Cuckoo Or Convinced? Robert Hinchcliffe Has Been Buying Galway Metals (GWM, TSX-V) The Whole Way Down!

Jan 16

From nearly an all-time high of 53 cents to multi-year lows of 15 cents more recently, Galway’s CEO Robert Hinchcliffe has been buying and buying. According to SEDI filings he’s added more than 4 million shares to his position, which now stands at a total of 11,847,884 shares (or approximately 13% of Galway‘s shares outstanding).

As a sophisticated speculator, you typically only want to be part owner of companies run by management teams with a meaningful amount of skin in the game. You want management’s incentives to be aligned with your own – a higher stock price.

So whenever you see insiders buying and buying, the whole way down (from 53 cents to 15 cents), like Hinchcliffe has (and Michael Sutton to a lesser extent, who previously worked as Chief Geologist for Kirkland Lake), it’s normally a great sign for what’s to come.

Clarence Stream – An Emerging Gold District On Canada’s East Coast?

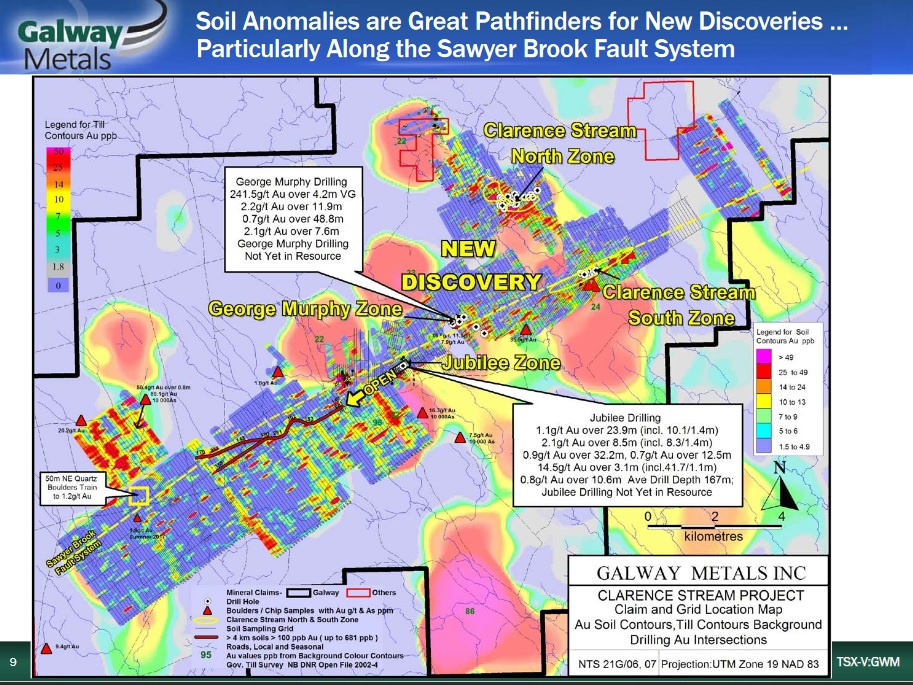

In Clarence Stream, Galway owns 65 km of strike length along the Sawyer Brook fault.

Sutton postulates that the Sawyer Brook fault is analogous to the Porcupine Destor fault or Larder Lake (if he’s proven right, this would have massive implications for the Clarence Stream land package).

Galway acquired the property several years ago because they believed it was “misunderstood”. Essentially, the previous owner was looking for high-grade Gold vein deposits and didn’t believe multi-million ounce open-pit deposits could exist in Eastern Canada.

Now we know they were wrong and Galway was right.

Marathon (MOZ, TSX), Atlantic Gold (AGB, TSX) and Oceana Gold (OGC, TSX) have all demonstrated that multi-million ounce open-pit deposits, from 2 to +4 million ounces, exist along the east coast.

In Summary: shares of GWM make for a pretty interesting speculation. As per Galway’s financials ending September, they had $5 million cash and completed a $3.3 million raise in December. I wouldn’t have thought the PP was necessary, but they’re definitely cashed up now with a market cap of $22 million. Having looked at many-many other resource deals, this seems a reasonable valuation for Clarence Stream and what could be a new Gold district in friendly eastern Canada.