Pet Lovers… OPCO Is A Treat For Your Investment Portfolio!

Dec 26

A massive market with one little problem…

According to American Pet Products Association (APPA) statistics, there are approximately 175 million companion dogs and cats in the United States, and over 650 million dogs and cats worldwide.

In the U.S. alone, pet owners spent a record $60.3 billion on their furry friends during 2015. Forecasters at the APPA are calling for another new record this year.

First viewed by subscribers of BMR on December 4th.

Clearly, pet-related products and services represent a massive market opportunity. Problem is, there are almost no ways to invest in this growing industry via the stock market. After Petsmart was taken private, there are only 2 large stocks left (that I know of) – Central Garden & Pet (CENT, NASDAQ) and Blue Buffalo (BUFF, NASDAQ). Check out those charts! Central Garden supplies an incredibly diverse line of products and Blue Buffalo sells high-end food. I’m not as thrilled about those because each is valued in the billions, and over my history my 5 and 10-baggers have come from microcap stocks that have little to no analyst coverage.

I’ve searched far and wide for a publicly trading profitable company that’s an established, undervalued player in the pet products business, and I found one – a stock you can put away for the long-term and watch it grow like your puppy!

Hidden gem?…

The treat I want to focus on for your investment consideration is OurPet’s (OPCO, OTCMKTS) which recently reported record Q3 revenue with 9-month sales growth more than double the industry average.

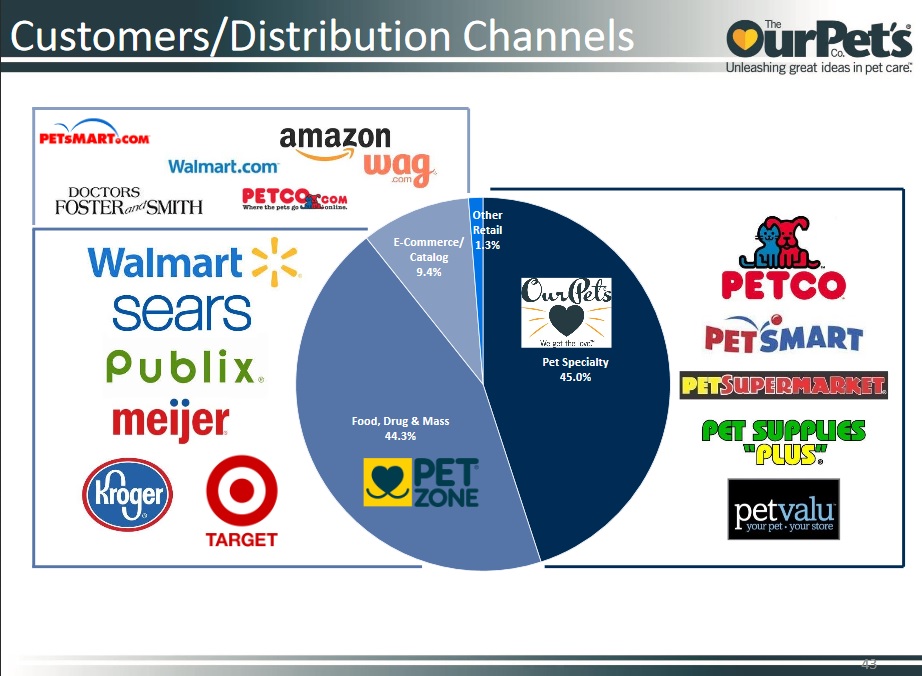

OurPet’s develops, produces and markets various pet accessory and consumable products designed to awaken pets’ natural instincts, be it in feeding, playing or waste management. Its products are sold globally through pet specialty retailers, food, drug and mass chains, e-commerce and international channels such as:

This little gem (OPCO) has a market cap of just $18 million, the share price is $1, and the company sports a consistent track record of sales and earnings growth to support a much higher valuation.

Last quarter, OurPet’s sales increased 21% to $7.26 million. For the first 9 months, sales are up 10% (more than double the industry average) to $18.8 million, so we’re talking about a compelling “value” stock here priced below 1 x sales. Net income through the first 9 months was $918,000.

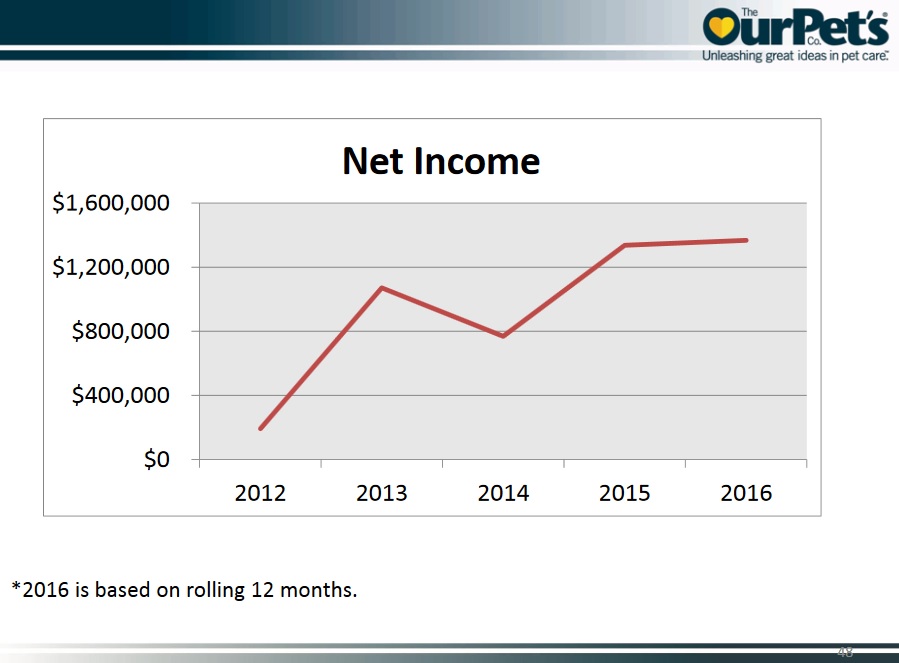

Since 2012, net income has increased about 600%!

Impressive.

With OPCO we’re not just buying into a “good story”, we’re buying into a good story with a real business attached that’s one of the only non-retail pet plays in the stock market. For a damn good price if I do say so myself! On a back of the envelope calculation, OurPet’s has a 13 P/E ratio, far below its historic net income growth rate.

Target markets…

OurPet’s is focused on high growth categories in non-food pet products such as:

- Interactive cat and dog toys and accessories ($1 billion/year category)

- Healthy feeding and storage systems ($100 million/year category)

- Feline waste and odor control solutions ($250 million/year category)

The company has a solid pipeline of new, innovative products and line extensions, as well as 170 patents issued/pending to protect its intellectual property and unique designs.

“Bird in a Cage” is one example of OurPet’s proprietary cat toys designed to awaken their natural instincts.

- Satisfy the mental/physical, safety and comfort of pets

- Satisfy the pet owners pleasure and convenience of owning a pet

- Satisfy the needs of retailers for innovative, upscale, and profitable pet products

More than 65% of households own a pet. In other words, there are more than 82 million pet owners in the U.S. alone.

We also know the vast majority of owners love their pets and will spend money on them during good economic times and bad.

With a track record of sales growth and profitability, OPCO represents an attractive investment opportunity – one of the few pure plays on the massive pet products market.

“Beyond 2016, our strategy is to achieve double-digit growth in sales and net income with an emphasis on developing and launching proprietary, innovative products and entering appropriate new market segments,” says Dr. Stephen Tsengas, OurPet’s President & CEO. “We recently announced our new partnership with Paulee Cleantec, Inc. whereby we plan to commercialize its patented technology to develop portable and fixed-base product solutions to safely and conveniently eliminate pet waste.

“In addition, we recently completed contracts with a leading direct TV (DRTV) marketing company to test market several of our new electronic interactive cat toys for a possible DRTV campaign to launch sometime in the second quarter of 2017. The contracts will allow both parties to move forward with what we believe will be the first of several DRTV programs to raise customer awareness for our entire electronic interactive pet toy category. We have many ‘irons in the fire’ and are very excited about the future.”

Technically speaking…

Lastly, OurPet’s has only 17.7 million shares outstanding. This incredibly tight share structure makes OPCO a challenging stock to buy in large quantities, so when bigger buyers want in, and I suspect they will soon enough, patient investors could realize multi-bagger gains.

I’m seeing a long-term uptrend, well intact, and a tightly wound set-up that could lift OPCO toward $1.75 and beyond, assuming it continues growing the way it has.

The rising 200-day moving average (SMA) is 93 cents. This is not a stock to “flip” in a few weeks’ time. We’d suggest tucking some away for the long-term (at least 1 year) by trying a small bid at 95 cents with the goal of turning OPCO into a 5-bagger or better on a future takeover or much higher earnings. The risk-reward ratio is attractive, so it’ll be hard not to make some money on this one.

*Author has a long position in OurPets Corp

DISCLAIMER: The information in this publication is not intended to be, nor shall constitute, an offer to sell or solicit any offer to buy any security. The information presented on this website is subject to change without notice, and neither Penny Stock Experts nor its affiliates assume any responsibility to update this information. Additionally, it is not intended to be a complete description of the securities, markets, or developments referred to in the material. Penny Stock Experts and its Author(s) cannot and do not assess, verify or guarantee the adequacy, accuracy or completeness of any information, the suitability or profitability of any particular investment, or the potential value of any investment or informational source. Additionally, Penny Stock Experts and its Author(s) in no way warrants the solvency, financial condition, or investment advisability of any of the securities mentioned. Furthermore, Penny Stock Experts and its Author(s) accept no liability whatsoever for any direct or consequential loss arising from any use of our product, website, or other content. The reader bears responsibility for his/her own investment research and decisions and should seek the advice of a qualified investment advisor and investigate and fully understand any and all risks before investing. Information and statistical data contained in this website were obtained or derived from sources believed to be reliable. However, Penny Stock Experts and its Author(s) do not represent that any such information, opinion or statistical data is accurate or complete and should not be relied upon as such. This publication may provide addresses of, or contain hyperlinks to, Internet websites, Penny Stock Experts takes no responsibility for the contents thereof. Each such address or hyperlink is provided solely for the convenience and information of this website’s users, and the content of linked third-party websites is not in any way incorporated into this website. Those who choose to access such third-party websites or follow such hyperlinks do so at their own risk. The publisher, owner, writer or their affiliates may own securities of companies mentioned in this publication.