Area 52: Balmoral Finds “Visible Gold” In 3 Of 5 Holes So Far

Sep 23

More than likely that means high-grade assays when results are released next week.

In their August 26 update, highlighting how they added 3 new Nickel-Copper-PGE targets, Balmoral (BAR, TSX) said mineralized zones (shear zone related, vein-hosted quartz/sulphide mineralization) were observed in all 4 holes drilled at Area 52 over widths varying from 1 to tens of metres.

As written, the news release left a little room for doubt.

Did they see “visible Gold” in the core, or didn’t they?

Speculators wanted to hear those 2 magic words, which typically mean high-grade, but they didn’t August 26. Shares

of BAR held up though, remaining range bound between 20 and 25 cents. We advised subscribers that BAR is a high probability opportunity to profit from in September, and I’m doubling down on that prediction following Balmoral’s news this past Tuesday.

Visible Gold mineralization intersected in first follow-up hole.

This was a short press release, but it was sweet!

We now know, with certainty, Balmoral has intersected visible Gold in 3 of its first 5 holes at Area 52.

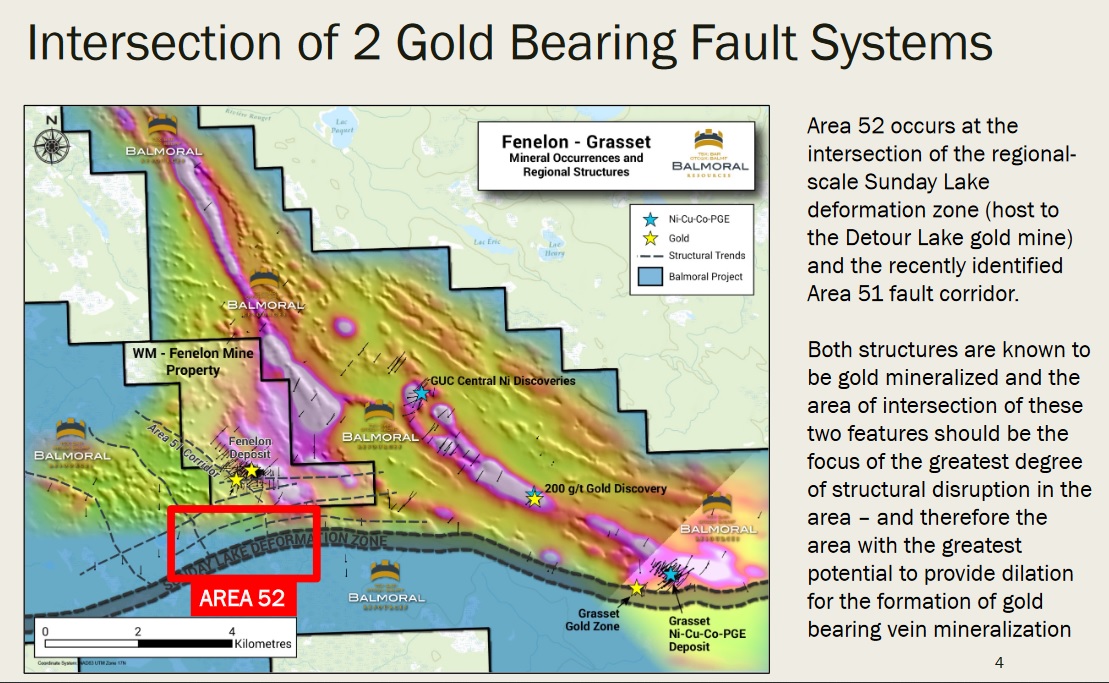

The drill program targeting the intersection of 2 Gold bearing fault systems, never previously drilled, is ongoing. Assay results from the first 4 holes should be released before the end of next week – 1,400 samples from 2,148 metres of core were submitted to the lab.

Area 52 covers an extensive, untested segment of the Sunday Lake deformation zone, the southern extension of the recently identified Area 51 Corridor, and the intersection of these 2 Gold bearing structural zones. The Sunday Lake deformation zone is the crustal scale, east-west trending fault system which controlled the emplacement of the nearby >20 million ounce Detour Lake Gold deposit.

From a TA standpoint BAR looks great. After jumping 150% on volume from all-time lows, the stock has held most of its gains. The consolidation range is tightening, between 22 and 24 cents. At some point BAR is going to blast past its key 25-cent resistance, and it’s possible that could come when assays containing visible Gold are released (it sounds like they’ll be published sometime next week).

We like the risk-reward ratio here.

Technically and fundamentally there are many reasons to bet on Balmoral with a market cap that is still just $35 million.

Company-wide, Balmoral has an estimated 138,672,900 pounds of Nickel equivalent and 2,002,900 ounces of Gold on the books (Martiniere offers a near 2 g/t Au open-pit, for starters). Lots of metal in the ground and all these deposits have potential to grow!

At 23 cents per share, Balmoral is valued near $17 per ounce Gold, very reasonably in itself. And of course, that assigns little to no value for Grasset (which contains a high-grade core of 3.45 Mt at 1.8% NiEq), Balmoral’s discovery stage Nickel projects, and Area 52 (“visible Gold” mineralization in 3 of 5 holes drilled so far).

I’m happy to see CEO Darin Wagner is pounding the pavement in Vancouver, telling Balmoral’s story. Below are a few important statements he’s made recently (he’s off to Denver now).

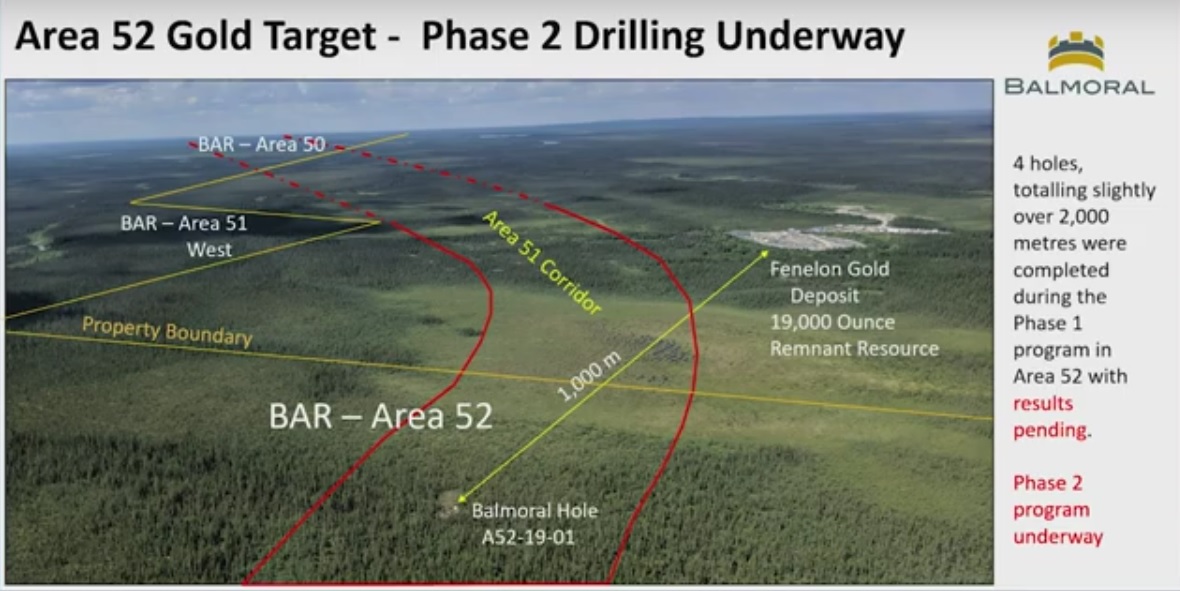

- “Phase 2 drilling is now underway at Area 52. We started Phase 2 drilling without seeing the numbers from Phase 1 drilling. That should suggest to you that we like what we see.” Assay results are imminent.

- “We think ourselves and our neighbor are going to have a lot of fun out here over the next few months as we both work to drill this system out. From what we can see this Area 51 corridor probably tracks onto our property to the south, north, and west.”

Regarding the 2nd bullet point: During his presentation Wagner almost seemed to go out of his way to avoid saying “Wallbridge (WM, TSX)”. Instead, he referred to Wallbridge as Balmoral’s neighbor. A subtle point, but it could indicate some sort of discussions are ongoing. Be it with Wallbridge or some other group, we know more people than just Wallbridge and Eric Sprott are paying attention to this situation.

Non-disclosure type agreements are a dime-a-dozen anyway.

Point being, Wallbridge and Balmoral have 7 drill rigs working this Area 51 and Area 52 corridor right now. Only a few weeks ago Sprott was talking about Balmoral’s drill program at Area 52, how it was worth watching and if they hit it could add up to a lot of ounces really quickly! Balmoral’s “good news” would be good news for Wallbridge, in essence.

I agree with that assessment. And I’ll add that going forward Wallbridge’s results should be a net positive for Balmoral, where it really hadn’t been to any great extent previously.

This Area 51 and Area 52 play is really underway, today, and it’s starting to really help Balmoral’s currency at a time they needed non-dilutive and/or less dilutive sources of money. So I’d argue they’re almost in the driver’s seat as it relates to this growing high-grade corridor.

- Getting back to Nickel, Grasset is the largest high-grade Nickel resource north of 1.5% NiEq, not owned by a major or private equity group. The deposit has been traced down to 500 vertical m, and it remains open below that. Drilling at Grasset will resume in January.

- A number of interesting magnetic anomalies were identified from their flyover survey at the RUM Project (almost all have conductors associated with them), which comprises 6 properties in the Lac Rocher Nickel district of Quebec. RUM is a prospecting discovery that outcrops at surface, 1.1% NiEq. RUM is probably a 2020 story for Balmoral, in terms of drilling.

In Summary: Balmoral is uniquely positioned to benefit from rising Gold prices and the new global-scale demand for Class 1 Nickel resulting from the introduction of electric vehicles and SE Asian supply concerns. BAR is poised, ready, and able to blast past 25 cents. Assay results from the first 4 holes of Balmoral’s Phase 1 drilling program, 2 of which contained “visible Gold“, are the key catalysts for a strong move to the upside. Compared to its peer group, BAR appears undervalued and those fundamental underpinnings provide some downside protection.