+40 G/T Gold Hits 2 Weeks In A Row!

Feb 03

You’ve got to like what QMX Gold (QMX, TSX-V) is doing in Val d’Or.

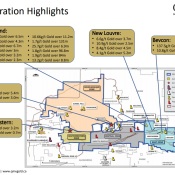

Wednesday morning we finally started getting assay results from QMX’s River target, located toward the far western end of their 200 sq. km property. The initial drill program consisted of just 7 holes, but as of now we know the first 3 were quite good (4 holes are pending)!

- DDH 17421–19–045 returned 7.8 g/t Au over 2.9 m

- DDH 17421–19–046 returned 39.8 g/t Au over 2.0 m

- and DDH 17421–19–047 returned 17.7 g/t Au over 4.0 m (starting at a depth of 25 m)

“We are delighted that we immediately achieved high grade Gold intersections in the first 3 drill holes on our new River target,” says Dr. Andreas Rompel, VP Exploration. “This gives us great optimism and encouragement to continue with our structural target delineation in general and for the River target in particular, where we anticipate establishing additional resources to our already substantial Bonnefond resource.”

The River Target is located in the Bourlamaque Zone, roughly 1 km west of the Lac Herbin-Dumont-Ferderber Gold system that produced a total of 793,000 ounces of Gold historically. The target was discovered in 2011 and had not been followed up since. The Gold mineralization is hosted by quartz-tourmaline veins with pyrite in shear zones in the Bourlamaque batholith. The objective of the program is to evaluate the continuity of the grades and structures.

Another round of drilling will be planned on this target once all the assays are back and the 3D modeling is completed.

Way east of Lac Herbin and River, in what QMX calls the East Zone, they announced results from Bonnefond last week that included 41.8 g/t Au over 3.4 m and 171 g/t Au over 1 m.

So 2 weeks in a row with 40 gram Gold hits, you gotta like that! Drill, baby, drill! QMX is funded for +15,000 m of drilling through the winter season and thereafter.

The stock’s doubled since I started recommending it in December, but you might say that was just Phase I of a multi-phase bullish trend that ought to shoot QMX well into the 20’s this year. It’s facing some resistance at 12 cents, but look at the volume! QMX is still a strong buy below 12 cents.

Here’s Your Chance! Now’s The Time!

As I suspected, 1911 Gold (AUMB, TSX-V) was a “sell the news” situation. But it’s all good! The stock got ahead of itself a few weeks ago. Someone was like “panic buying” AUMB and that drove it up to 48 cents. Now AUMB sits right near support in the mid-30’s.

This is textbook for a trade! AUMB broke past its 200-day SMA on heavy volume mid-January and now it’s retesting new support in the mid-30‘s. Awesome entry point! I added another 100,000 shares to my managed accounts, and 40,000 more to my own Thursday and Friday.

Thanks so much to everyone who sold me those shares!

Making any rash sell decision based on the first 10 holes of what’s merely 1 of +10 multi-square km targets doesn’t make good business sense. Bidou isn’t even Dr. Scott Anderson and 1911’s favorite target! It was actually one of their least favorite targets, but they started there because it was accessible before winter freeze-up.

Even at that, they hit roughly 10 g/t Gold over nearly 1 m in 2 holes that were 100 m apart. Not “discovery holes”, but not too shabby considering these are large targets that have never been drilled before. A shear vein of 16.2 m core length was even intersected in the first hole.

Dr. Scott Anderson, Vice President, Exploration, commented, “The drilling completed to date strongly supports our geological models for these targets and has confirmed the existence of Gold-bearing structures to depth, which are being interpreted in the context of a camp-scale mineral system. We are extremely encouraged by these initial results and look forward to further testing these targets, as well as other new targets in the Bidou and Tinney project areas”.

This 1911 Gold is a simple situation – don’t overthink it. You’re buying a fantastic exploration speculation (+70 km crustal scale fault, nearly the entire Rice Lake belt!) that just so happens to own 100% of an existing state-of-the-art 1,200 tpd permitted mill and tailings facility for less than $5 million, ex-cash.

Via San Gold, at the peak of the last Gold cycle this exact same asset received a market cap of $1.3 billion. That’s the high-end in terms of valuation. I would’ve thought $37 million to be the low-end in terms of valuation, that’s what Klondex paid out of bankruptcy in late 2015. Following the acquisition Klondex made mill improvements and acquisitions to the tune of spending around $40 million.

1911 Gold is now the beneficiary of those improvements. By the way, Gold prices in Canada are now $2,100 compared to $1,500 or so. This can all be yours via AUMB for an all-time probably never-to-be-lower again price of $12.7 million. They actually ended the year with more cash than they started with, $9.6 million.