2 “Exciting” Tech Stocks That Are Solving Real World Problems

Sep 27

Around the world and closer to home, there are many things we could be worried about right now. But there are also many things we can be excited about.

Today, I’m thinking we should take a quick look at two technology stocks! Each company has numerous exciting products that are solving real world problems. Keep in mind, I’ve selected these stocks not only because the technologies are “exciting”, but because the market valuations are attractive relative to growth potential. In other words, these small cap growth stocks are cheap.

I’d like to think each is a fairly sophisticated speculation.

Are you ready?

L L L Lets get ready to rumble!

1) iCAD Inc.

(ICAD, NASDAQ) is in the business of targeted detection, targeted therapy, and ultimately improving patient outcomes. The company’s solutions and services enable clinicians to find and treat cancers earlier and faster.

The business breaks down into 2 segments:

- Cancer detection, “interpretive software”

- Radiation therapy

Presently, there are approximately 5,500 systems globally using iCAD’s 2D software (Mammo Detection). The software helps radiologists identify cancers earlier, quicker and with more confidence. iCAD’s largest customer for this product is General Electric, but it also does quite a bit of business with Siemens and many of the other mammography machine providers.

The company has first mover advantage with an approved 3D machine learning / AI software for detecting breast cancer. Upgrading the existing installed base to iCAD’s PowerLook is a large opportunity ($250 million) over the next 5 years relative to its $72 million market cap.

iCAD’s PowerLook 3D software has been proven to be extremely effective in identifying cancer while simultaneously improving radiologists’ workflow and producing less “false positives”. Radiologists have been raving about this new software! Here’s what a few of them had to say:

- “Enhanced V-Preview (EVP) improves the reading experience, allowing me to organize how I read tomo and help me become more efficient. There’s a high fatigue factor when reading tomo studies all day because of the number of images involved. EVP will definitely help reduce fatigue that can certainly lead to missing things. I think every radiologist will want to read tomo exams this way.” – Laurent Levy, MD

- “Enhanced V-Preview is a better image than C-View and it will give General Electric an advantage over Hologic.” – Philippe Benillouch, MD

Hologic is GE’s #1 competitor for mammography equipment.

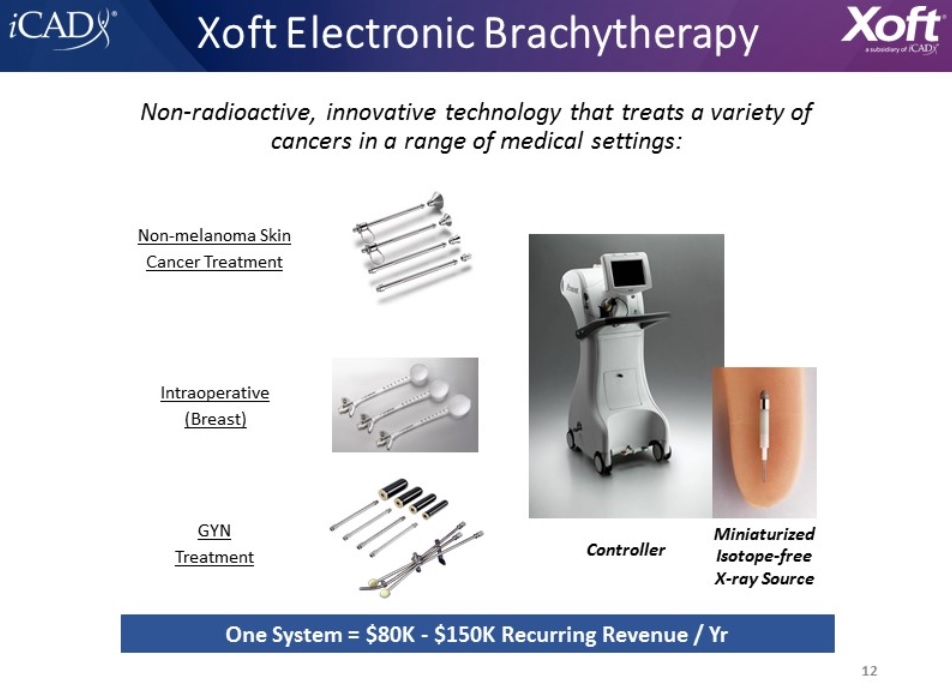

Now for the 2nd side of iCAD’s business – radiation based therapies.

The company makes a high-dose X-ray source (non-radioactive) in contrast to the more traditional radiation therapies that use a radioactive isotope. This innovative technology can treat a wide range of cancers in a range of medical settings.

“Over $100 million dollars has been spent perfecting this technology,” said CEO Ken Ferry.

Today iCAD is treating breast cancers, GYN cancers, and non-melanoma skin cancer.

Skin cancer has become an epidemic and it is by far the company’s largest market opportunity, estimated to be over $1 billion spread across +7,000 dermatology offices. There is a growing body of clinical data that shows iCAD’s solution is not only clinically effective, but superior to Mohs (the “surgical” standard treatment) from a cosmetic viewpoint. This in a non-invasive pain free option commonly used to treat non-melanoma skin cancer on the nose, ear, and eyelid.

The company believes it’s capable of treating 1 million lesions per year. Right now this market opportunity is less than 1% penetrated by iCAD.

iCAD’s revenues in the first half of 2017 were $13.2 million (last year FY revenue was just over $26 million). It had just under $8 million cash at the end of Q2. Ferry is calling for growth to accelerate in the 2nd half of the year.

At $4.40 per share, ICAD is valued at roughly 2.8 x sales, arguably a low multiple for a technology stock with high-margin products making inroads in several large markets.

Taking a look at the 1-year chart, you’ll see a spike higher on the far right.

ICAD soared as high as $4.67 today before closing at $4.06 on heavier than usual volume. The company issued positive news relating to breast cancer therapy and upcoming presentations that will be made at important dermatology conferences in the near future.

While I like the longer and near-term growth potential for iCAD, we should be patient on it right now. A price below $4 would make for a better entry point (fingers crossed, I hope it will get back there). Tightly held and with only 16.5 million shares outstanding, the stock is bound to be volatile (with an upside bias in the years to come, is my suspicion). Notably, large institutions like BlackRock and Vanguard are already in this microcap, each holding +500k share positions.

2) Ekso Bionics

(EKSO, NASDAQ) is a pioneer in the field of robotics.

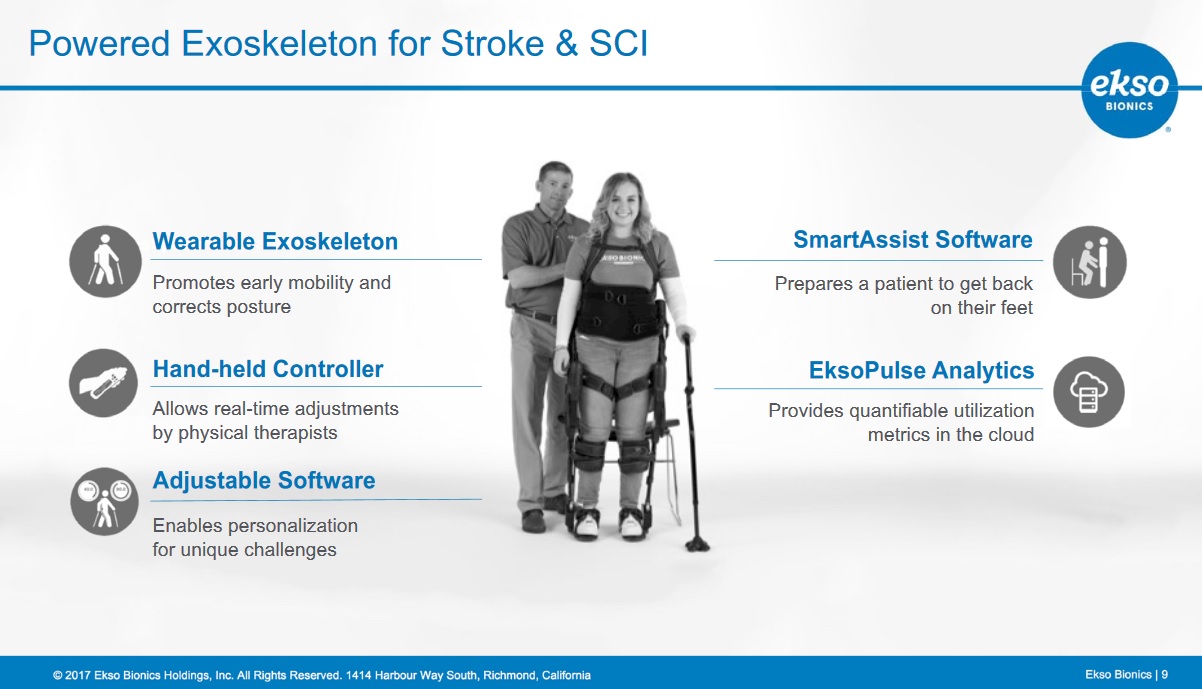

For over a decade Ekso has been committed to developing the latest technology and engineering to commercialize wearable exoskeletons and robotic-assist devices in a variety of applications such as medical and industrial markets. Exoskeletons resolve unique customer challenges in rehabilitation allowing people to rethink their current physical limitations. Light-weight assist devices for industrial workers will help achieve mobility, strength, or endurance not otherwise possible.

During the most recent quarter, Ekso shipped 20 Ekso GT units (of which 13 were “sales” and 7 were “rentals”), the most during any one quarter of its history. That compares with 8 units shipped last year and 10 in the previous quarter. More than 240 Ekso GT units are currently in the field being used by more than 185 customers.

This exoskeleton is the first FDA-cleared unit addressing the estimated $16 billion stroke population. It has also been cleared and is currently in use by people with spinal cord injuries. Rehab specialists see an obvious improvement in a person’s outlook and psychology the faster they are able to get back onto their feet.

Ekso’s GT unit has helped more than 500 people take more than 72 million steps, and counting…

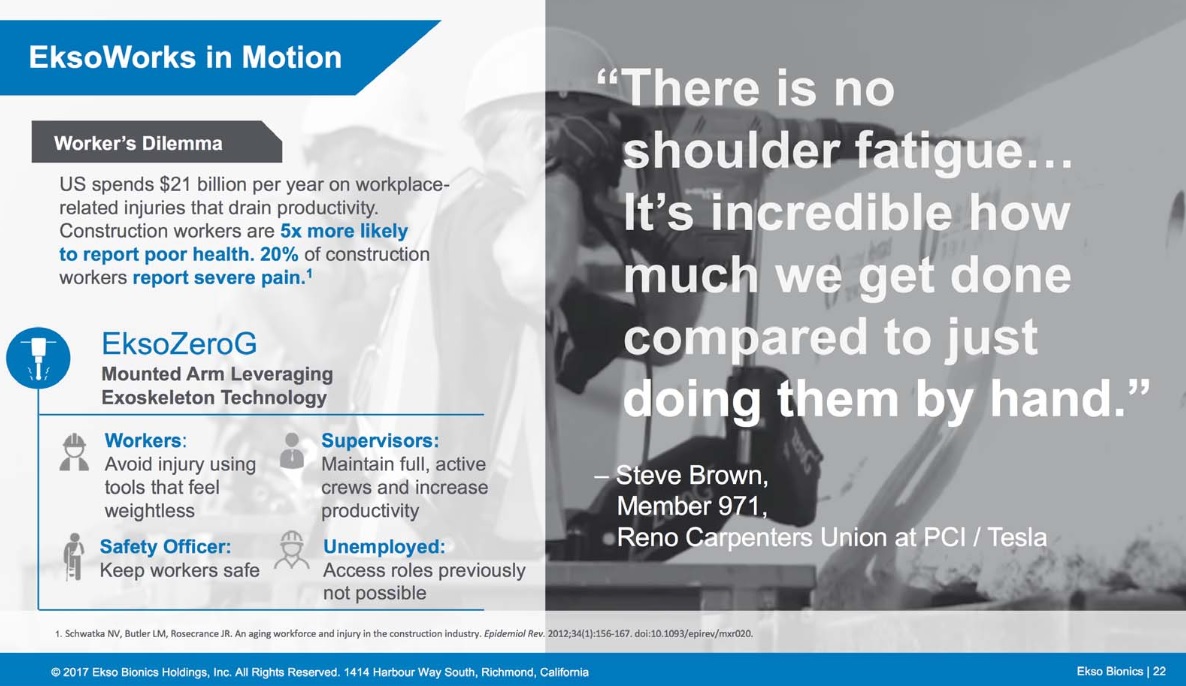

Switching over to the “industrial” market, while still early days (less than $1 million revenue, but growing +33%), Ekso has developed the first lightweight assist device for construction workers on aerial work platforms and scaffolding. Rental Management Magazine called this product, which greatly improves worker efficiency while reducing workplace injuries, a “1 of 1,000″ and placed it on its Hot List.

Ekso has also developed a non-battery powered vest that makes things feel lighter than they really are. Products that increase efficiency and reduce workplace related injuries pay for themselves quickly. Also, these new products pave the way for more women to enter the construction industry.

The company’s intellectual property portfolio is industry-leading, with more than 20 patents issued to date.

Last week former Goldman Sachs partner, Mr. Ted Wang PhD., joined Ekso’s board. Dr. Wang is now the Chief Investment Officer of Puissance Capital Management, a global asset manager founded in 2015 with offices in the U.S. and China. Puissance was the lead investor in Ekso’s recently completed rights offering (investing $20 million of the $34 million raised at $1 per share).

Dr. Wang commented, “I am excited to join the Ekso Bionics Board, and I look forward to helping the company realize the potential and promise of its innovative exoskeleton portfolio. Ekso has an extraordinary opportunity to expand its presence in key international markets, and I am committed to working with the Ekso management team to execute on that opportunity.”

It sounds like Dr. Wang could be instrumental in helping Ekso capture the Asian market. Ekso’s CEO Tom Looby was the keynote speaker a few weeks ago at the WearRAcon China (Beijing) conference, which was held in conjunction with the China Disabled Persons’ Federation.

Taking a look at the 1-year chart, EKSO is down but looks poised to get back up.

EKSO looks like a nice trade to me right now. It’s been consolidating nicely between $1.10 and $1.30 over the past month and today it closed at $1.26. If it were to drop below $1, we’d have to reevaluate.

First published at BullMarketRun.com

DISCLAIMER: The information in this publication is not intended to be, nor shall constitute, an offer to sell or solicit any offer to buy any security. The information presented on this website is subject to change without notice, and neither Penny Stock Experts nor its affiliates assume any responsibility to update this information. Additionally, it is not intended to be a complete description of the securities, markets, or developments referred to in the material. Penny Stock Experts and its Author(s) cannot and do not assess, verify or guarantee the adequacy, accuracy or completeness of any information, the suitability or profitability of any particular investment, or the potential value of any investment or informational source. Additionally, Penny Stock Experts and its Author(s) in no way warrants the solvency, financial condition, or investment advisability of any of the securities mentioned. Furthermore, Penny Stock Experts and its Author(s) accept no liability whatsoever for any direct or consequential loss arising from any use of our product, website, or other content. The reader bears responsibility for his/her own investment research and decisions and should seek the advice of a qualified investment advisor and investigate and fully understand any and all risks before investing. Information and statistical data contained in this website were obtained or derived from sources believed to be reliable. However, Penny Stock Experts and its Author(s) do not represent that any such information, opinion or statistical data is accurate or complete and should not be relied upon as such. This publication may provide addresses of, or contain hyperlinks to, Internet websites, Penny Stock Experts takes no responsibility for the contents thereof. Each such address or hyperlink is provided solely for the convenience and information of this website’s users, and the content of linked third-party websites is not in any way incorporated into this website. Those who choose to access such third-party websites or follow such hyperlinks do so at their own risk. The publisher, owner, writer or their affiliates may own securities of companies mentioned in this publication.