3 Strong Reasons GoGold (GGD, TSX) Is A “BUY” Right Now

Jan 21

GoGold Resources Inc. (GGD, TSX-V)

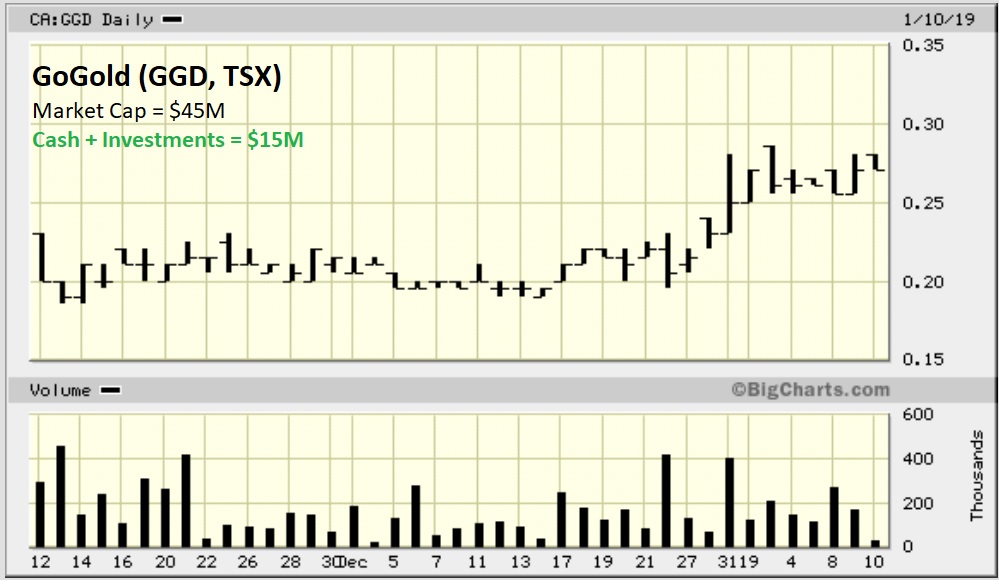

Having closed yesterday at 27 cents, GGD is up 23% since my initial recommendation less than a month ago (December 18). This morning I’m going to use this opportunity to keep pounding the table on GoGold by providing 3 strong reasons you should accumulate some stock, if you haven’t already.

1. The Bottom Is Firmly In Place!

Building from its strong base of 20 cents, I see GGD trading up to +50 cents by mid-year for a potential gain of +100%.

The last 4 years have been a one-way street for GGD (down!). From a high of $1.75 the stock didn’t find its ultimate low until very recently at 19 cents. I’m sure we can all sympathize with the longs who’ve been holding the whole way. Ouch! They’ve lost 85% on paper. But we also know how this industry works. It can be incredibly volatile. So when mining stocks finally change direction they can more than make up for years of losses in a matter of months (remember H1 of 2016?).

After years of pain relating to Silver prices and getting past the agglomerated heap leach learning curve, GoGold finally has its 100%-owned Parral Tailings Project figured out. Plus, Silver prices should be helping them rather than hurting them.

Sure looks and feels like GAINS going forward for owners of GGD!

2. Finally, They Figured It Out!

Often times you can recognize pioneers because they’re the ones with the arrows in their backs.

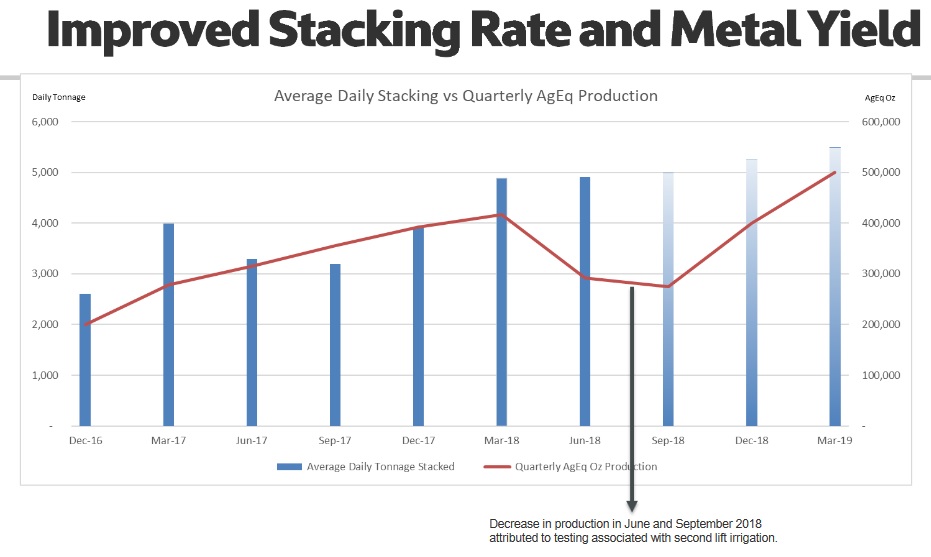

It’s taken longer than everyone would have liked but GoGold’s finally got this whole “agglomerated heap leach” thing figured out.

Their learning curve brought pain, headache, and expenses along with it but they’re confident the worst is in the rear view mirror.

Production for the quarter ending September was GoGold’s worst for 2018, which they attribute to testing associated with second lift irrigation, but CEO Brad Langille’s guidance for the quarter ending December is between 325,000 and 355,000 ounces of Silver equivalent (35% higher, at least).

The company’s near-term goal is making sure a fleet of 40 ton trucks is getting filled 125 times per day, equating to a 5,000 tpd stacking rate. Assuming recovery rates stay consistent, GoGold will produce approximately 425,000 ounces per quarter by stacking 5,000 tpd onto the leach pad (a nice bump UP from current levels). However, their ultimate goal is achieving a stack rate of 7,500 tpd.

7,500 tpd is an achievable goal and GoGold would become a +2 million ounce producer.

To my understanding, GoGold’s break-even rate is approximately 110,000 ounces of Silver per month using current prices. They exited December averaging 5,000 ounces per day, so GoGold’s on track for a strong Q1 2019. We should be getting an update sometime in January with the encouraging news.

3. They’re Going To Make An Acquisition!

“GoGold is in a very strong financial position and actively looking at opportunities to add quality undervalued assets,” said Langille on December 21.

What does an ideal acquisition target look like?

GoGold is looking at single asset producers, both public and private, that are priced favorably. Such a deal, perhaps a merger of equals, could benefit by bringing down overall G&A and mining costs. With that said, Langille has also been evaluating non-producers. The company isn’t opposed to buying a highly prospective, dare I say “proven”, exploration stage property.

In my view, either scenario will ultimately pay off for shareholders.

GoGold grows its production considerably, while simultaneously adding discovery optionality, via a merger of equals near the bottom of the market (therefore paying a fair/great price while gaining cost synergies). Otherwise, GoGold grabs a smaller exploration company and funds it toward production via cash flow from Parral – a strong position to be in.

Either way, shareholders gain discovery optionality at a time Mr. Market is beginning to place a premium on high-quality discoveries and exploration properties. Therein lies an important point – exploration upside! This one factor alone will be a great complement to their Parral Tailing Project, which offers production for another +10 years but no discovery premium.

GoGold needs to introduce a “mystery factor”, and they will.

I’ll argue one thing’s for sure, Langille is going to make another good deal for GoGold (like he’s done in the past).

To my understanding, given the due diligence done to date (plus the possibility this awesome window of opportunity could be closing given action in the metals market), Langille could be close to making a deal. By the sounds of it GoGold would like to have one finalized by the end of Q1.

If I had to guess, reading between the lines, GoGold’s going to acquire an asset that’s privately owned by a Mexican family. This particular property, to be named later, is pre-production. Speaking to its exploration upside and production potential, historical drilling has outlined the makings of what could become a 2 g/t Au open-pit mine!

Langille and his team have been busy working through some permitting and legal matters concerning that property.

Insiders are thinking and hoping this property, owned by a Mexican family, could be the next Santa Gertrudis. Langille recognized Santa Gertrudis as an undervalued opportunity, paid $11 million and ultimately got $92 million out of it (netting about $50 million for GoGold in the process).