4 Fabulous Project Generators! Guess Who…

Apr 10

Each of these 4 stocks is trading at or near decade lows, but their futures and financials have almost never looked better!

In my mind, these are “staple stocks”. These are some of the blue chips of the exploration business. Assuming you’ve got a year’s worth of patience, I can’t imagine you losing money on any of these stocks (not from these low-low prices). Over a longer time frame, say 2 or 3 years, the odds of losing money with these stocks is very close to zero – but you stand to make a FORTUNE!

…the risk/reward equation has almost never looked better.

Here’s the strategy – as opposed to picking just one or two I’d suggest equally weighting all 4. Make it a basket! If you were to buy the same amount of these 4 stocks and hold them for a year or more I’d be astonished if the basket didn’t trounce the market averages (pick your barometer, this will beat it), while assuming less risk.

On second thought, this basket might not outperform a basket of mining stocks with bad balance sheets (those offer huge leverage!). However, my fabulous 4 are a heck of a lot safer. Unlike the miners with bad balance sheets these prospect generators have like zero chance of going bankrupt (if they survived the last decade they ain’t dying now).

- Azimut Exploration (AZM, TSX-V)

- Eagle Plains (EPL, TSX-V)

- Globex Mining Enterprises (GMX, TSX)

- Strategic Metals (SMD, TSX-V)

I don’t want to sound over-confident or cocky. Maybe 1 of 4 will find a way to lose, anything is possible. But as a portfolio strategy, from these low-low prices the odds of this basket returning +25% or more between now and this time next year is extremely good. Extend your holding time and this basket could easily deliver +250% returns (while exposing your capital to a very limited amount of risk).

These companies offer the total package – prospective properties, cash flow, royalties, and management teams that are masters at using OPM (other people’s money) to explore/develop their projects.

Regular readers will already be familiar with these names, so I’ll try to keep this short and sweet. Tremendous bang for the buck with these 4 stocks!

Azimut Exploration Inc. (AZM, TSX-V)

Market Cap = $17 million | Working Capital Est. = $3.3 million

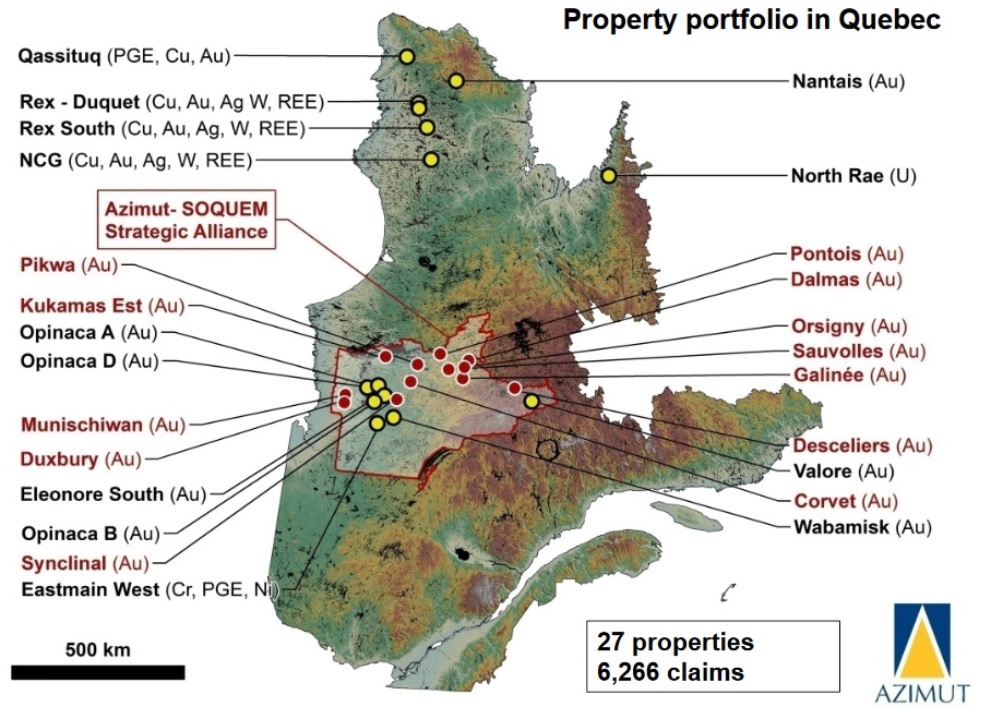

Compared to its project generator peers, Azimut has one of the best leverage ratios in the business (roughly 6 to 1). Since its inception, partners have spent $57.3 million versus Azimut’s $9.6 million.

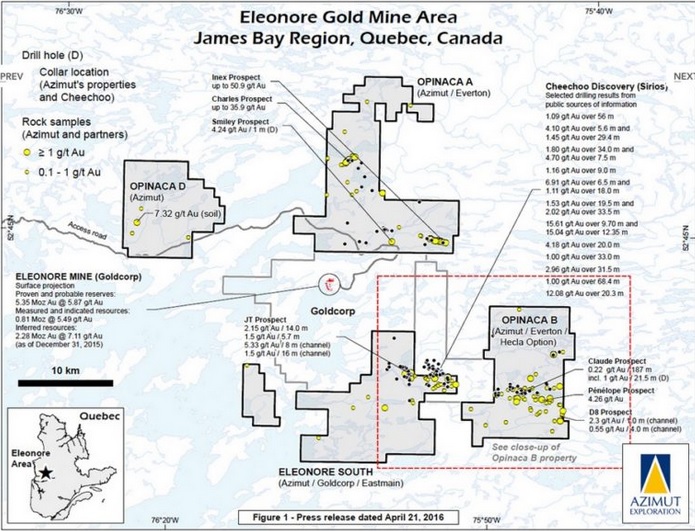

Azimut and Goldcorp, the key partner, believe they’ve got a discovery underway within a 4 km by 500 m Gold-bearing corridor at Eleonore South (located 10 km from a $2 billion mine and +8 million ounces).

Drilling results to date include 4.9 g/t Au over 45 m and 6.1 g/t Au over 9 m. As of late February a 5,100 m drill program is underway. Targets include a 79 g/t Au channel sample over 5.8 m and nearby a 1,500 g/t boulder (neither area has been drilled previously).

As you can see, Azimut has Goldorp’s Eleonore mine pretty well covered. Any significant discovery in the area would look quite appetizing to the hungry major.

Elsewhere, but also in the James Bay region, Azimut is drilling a “Ring of Fire” look alike called Chromaska. CEO Jean-Marc Lulin is excited about this property so he’s self-funding the program. Simultaneously, Azimut is leveraging its “Big Data Analytics” approach to exploration via an agreement with SOQUEM (the companies are doing early-stage work on up to 11 properties).

With only 48 million shares outstanding, AZM offers explosive upside potential (this thing is a coiled spring!), and I’m not seeing much room to the downside.

Relatively speaking, Azimut doesn’t have many shares outstanding. Plus, AZM is tightly held. Large Quebec-based institutional investors and Insiders control more than 50%.

Eagle Plains Resources Ltd. (EPL, TSX-V)

Market Cap = $22 million | Working Capital Est. = $5.3 million

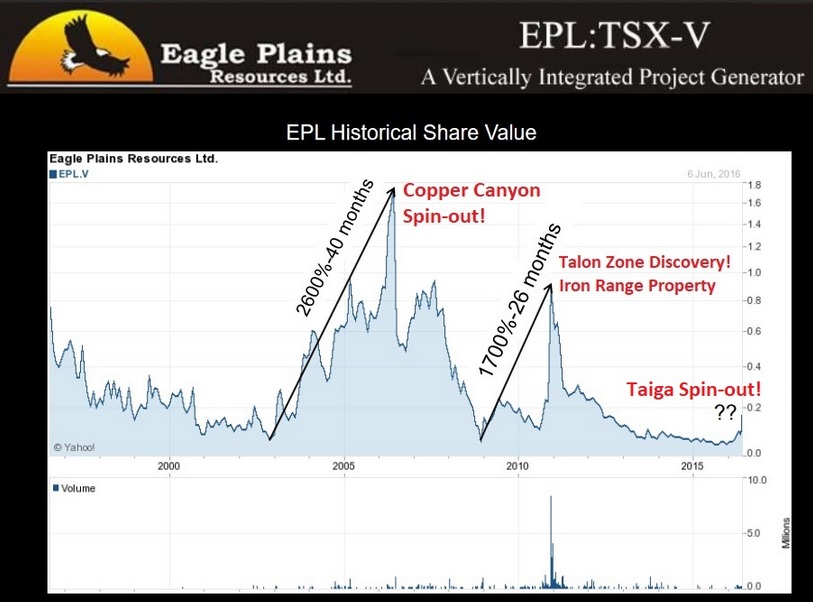

You usually don’t hear the words “sustainability” and “exploration” used in the same sentence, but Eagle Plains isn’t your usual resource stock. The company has been operating for 25 years and has never done a rollback. Since 2010 EPL has performed spectacularly for shareholders on two separate occasions, gaining 2,600% and 1,700%!

The biggest spike in Eagle Plain’s history came shortly after its spin-out of Copper Canyon. Question being – could EPL have another big spike leading up to and following the spin-out of Taiga Gold?

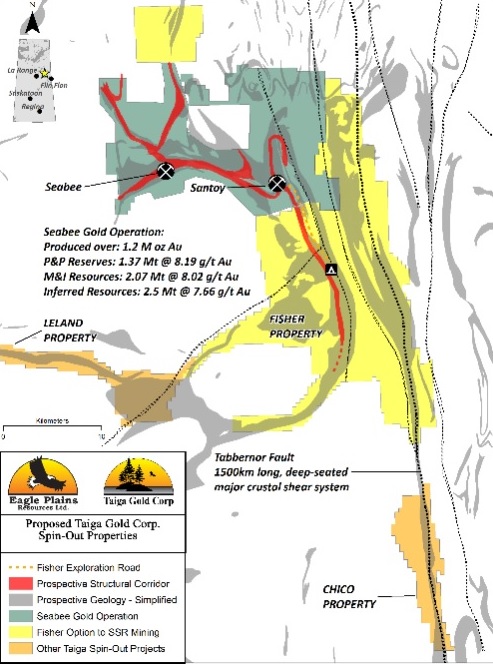

Scheduled to begin trading later in the month (buy EPL ASAP if you want to the Taiga dividend), Taiga has been prepped and is being readied for an eventual takeover by SSR Mining (SSRM, TSX).

SSR Mining has commenced an 18,000-m drill program on the Fisher Property. Given that amount of drilling, it’s unlikely the program doesn’t turn up some good results. Assuming SSR Mining likes what it sees, Taiga will receive $3 million as a cash payment toward further exploration and/or be acquired outright.

Either way, Taiga is going to be a nice dividend!

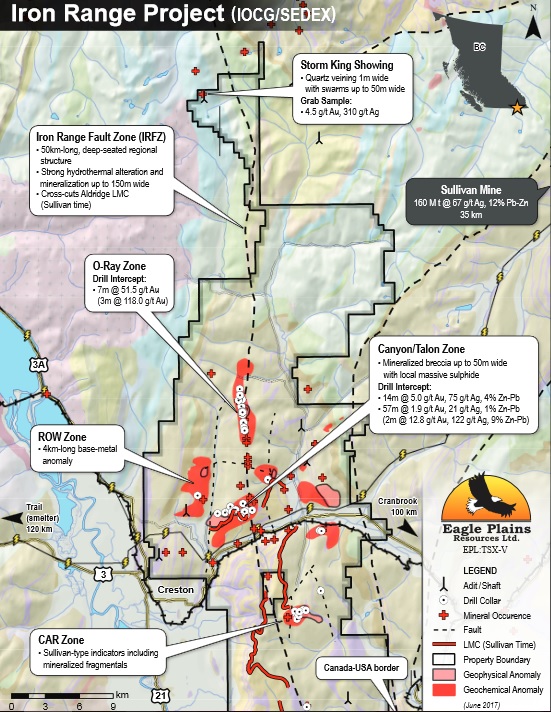

Many people might think EPL would be reduced in price accordingly to the spin-out. And it may, but probably not by much because Eagle Plains will shift gears to Iron Range.

It sounds like Eagle Plains will likely self-fund a drilling program (about $500,000 worth) on Iron Range this summer.

Another thing people might not know about Eagle Plains is that it has an exploration/consulting subsidiary called TerraLogic. That company has really helped pay bills, keep geologists employed (they have about 15 people working), and upgrade the property portfolio. In total, Eagle Plains has more than 30 projects and a dozen royalties (located in Western Canada).

Globex Mining Enterprises Inc. (GMX, TSX)

Market Cap = $23 million | Working Capital Est. = $3.1 million

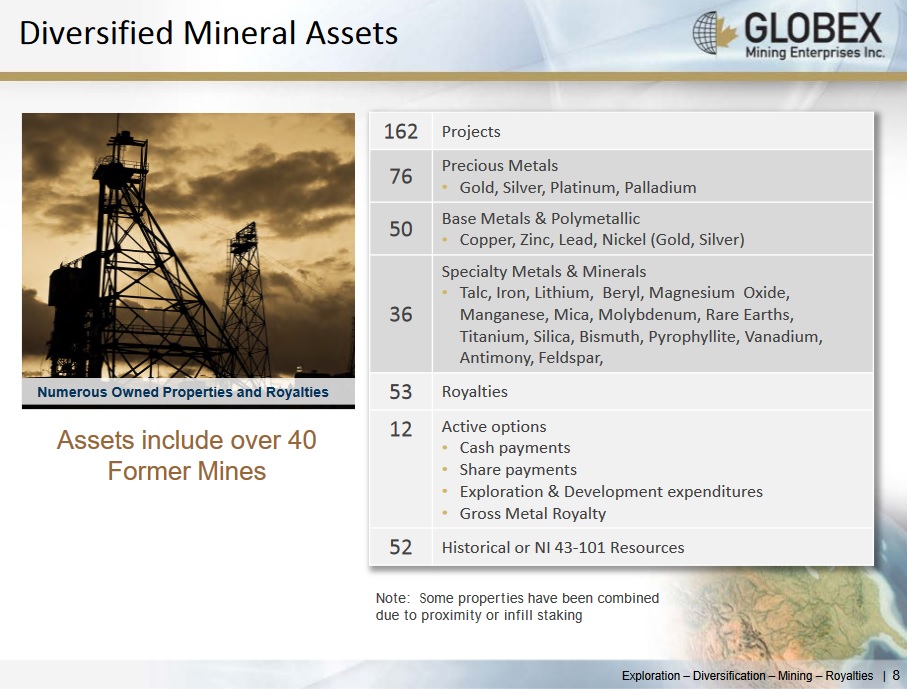

Trader Jack Stoch, also known as Globex’s CEO, started acquiring and vending exploration projects in 1976. Presently, I’d argue Mr. Market is greatly under-appreciating Jack’s 4 decades worth of effort.

Every single one of these properties, which stretch across the Abitibi geological belt for 320 km, have have one or more of the following key attributes:

- Historical or NI-43–101 Resource

- Drill intersections of economic interest

- Past production

- Mineralized showing or drill targets

- Location on major ore localizing structures or in prolific mining camps

Many companies like to say they have “royalties”, but very few of them have royalties generating cash flow. Globex does!

Globex’s Mid-Tennessee Zinc Royalty, on a mine operated by Nyrstar, is expected to generate nearly $2 million at current Zinc prices. During the month of January it paid $220,180! Think about that. Many exploration stocks, of comparable value to GMX, would have to sell 20 million shares at 10 cents to bring in that kind of money (and for Globex it could keep coming in for years, no effort required).

GMX may be down in price, but it definitely isn’t out!

Tremendous unrecognized value is pact within this $23 million market cap company (selling for roughly 10 x cash flow, a discount to most “royalty” stocks). If someone wants to sell you GMX for less than 50 cents over the coming months, I’d suggest buying it. More than 2 decades in the making Globex only has 51 million shares outstanding (GMX could certainly trade at $2 or $3 again).

Strategic Metals Ltd. (SMD, TSX-V)

Market Cap = $38 million | Working Capital Est. = $33 million

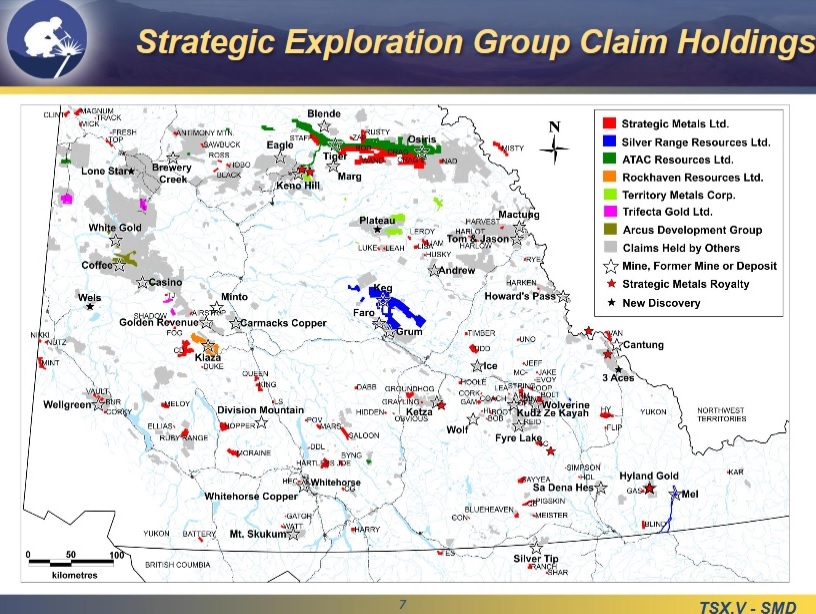

Here’s another company that’s been plugging away for more than a decade, with no “value” to show for it (unless it’s hidden in this +100 property portfolio somewhere). I don’t know, I’m just thinking Strategic must be worth something number far greater than the sum of its cash and marketable securities.

More than a few major and mid-tier mining companies have made substantial investment into the Yukon lately, so it’s a solid jurisdiction to be in. No real problems there, aside from arguments about remoteness and infrastructure (but now a days you’ve got to explore unexplored territories, and the government is addressing the infrastructure challenges).

While not being reflected in the stock price, Strategic would argue its research has kept them ahead of the herd (maybe they should be getting more respect?).

At 43 cents, SMD is just above what looks to be really solid support at 40. The stock has tested that level at least half a dozen times over the past 2 years without breaking below.

We’re getting closer to what should be a very active Yukon exploration season. Companies are starting to announce their plans. Today ATAC said Barrick would be drilling 20,000 m on the Rackla trend (home to Canada’s only known Carlin-style system).

Bottom line, if you want to make a discovery in the Yukon you should probably be talking to Strategic Metals.

This group has been involved with many discoveries and they know the territory very well.

I wouldn’t be selling SMD, not at this low-low price.

Want to Trade Like The Experts? Click below for more about our Subscriptions and receive the next up and coming opportunity!

DISCLAIMER: The information in this publication is not intended to be, nor shall constitute, an offer to sell or solicit any offer to buy any security. The information presented on this website is subject to change without notice, and neither Penny Stock Experts nor its affiliates assume any responsibility to update this information. Additionally, it is not intended to be a complete description of the securities, markets, or developments referred to in the material. Penny Stock Experts and its Author(s) cannot and do not assess, verify or guarantee the adequacy, accuracy or completeness of any information, the suitability or profitability of any particular investment, or the potential value of any investment or informational source. Additionally, Penny Stock Experts and its Author(s) in no way warrants the solvency, financial condition, or investment advisability of any of the securities mentioned. Furthermore, Penny Stock Experts and its Author(s) accept no liability whatsoever for any direct or consequential loss arising from any use of our product, website, or other content. The reader bears responsibility for his/her own investment research and decisions and should seek the advice of a qualified investment advisor and investigate and fully understand any and all risks before investing. Information and statistical data contained in this website were obtained or derived from sources believed to be reliable. However, Penny Stock Experts and its Author(s) do not represent that any such information, opinion or statistical data is accurate or complete and should not be relied upon as such. This publication may provide addresses of, or contain hyperlinks to, Internet websites, Penny Stock Experts takes no responsibility for the contents thereof. Each such address or hyperlink is provided solely for the convenience and information of this website’s users, and the content of linked third-party websites is not in any way incorporated into this website. Those who choose to access such third-party websites or follow such hyperlinks do so at their own risk. The publisher, owner, writer or their affiliates may own securities of companies mentioned in this publication.