3 Gold Exploration Stocks Endorsed by High Profile Investors

Nov 16

When exploring for penny stocks that may be worthy of speculation I like to see that high profile investors have skin in the game. No matter how rich already, no one invests because they are interested in losing money. There is always a financial incentive, and if the motive isn’t financial it’s often for “know how” or technological reasons.

Do-it-yourself investors of the world, there is no shame in piggybacking off someone else. In fact, copying off high profile investors can increase your odds of success.

Now then, who are these high profile investors?

In my mind, there are two types:

- Captains of industry – individuals with a track record of success in their respective fields; they’ve probably already struck it rich

- Leading companies – well financed and respected within the industry; they take equity stakes or partner on projects

Over the years I’ve dug through thousands of exploration and mining stocks; including all listings on the Canadian Venture, Toronto, AMEX, NASDAQ, NYSE, and OTC exchanges. While we can’t get to all of my discoveries in this article, I’ll highlight a few that offer geographic diversity as well as the high profile endorsement.

3 Gold exploration stocks endorsed by high profile investors

Without any further ado, here’s the names, in no particular order…

1) Eastmain Resources (TSE: ER) (OTCMKTS: EANRF)

High profile investor = Goldcorp (NYSE: GG) owns 8.8% of Eastmain

Arguably, Goldcorp is best of breed in the gold mining industry. It operates 13 mines and pays a peer leading dividend.

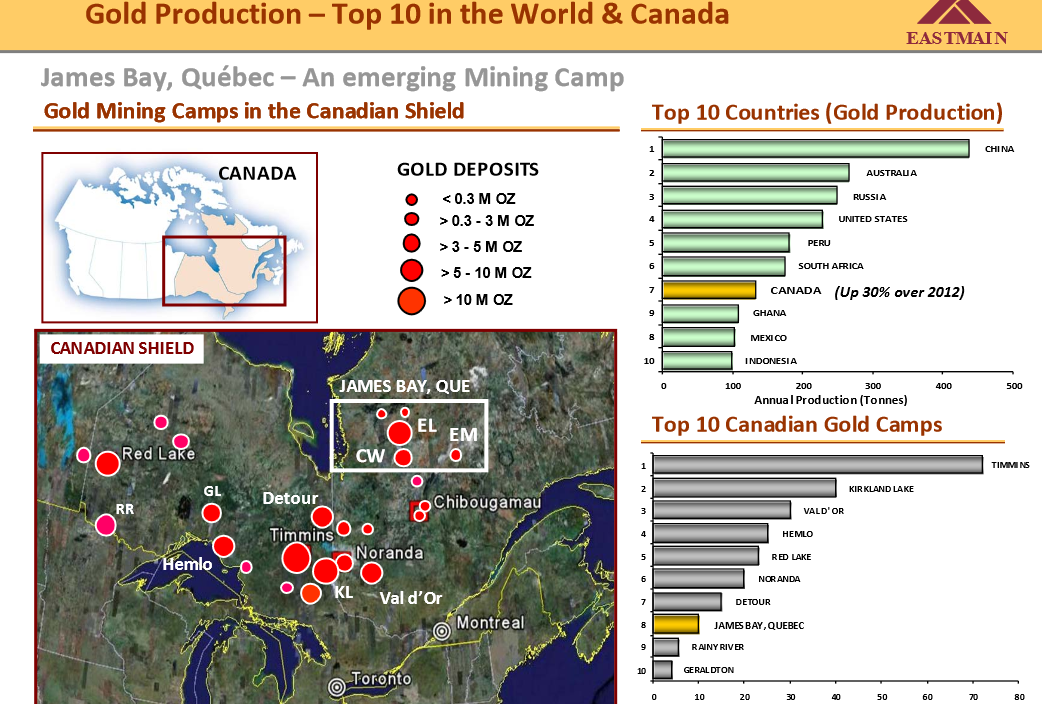

Eleonore is Goldcorp’s latest and greatest mine, it cost $1.8B to develop. At commercial production Goldcorp expects Eleonore will yield 600,000 ounces of gold annually. This mine is relevant to Eastmain because of its location, the James Bay region of Quebec. In geologic time, it has only taken a blink of an eye for James Bay to catapult onto the Top 10 list of gold camps in Canada. Eastmain’s management team, led by Donald Robinson Ph.D, P.Geo, has been aware of James Bay and operating there since the 1980’s, so it’s safe to say they’re one of the first movers.

Eastmain owns 36.8% of a 3-way joint venture with Goldcorp (36.8%) and Azimut Exploration (26.4%) on a project called Eleonore South. The property is contiguous with Goldcorp’s 4-million ounce Eleonore deposit.

Some lower-quality exploration stocks may try to make a go out of this one project alone, but not Eastmain, it controls 12 more properties in James Bay. One of which [Clearwater] hosts a deposit [Eau Claire] that is higher grade than 75% of all gold deposits worldwide!

The current resource base (M+I plus Inferred) stands at over 1.8 million ounces; 4.9 million tonnes of 4.6 g/t material would be conducive to open pit mining. Plenty of blue sky potential remains, as Eau Claire only covers about 20% of the 200 square kilometer Clearwater property.

Near term catalyst… 70,000 metres of drilling has been done at Eau Claire since the last resource update; the updated resource numbers are COMING SOON.

2) Calibre Mining (CVE: CXB) (OTCMKTS: CXBMF)

High profile investor(s) = B2Gold (NYSEMKT: BTG), IAMGold (NYSE: IAM), and Pierre Lassonde

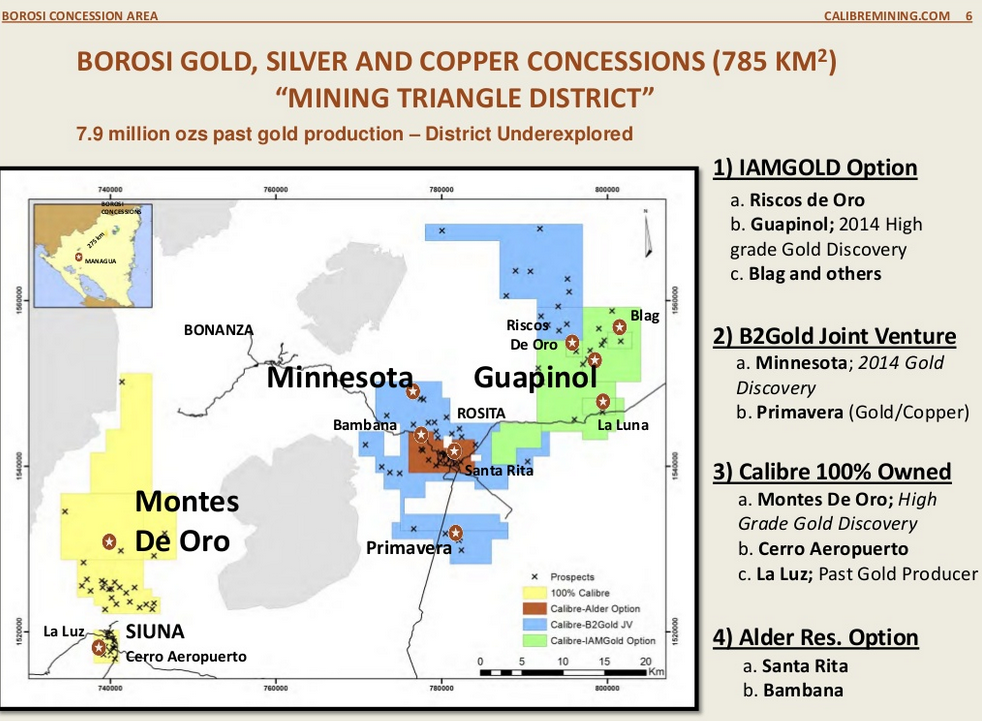

Calibre Mining is partnered with or sole owner of numerous gold exploration projects in what’s known as the Mining Triangle, a highly prolific region of northeastern Nicaragua. Despite being underexplored, nearly 8 million ounces of gold have been mined there to date.

On September 17th Pierre Lassonde invested $2M, representing an 11.2% equity stake, into Calibre Mining as part of a strategic financing. Mr. Lassonde is well known in the international mining community and North American capital markets, he is currently Chairman of Franco-Nevada (NYSE: FNV). Recognized by the market as a strong endorsement and vote of confidence, shares of Calibre Mining traded higher on heavy volume following the announcement.

Partners IAMGold and B2Gold are expected to spend at least $11M over a 3 year period to move the projects forward. As of 2013, gold is Nicaragua’s #1 export.

3) Salazar Resources (CVE: SRL)

High profile investor(s) = Lundin Mining (TSE: LUN) owns 9.9%, Silvercorp (NYSE: SVM) owns 7%, and Trafigura owns 13%.

Recently, Sprott Inc., one of Canada’s brand name resource focused brokerage firms did a write-up on Ecuador. Sprott’s analyst advised that Ecuador was now more mining-friendly, but still, as always, a destination ripe with exploration potential. In the article two Ecuadorian focused exploration stocks were mentioned— Ecuador Gold and Copper (CVE: EGX) and Odin Mining (CVE: ODN). Odin was mentioned because of its association with another captain of industry, Ross Beaty.

Personally, I was happy to see that Sprott failed to mention Salazar Resources. Judging by its trading volume and news flow over the past few years I’d say Salazar Resources is well off the radar of most professional speculators—a positive sign for savvy do-it-yourselfers’.

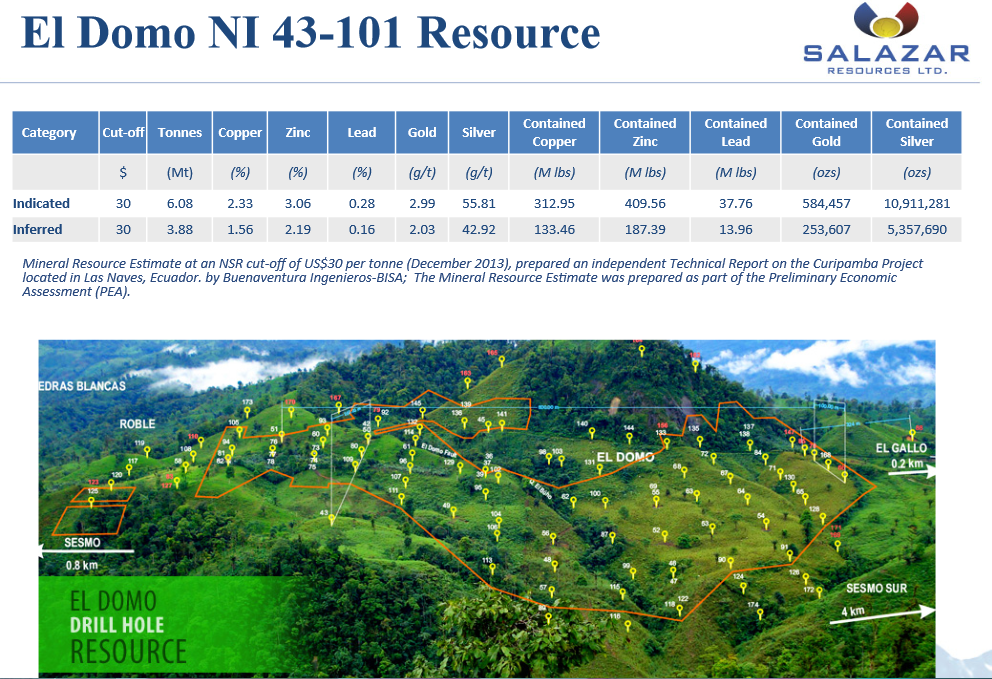

Lead by a team of geologists that were involved with the Frutta del Norte discovery and its namesake Fredy Salazar, Salazar Resources owns 100% of the Curipamba project (30,327 hectares in size).

Arguably, the Curipamba project is one of the best VMS (volcanogenic massive sulfide) camps discovered in the America’s over the past decade. The largest deposit identified to date, El Domo, hosts an Indicated resource of 6 million tonnes with an average grade of 2.33% Cu, 3.06% Zn, 0.28% Pb, 2.99 g/t Au, and 55.81 g/t Ag.

Salazar Resources has a relatively tight share structure, 61.1 million shares are outstanding on a fully diluted basis. In addition to the high profile investors mentioned, Salazar’s management team controls 30% of the equity.

Near term catalyst… Salazar and the Guangshou Group have signed a letter of intent to advance the Curipamba project. Guangshou would invest $50M and bring the El Domo deposit into commercial production in exchange for 60%. Unfortunately, as of the most recent update, Mr. Guoqin Huang, the Chairman and CEO of Guangshou was reportedly in an automobile accident, so the deal has been delayed.