Off 85%, is Scorpio Gold a legitimate bargain?

Oct 18

Scorpio Gold Corp (CVE: SGN) (OTCMKTS: SRCRF) holds a 70% interest in the Mineral Ridge project with joint venture partner Waterton Global Value L.P. (30%). Gold production for the first nine months of 2014 totals 30,556 ounces, representing an increase of 9.9% over the same period in 2013. Guidance for 2014 is 40,000 – 45,000 ounces of production at cash costs of $800 – $850 per ounce.

Mineral Ridge is an open-pit heap leach operation; production is not hedged and there are no underlying royalties on the property.

Ideally, Scorpio would own 100% of Mineral Ridge, if they did, the market would probably be more generous with its valuation. Having said that, Waterton isn’t a bad financial partner to have. As per the arrangement, Scorpio keeps 80% of the earnings, but Waterton is responsible for 30% of the expenses at Mineral Ridge. Additionally, Scorpio has repaid more than 80% of the money it borrowed in 2012, so Waterton probably wouldn’t hesitate to lend more in the future.

Under Wall Street’s Bay Street’s radar

As a rule of thumb, most institutional investors in the gold mining space are only interested in operations that are producing more than 100,000 ounces per year. While Scorpio’s goal is to reach 100,000 ounces of annual production, it isn’t there today. Therefore, the stock is ignored by Wall Street. Scorpio only has one analyst that officially covers the stock, so it’s highly unlikely you’ll ever get a phone call from a stockbroker recommending it. The lack of attention can be good news for individual investors that are looking for bargains.

So, is Scorpio a legitimate penny stock worth buying?

Setting any thoughts or predictions about future gold prices aside (although it would be nice if they held above $1200) Scorpio looks to be inexpensive based on a number of metrics.

Take this anecdotal piece of evidence into consideration… back in March of 2014, Gold Standard Ventures (NYSE: GSV) paid Scorpio $8.5 million cash for Scorpio’s Pinon property. Relative to Scorpio’s market value today, $20 million, it represented a hefty portion of the whole. But that’ not all, Gold Standard still owes Scorpio another $2.5M cash, which will be paid March 2015, there’s more too, Scorpio owns 6,750,000 shares of GSV, with further cash bonuses to be paid if Pinon or Gold Standard is sold for more than $100M. Scorpio’s equity position in GSV represents approximately 5% of the company. This provides Scorpio shareholders nice exposure to a large land package in Nevada’s Carlin Trend, at least until it decides to sell, using the money to payoff debt or reinvest back into the company.

Bottom line: Gold Standard paid more than $15M for an exploration stage property that wasn’t strategic for Scorpio.

That’s all well and good… but show me the money!

Not sure how much stock you put into “Adj EBITDA” numbers, but Scorpio did $25M worth of adjusted ebitda last year, today it’s valued at $23M. In the first six months of 2014 Scorpio generated $5.4M in cash flow from operations. If that pace holds, investors are paying less than 2-times cash flow to buy Scorpio Gold now.

Meanwhile, Scorpio has been paying down debt and funding its operations from cash flow. At the Precious Metals Summit in September, Steve Roebuck (Pres.), said the current exploration budget of $3.9M is its largest ever, all funded via cash flow. That’s an important piece of information, because the largest knock against Scorpio is the lack of proven reserves and relatively short life of mine plan. The most recent plan consists of 130,000 ounces of gold, suggesting production at Mineral Ridge will extend out to Q3 2016. However, expansion drilling since March suggests the resource will expand further and the mine could have more life than that.

As of the most recent quarter, Scorpio has working capital of $16.8M. The CASH component is $1.8M and gold inventory is 1,613 ounces.

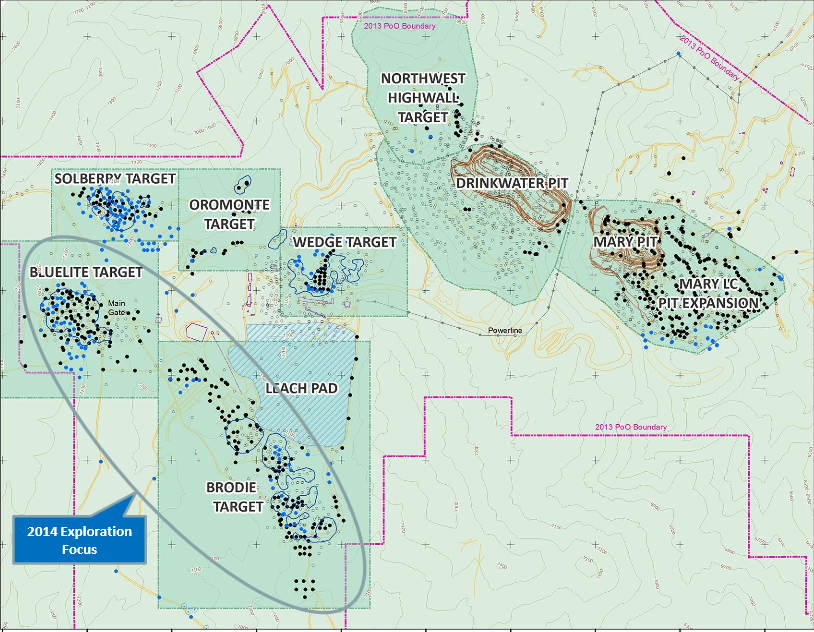

Production areas and satellite deposits:

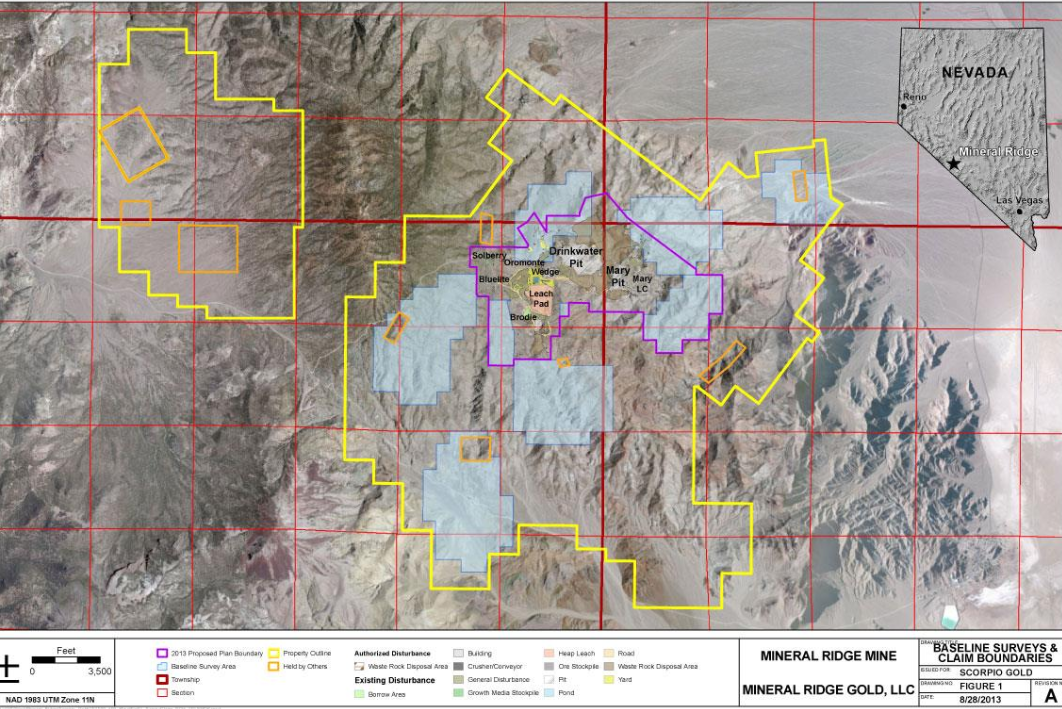

Looking at the illustration above, Scorpio is currently mining from the Drinkwater and Mary pits (Drinkwater is winding down). The entire Mineral Ridge land package, spans 12,380 acres, the production and satellite areas are outlined in pink. Of late, exploration drilling has focused on the Bluelite and Brodie targets. Evidence is building, more drilling will be required to prove it, but drill results between satellite deposits Bluelite and Brodie (Eg. Holes #’d 14977, 14978, 14942, 14973, and 13742… some of the blue dots) are beginning to form the basis of what could be one larger deposit. On a side note, 2014 is the first full year of genuine step out drilling, to some extent, Scorpio has been confined by permitting, as the approvals come Scorpio Gold will have the luxury of stepping our further.

Additionally, highlights from drilling at Solberry during 2014 include respectable intercepts such as 1) 9.27 g/t gold over 13.72 meters — 2) 5.54 g/t gold over 7.62 meters — and 3) 2.01 g/t gold over 10.67 meters. Also worthy of noting, Hole MR14929 turned up 12.15 g/t gold over 19.81 meters at Solberry (from June 16, 2014 press release). Solberry is conveniently located, just 600 meters northwest of the heap leach pad.

Viewing the production and satellite deposits (pink outline) in relation to the entire Mineral Ridge land map (yellow outline):

Bottom line: with a gold price above $1250 Mineral Ridge should put-out well beyond Q3 2016. At last check, Scorpio is operating below 60% of capacity, should confidence in resources and reserves improve, production rates could potentially be increased.

“Goldwedge” is Scorpio’s second asset, but at today’s price you get it for free.

Goldwedge is a fully functional, fully permitted facility that has 400tpd of unused capacity [replacement cost would be $5 – $10 million].

Located in what’s known as the Manhattan Calderra, Goldwedge has an underground (higher grade) and surface component. Historically speaking, over 200 drill holes have pierced the ground there [Goldwedge] dating back to the 1930’s, so Scorpio’s geologists are busy compiling this data. Word on the street is that Scorpio began drilling from surface at Goldwedge in July — so results could be due any day now. Any positive news from Goldwedge would be a market mover for Scorpio, as the value being assigned to this project are low to quite low. Encouraging results from surface would be immediately followed up with drilling from underground.

In its history, more than 500,000 ounces (an estimate) of gold have been mined from Goldwedge, when considering both underground and placer mining.

Within the next 18-months, Scorpio should begin generating some revenue from Goldwedge via toll milling or processing its own material.

Who controls the equity?

Scorpio Mining owns approx. 10% (Scorpio Gold was a spin-off)

Management and Directors own more than 10%

Sentry Select and Tocqueville own approx. 20%

*Full Disclosure… the analyst writing this report owns stock in Scorpio Gold. No payment was received for this publication.