3 Project Generators Entering 2019 In A Strong Financial Position (They’re Valued Near “Cash”, Or Below)

Jan 27

Benton Resources Inc. (BEX, TSX-V)

Market Cap = $4.2 Million | Cash + Investments = $5.9 Million

Prospecting and mining roots run deep in the Stares family, dating back at least 100 years. They’ve even been recognized by PDAC with the “Bill Dennis Prospector Of The Year Award” for their achievements.

In addition to doing his own boots-on-the-ground reconnaissance work, I think it’s fair to say CEO Stephen Stares is well-connected with independent prospectors across Eastern Canada (especially in Newfoundland and Ontario). With roughly $5.9 million in working capital, Benton is ready and able to pull the trigger on properties of merit. The company has around 11 projects available for option (Rio Tinto is working on their Bark and Baril Lake claims as we speak).

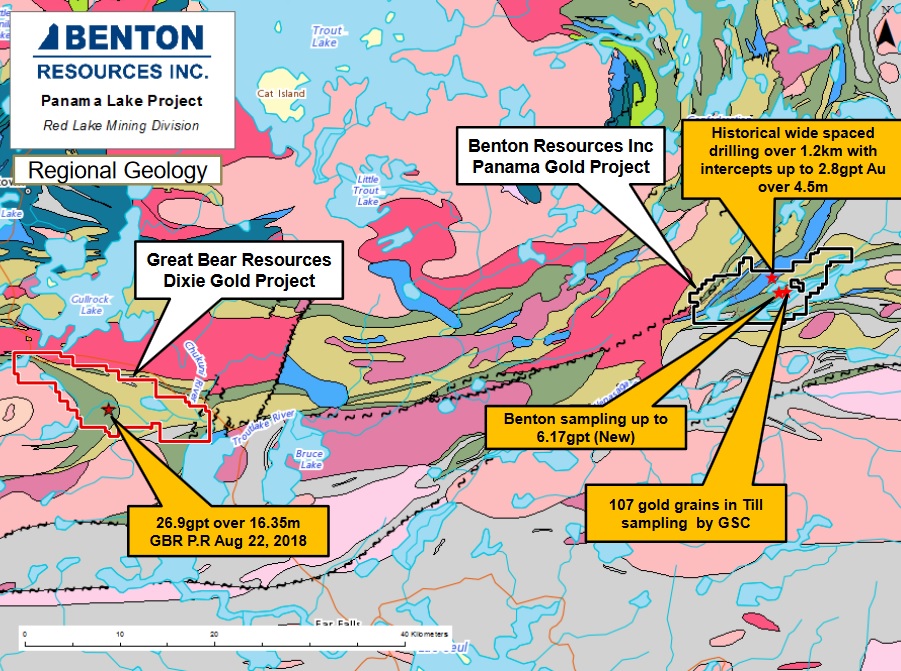

Knowing that, a project called “Panama”, located about 50 km northeast and along strike of Great Bear (GBR, TSX-V), is currently Benton’s focus.

The Panama Property hosts one of the highest Gold grain counts (107 grains) in till sampling found to date in the Red Lake District (according to the Ontario Geological Survey).

This morning Benton announced it will be funding a 1,000-m drill program at Panama during the month of January.

BEX is trading at 5 cents, well off its most recent high of 15 cents (4 cents looks to be firm support).

Eagle Plains Resources Ltd. (EPL, TSX-V)

Market Cap = $9 Million | Cash + Investments = $7.6 Million

Exploration is the R&D side of the mining business. It’s a Risky business, with a capital “R”, but the Rewards for economic discoveries are huge (capital “R” there as well).

The world as we know it today wouldn’t function without metals, so somebody’s got to do the searching. Major mining companies aren’t doing grassroots exploration, most junior miners aren’t either, which leaves a ripe opportunity on the plate of experienced prospecting groups like Eagle Plains.

The company hedges the inherent risk of grassroots exploration by using OPM (other people’s money) to do the heavy lifting (drilling). Simply put, Eagle Plains, like other project generators, would rather keep 20% of something rather than 100% of nothing. And “nothing” is what the vast majority of exploration stock shareholders are left with once all is said and done.

CEO Tim Termuende, P. Geo., and his Dad (Bob) founded Eagle Plains over 25 years ago. Impressively, the equity has never been rolled back and if you account for spinoffs EPL has paid roughly 40 cents worth of dividends to its shareholders since inception!

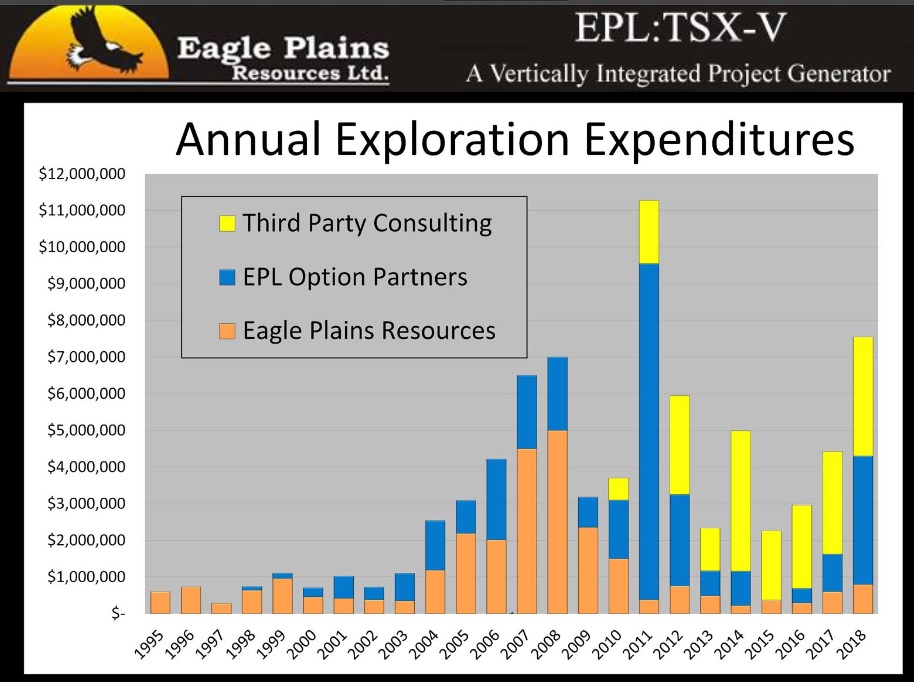

Also unique, and of consequence, Eagle Plains generates revenue via its 3rd party geologic consulting arm (TerraLogic). Not only does this non-dilutive revenue help fund the company during lean years, it helps keep a team of geologists employed and thinking about the next discovery area. The following slide illustrates how much money has been spent on exploration to date (it’s a lot relative to their $1.4 million market cap, ex-cash and investments).

Eagle Plains has a portfolio of 25 projects, plus royalties.

They’ve got large equity stakes in Taiga Gold (TGC, CSE), which has a joint venture with SSR Mining (SSRM, TSX) in Saskatchewan, and they’ll also end up with a big chunk of a new listing called Rockridge (ROCK, TSX-V). Smart speculators will keep an eye on TGC and ROCK as it relates to Eagle Plains‘ investment portfolio.

EPL is trading at 10 cents, way down from its all-time high of nearly $2 (8 cents should be the floor). The stock’s jumped 2,600% on one occasion and 1,600% on another over the past 2 decades. So if history rhymes or repeats, EPL is overdue for another massive move.

Strategic Metals Ltd. (SMD, TSX-V)

Market Cap = $30 Million | Cash + Investments = $22 Million

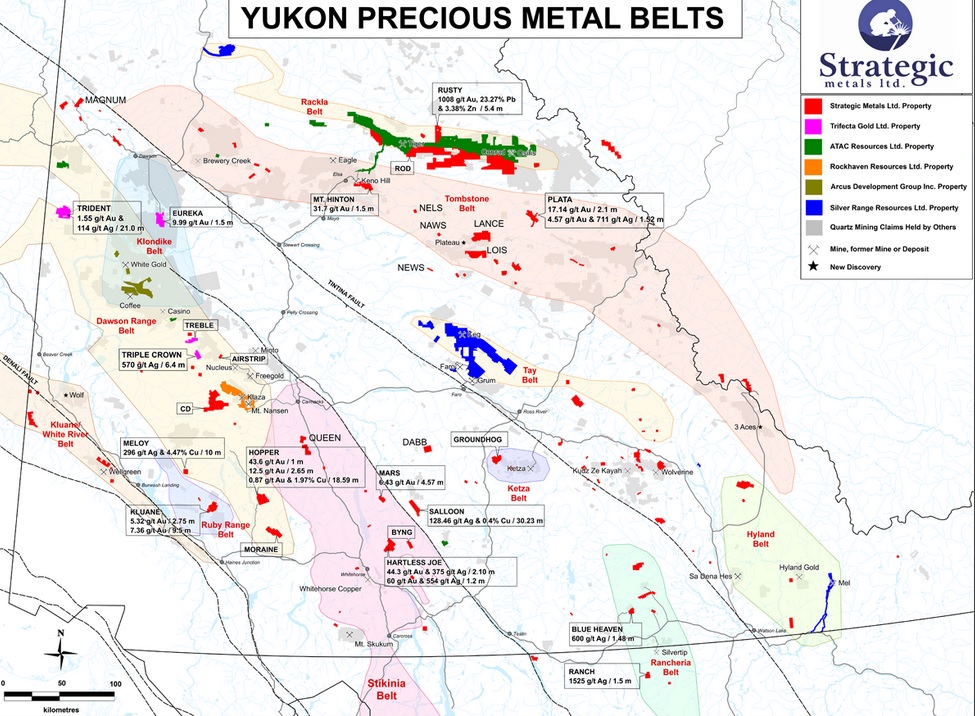

Arguably, nobody knows the Yukon better than Archo Cathro and Strategic Metals. The two exploration groups fit together almost like hand and glove. Combined, they’ve been involved with almost every major discovery in Yukon – period.

Strategic is a project generator’s project generator! They’ve got more than 100 properties, of which 10 or 15 are getting boots-on-the-ground advancement each summer (in-house work). When the exploration cycle turns for the better, more than half of Strategic’s portfolio will get attention via JV, in-house, and/or spinoff exposure.

If there’s a knock against Strategic, having too much land could be it! They’ve got claims staked in and around every known belt and prospective rock package in the province.

While Strategic also has a large investment portfolio, with hefty stakes in companies like Precipitate (PRG, TSX-V), ATAC Resources (ATC, TSX-V), Silver Range (SNG, TSX-V), and a little-known diamond play called GGL Resources (GGL, TSX-V), smart speculators interested in SMD should keep an especially close eye on RK.

Over the past few weeks Rockhaven (RK, TSX-V) has moved up from 8.5 cents to 17 cents, and Strategic owns 66 million shares! It’s not unreasonable to think RK could continue its advance as this bull market moves forward. Assuming it hit 40 cents per share, a little more than a double from here, Strategic’s entire market cap, almost, would be covered by Rockhaven shares.

Once nearly a $4 stock, SMD seems a shell of its former self at 33 cents. But in reality, they’re a stronger project generator today than they were then. I guess the stock could temporarily drop back to 25 cents, anything’s possible, though I highly doubt it.