nor its affiliates assume any responsibility to update this information. Additionally, it is not intended to be a complete description of the securities, markets, or developments referred to in the material. Penny Stock Experts and its Author(s) cannot and do not assess, verify or guarantee the adequacy, accuracy or completeness of any information, the suitability or profitability of any particular investment, or the potential value of any investment or informational source. Additionally, Penny Stock Experts and its Author(s) in no way warrants the solvency, financial condition, or investment advisability of any of the securities mentioned. Furthermore, Penny Stock Experts and its Author(s) accept no liability whatsoever for any direct or consequential loss arising from any use of our product, website, or other content. The reader bears responsibility for his/her own investment research and decisions and should seek the advice of a qualified investment advisor and investigate and fully understand any and all risks before investing. Information and statistical data contained in this website were obtained or derived from sources believed to be reliable. However, Penny Stock Experts and its Author(s) do not represent that any such information, opinion or statistical data is accurate or complete and should not be relied upon as such. This publication may provide addresses of, or contain hyperlinks to, Internet websites, Penny Stock Experts takes no responsibility for the contents thereof. Each such address or hyperlink is provided solely for the convenience and information of this website’s users, and the content of linked third-party websites is not in any way incorporated into this website. Those who choose to access such third-party websites or follow such hyperlinks do so at their own risk. The publisher, owner, writer or their affiliates may own securities of companies mentioned in this publication.