Claude Resources: Q3 Net Profit $6.9M / $22M Cash Flow YTD / All-in Cost $976 per oz.

Nov 03

Back on October 7th Claude Resources (TSE: CRJ) (OTCMKTS: CLGRF) announced it mined 20,614 ounces of gold during Q3– its highest quarterly production in history! Claude’s been around for more than a decade too, so it was newsworthy news, and quite the achievement overall. On relatively high volume, it moved up about 20% to 24 cents per share on the news.

Today, Claude announced it earned $6.9M net profit ($0.04 EPS) and $10.6M cash flow from operations ($22M YTD), putting Q3 in the books. The financials would have been even stronger, but Claude only sold 85% (17,578 ounces) of its production. Therefore, it had roughly 3,036 ounces under its belt that will be credited to the Q4 numbers.

Share price notwithstanding, 2014 has been a banner year for Claude.

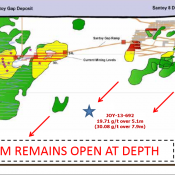

More than one mining analysts believe Claude’s Santoy Gap discovery, now in production averaging 250 – 350tpd, is one of the most exciting growth stories in the industry, but they have yet to come out of the closet with their feelings. Most likely, these same analysts will wait to see a few more quarters of production, and if Claude continues to perform like it has been they will begin revealing their excitement to the mass media. Upwardly revised price targets would follow soon thereafter. Behind the scenes, the technical pattern would indicate that institutional investors have been accumulating CRJ.TO for themselves in the 22 to 26 cent range.

Year to date, Santoy Gap has delivered over 28,000 tonnes at 8.6 g/t. As the sample set grows in size the market and Claude will get a better feel for whether or not Santoy Gap will continue to yield material above its 6.4 g/t reserve grade. Expect to see updated reserve and resources numbers from Claude during Q1 2015.

Here’s a quick rundown of Q3:

New record quarterly gold production of 20,614 ounces, a 96% increase from Q3 2013

Year to date gold production of 50,700 ounces, a 63% increase from the first nine months of 2013 and 16% better than full year 2013

Mill head grade of 8.88 grams per tonne for the quarter, a 68% increase from Q3 2013

Debt reduction totaling $9.7 million during the first nine months of 2014; CASH accumulation of $10.6M (working capital +$27M)

All in sustaining cost per ounce of gold of $1,063 (U.S. $976), a 32% decrease from Q3 2013

12,500 ounces of gold hedged at $1,425 Canadian

Here’s what to expect from Claude Resources going forward…

Meet or exceed 2014 production guidance of 61,000 to 64,000 ounces. This number is already above its first raised guidance of 51-54,000 ounces from earlier in the year. It will only take another 10,300 ounces for Claude to hit the low-end. Considering it produced over 11,000 ounces during Q1, historically its weakest quarter, Claude could be setting the market up to beat on already twice-raised guidance.

Claude’s Seabee operation could potentially be a +60,000 ounce per year mine (annually) going forward.

Today’s market valuation doesn’t reflect this.

We know that Q1 is historically the lowest production quarter, to get its operations and stock price to the next level Claude will need to break out of this early year slump. How will they do it? Well, on the conference call management advised they were already beginning to build and schedule tonnage, preparing in advance to help make sure Q1 2015 is better than prior years (11,344 ounces in 2014 and 8,082 in 2013).

Claude’s Seabee mine is a fly-in / fly-out operation, it typically spends $14-$15M to resupply each winter. Last year Claude and shareholders were uncertain as to how it could even afford the winter resupply; this year Claude expects to fund the resupply via cash-flow and working capital. It’s looking like Claude will end the year with a positive cash balance.

Representatives from Claude will be making the rounds in Toronto and NYC in the weeks and months to come. This visit will have a cost, so it should also pay some returns in the form of new money coming into the stock.

Compared to prior years, Claude’s financial and operational performance seems almost too good to be true– was 2014s stellar performance just a flash in the pan? Some might also be concerned that Claude is “high-grading” the properties… well, this question was also asked during the call, and management stated that it was not “cherry picking” the orebody, but would describe it as optimizing the mine plan for margin and cash flow. Even if they were high-grading, Claude’s property portfolio has plenty of exploration upside left (not including the current +10year mine life at Santoy Gap), one could argue that you have to do what you have to do during this tough environment.

2 More Catalysts that could move the stock higher:

1) Historically, Claude traded on the AMEX exchange, losing that listing has definitely weighed on the share price. Additionally, the OTC listing prevents many broker dealers from buying the stock because of regulatory risks. If Claude could work its way back onto the AMEX it would be a positive catalyst.

2) The strategic review is ongoing… at current prices Claude makes for an attractive acquisition candidate.