186 g/t Gold And 1,055 g/t Silver Over 2 Metres At Sesmo!

Mar 27

186 g/t Gold And 1,055 g/t Silver Over 2 Metres At Sesmo!

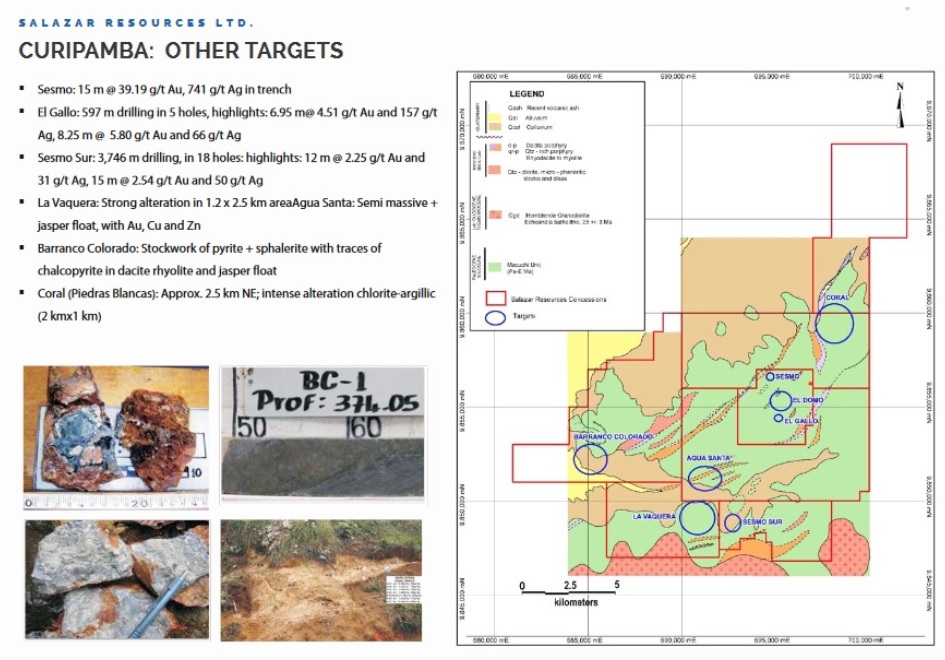

Fairly exciting news to report – the first drill hole at Sesmo has been completed (now they’re drilling a second!). Next month we’re going to find out what Salazar Resources (SRL, TSX-V) and Adventus (ADZN, TSX-V) intercepted below a trench that yielded 186 g/t Gold and 1,055 g/t Silver (including 39 g/t Gold and 741 g/t Silver over 15 m)!

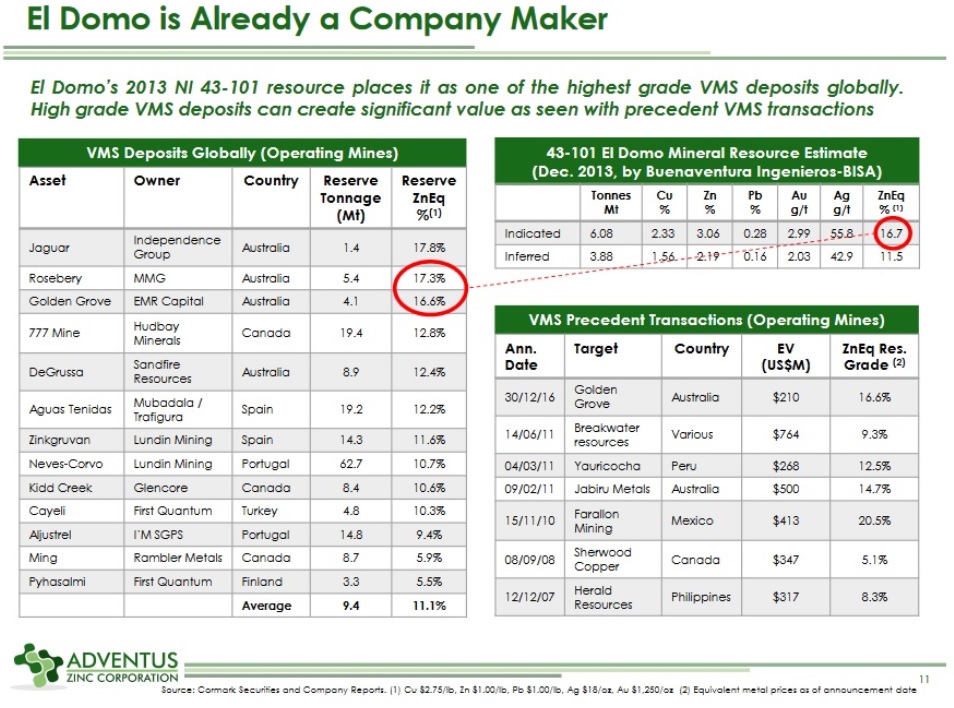

El Domo (one of the world’s highest grade VMS deposits) and Sesmo Sur (2.5 g/t Gold and 50 g/t Silver over 15 m) are two examples within the 21,537 hectare Curipamba Property where trenching results led to drilling discoveries. So I’m expecting solid numbers from Sesmo, but hoping for blockbuster numbers!

With two rigs on the ground (pending results they’ll be bringing in a third rig), and plans to drill around 20,000 m, these results from Sesmo will be the first in a wave of news flow that continues throughout 2018.

If 20,000 m of drilling, an airborne geophysical survey, bulk sampling, and an updated PEA doesn’t move Salazar Resources to at least 25 cents (a “leap” of $12 million in market cap?), I will be astonished and completely dumbfounded (but I’ll keep buying anyway).

…please show me another exploration stock, sub $15 million market CAP, with such an extensive work program (on a world class deposit).

Only 1 Of 50 Resource Speculators Knows About SRL!

Ask around.

Okay, on the one hand I wish SRL had an aggressive marketing and promotional program in place. But on the other, I’m completely convinced that when PEOPLE WAKE UP to this opportunity (starting in April) it’s going to move very quickly.

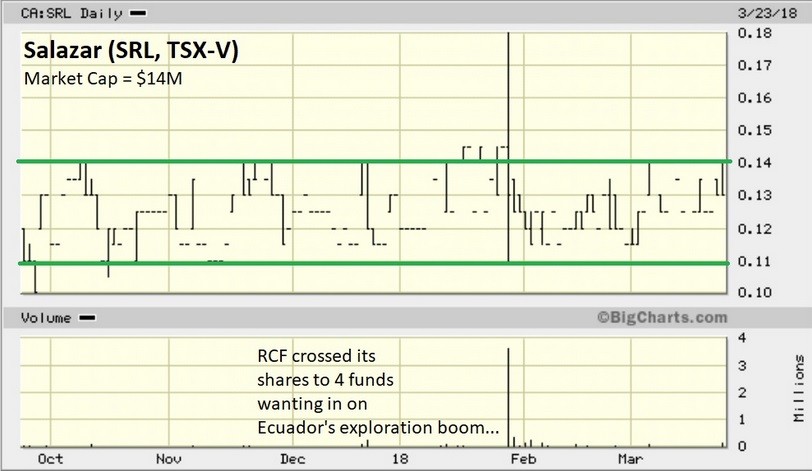

The upside of Salazar Resources obscurity is that there are lots of new buyers on the sidelines! If you think purchasing SRL is difficult now, just wait until it breaks above 15 cents on volume. From there the chase will be on because only 30% or so of the shares are in the float (70% is in strong hands, and they’re in this for way more than a double).

SRL has bumped its head against 14 cents at least a dozen times since October. More recently, it doesn’t want to spend much time below 12 cents. As I see it, by purchasing SRL in this range you’re risking a penny or two for reward potential of 30 cents or more (assuming you’re patient). I’ve been adding to my position lately and I’m extremely confident big paydays are coming.

: ) Mr. Market will eventually come around to my way of thinking.

Wrapping up with Salazar Resources, I’d like to remind you that some really smart geologists are digging Curipamba (then provide an introduction to Ruminahui).

- According to my sources, Altius’ CEO and Co-Founder Brian Dalton says Curipamba is one of the best exploration projects he’s ever seen;

- Lundin Mining’s (LUN, TSX) Senior VP of Exploration, Neil O’Brien, is one of Curipamba’s biggest fans (which explains why the company took a 5% stake in Salazar Resources years ago at much higher prices;

- Geologically speaking, there are some “weird” and potentially special things happening there, which normally means GOOD things. While the VMS potential is well recognized, Curipamba could also host a completely different type of system (perhaps hydrothermal).

While Eskay Creek is famous for its very high-grade Gold, many people have forgotten that it was technically a VMS deposit with Copper and Zinc to go along with the exceptional Gold and Silver grades (so comparisons are being made between it and Curipamba).

The Entire Country Is Heating Up, And Big Dollars Are Flowing In!

I’m surprised speculators aren’t tripping over themselves rushing in to place bets on Ecuador.

…the world’s largest mining companies are.

Lundin Gold led the way, but since then (really just last year) BHP has joined the rush, along with Anglo, Vale, First Quantum, Fortescue, and Hancock. Perhaps most notable, Codelco, Chile’s state-run and world’s largest Copper miner, made its first move outside of their home country.

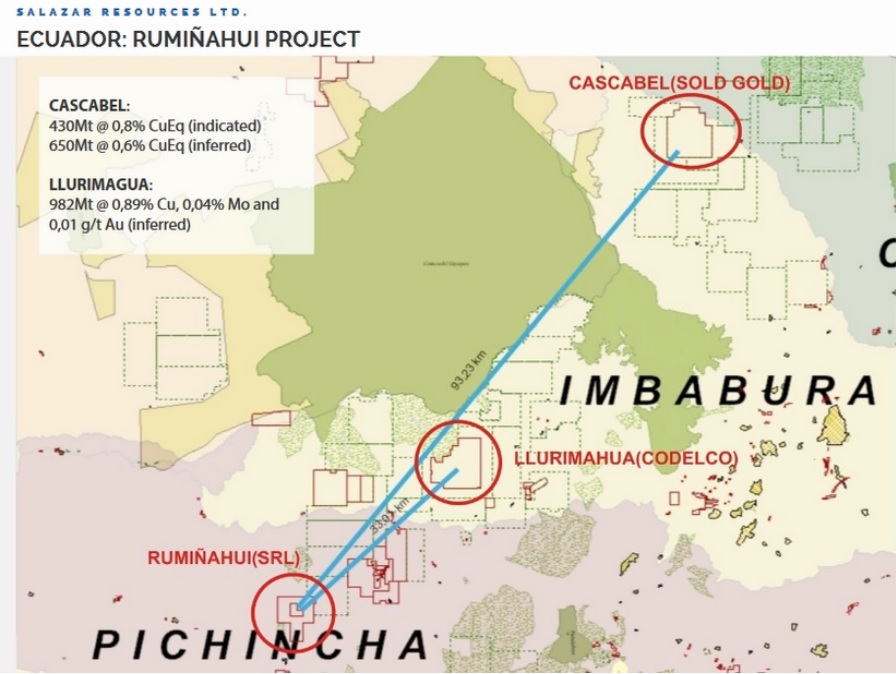

Here’s the deal – Codelco is buying into Llurimagua and partnering up with ENAMI (Ecuador’s state-run miner). Llurimagua happens to be located just 33 km SW of Salazar Resources’ Ruminahui project.

Maybe it’s nothing, but in theory, I could see the market getting excited about Salazar Resources drilling Ruminahui. Who knows, Ruminahui could get a JV partner to bite since it’s located on trend with a pair of +1 billion ton Copper deposits (an emerging/recognized porphyry belt?).

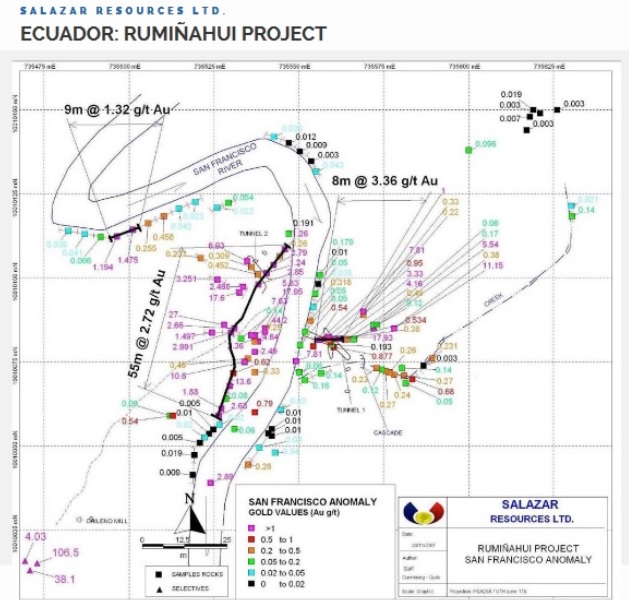

Salazar Resources’ 100% owned Ruminahui concessions cover 2,910 hectares prospective for Au-Cu-Ag targets. The main targets identified to date are the original discovery areas previously worked by artisan miners.

Gold values from rock chip and channel sampling have returned grades of up to 2.7 g/t Gold over 55 m and 3.4 g/t Gold over 8 m.

In Summary: The market has yet to recognize the value in Curipamba and El Domo (a world class VMS deposit and property with +12 untested targets). Salazar Resources, with a sub $15 million market cap, continues to own 100% of that project until Adventus spends $25 million. In addition to Curipamba, Salazar Resources controls 9 more highly-prospective properties (selected by lifelong Ecuadorian geologists). Ruminahui is one, and happens to be located 33 km SW of and on trend with what will become a massive Copper mine jointly owned by the Chilean-Ecuadorian state-run mining companies.

Want to Trade Like The Experts? Click below for more about our Subscriptions and receive the next up and coming opportunity!

*Author has a long position in Salazar Resources

DISCLAIMER: The information in this publication is not intended to be, nor shall constitute, an offer to sell or solicit any offer to buy any security. The information presented on this website is subject to change without notice, and neither Penny Stock Experts nor its affiliates assume any responsibility to update this information. Additionally, it is not intended to be a complete description of the securities, markets, or developments referred to in the material. Penny Stock Experts and its Author(s) cannot and do not assess, verify or guarantee the adequacy, accuracy or completeness of any information, the suitability or profitability of any particular investment, or the potential value of any investment or informational source. Additionally, Penny Stock Experts and its Author(s) in no way warrants the solvency, financial condition, or investment advisability of any of the securities mentioned. Furthermore, Penny Stock Experts and its Author(s) accept no liability whatsoever for any direct or consequential loss arising from any use of our product, website, or other content. The reader bears responsibility for his/her own investment research and decisions and should seek the advice of a qualified investment advisor and investigate and fully understand any and all risks before investing. Information and statistical data contained in this website were obtained or derived from sources believed to be reliable. However, Penny Stock Experts and its Author(s) do not represent that any such information, opinion or statistical data is accurate or complete and should not be relied upon as such. This publication may provide addresses of, or contain hyperlinks to, Internet websites, Penny Stock Experts takes no responsibility for the contents thereof. Each such address or hyperlink is provided solely for the convenience and information of this website’s users, and the content of linked third-party websites is not in any way incorporated into this website. Those who choose to access such third-party websites or follow such hyperlinks do so at their own risk. The publisher, owner, writer or their affiliates may own securities of companies mentioned in this publication.